[ad_1]

For the primary time in practically two months, crude oil costs have fallen under $100 a barrel this week, but in Singapore the value hole between excessive and low sulphur gas oil – often called the Hi5 – stays at report highs, nudging in the direction of $600 per tonne with ships within the area more and more swerving away to different bunkering locations.

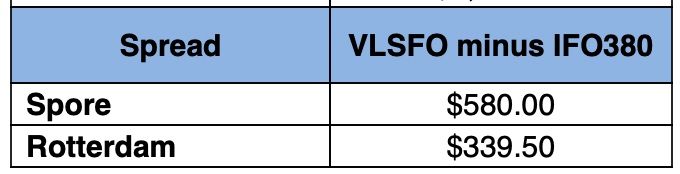

The pricing hole between Singapore and Rotterdam, the world’s two largest bunkering hubs, is stark.

“VLSFO provide has been acutely tight for weeks in Singapore’s bunker market, with excessive worth premiums quoted for immediate supply dates,” a brand new report from bunker platform Engine states, including: “Sources in Singapore’s bunker market level to a scarcity of incoming VLSFO cargo flows as a cause for the grade being tight.”

The state of affairs is predicted to stay tight all through July with experiences rising of ships avoiding Singapore for bunker operations, one thing that might improve on high quality considerations. International testing agency Intertek Lintec on Tuesday issued an alert relating to flash factors under the ISO 8217 minimal requirement of 60°C present in VLSFO bunker samples from vessels which have taken gas in Singapore, the newest in a sequence of damaging bunker high quality incidents hitting the republic this yr.

“It’s the nature of the product and the inter-relationships with excessive priced transport fuels that’s driving VLSFO costs so excessive, particularly in Singapore. The place within the east is stronger than within the west, with exceptionally low diesel and gasoline exports out of India and China leading to extremely restricted provides east of Suez,” a current report from Integr8 Fuels identified.

This yr’s rising worth hole between delivery’s most important two fuels is seeing a renewed curiosity in scrubbers.

Wanting on the VLCC section, Norwegian dealer Fearnleys noticed in its most up-to-date weekly report: “The disparity between the scrubbered and unscrubbered vessels is stark.”

With a worth differential near double, a VLCC proprietor capable of burn excessive sulphur gas oil can look to earn round $27,000 a day for a Center East to China run, in keeping with Fearnleys. Nonetheless, for the non-eco, non-scrubber vessels, on the identical voyage, TCE returns are nonetheless struggling to interrupt even.

Many will likely be eyeing the following dry dock as a chance to suit a scrubber and stage the taking part in area

“Many will likely be eyeing the following dry dock as a chance to suit a scrubber and stage the taking part in area,” Fearnleys predicted, one thing rival dealer Clarksons additionally forecast in its newest weekly report, noting that due to the excessive gas worth differential, the share of world tonnage with a scrubber is ready to develop to 24% by begin 2023.

Costs for crude oil have dropped noticeably this week with rising fears about recession in lots of western international locations. Not all delivery analysts are satisfied {that a} plummeting oil worth will likely be eagerly greeted by the delivery trade at giant.

“Shippers and delivery corporations will usually agree that decrease crude and bunker costs are to be most well-liked, nonetheless, proper now most will most likely be comfortable for crude to remain round $100 per barrel as a lot decrease costs will likely be a mirrored image of hostile international financial developments that assist nobody,” BIMCO’s chief delivery analyst, Niels Rasmussen, commented at present.

[ad_2]

Source link