[ad_1]

Some two to 3 a long time in the past, cellular fee was nowhere in sight on the African continent. The quantity of people that had financial institution accounts had been beneath common and expertise had not almost superior to the purpose of banking apps or fintech options. In in the present day’s world, Africans are actually confronted with new sorts of issues.

Statista places the variety of banked adults in Africa at 456 million (projection for 2022), an enormous leap from the 171 million as at 2012. In Nigeria alone, there are over 120 million lively financial institution accounts, with many having a number of financial institution accounts, totally different fintech choices, and a number of fee options. As many fintech platforms attempt to additional shut the monetary inclusion hole, automated and contactless funds are nonetheless lagging.

However right here comes Flick

The easy motive behind Flick is that this – funds ought to be quicker and simpler. Why ought to you must leap by means of a number of banking apps, quite a few debit and bank cards, USSD choices, amongst others, simply to make a easy fee when you may have all of your financial institution accounts collectively in a single app and make all funds with ease?

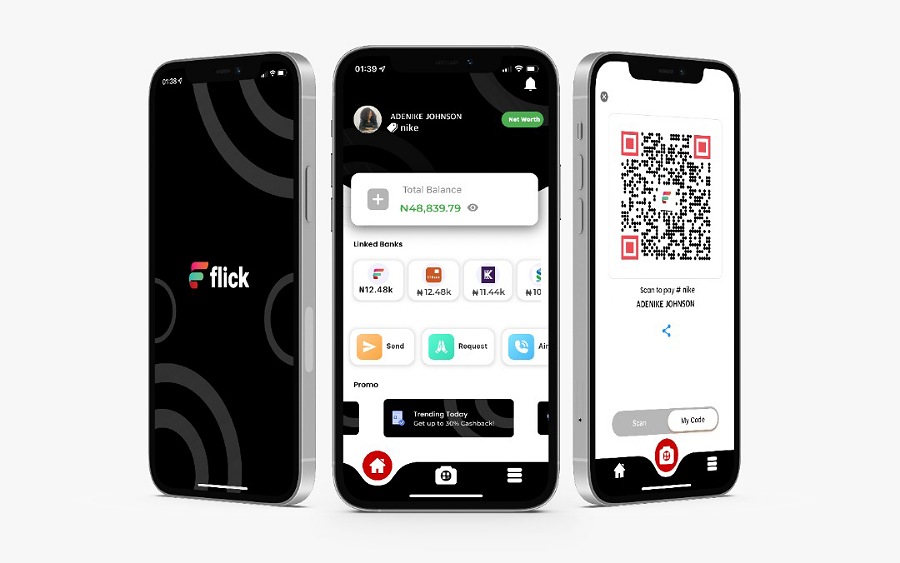

Flick is the primary fee answer that permits customers hyperlink all their financial institution accounts in a single place and make quick contactless funds wherever throughout Africa. The objective is to make bank-to-bank fee seamless and quicker for the over 120 million financial institution accounts in Nigeria. Moreover, Flick presents a number of options by means of its holistic enterprise mannequin.

Buying will get very irritating when funds or transfers don’t undergo or there are POS community points. This doesn’t should be your expertise.

On one hand, bodily purchasing is less complicated with the Flick ‘Scan-to-Pay’ choice which permits you pay the service provider immediately out of your linked account or pockets inside seconds.

Its on-line checkout answer additionally gives a seamless method of transacting. By merely signing in together with your cellular quantity to finish your on-line buy from any of the linked accounts, clients wouldn’t have to re-enter card particulars to make a fee or expertise switch delays because it occurs with another fee options.

There may be additionally no want to fret about safety; Along with the financial institution grade safety, Flick has multi-layered encryption to maintain customers’ knowledge and cash protected. There may be the safe PIN, in addition to an automatic and seamless course of that ensures that each fee is authenticated by the consumer’s originating financial institution earlier than being processed by Flick.

Private finance administration can be simpler with Flick. You don’t want to leap from one financial institution app or assertion of account to the opposite to trace how your cash was spent. There on the Flick app, you may view the steadiness of all of the accounts you have got linked and handle your transactions. Many discover it laborious to maintain observe of their funds particularly with a number of accounts receiving a number of month-to-month statements. Flick brings all of it collectively. With all of your finance particulars in a single area, you may see your actual time Internet-worth, and know your debt profile and Credit score Rating all on the Flick App. With this, you may handle your funds, and if you must go in the hunt for a credit score facility, your credit score rating could be simply accessible.

The Flick staff has onboarded and built-in over 20 banks and fintechs on the platform, so you may simply join all of your banking particulars into this single answer and make quick contactless funds.

Flick might be simply the answer to the countless purchasing queues, irritating funds delays and excessive fee of cart abandonment.

To seek out out extra about Flick, go to the web site.

Associated

[ad_2]

Source link