[ad_1]

Key occasions

UK inflation to hit 18% as power payments rocket, warns Citi

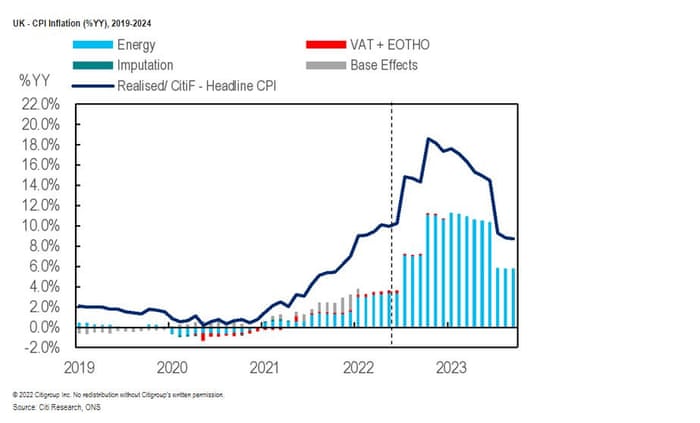

Surging power payments will drive UK inflation over 18% early subsequent 12 months — the very best peak in nearly half a century — funding financial institution Citi has warned.

Citi has forecast that CPI inflation will hit 18.6% in January 2023, whereas the RPI inflation charge will hit 21%, resulting from extraordinarily painful rises in power payments that may push the price of dwelling into the “stratosphere”.

Citi predicts that the worth cap on power payments throughout Nice Britain will rise to £3,717 in October (up from £1,971 right now), after which leap to £4,567 in January after which £5,816 in April.

Benjamin Nabarro, chief UK economist at Citi, informed purchasers:

Our newest estimate, up to date for the additional 25% and seven% rally in UK gasoline and electrical energy costs final week, factors to an extra upside shift in UK inflation.

Accounting for these developments, in addition to updating our personal weights for CPI/ RPI and honing our personal accounting for curve backwardation, we now anticipate CPI inflation to peak at over 18% in January. RPI inflation, we predict, will peak at over 20%.

The query now could be what coverage might do to offset the influence on each inflation and the true economic system, Nabarro provides:

For now, we predict [Liz] Truss’s feedback level to solely a restricted offset for headline inflation. Although the dangers stay skewed in the direction of additional help.

Earlier this month the Financial institution of England forecast that UK inflation will peak over 13% this autumn when the power worth cap is lifted.

Wholesale gasoline costs have continued to rise by August, as Vladimir Putin has ‘weaponised’ Russia’s power provides.

As flagged earlier, they’ve surged this morning as Gazprom prepares to close down its Nord Stream 1 pipeline for 3 days on the finish of this month.

The FT factors out that if UK inflation hits 18%, that may be greater than the height of inflation after the second Opec oil shock of 1979 when CPI reached 17.8%, in response to estimates from the Workplace for Nationwide Statistics.

Poor households, and people in badly insulted properties, will endure most from the looming surge in power payments, warned Decision Basis in a report revealed this month:

#CostOfLivingCrisis: Vitality payments in Jan-March 2023 are set to be an annualised £4,266 fairly than the £2.800 anticipated earlier this 12 months. Low-income households should cut back “non-essential” spending by 3x as a lot as high-income households with the intention to afford these payments. 🧵 pic.twitter.com/wFmSHlyitL

— Decision Basis (@resfoundation) August 22, 2022

Poorer households, within the lowest quintile of the earnings distribution, should in the reduction of nearly 1 in £4 (24%) of non-essential spending to accommodate the upper payments and afford meals, hire & necessities this winter, in comparison with 1 in £12 (8%) for the richest tenth of households. pic.twitter.com/UOCqOcjxje

— Decision Basis (@resfoundation) August 22, 2022

A typical low-income family paying by Direct Debit is now anticipated to want an additional £418 to pay their power payments over the primary three months of subsequent 12 months than was anticipated again in Could 2022.

— Decision Basis (@resfoundation) August 22, 2022

The approaching leap in power prices will coincide with winter, when family demand will increase considerably. Virtually half of annual family gasoline prices come from utilization between January-March, with the kind of housing individuals reside in set to play a giant half in how a lot their prices soar.

