[ad_1]

Bolster the Warren Buffet “Concern and Greed” mantra with three extra dependable indicators to extend your odds of sucess in buying and selling.

shutterstock.com – StockNews

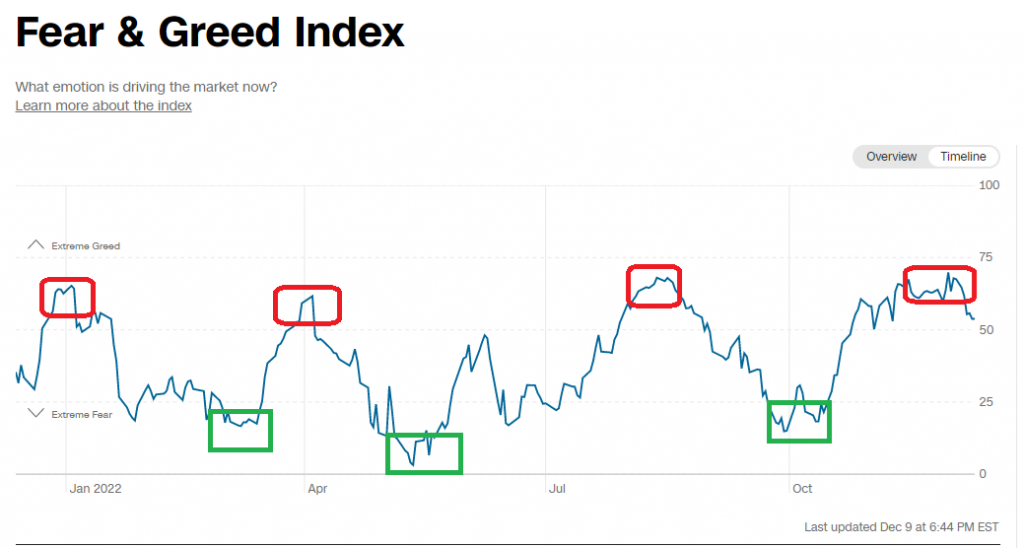

“Be Fearful When Others Are Grasping And Grasping When Others Are Fearful” is a well-known inventory market adage of famed investor Warren Buffet. The CNN Concern and Greed Index actually epitomizes that notion. The chart under exhibits how greed and worry are inclined to swing forwards and backwards from one excessive to the opposite.

Following within the footsteps of Mr. Buffet isn’t a nasty resolution, for my part. Getting grasping when others are fearful and fearful when others are grasping has labored effectively in 2022. Including in a number of different tried and true methodologies to that philosophy could make it much more sturdy. Listed here are three extra methods to extend the chances of success in buying and selling.

Technicals

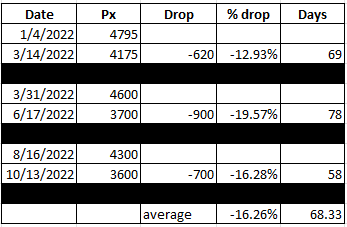

The chart under exhibits the one-year value motion for the S&P 500 (SPX). It’s evident that the SPX continues to be in a well-defined downtrend, with a sequence of decrease highs and decrease lows. Certainly, the current robust rally we noticed off the lows ended proper on the pattern line earlier than starting to reverse course.

How far the present pullback will go is anybody’s greatest guess. Nonetheless, if earlier historical past is any information, then $3400 could be a great guess.

I pulled off the numbers from the prior 3 times the SPX fell from the downtrend line earlier than bottoming out and heading again up, as seen within the desk under.

The typical of the three drops to date this 12 months has been simply over 16% and took roughly somewhat over two months. That might equate to a drop that finally ends up round $3400 within the S&P 500 by about February possibility expiration on 2/17/2023-if the averages maintain.

