[ad_1]

Our transport correspondent Gwyn Topham toured the Elizabeth line in February, and reported:

On the primary media journey to see the road in motion, using on spacious trains alongside the tunnels winding from Paddington to Liverpool Avenue, flaws appeared conspicuously absent. Twelve trains an hour at the moment are operating within the central part excavated below the capital, with an official deadline for opening on the finish of June.

Andy Byford, the transport commissioner, mentioned the opening can be “an enormous fillip to London’s morale and confidence” after the capital was drained of a lot life in the course of the pandemic. “When individuals arrive, day one, they are going to be blown away by the size and by how quiet and easy the prepare experience is.”

On the concourse under the glass roof of Paddington’s Elizabeth line station, Byford’s phrases appeared no exaggeration, with trains arriving barely audibly behind the screens sealing the observe from the platforms.

Mark Wild, the chief govt of Crossrail, mentioned it was “epic, a wonderful consequence”. A lot of the volumes of the newly constructed stations, such because the management rooms, aren’t even seen, he mentioned: “The Shard would slot in right here fairly comfortably.”

Crossrail’s official opening deliberate for December 2018 had been cancelled, and Byford defined in February that the road “must be flawless” earlier than it launched.

Crossrail have put collectively this video exhibiting the work behind the long-delayed £19bn line, which lastly opens in three weeks:

London’s new Elizabeth line will open on Could twenty fourth, says TfL. It has taken years for crossrail to be a actuality, and now it’s simply days away pic.twitter.com/Abd7bbADAR

— Tom Warren (@tomwarren) May 4, 2022

Crossrail: Elizabeth line to open on Could 24

Gwyn Topham

The Elizabeth line will open on 24 Could, with the tunnelled central London part of the long-delayed £19bn Crossrail undertaking now prepared for passengers.

Transport for London mentioned that the road will open, topic to closing security approvals, the week previous to the Queen’s Jubilee celebrations.

The road is about to massively enhance capability on transport in London and the South East, reducing journey occasions, with quite a lot of new stations and for much longer, spacious trains.

The Elizabeth line will initially function as three separate railways, with the overground companies already operating as TfL Rail within the west and east deliberate to hitch immediately with the central part from this autumn.

Russia’s manufacturing unit sector continues to contract

Russia’s manufacturing unit sector continued to shrink final month, because the nation headed into an sharp financial downturn

The most recent S&P World Russia Manufacturing PMI confirmed that the sector deteriorated in April.

Output, new orders, employment and shares of purchases all fell, and provider supply occasions lengthening markedly.

It discovered:

- Output and new orders contract once more amid impression of sanctions

- Inflationary pressures stay substantial

- Employment falls for third month in a row

The PMI rose to 48.2 in April, up from 44.1 in March — any studying under 50 reveals that exercise fell.

The report says:

Charges of contraction in manufacturing and new gross sales eased from March, however sanctions weighed on consumer demand and the power of companies to supply uncooked supplies. Enter shortages and unfavourable alternate fee actions in the meantime led to additional substantial upticks in price burdens and output fees.

In the meantime, output expectations had been traditionally subdued amid issues relating to the impression of sanctions on future demand and new orders.

Jasper Jolly

Aston Martin has appointed its third chief govt in three years, with Tobias Moers stepping down from the maker of sports activities vehicles after solely two years in cost.

Moers will go away the board of the British carmaker with speedy impact however will keep till the top of July to “help the management group with a easy transition”, Aston Martin Lagonda introduced.

The previous Ferrari boss Amedeo Felisa will substitute him a chief govt. Felisa joined Aston Martin’s board as a non-executive director in July 2021.

Aston Martin, often known as the maker of vehicles used within the James Bond movie franchise, has often gone by means of turbulent durations in its 109-year historical past. Its newest issues started with a inventory market itemizing in 2018 that rapidly went bitter as excessive itemizing prices pressured it to search for new funding.

On the UK’s price of dwelling disaster, the UK’s setting secretary has been criticised for proposing customers ought to select worth manufacturers within the grocery store as the price of meals soars.