— Decision Basis (@resfoundation) August 22, 2022

Come January, households in energy-inefficient properties will face month-to-month gasoline payments £231 greater than these dwelling in equal properties that already meet the Authorities’s effectivity goal (EPC C). Over the 2022-23 winter interval, this penalty provides as much as £849, a mean of £141 a month. pic.twitter.com/Khkj8KjFq5

— Decision Basis (@resfoundation) August 22, 2022

Breaking gasoline payments down into particular person actions, we will see the each day price of turning the (gasoline) heating on will likely be £7.34 this winter, even for households in power environment friendly (EPC C) properties. For these in badly insulated properties this determine rises by over half (58%) to £11.60 a day. pic.twitter.com/odH9Oi89JP

— Decision Basis (@resfoundation) August 22, 2022

Within the final pre-Covid winter, there have been 28,300 extra winter deaths in England and Wales, with WHO estimates implying round 8,500 of those might be attributed to chilly properties – and nearly half (49%) of the poorest fifth of households reside in properties with uninsulated partitions.

— Decision Basis (@resfoundation) August 22, 2022

Though this degree is essentially constant throughout the earnings spectrum, the monetary penalties of dwelling in energy-inefficient properties will hit lower-income households hardest (and, as beforehand proven, power them to chop again on a better proportion of their general spending).

— Decision Basis (@resfoundation) August 22, 2022

The Authorities should act shortly to place in place the help that will likely be wanted this winter, in addition to accelerating modifications in how we produce and devour power so households are much less uncovered to cost shocks. Learn extra in ‘Chopping again to maintain heat’: https://t.co/hudKJBjm55

— Decision Basis (@resfoundation) August 22, 2022

Common pay for FTSE 100 chiefs jumps by 39% to £3.4m

One team of workers has managed to get an inflation-beating improve in earnings – Britain’s CEOs.

Chief executives of the UK’s 100 greatest firms have seen their pay leap by 39% to a mean of £3.4m, in response to analysis by the Excessive Pay Centre thinktank and the Trades Union Congress (TUC).

The median common pay of CEOs of firms within the FTSE 100 index rose to £3.4m in 2021, in contrast with £2.5m in 2020 in the course of the peak of the coronavirus pandemic when many bosses took a voluntary pay lower as they positioned thousands and thousands of workers on furlough.

CEO pay has additionally surpassed the £3.25m median recorded in 2019, earlier than the pandemic.

Right here’s the complete story, by our wealth correspondent Rupert Neate:

Invoice Bullen, the chief government of Utilita, has referred to as for the Conservative social gathering to finish their management contest early in order that the power disaster might be tackled now.

Bullen warned that the disaster can not wait till Boris Johnson’s successor has been chosen in early September. Motion is required this week, forward of Ofgem’s worth cap announcement on Friday.

Bullen informed the At this time programme:

“All by the summer season, we’ve been listening to about clients in misery, clients who’re nervous that they’re not capable of warmth their properties over this coming winter.

“That’s why we’re saying to the Authorities, you’ve received to take this determination to freeze costs at their present degree proper now.

“This can not wait till the fifth or sixth of September. The Conservative Social gathering must type themselves out, resolve who the chief goes to be this week, in order that the Ofgem announcement on the twenty sixth doesn’t must occur. That’s such an crucial.

“Frankly, for the sake of the nation, I believe the Conservative Social gathering must type their management contest out faster than they’re at present planning on doing it. Then at the least we’ll take away the stress of this winter arising for tens of thousands and thousands of households.”

Liz Truss, the frontrunner to develop into the subsequent prime minister, signalled over the weekend she would supply help “throughout the board” for households and companies hit by hovering power costs.

Beforehand she’s opposed “giving out handouts”, however that place could also be shifting as thousands and thousands of households face a grim winter [the cap is likely to rise again in January].

Octopus boss: Fuel worth surge equal to £25 pint

If beer costs had risen as quick as gasoline costs this 12 months, then a pint of beer would price £25, the top of provider Octopus Vitality factors out.

Greg Jackson, founder and chief government of Octopus, informed Radio 4’s At this time Programme that gasoline costs are at present 9 to 11 occasions greater than normal.

“Look, to place that in perspective, if this was beer, we’re speaking in regards to the wholesale worth being £25 a pint.

“Individuals don’t know what a therm is, however, beneath it, the worth per therm has gone from 60p to round £5 for the time being and that’s what’s passing by to clients if we don’t do one thing.”

