[ad_1]

My end-of-week morning practice WFH reads:

• People Have Stop Quitting Their Jobs: The speed at which staff are voluntarily leaving employers is approaching prepandemic ranges. (Wall Road Journal)

• The Case for Declining Core Inflation: We see 4 causes to count on renewed declines in inflation this summer season and past: 1) 9% pullback in used automotive public sale costs we imagine is just midway achieved, 2) detrimental residual seasonality in the summertime for CPI and PCE costs, 3) sharp deceleration in residence lease checklist costs, and 4) important progress on labor market rebalancing. (Goldman Sachs) see additionally Chartflation: 5 Charts Exhibiting Inflation Isn’t as ‘Sticky’ as Feared: Main inflation indicators level towards value pressures easing additional. Whereas we don’t assume it is a direct market driver, with inflation persevering with to weigh on sentiment, the clearing fog doubtless reveals a better-than-expected actuality. (Fisher Investments)

• The economic system’s doomsday clock has been reset: Wall Road’s fearmongers had been completely fallacious a few recession. (Enterprise Insider)

• The Easy Mistake That Nearly Triggered a Recession: Main economists mentioned we’d want increased unemployment to tame inflation. Right here’s why they had been fallacious. (The Atlantic)

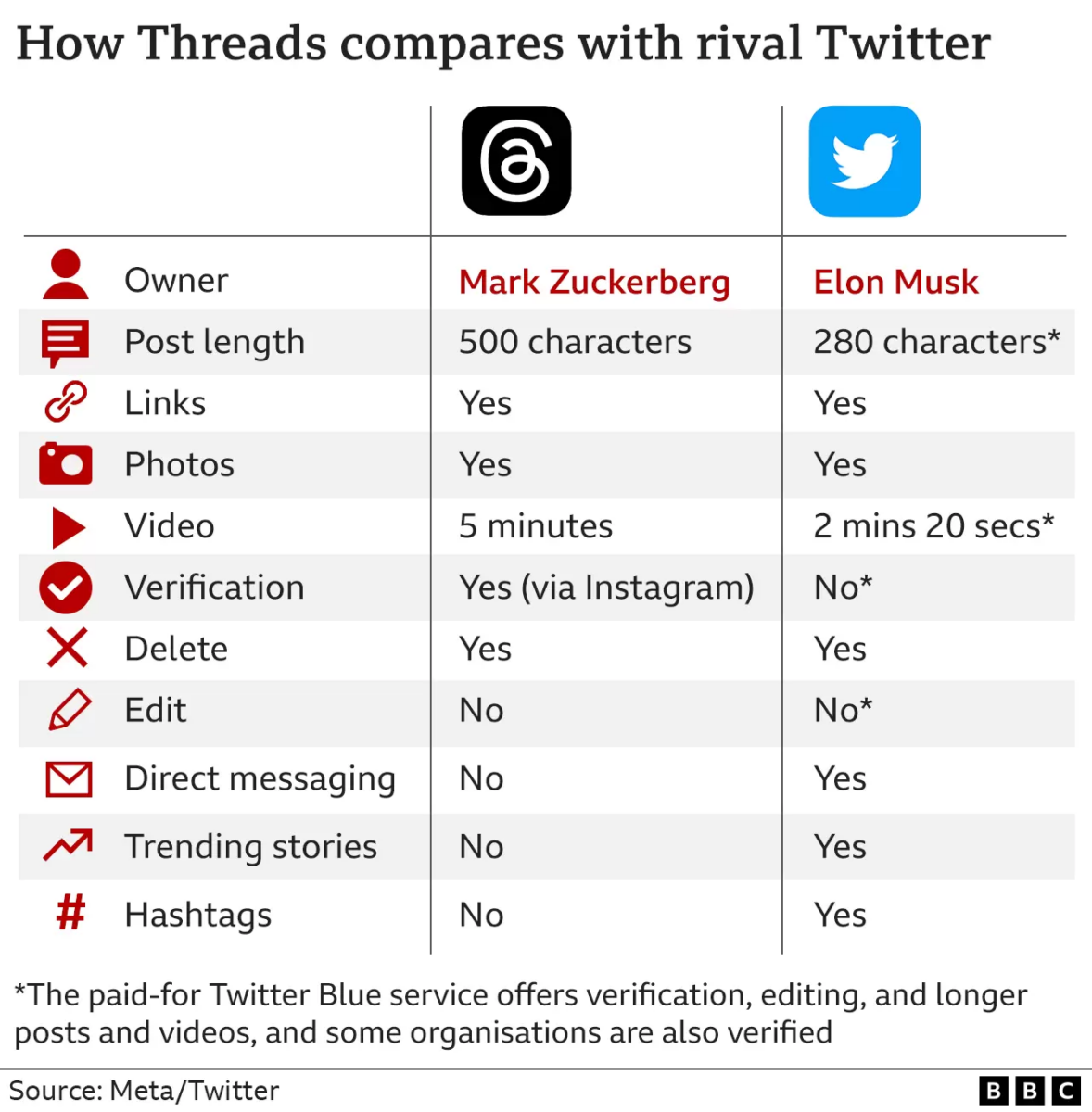

• Twitter is threatening to sue Meta over Threads. Twitter’s letter is an early signal that Threads is essentially the most critical rival but to Musk’s chaotic, however still-central, platform. (Semafor)

• The persistence of cognitive biases in monetary choices throughout financial teams: It’s usually implied however not examined that alternative patterns amongst low-income people could also be an element impeding behavioral interventions geared toward bettering upward financial mobility. Selections impeded by cognitive biases alone can not clarify why some people don’t expertise upward financial mobility. Insurance policies should mix each behavioral and structural interventions to enhance monetary well-being throughout populations. (Nature)

• Sure, it’s scorching. However this might be one of many coolest summers of the remainder of your life. Warmth waves like these in Texas and Europe are prone to worsen on the entire, not higher. (Vox)

• Trump coup plotter John Eastman is lastly dealing with actual accountability: Take note of the disbarment proceedings that lawyer John Eastman is dealing with in California. He manufactured the bogus concept behind Trump’s effort to overturn his 2020 election loss + might lose his regulation license. (Washington Put up)

• The trauma of Cary Grant: how he thrived after a horrible childhood – as informed by his daughter Born into excessive poverty, Grant was informed as a baby his mom had died. She had really been positioned in a psychiatric establishment. It was the beginning of a lifetime of repression and extraordinary reinvention. (The Guardian)

• Cash Isn’t Successful in MLB This Season. Is That Good or Dangerous for Baseball? The high-payroll Mets and Padres are flailing. The low-budget Rays, Diamondbacks, Orioles, and Reds are thriving. What’s behind MLB’s topsy-turvy standings? And what might it portend about the way forward for the game? (The Ringer)

Remember to take a look at our Masters in Enterprise this weekend with Franklin Templeton CEO Jenny Johnson, which manages $1.5 trillion greenback in shopper belongings. She has labored at FT since 1988, and held management roles in funding administration, distribution, expertise, operations, and high-net-worth purchasers. Franklin Templeton oversees greater than 9000 staff and 1300 funding professionals. Johnson is on the checklist of strongest girls (Barron’s, Forbes, American Banker, and extra). She has been CEO February 2020.

Threads might trigger actual issues for Twitter

Supply: BBC

Join our reads-only mailing checklist right here.

[ad_2]

Source link