George Eustice, the cupboard minister overseeing meals and farming, instructed Sky Information meals costs had been going up due to the knock-on impact of upper power prices, pushing up fertiliser and feed prices.

“Typically talking, what individuals discover is by going for a number of the worth manufacturers relatively than own-branded merchandise – they will really comprise and handle their family price range.

“It’s going to undoubtedly put a strain on family budgets and, after all, it comes on high of these excessive gasoline costs as effectively.”

Pat McFadden, a Labour shadow Treasury minister, criticised Eustice’s feedback as “woefully out of contact from a authorities with no answer to the cost-of-living disaster dealing with working individuals”.

Creator and campaigner Jack Monroe flagged in January that lots of the Sensible Worth, Fundamentals and Worth vary merchandise have been vanishing from cabinets:

Whereas Western international locations minimize their reliance on Russian oil, China’s impartial refiners have been discreetly shopping for it at steep reductions, the Monetary Instances experiences in the present day.

Right here’s the small print:

An official at a Shandong-based impartial refinery mentioned it had not publicly reported offers with Russian oil suppliers for the reason that Ukraine warfare began so as to keep away from attracting scrutiny and being hit by US sanctions.

The official added that the refinery had taken over a number of the buy quota for Russian crude from state-owned commodity buying and selling companies, that are seen to signify Beijing and have largely declined to signal new provide contracts.

Many western firms are self-sanctioning or struggling to safe the insurance coverage, transport or financing wanted to purchase Russia’s commodity exports, elevating expectations that energy-hungry China will step in and purchase the unsold barrels.

Extra right here: China’s impartial refiners begin shopping for Russian oil at steep reductions

Oil jumps after EU proposes Russia ban

Oil costs have jumped after the European Union proposed phasing out imports of Russian oil.

Brent crude has risen over 3%, to round $3 per barrel, to $108.77 per barrel, as merchants digest the prospect of an embargo inside six months.

WTI, Brent crude up 2% after EU proclaims proposal to part out Russia oil #news

— BlackCentaur (@JacekWierzbicki) May 4, 2022

Earlier than the Ukraine invasion, Brent crude had been buying and selling round $90 per barrel.

However in the present day’s rally nonetheless leaves oil under the highs of early March, when it hit $130/barrel because the UK and US introduced bans on Russian oil.

Stephen Innes, managing accomplice at SPI Asset Administration says:

“Oil costs aren’t exactly flying, so merchants suspect the satan can be within the particulars at this stage.

One key element is that Hungary and Slovakia can be given an exemption, to allow them to maintain shopping for Russian crude oil till the top of 2023 below present contracts, an EU supply instructed Reuters.

Right here’s our full story on the proposal for a complete, phased-in ban on Russian oil imports to the EU:

Ursula von der Leyen has proposed a complete ban on Russian oil imports to the EU, saying Vladimir Putin needed to pay a “excessive value for his brutal aggression” in Ukraine.

Member states in Brussels are scrutinising a proposed sixth bundle of sanctions, however in a speech on Wednesday the European Fee president mentioned Russian oil flows needed to cease.

Von der Leyen mentioned Russian provide of crude oil can be prohibited inside six months and refined merchandise can be banned by the top of the yr, whereas she acknowledged the calls for from international locations equivalent to Slovakia and Hungary for extra flexibility.

EU proposes eradicating Sberbank, two different Russian banks from SWIFT

Europe’s newest proposed sanctions on Russia will hit three of its banks, together with the most important, Sberbank.

Fee head Ursula von der Leyen instructed the European Parliament that Sberbank and two different banks can be faraway from the worldwide SWIFT transaction and messaging system.

That will additional isolate the Russian monetary system, over the continuing warfare in Ukraine, Fee head Ursula von der Leyen instructed European Parliament.

“We de-SWIFT Sberbank – by far Russia’s largest financial institution, and two different main banks.

By that, we hit banks which are systemically vital to the Russian monetary system and Putin’s skill to wage destruction.”

