[ad_1]

- 2023 was among the many finest years for the residential sector in Abu Dhabi with 11,200 models bought throughout town.

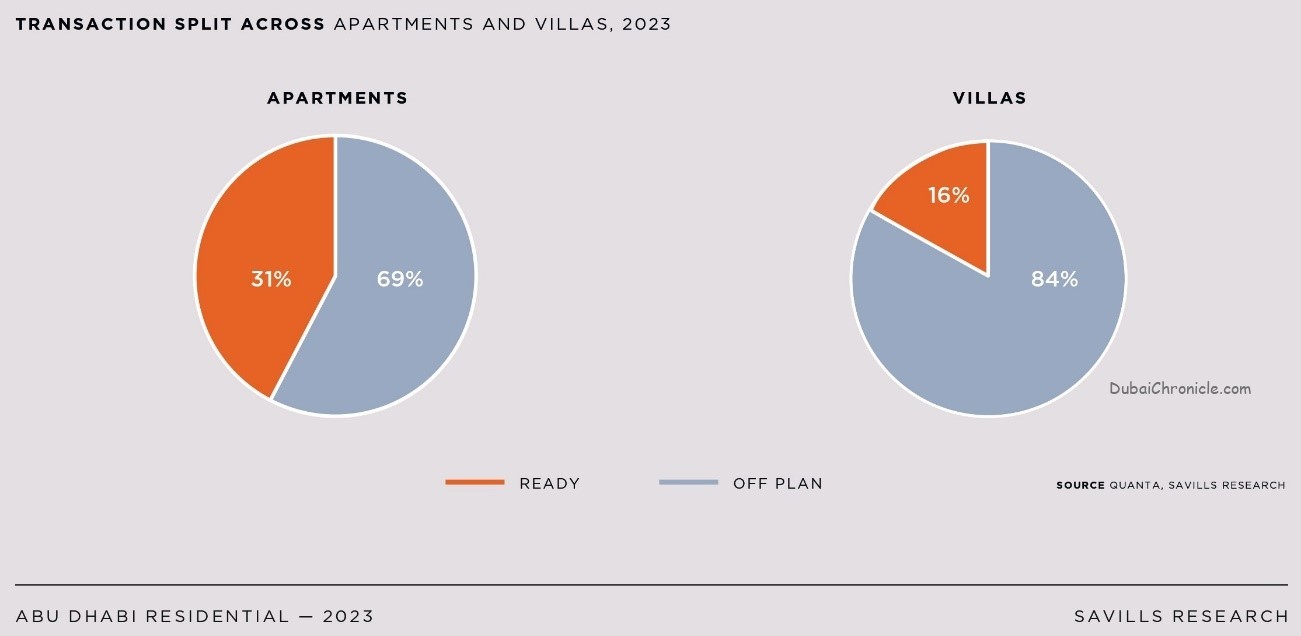

- Beneath-construction properties accounted for 75% of transactions in 2023.

- Greater than 8,000 models have been launched to fulfill the rising demand.

Abu Dhabi’s residential sector has witnessed among the finest years on report, the place a complete of 11,200 models have been bought throughout the capital, up 83% y-o-y. The rise in demand for residences has been pushed by a number of constructive initiatives and bulletins by the federal government, a thriving financial system, and new undertaking launches, Savills newest analysis on the emirate’s residential sector confirmed.

Abu Dhabi has additionally benefited from an increase within the variety of expats and digital nomads, as mirrored within the Savills Govt Nomad Index, the place town made a brand new entry this yr to assert 4th place.

Stephen Forbes, Head of Savills Abu Dhabi, mentioned, “The rising demand has led to a spike in new undertaking launches, with greater than 8,000 models launched. Market transparency additionally improved over the course of the yr, making it extra interesting to a broader vary of traders and end-users past the standard investor phase. In 2023, the market had benefited from a rise in investments by overseas nationals and sustained demand ranges from the Emirati inhabitants.”

A gradual rise in demand for high-end villas and townhouses was noticed, Savills famous. The phase emerged as one of the fashionable in 2023, a development mirrored in different emirates. In 2023, 4,800 villa and townhouse models have been bought, accounting for 43% of complete gross sales. Off-plan transactions accounted for about 84% of all villa and townhouse transactions. Demand was highest for initiatives on Saadiyat Island, Yas Island, and Al Reem Island, indicating a choice for these waterfront places amongst end-users and traders.

Amongst different new initiatives, the Abu Dhabi Housing Authority (ADHA) has introduced the opening of 1,700 models in Balghaiylam, a brand new residential improvement situated north-east of Yas Island.

Ali Ishaq, Head of Residential Company at Savills Abu Dhabi, added, “Villa costs have appreciated throughout the emirate, with some places recording greater positive aspects than others. The common capital worth for villas within the metropolis grew by 6% y-o-y, to achieve 11,800 AED/sq m, nevertheless some places like Saadiyat Island and Yas Island recorded capital values as excessive as 16,000 AED/sq m.”

Flats took up a bigger share of the gross sales pie, comprising 57% of complete transactions. Off-plan residences accounted for 69% of the demand. Because of the sturdy demand, practically 3,400 models have been launched within the yr, with 51% situated throughout the Yas and Saadiyat Islands. Lately, Yas Island has gained recognition amongst residents because of the introduction of latest household leisure choices.

Saadiyat Island has witnessed the launch of 700 models by Aldar Properties, in addition to initiatives like Nobu Residence, Manarat Residing, and The Supply. Tiger Properties’ Renad Tower undertaking added solely 256 models to Al Reem Island, in comparison with Yas Island and Saadiyat, which noticed extra new undertaking launches. 2023 noticed a number of notable undertaking launches, together with Aldar Properties at Al Shamhka, Bloom Properties’ Casares at Bloom Residing, Marsa Al Jubail, Jubail Terraces at Jubail Island, and Reportage Actual Property’s Royal Park at Masdar Metropolis.

The capital worth of residences continued to rise, growing by a mean of 6% yr on yr, whereas the common capital worth for residences within the metropolis is at 14,800 AED/sqm, with some areas experiencing as much as 18% y-o-y progress, and residence rental values remained secure, with lower than 1% progress y-o-y.

“The non-oil sectors have seen vital enlargement over the previous two years, remained wholesome, and are properly positioned to develop over the subsequent twelve months, affecting the true property sector positively,” continued Swapnil Pillai, Affiliate Director of Analysis at Savills Center East. The trade has additionally profited from the federal government’s latest determination to take away the minimal down fee wanted for candidates to qualify for a Golden Visa, since it is going to additional encourage extra individuals to turn out to be long-term metropolis residents and encourage consumers to put money into actual property.

[ad_2]

Source link