Seasonality

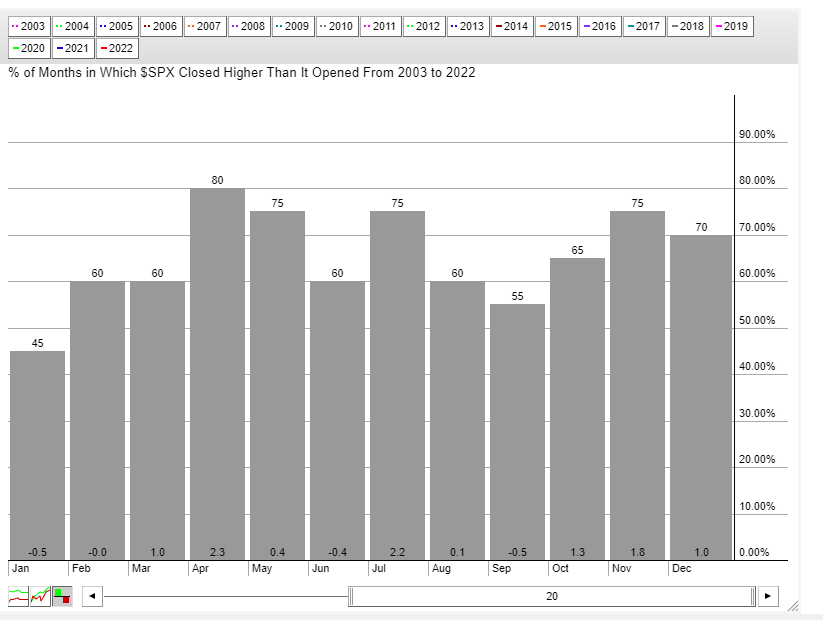

Definitely, many are nonetheless ready for the so-called “Santa Claus Rally” to take shares increased on a seasonal foundation into Christmas. Given the red-hot rally since October, Santa might have already come early for the markets. However seasonality is a two-edged sword. As soon as Kris Kringle leaves city, shares are inclined to endure.

January has been the worst performing month for shares over the previous twenty years. The S&P 500 has proven a median lack of 0.5% in that timeframe and has dropped 55% of the time. February has been a laggard as effectively.

Shares might have bother discovering their footing till springtime if seasonality is any information.

The VIX

The VIX is a measure of 30-day implied volatility within the S&P 500 choices. It’s also known as the worry gauge because it tends to rise when shares drop and fall when shares rally. I lately wrote an article that confirmed how you should use the VIX to time the market.

The chart under exhibits simply how pops and drops within the VIX have corresponded nearly exactly to related drops and pops within the S&P 500. Additionally observe how the VIX extremes correspond to the CNN Concern and Greed Index extremes famous at the beginning of this text.

The newest fall within the VIX from highs at 34 to the current lows beneath 20, adopted by a subsequent rally to just about 23, generated one other VIX-based promote sign for shares. Every of the earlier strikes off the lows within the VIX ended up lastly stalling on the 34 space. If historical past holds, the VIX has a lot additional to move higher-and shares have a lot additional to fall.

As you possibly can see within the chart, every new VIX-based Purchase sign corresponded with a brand new low within the SPY, which is the S&P 500 ETF.

Every thing being equal, shares might not backside out and be a purchase till they make new lows on the 12 months.

Buying and selling is all about likelihood, not certainty. Utilizing these three measures mentioned in your resolution making will assist put probabilities-and due to this fact the odds- in your favor.

POWR Choices

What To Do Subsequent?

For those who’re in search of the most effective choices trades for immediately’s market, you need to try our newest presentation The best way to Commerce Choices with the POWR Scores. Right here we present you learn how to constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to study extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

The best way to Commerce Choices with the POWR Scores

All of the Finest!

Tim Biggam

Editor, POWR Choices Publication

SPY shares closed at $393.28 on Friday, down $-2.96 (-0.75%). Yr-to-date, SPY has declined -16.24%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Stay”. His overriding ardour is to make the complicated world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

Extra…

The submit 3 Massive Causes Why Shares Are Primed For A Probabilistic Pullback appeared first on StockNews.com

[ad_2]

Source link