„As we speak we are going to suggest to ban all russian oil from Europe.“

Ursula von der Leyen, EU-Kommissionspräsidentin im Europaparlament pic.twitter.com/AWmp3gzxea

— Anne Gellinek (@a_gellinek) May 4, 2022

NOW- @vonderleyen proclaims key sixth sanction bundle:

-listing high-ranking individuals who dedicated warfare crimes in Bucha

-De-SWIFT Sberbank and a pair of different main banks.

– Banning 3 large Russian state- owned broadcasters

-Banning consulting companies from being offered to RUS CorpAND

— Jorge Valero (@europressos) May 4, 2022

Swift (the Society for Worldwide Interbank Monetary Telecommunication) is the primary safe messaging system that banks use to make speedy and safe cross-border funds, permitting worldwide commerce to move easily.

It has develop into the principal mechanism for financing worldwide commerce. In 2020, about 38 million transactions had been despatched every day over the Swift platform, facilitating trillions of {dollars}’ price of offers.

Being minimize off from Swift would harm Russian commerce, and making it more durable for its firms to do enterprise.

German commerce: What the consultants say

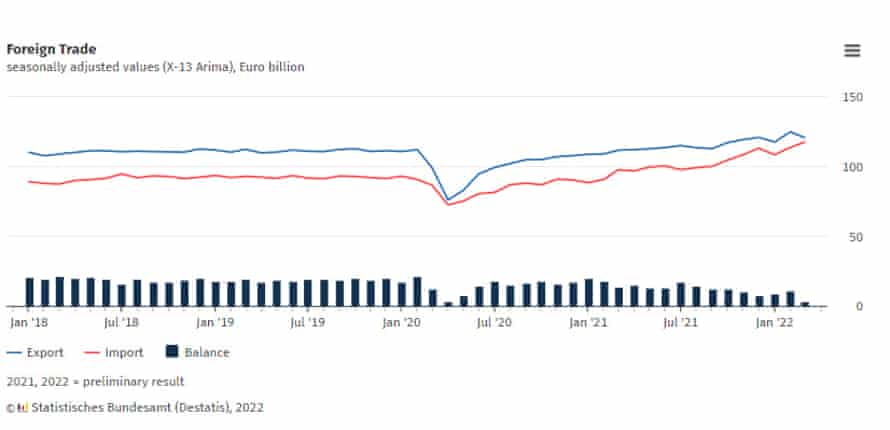

Germany’s commerce stability ‘crashed’ in March, warns Oliver Rakau of Oxford Economics:

German commerce stability crashed in March to under its pandemic low to ranges in any other case final seen within the early-2000s. Adj. for hovering import costs the products stability fell a lot much less markedly in actual phrases, however (self-) sanctions & provide chain points nonetheless left their mark in exports. https://t.co/m8RmstuFAT pic.twitter.com/8dkJvDNluv

— Oliver Rakau (@OliverRakau) May 4, 2022

With exports down 3.3%, and imports up 3.4%, Germany’s conventional commerce surplus dropped to €3.2bn in March. That’s down from €11.1bn in February and €14bn a yr earlier in March 2021.

Right here’s Bloomberg’s take:

German exports to Russia plummeted to their lowest in virtually twenty years, with the fallout from President Vladimir Putin’s assault on Ukraine additionally contributing to a drop in general commerce.

Governments and firms are severing ties with Russia amid Western outrage on the assault and the barrage of sanctions imposed on the Kremlin and related tycoons. Germany’s financial outlook, in the meantime, has darkened as its key manufacturing sector suffers from enter shortages and report inflation because of the warfare.

Extra right here: German Exports to Russia Sink to Two-Decade Low After Invasion

Introduction: German exports tumble as commerce with Russia shrinks

Good morning, and welcome to our rolling protection of enterprise, the world financial system and the monetary markets.

German exports to Russia have tumbled to their lowest in virtually twenty years, because the Ukraine warfare hits the European financial system.

Gross sales to Russia sank practically two-thirds to about €860m in March, with general German exports additionally dropping in an early signal of the financial impression of the Ukraine warfare on Europe’s largest financial system.

And with a ban on Russian oil looming, commerce pressures may intensify.

