[ad_1]

As we speak is Fed day, once we get the 75 bps enhance that dramatically will increase the chances of a recession. The principle storyline is inflation, however the missed subplot right here is Wages. I’ve detailed over the previous decade or so the lagging nature of wages in America — deflationary in financial phrases — and the way that had begun to alter within the late 2010s pre-pandemic.

Take into account these columns going again to 2013 declaring the foolishness of tax-payer backed company welfare queens (2013), and why median wages have been rising (2016, 2017, 2018, 2018, 2019). Then got here the pandemic, and an enormous federal employee subsidy. Employees upskilled and launched new companies. The steadiness of energy had shifted. After a long time of wages being deflationary, they not-so-suddenly turned inflationary.

The so-called “Nice Resignation” — a really particular and uniquely American response to these complicated compensation circumstances — is over. The information suggests it peaked over a 12 months in the past, slowly falling again in direction of pre-pandemic ranges.

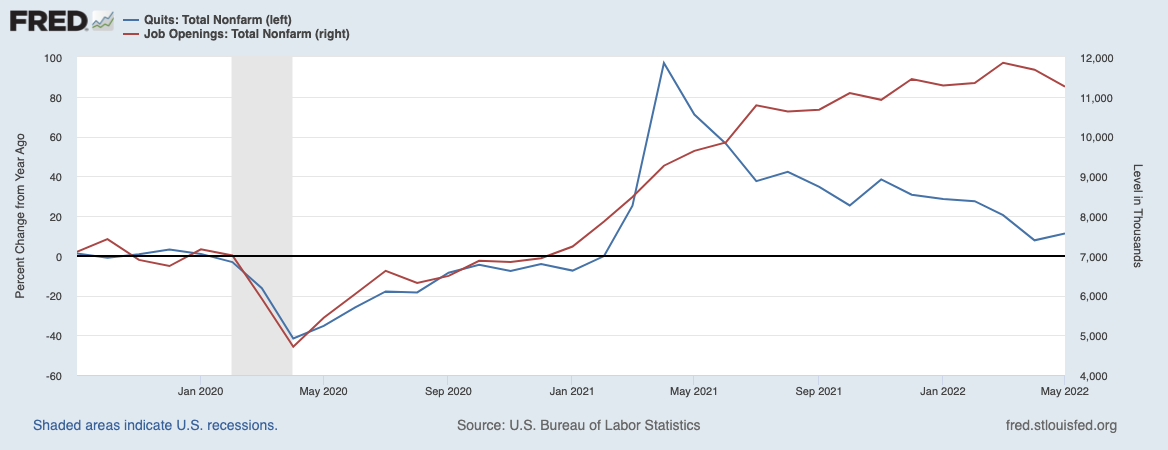

Take into account the chart up high (it’s from an RWM client-only quarterly name). The FRED database reveals each Quits Price in proportion change and Job Openings in 1000s. By any measure, we nonetheless have an infinite variety of unfilled positions. It’s simply off the height, however nonetheless extraordinarily excessive by any measure. This attests to the robustness of the labor economic system, recession or not. Sure, I perceive simply how ridiculous that sentence is.

But in addition have a look at the year-over-year change within the Quits Price: It spiked in proportion phrases to all-time highs in early 2021, earlier than slowly easing again in direction of (roughly) flat to 2019 over the following 12 months. In different phrases, the Nice Resignation was largely in 2021, however the after-effects are nonetheless being felt at the moment even after Give up charges normalized.

It’s simple to overlook how this occurred: Lagging wages from the Sixties by the 2000s not solely led to a pressured center class, however additionally they helped set the stage for the Nice Monetary Disaster. No one desires to see their lifestyle fall, however that was what occurred within the U.S. The broad post-war growth (1946-66) slowed, then stopped, then started to contract. It acquired worse by the Seventies, 80s, 90s. Relatively than settle for their destiny, Individuals used free cash provided by the personal unregulated banking system within the type of Dwelling Gross sales, HELOCs, and Refinancings. This was the uncooked gas to Wall Road, who lit it on hearth to drive nice earnings in securitized mortgages proper up till the second all of it went to hell. (I wrote a e-book about this).

The post- 2008-09 period noticed wealth inequality, already substantial in america, explode. The 2010s financial rescue plan benefitted anyone who owned capital belongings: Shares, Bonds, and Actual Property. However the pandemic was a large reset, with an enormous fiscal stimulus quite than only a financial one.

Now we have now inflation. When you needed to guess who will get to pay for that with blood and tears and {dollars}, who do you suppose loses: Capital or Labor?

The Federal Reserve has little management over the provision points which have pushed many of the inflation we see — within the underbuilt variety of new Properties, within the semiconductor-impacted scarcity of cars, I’m the Russian war-driven will increase in vitality and meals. Relatively than acknowledge this, they’ll destroy demand by throwing 3-5 million individuals out of labor.

That ought to indicate inflation who’s in cost!

As we speak’s disastrous FOMC resolution will likely be launched at 2:00 pm

See additionally:

Thousands and thousands of Individuals Remorse the Nice Resignation (Bloomberg, July 12, 2022)

Sahm: A Fed-induced recession is a medication worse than the illness (Monetary Instances)

Beforehand:

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

$1.395 Trillion Peak Unemployment Insurance coverage (March 4, 2022)

Elvis (Your Waiter) Has Left the Constructing (July 9, 2021)

Wages in America

[ad_2]

Source link