Jackson added that there are systemic points inside the power business, however that power suppliers can’t be anticipated to go such excessive wholesale prices onto shoppers.

Vitality regulator Ofgem is because of announce the UK’s power worth cap on Friday. Payments may soar round 80% from October, to £3,600 per 12 months from £1,971 at current.

Jackson warned that the UK’s power invoice is rising from £15bn in a standard 12 months to £75bn this 12 months – the equal of an additional 9p on the bottom charge earnings tax.

He says the federal government should improve its present help package deal – one possibility can be to create a ‘tariff deficit fund’, which might freeze the cap the place it’s, and repay the price when wholesale costs return to regular ranges.

Again from vacation. Since Aug 20, costs have:

🔥European gasoline TTF up ~40%

🔌German 1-year electrical energy up ~36% (report excessive)

⛽️Brent crude down ~3%

🏭Thermal coal API2 up ~6%— Javier Blas (@JavierBlas) August 22, 2022

UK gasoline costs leap on Russia provide fears

UK wholesale gasoline costs have surged this morning, after Russia introduced it’ll halt provides by its major pipeline to Europe for 3 days on the finish of the month.

The worth of gasoline for supply to the UK subsequent month has risen nearly 20% to 550p per therm.

That’s its highest since early March after the Ukraine conflict started.

The day-ahead UK gasoline worth has jumped 27% to 460p per therm.

European gasoline costs have risen too, with the benchmark September contract up 5%, and the October contract leaping 10%.

The transfer comes after Gazprom mentioned on Friday it will conduct unscheduled upkeep on a Nord Stream 1 turbine, which pumps gasoline underneath the Baltic Sea to Germany.

The transfer deepens an power standoff between Moscow and Brussels, at a time when European nations try to construct up stockpiles for the winter.

Analyst Nathan Piper of Investec says considerations over gasoline provides are rising, pushing up costs:

Gazprom introduced an unplanned upkeep of a Nordstream 1 turbine. Fuel provides by way of the pipeline will likely be shut off for at the least three days beginning finish August.

Russian gasoline provides to Europe have been already down 75% 12 months on 12 months and this announcement has pushed UK/European gasoline costs to all-time highs (10x the 10-year common) for 5 consecutive days.

We anticipate an extra surge in spot costs and the ahead curve as uncertainties round gasoline provide improve forward of winter, when gasoline demand rises for heating.

Barristers have voted to start putting indefinitely from subsequent month, within the newest industrial motion to hit the UK.

The Prison Bar Affiliation, which represents advocates in England and Wales, has introduced that 80% of voting members had backed escalating their industrial motion of their ongoing dispute over authorities funding.

They’ll now stroll out indefinitely from September 5, the day Boris Johnson’s successor as new prime minister is because of be introduced.

Barristers started holding strikes earlier this summer season, warning that cuts to authorized assist funding have been bringing the legal justice system to its knees.

The CBA says there was a 28% lower in legal authorized assist charges up to now decade and is demanding a 25% improve.

Germany has been hit by a drop in exports to non-European Union nations final month.

German exports past the EU fell by 7.6% on the month in July, the Federal Statistics Workplace mentioned this morning.

That exhibits Europe’s largest economic system made a weak begin to the second half of 2022, after failing to develop in April-June, as the worldwide economic system struggled.

Reuters has extra particulars:

The USA remained crucial buying and selling associate for German exporters in July, with exports of products to the U.S. market rising 14.9% on the 12 months. Exports to China rose 6.1% on the 12 months. Exports to Russia fell 56.0% on the 12 months.

The German economic system grew to become extra depending on China within the first half of 2022, with direct funding and its commerce deficit reaching new heights, regardless of political strain on Berlin to pivot away from Beijing, in response to analysis seen by Reuters

Over in China, the central financial institution has slashed mortgage lending charges for the second time this 12 months because it battles a liquidity disaster within the property sector.

China’s five-year mortgage prime charge has been lower to 4.3%, from 4.45%, matching the report discount made in Could.

The strikes suggests the Individuals’s Financial institution of China is nervous about issues within the housing market.

Final month, Chinese language banks have been informed to bail out struggling property builders to assist them full unfinished housing tasks and head off the rising mortgage strike that threatens to significantly harm the economic system.

