[ad_1]

ZayZoon, a fintech agency that received its begin charging staff $5 to receives a commission sooner, has raised $34.5 million in a Sequence B spherical co-led by Framework, EDC with participation from ATB Monetary.

CEO Dary Tuer says that the funds, which carry ZayZoon’s complete raised to $75 million, might be put towards “doubling down” on ZayZoon’s development and accelerating the event of latest options on its product roadmap.

“ZayZoon is on a mission to avoid wasting 10 million staff 10 billion {dollars}. We’ll obtain that with a relentless concentrate on serving to staff which are struggling to make ends meet,” Tuer informed TechCrunch in an e-mail interview. “On the identical time, small- and mid-sized companies are confronted with their very own monetary challenges whereas struggling to recruit expertise. ZayZoon helps employers recruit and cut back turnover whereas holding staff away from predatory loans and pointless financial institution charges.”

Tuer co-founded Calgary-based ZayZoon with Tate Hackert and Jamie Ha in 2014. Tuer, a serial entrepreneur, got here on to scale Hackert’s preliminary proof of idea, and Tuer and Hackert met Ha, an funding banker, at an area startup occasion that ZayZoon was taking part in.

Hackert had the thought for the enterprise a number of years earlier than assembly Tuer and Ha. After making a living engaged on a business fishing rig, Hackert — then 16 years previous — lent money by way of Craigslist and the Canadian labeled advertisements web site Kijiji to assist staff bridge the gaps between paychecks.

Within the almost ten years since its founding, Tuer claims that ZayZoon has grow to be one of many fastest-growing apps of its variety, buying greater than 10,000 enterprise prospects throughout the U.S. and partnering with greater than 160 payroll suppliers.

“ZayZoon supplies staff with entry to their earned wages every time they want them, as an alternative of getting to attend till payday,” Tuer mentioned. “This helps them steer clear of payday loans or take care of pointless financial institution charges.”

ZayZoon falls into the class of fintechs referred to as earned wage entry (EWA), which largely function on the identical premise. For a price — in ZayZoon’s case, $5 — staff can request a portion of their common paycheck early. ZayZoon lets staff withdraw a minimal of $20 and a most of $200 every pay interval.

ZayZoon and different EWA corporations pitch their merchandise as a method to assist prospects keep away from high-interest loans and bank cards. However the actuality is usually much less rosy then their advertising and marketing suggests.