Whole German exports dropped by 3.3% month-on-month in March, the newest knowledge from statistics physique Destatis this morning reveals.

Exports to Russia had been significantly hit, sinking over 60% in contrast with February, because of sanctions imposed because of the Ukraine invasion, and “unsanctioned behaviour of market individuals”, Destatis experiences.

German Exports to Russia Sink to Two-Decade Low After Invasion

— AceMarketU.com (@AceMarketU) May 4, 2022

Wanting forward, regardless of richly stuffed order books, the short-term outlook for German exports doesn’t look encouraging, warns ING’s Carsten Brzeski:

New lockdowns in China and a continuation of, as a substitute of easing, final yr’s provide chain disruptions will go away important marks on German business. In keeping with a current Ifo survey, virtually half of all German firms are depending on imports from China. Additionally, the warfare in Ukraine may be very prone to disrupt different provide chains for good.

Extra usually, with a excessive threat that the warfare accelerates the pattern of deglobalization and excessive power and commodity costs for longer, the German export sector is dealing with extra headwinds forward.

German exports plunge in March | Snap | ING Suppose – The sharp drop in German exports in March is the primary arduous proof of the impression the warfare in Ukraine is having on the German, but additionally on the European,… https://t.co/HQB0LALedT

— Carsten Brzeski (@carstenbrzeski) May 4, 2022

German imports, although, rose 3.4% in the course of the month — suggesting that provide chain frictions didn’t hamper items coming in.

Notably, imports from Russia into Germany solely fell by 2.4% to €3.6bn, as oil and gasoline continued to move.

However that would change quickly, with the EU outlining a phased oil embargo on Russia over its warfare in Ukraine, in addition to sanctioning Russia’s high financial institution and banning Russian broadcasters from European airwaves.

President of the European Fee Ursula von der Leyen introduced the proposals in a speech within the European parliament.

This can be a whole import ban on all Russian oil, seaborne and pipeline, crude and refined. We’ll ensure that we part out Russian oil in an orderly vogue, in a means that enables us and our companions to safe different provide routes and minimises the impression on international markets.

For this reason we are going to part out Russian provide of crude oil inside six months and refined merchandise by the top of the yr.

The transfer is an try to “break the Russian warfare machine”, after Germany dropped its opposition, our Brussels bureau explains:

A proposal to part in a prohibition on Russian oil imports can be mentioned by member state ambassadors in Brussels on Wednesday, with essentially the most dependent, equivalent to Slovakia and Hungary, looking for exemptions.

These championing the ban have been bolstered by a change in strategy in Germany, the place reliance on Russian oil has been decreased from 35% on the finish of final yr to 12%.

The German economics minister, Robert Habeck, has referred to as on EU member states to indicate “solidarity with Ukraine” and “do their bit”

Elsewhere in the present day

The UK’s price of dwelling squeeze has intensified, with family items costs rising by the quickest fee in additional than 15 years.

Non-food inflation jumped to 2.2% in April, from 1.5% in March, as hovering power prices, the widerimpact of the warfare in Ukraine, and Covid lockdowns in China, pushed up costs.

Employees on the UK’s Metropolis watchdog are hanging in the present day in a dispute over pay and dealing situations.

Unite members on the Monetary Conduct Authority will maintain a two-day walkout, over modifications to pay, phrases and situations which it says have left 1000’s of FCA employees worse off.

On-line grocery group Ocado may face a shareholder revolt in the present day at its annual normal conferences. Some shareholders, together with Royal London Asset Administration, are opposing plans to increase a pay bundle that would give high bosses as much as £20m per yr for 5 years.

European markets are set for a subdued begin, as traders brace for the Federal Reserve to (in all probability) hike US rates of interest later in the present day.

The agenda

- 7am BST: German commerce stability for March

- 9am BST: Eurozone service sector PMI report

- 9.30am BST: UK mortgage approvals and shopper credit score knowledge for March

- 1.15pm BST: ADP report of US personal sector payrolls

- 7pm BST: US Federal Reserve rate of interest resolution

- 7.30pm BST: US Federal Reserve press convention

[ad_2]

Source link