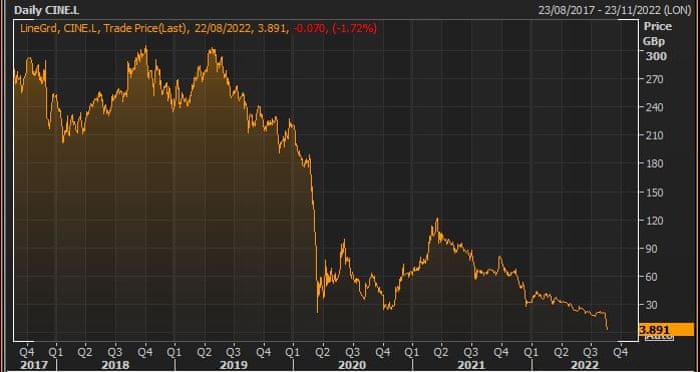

Cineworld’s debt burden has left the corporate on the point of collapse, warns Victoria Scholar, head of funding at interactive investor:

The corporate has been destroyed by the pandemic. Covid meant that cinemas have been closed for a lot of months, Hollywood was unable to churn out hits and shopper preferences shifted in the direction of streaming as a substitute which has brought on lasting harm for ticket demand even after film theatres reopened.

On high of that, Sky for instance now releases new blockbusters concurrently the cinemas, once more decreasing the inducement to depart the home and organise a cinema journey.

Plus, Cineworld has been coping with issues of its personal with its £700m damages invoice for abandoning its takeover of Cineplex, touchdown the embattled cinema chain with an unmanageable debt pile.

Shares have plunged from above 300p earlier than the pandemic to round 4p a share right now.

The Felixstowe port strike may add to the UK’s financial disruption, warns Sophie Lund-Yates, lead fairness analyst at Hargreaves Lansdown:

“The Port of Felixstowe is an important lynchpin within the UK’s commerce operations, and an eight-day strike is prone to end in interrupted provides for supermarkets in addition to exports. It’s a chance that industrial motion may march on by to Christmas, too.

That is the newest undesirable twist in our weekly meals outlets, with excessive costs already making the expertise harder for a lot of consumers. From an financial standpoint, a disruption to commerce is the very last thing the UK wants proper now. There are already far-reaching productiveness issues which hold a lid on financial progress, with an avoidable blip reminiscent of port strikes including insult to an present harm.

The Instances says the strike may disrupt £700m of commerce, and have a direct influence on the likes of Asda, John Lewis, Tesco and Marks & Spencer.

Strike underway at UK’s largest container port

The UK’s summer season of business motion is continuous as dock staff in Felixstowe maintain an eight-day strike over a pay dispute.

Round 1,900 staff on the UK’s greatest container port started their first strike since 1989 on Sunday, main transport firms and union leaders to warn that provide chains could possibly be disrupted.

Staff together with crane drivers, machine operators and stevedores will take motion after voting by greater than 9 to 1 in favour of strikes.

The Unite union mentioned the eight-day stoppage would have a big effect on the port, which handles round 4m containers a 12 months from 2,000 ships.

Robert Morton, Unite’s nationwide officer has informed Sky Information that Felixstowe staff are looking for safety from the cost-of-living disaster.

“We try to maintain tempo with the inflation charge, but the employer at Felixstowe has supplied a 7% improve in addition to a £500 lump sum cost that’s not consolidated inside the pay.”

Morton identified that the RPI inflation charge is now 12.3%:

“Like all negotiations, you don’t all the time get what you need.

“Nonetheless, if we will sit down and thrash this out, there will likely be a determine between 7% and 12.3% that’s acceptable to my membership.”

In response to the provide being far more than that supplied to NHS employees, Mr Morton mentioned:

“I believe that the NHS employees ought to be paid greater than anybody else really, however our members are working (outdoors) in all types of climate, they’re very extremely expert individuals and I believe they deserve extra from the corporate who’s making large income and is extraordinarily.

“My message to them is ‘should you will pay it, then achieve this’.”

‘We received you thru the pandemic and that is the best way you deal with us?’

Robert Morton, Nationwide Officer for Docks, Unite The Union, says they’re ‘genuinely aggrieved’ on the 7% pay rise provide as Felixstowe dock staff stroll out for the primary time since 1989. pic.twitter.com/vAKjPDuGF6

— GB Information (@GBNEWS) August 22, 2022

‘All of us wrestle…none of us wish to strike we’ve been pushed to it.’ Sean, who has labored as a crane drive for almost 30 years on the port of Felixstowe on why he’s putting over pay. @GMB pic.twitter.com/hqbuHjUh2g

— Nitya Gracianna Rajan (@NityaGRajan) August 22, 2022

After greater than halving on Friday, shares in Cineworld are hovering round 4p in early buying and selling.

