[ad_1]

On-chain knowledge reveals the most important of the Bitcoin whales have switched to promoting not too long ago, a possible signal that these buyers suppose the highest is in.

Bitcoin Buyers With Extra Than 10,000 BTC Are Now Distributing

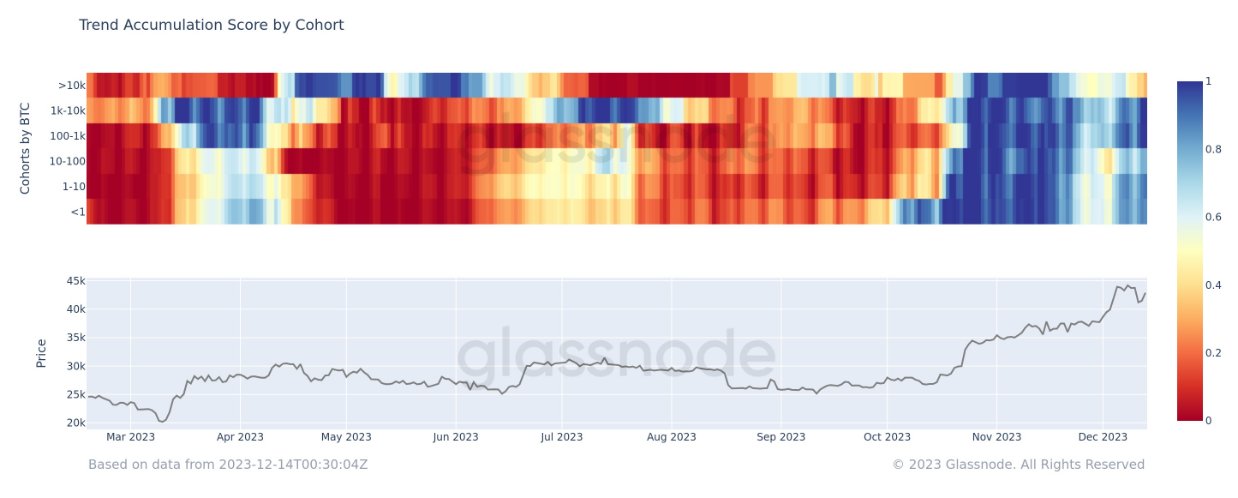

In a brand new post on X, analyst James V. Straten has shared a chart that reveals the conduct the totally different Bitcoin investor cohorts are displaying proper now. The indicator of curiosity is the “Accumulation Development Rating” from the on-chain analytics agency Glassnode.

The metric principally tells us about whether or not the Bitcoin buyers have been collaborating in accumulation or distribution in the course of the previous month. The metric not solely takes into consideration for the stability modifications taking place within the holders’ wallets, but in addition for the scale of the wallets.

When the worth of this metric is near 1, it signifies that the big buyers have been accumulating not too long ago, or alternatively, numerous small buyers have been displaying this conduct.

Then again, values of the rating near 0 indicate the holders have both been collaborating in distribution, or just not been participating in any accumulation.

Now, right here is the chart shared by the analyst that reveals the development within the Bitcoin Accumulation Development Rating individually for the totally different investor segments of the cryptocurrency:

Seems to be like a lot of the market is accumulating in the meanwhile | Supply: @jimmyvs24 on X

As displayed within the above graph, the Bitcoin Accumulation Development Rating had been exceptionally darkish blue for all the cohorts throughout late October and most of November, suggesting that the buyers throughout the market had been collaborating in heavy accumulation.

Accumulation turned a bit extra lighter within the leadup to the rally in the direction of the $44,000 stage, with some teams even dipping into distribution, however the market returned to accumulation because the rally occurred.

At current, all teams apart from one are doing a little notable quantity of shopping for. The one exception being the holders carrying greater than 10,000 BTC of their wallets.

Usually, the buyers proudly owning greater than 1,000 BTC are referred to as the “whales,” so these entities with greater than 10,000 BTC can be humongous even for whale requirements.

Naturally, the bigger the holdings of an investor, the extra affect they carry out there. Due to this motive, the whales are thought of highly effective entities. This may, thus, make the mega whales essentially the most influential beings on the community, as they’re even bigger than the whales.

As these humongous buyers have switched focus in the direction of distribution not too long ago, it might be unhealthy information for the market. This cohort might imagine that the highest is already in, therefore why they’ve determined to promote their luggage right here.

Nonetheless, the remainder of the buyers, together with the whales, are nonetheless accumulating, so now it stays to be seen whether or not the mega whales or these hopeful smaller entities are proper in regards to the cryptocurrency.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $42,400, down 3% up to now week.

The worth of the asset seems to have made some restoration not too long ago | Supply: BTCUSD on TradingView

Featured picture from Rod Lengthy on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link