[ad_1]

Programming word: Morning Reads will likely be in Dallas Thursday and Friday — we will likely be again on the weekend…

My mid-week morning prepare reads:

• Dissecting Goldman’s gory $2.25bn SVB fairness difficulty Nicely that escalated rapidly. (Monetary Occasions)

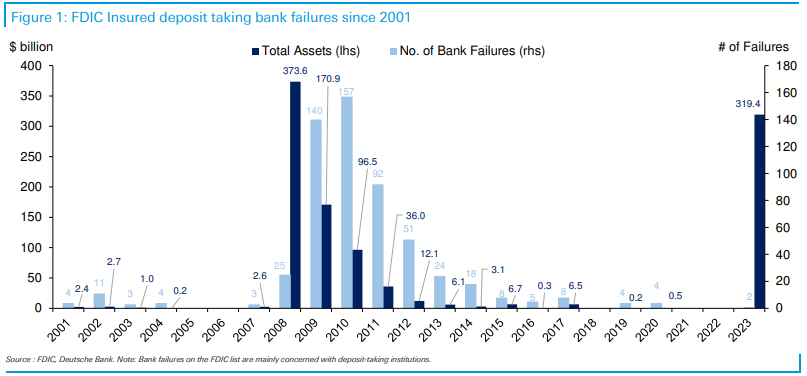

• Whose Fault is it Anyway: It has been 872 days since a financial institution failed in the US. This was the longest streak on report. We’re now at day zero. Silicon Valley financial institution went down on Friday. Signature Financial institution final evening. These are the second and third largest financial institution failures in historical past behind Washington Mutual through the GFC. (Irrelevant Investor)

• Three Million U.S. Households Making Over $150,000 Are Nonetheless Renters: Excessive price of homeownership and a good housing market drive demand for rental properties. (Wall Road Journal)

• How Silicon Valley Turned on Silicon Valley Financial institution: The fallout threatens to engulf the startup world—and has uncovered a brand new set of vulnerabilities for the banking system. (Wall Road Journal) see additionally The Finish of Silicon Valley Financial institution—And a Silicon Valley Fable: We’re nonetheless studying precisely how a lot of this trade’s genius was a mere LIRP, or low-interest-rate phenomenon. (The Atlantic)

• Fiscal Justice Investing Is Altering the Municipal Bond Market: A brand new era of traders is imbuing that conventional sense of function with an consciousness of those that have been traditionally underserved. (Value)

• Meta provides up on NFTs for Fb and Instagram: Meta is shifting on from extra crypto initiatives, although NFTs / digital collectibles have been as soon as pitched as a part of its ‘metaverse’ future. (The Verge)

• How faux sugars sneak into meals and disrupt metabolic well being: Synthetic sweeteners and different sugar substitutes sweeten meals with out additional energy. However research present the elements can have an effect on intestine and coronary heart well being. (Washington Submit)

• Contained in the Bro-tastic Occasion Mansions Upending a Historic Austin Group: They’ve swimming swimming pools, dozens of beds, and at the least one stripper pole in a yard college bus (you learn that proper). Locals say they’re turning a susceptible neighborhood right into a “theme park” for hard-partying vacationers. (Texas Month-to-month)

• Physicists Are Looking for Indicators of a Second ‘Darkish’ Large Bang to Resolve a Main Thriller: Darkish matter within the universe could be so mysterious as a result of it has a totally totally different origin to the remainder of the cosmos, a brand new principle proposes. (Vice)

• Brett Goldstein Faces Life After ‘Lasso’ The Apple TV+ present’s breakout star is getting ready to play a Marvel film god when he’s not engaged on the hit streaming collection “Shrinking.” However what he’s actually after is human connection. (New York Occasions)

You’ll want to try our Masters in Enterprise interview this weekend with Rich Bernstein of Richard Bernstein Advisors (RBA), which was based in 2009 and is operating $14.6B in belongings. Beforehand, he was Chief Funding Strategist at Merrill Lynch, the place he had labored for 21 years. Bernstein was named to the Institutional Investor’s “All-America Analysis Crew” 18 instances and has been inducted into the Institutional Investor “Corridor of Fame.” He’s the creator of “Navigate the Noise: Investing within the New Age of Media and Hype.”

563rd US financial institution failure since 2001

Supply: Jim Reid, DB

Join our reads-only mailing record right here.

Morning reads will likely be in Dallas Thursday and Friday — we will likely be again on the weekend…

[ad_2]

Source link