[ad_1]

It began with a single tweet in November 2019. David Heinemeier Hansson, a high-profile tech entrepreneur, lashed out at Apple’s newly launched bank card, calling it “sexist” for providing his spouse a credit score restrict 20 instances decrease than his personal.

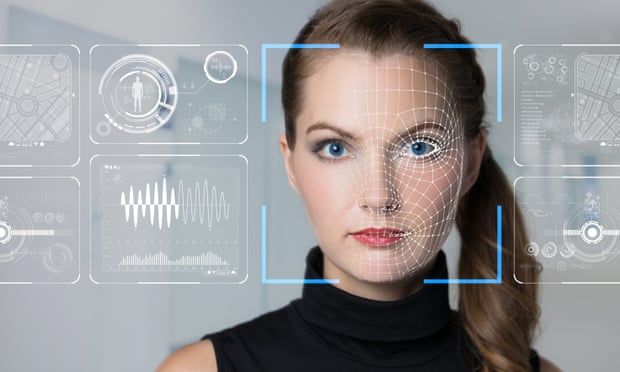

The allegations unfold like wildfire, with Hansson stressing that synthetic intelligence – now broadly used to make lending choices – was to blame. “It doesn’t matter what the intent of particular person Apple reps are, it issues what THE ALGORITHM they’ve positioned their full religion in does. And what it does is discriminate. That is fucked up.”

Whereas Apple and its underwriters Goldman Sachs have been in the end cleared by US regulators of violating truthful lending guidelines final 12 months, it rekindled a wider debate round AI use throughout private and non-private industries.

Politicians within the European Union are actually planning to introduce the primary complete international template for regulating AI, as establishments more and more automate routine duties in an try to spice up effectivity and in the end minimize prices.

That laws, often called the Synthetic Intelligence Act, may have penalties past EU borders, and just like the EU’s Common Information Safety Regulation, will apply to any establishment, together with UK banks, that serves EU prospects. “The affect of the act, as soon as adopted, can’t be overstated,” mentioned Alexandru Circiumaru, European public coverage lead on the Ada Lovelace Institute.

Relying on the EU’s remaining record of “excessive danger” makes use of, there may be an impetus to introduce strict guidelines round how AI is used to filter job, college or welfare purposes, or – within the case of lenders – assess the creditworthiness of potential debtors.

EU officers hope that with further oversight and restrictions on the kind of AI fashions that can be utilized, the principles will curb the sort of machine-based discrimination that would affect life-altering choices equivalent to whether or not you’ll be able to afford a house or a pupil mortgage.

“AI can be utilized to analyse your complete monetary well being together with spending, saving, different debt, to reach at a extra holistic image,” Sarah Kocianski, an impartial monetary expertise marketing consultant mentioned. “If designed appropriately, such techniques can present wider entry to reasonably priced credit score.”

However one of many largest risks is unintentional bias, by which algorithms find yourself denying loans or accounts to sure teams together with girls, migrants or folks of color.

A part of the issue is that almost all AI fashions can solely be taught from historic information they’ve been fed, which means they may be taught which sort of buyer has beforehand been lent to and which prospects have been marked as unreliable. “There’s a hazard that they are going to be biased when it comes to what a ‘good’ borrower seems like,” Kocianski mentioned. “Notably, gender and ethnicity are sometimes discovered to play an element within the AI’s decision-making processes based mostly on the info it has been taught on: components which might be under no circumstances related to an individual’s skill to repay a mortgage.”

Moreover, some fashions are designed to be blind to so-called protected traits, which means they don’t seem to be meant to contemplate the affect of gender, race, ethnicity or incapacity. However these AI fashions can nonetheless discriminate because of analysing different information factors equivalent to postcodes, which can correlate with traditionally deprived teams which have by no means beforehand utilized for, secured, or repaid loans or mortgages.

And most often, when an algorithm decides, it’s tough for anybody to know the way it got here to that conclusion, leading to what is usually known as “black-box” syndrome. It implies that banks, for instance, may wrestle to clarify what an applicant might have completed otherwise to qualify for a mortgage or bank card, or whether or not altering an applicant’s gender from male to feminine may lead to a unique final result.

Circiumaru mentioned the AI act, which might come into impact in late 2024, would profit tech corporations that managed to develop what he referred to as “reliable AI” fashions which might be compliant with the brand new EU guidelines.

Darko Matovski, the chief govt and co-founder of London-headquartered AI startup causaLens, believes his agency is amongst them.

The startup, which publicly launched in January 2021, has already licensed its expertise to the likes of asset supervisor Aviva, and quant buying and selling agency Tibra, and says numerous retail banks are within the strategy of signing offers with the agency earlier than the EU guidelines come into power.

The entrepreneur mentioned causaLens provides a extra superior type of AI that avoids potential bias by accounting and controlling for discriminatory correlations within the information. “Correlation-based fashions are studying the injustices from the previous they usually’re simply replaying it into the longer term,” Matovski mentioned.

He believes the proliferation of so-called causal AI fashions like his personal will result in higher outcomes for marginalised teams who could have missed out on academic and monetary alternatives.

“It’s actually onerous to know the size of the harm already induced, as a result of we can’t actually examine this mannequin,” he mentioned. “We don’t know the way many individuals haven’t gone to school due to a haywire algorithm. We don’t know the way many individuals weren’t capable of get their mortgage due to algorithm biases. We simply don’t know.”

Matovski mentioned the one option to defend towards potential discrimination was to make use of protected traits equivalent to incapacity, gender or race as an enter however assure that no matter these particular inputs, the choice didn’t change.

He mentioned it was a matter of guaranteeing AI fashions mirrored our present social values and prevented perpetuating any racist, ableist or misogynistic decision-making from the previous. “Society thinks that we must always deal with everyone equal, it doesn’t matter what gender, what their postcode is, what race they’re. So then the algorithms should not solely attempt to do it, however they need to assure it,” he mentioned.

Signal as much as the day by day Enterprise At present electronic mail or comply with Guardian Enterprise on Twitter at @BusinessDesk

Whereas the EU’s new guidelines are more likely to be an enormous step in curbing machine-based bias, some consultants, together with these on the Ada Lovelace Institute, are pushing for shoppers to have the best to complain and search redress in the event that they suppose they’ve been put at a drawback.

“The dangers posed by AI, particularly when utilized in sure particular circumstances, are actual, vital and already current,” Circiumaru mentioned.

“AI regulation ought to be certain that people might be appropriately shielded from hurt by approving or not approving makes use of of AI and have cures accessible the place accredited AI techniques malfunction or lead to harms. We can’t faux accredited AI techniques will at all times operate completely and fail to arrange for the situations after they received’t.”

[ad_2]

Source link