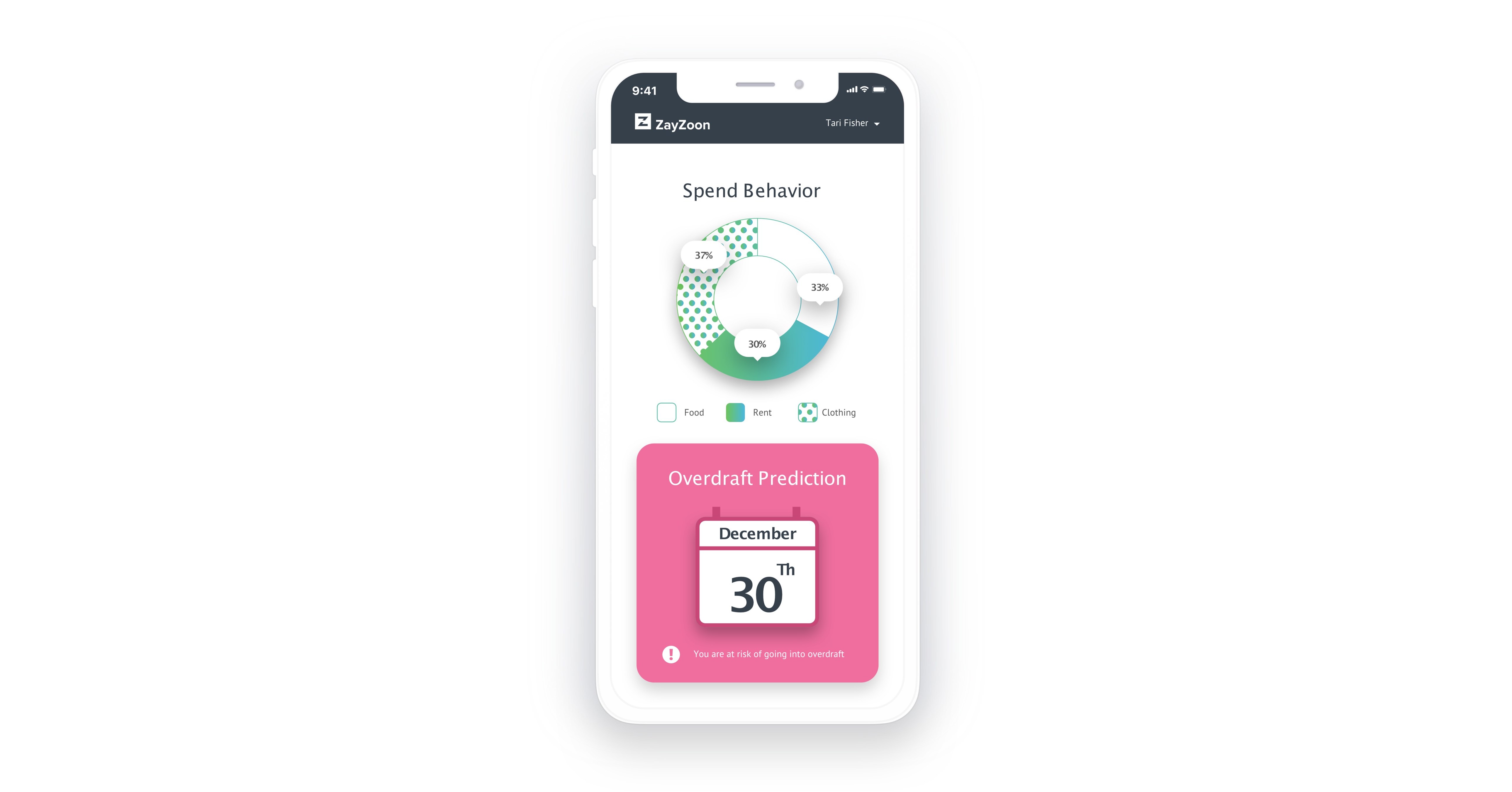

Picture Credit: ZayZoon

Some client teams argue that EWA packages like ZayZoon’s needs to be labeled as loans below the U.S. Fact in Lending Act, which supplies protections corresponding to requiring lenders to provide advance discover earlier than rising sure expenses. Customers aren’t below a authorized obligation to repay ZayZoon and ZayZoon gained’t take motion to gather funds. However as a result of ZayZoon makes computerized withdrawals from customers’ related financial institution accounts, it may well nonetheless pressure customers into overdraft whereas successfully charging curiosity by way of its charges.

ZayZoon affords a no-fee payout possibility. Nonetheless, it requires staff to just accept funds within the type of presents playing cards for retail companions corresponding to CVS and Goal and to conform to share their private data, together with their title, date of beginning, gender and deal with, for promoting functions. (Staff can e-mail ZayZoon’s buyer help to request that their knowledge be deleted, however there isn’t an in-app mechanism to make this simple.)

A $5 per-pay-period price won’t sound like very a lot. However it may well add up, particularly for a low-income employee — and the implications will be disastrous. Simply $100 fewer in financial savings could make households extra more likely to pursue predatory lending and forgo utility invoice funds, one 2020 research confirmed. And an estimated one in 5 households within the U.S. has lower than two weeks of liquid financial savings.

ZayZoon, like its rivals Refyne, Department, DailyPay and Even, declare that they’re a retention instrument for companies. However it stays unclear whether or not EWA packages are a internet constructive for corporations. Taking Walmart for instance, the retail large had excessive hopes of boosting retention by giving staff entry to earned wages early. As an alternative, it discovered that staff utilizing the early wage entry service tended to stop sooner.

EWA utilization is on the rise, regardless. A 2021 report from analysis agency Aite-Novarica estimated that employees accessed $9.5 billion through EWA apps in 2020, up from $6.3 billion in 2019 and $3.2 billion in 2018.

As their recognition amongst employees — significantly these with decrease credit score scores — grows, regulators are starting to step in. In June, Nevada enacted a regulation that requires early wage entry suppliers to be audited and examined by the state. The next month, Missouri handed a regulation that requires EWA corporations to register with the state, pay a $1,000 registration price and retain cost data for at least two years.

ZayZoon, which is among the bigger EWA startups with 102 staff, isn’t letting the elevated scrutiny get in the best way of enlargement.

“We’re in common discussions with the institutional funding neighborhood and determined to execute on an opportunistic increase,” Tuer mentioned. “Strengthening our stability sheet will assist us cement ZayZoon’s place as a class chief.”

[ad_2]

Source link

/cdn.vox-cdn.com/uploads/chorus_asset/file/25524175/DSCF8101.jpg)