[ad_1]

Key occasions

Filters BETA

One other signal that inflationary pressures within the US financial system could have peaked: the common value of US retail gasoline fell under $4 per gallon on Thursday.

The nationwide common value for normal unleaded petrol fell to $3.990 a gallon on 11 August, in response to the American Car Affiliation’s value tracker. That’s down from $4.68 a month in the past, and above $5 in mid-June.

Rising petrol costs have been an vital a part of the inflationary story around the globe, as many individuals outdoors city areas can’t keep away from filling up their vehicles. It filters via to the worth of virtually the whole lot else through companies.

Gas subsidies have been utilized in a number of international locations to cushion the inflationary blow, though many economists and analysts say this may be counterproductive, because it encourages individuals to proceed to purchase extra gas. And wealthy households are likely to spend extra on gas, so subsidies assist them extra.

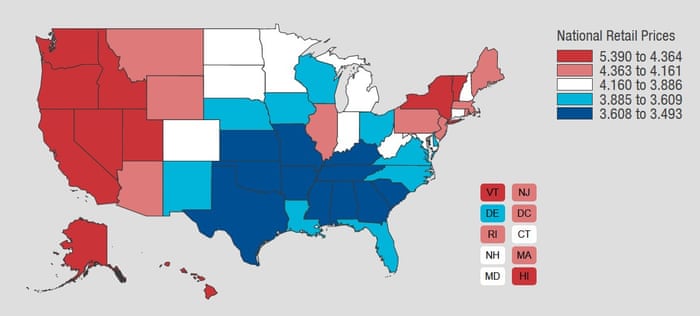

A couple of extra attention-grabbing factors. Firstly, the American Car Affiliation’s map of petrol costs will not be a foul proxy for a US election map (albeit with the color scheme swapped):

Secondly American petrol costs take pleasure in an enormous implicit subsidy: costs are basically decrease than many different elements of the world. $4 per gallon – a pump value degree that prompts howls of concern within the US – equates to about 87p per litre in British cash. That’s lower than half what British drivers pay, in response to the RAC.

The FTSE 100 leaders this morning are Ladbrokes proprietor Entain and Coca-Cola Hellenic Bottling Firm, each of which have given their shareholders positives amid a difficult macro setting.

Coca-Cola HBC, one of many greatest house owners of a bottling franchise for US-based Coca-Cola, gained 3.6% after it forecast working earnings in 2022 much like 2021 – even after reporting a €190m (£160m) hit from its Russian enterprise, after it stopped promoting Coke merchandise following the invasion of Ukraine.

Playing firm Entain stated it’s shopping for a Croatia’s SuperSport Group bookmaker in a progress drive, and its earnings (in any other case often called clients’ playing losses) had been up 20% on a 12 months earlier. Its share value rose by 2.2%.

FTSE 100 flat as Federal Reserve officers say inflation ‘victory’ is much off

Good morning, and welcome to our dwell protection of enterprise, economics and monetary markets.

Inventory markets around the globe have rallied after US shopper value index inflation slowed in July. Nevertheless, Federal Reserve officers have achieved their finest to stress that the world’s largest and most influential financial system will not be out of the woods but.

The reduction rally prompted by the slower inflation (which might indicate much less want for rate of interest hikes to sluggish financial progress) continued in Asia in a single day, with the Shanghai Inventory Change Composite index gaining 1.5% and Hong Kong’s Cling Seng up 2.1%. In Europe the Stoxx 600 index gained 0.4% within the opening minutes of buying and selling, however the FTSE 100 edged down.

Buyers try to stability their hopes that inflationary pressures could also be falling with the data that the US Federal Reserve continues to be dedicated to rising rates of interest additional, doubtlessly triggering a recession. Falling inflation within the US would feed via on to economies around the globe, together with the UK, the place the Financial institution of England has already forecast a year-long recession.

Neel Kashkari, the president of the Federal Reserve Financial institution of Minneapolis, final night time stated the slower-than-expected US inflation studying was “welcome” information however didn’t alter his expectation that the US central financial institution would wish to lift its charges to three.9% by year-end and to 4.4% by the tip of 2023. The speed is at present within the 2.25%-2.5% vary.

The Fed is “far, far-off from declaring victory” on inflation, Kashkari stated on the Aspen Concepts Convention, Reuters reported.

One other official, San Francisco Federal Reserve Financial institution president Mary Daly, gave the Monetary Instances an analogous message on Wednesday. She stated:

There’s excellent news on the month-to-month knowledge that customers and enterprise are getting some reduction, however inflation stays far too excessive and never close to our value stability aim.

We may have an extra indication of inflationary pressures within the US later right this moment, with the producer value index giving a sign of the costs producers are charging.

The agenda

-

1:30pm BST: US producer value index inflation (July; earlier: 11.3%; consensus: 10.4%)

-

1:30pm BST: US preliminary jobless claims (week ending 6 August; earlier: 260,000; consensus: 263,000)

[ad_2]

Source link