They’ve misplaced round 85% of their worth to date this 12 months, and have been value round £2 at the beginning of 2022, earlier than the pandemic hit the sector.

Cineworld has narrowly prevented chapter twice up to now two years, because the Monetary Instances defined final week:

Cineworld additionally ready a Chapter 11 submitting in 2020, in case negotiations with its lenders over a debt restructuring fell by.

The corporate didn’t must enter chapter at the moment, nevertheless, as a result of lenders agreed to supply a $450mn rescue mortgage that gave the corporate the liquidity wanted to outlive within the quick time period.

However the enterprise’s restoration has taken longer than anticipated. One other potential choice to rescue the chain is a debt-for-equity swap that may give the corporate’s lenders management of the group. A clutch of lenders took management of rival Vue in an analogous deal final month.

Information that Cineworld may file for chapter broke on Friday, sending its shares slumping.

My colleague Mark Sweney defined:

Cineworld, which faces an nearly $1bn payout for pulling out of a deal to purchase its Canadian rival Cineplex, reported a $493m 12 months on 12 months improve in internet debt to $4.8bn on the finish of 2021.

The group made a $708m loss final 12 months. Nonetheless, revenues greater than doubled from $852m to $1.8bn, due to the newest James Bond and Spider-Man movies. In 2020, the corporate reported a report $3bn loss.

“The agency will blame the dearth of summer season blockbusters as a purpose behind its sharp downfall however in actuality its aggressive acquisition plan has taken on an excessive amount of debt and this was all the time an enormous danger as rates of interest rise,” mentioned Walid Koudmani, chief market analyst on the monetary brokerage XTB.

Introduction: Cineworld contemplating submitting for US chapter

Good morning, and welcome to our rolling protection of enterprise, the world economic system and the monetary markets.

Troubled cinema chain Cineworld has confirmed that it’s contemplating submitting for bankrupcy safety in america, because it appears to be like to restructure its stability sheet and lift further funds.

In an announcement to the Metropolis this morning, Cineworld says that its Cineworld and Regal theaters globally are open for enterprise as normal whereas it considers numerous strategic choices – together with a potential voluntary Chapter 11 submitting within the US, and related measures in different jurisdictions.

The world’s second-largest cinema chain is combating near-term liquidity following the disruption of the pandemic, and a slower-than-hoped restoration in movie-going, which has left it with money owed of greater than $4.8bn (£4bn).

The price of dwelling crunch has added to the leisure business’s woes, as shoppers are pressured to chop again.

The corporate, which operates 751 websites in 10 nations together with the Cineworld and Picturehouse chains within the UK, says there wouldn’t be any ‘vital influence’ on its employees if it filed for bankrupcy safety.

Cineworld says it’s taking a look at choices to boost “further liquidity and doubtlessly restructure its stability sheet by a complete deleveraging transaction”.

Any such submitting can be anticipated to permit the Group to entry near-term liquidity and help the orderly implementation of a totally funded deleveraging transaction.

Cineworld would anticipate to take care of its operations within the bizarre course till and following any submitting and in the end to proceed its enterprise over the long term with no vital influence upon its workers.

Cineworld employs round 45,000 peope worldwide, together with greater than 5,000 within the UK.

Shareholders may see their stakes closely diluted, Cineworld provides:

As beforehand introduced, any deleveraging transaction would, nevertheless, end in very vital dilution of present fairness pursuits in Cineworld.

Cineworld’s analysis of those strategic choices stays ongoing. An extra announcement will likely be made if and when acceptable.

Cineworld (#CINE) confirms market chat it is contemplating voluntary Chapter 11 within the US and related measures in different jurisdictions. Shares crashed one other 58% Friday to 4p.https://t.co/qrmeHefbUK

— Ian Conway (@SharesMagIan) August 22, 2022

Additionally arising right now

Recession fears are knocking the oil worth this morning. Brent crude has fallen over 1% to $95.45 per barrel, on considerations that aggressive US rate of interest hikes will harm an already-weak world economic system, and knock demand for gas.

European inventory markets are set for a decrease open, as traders await the Kansas Metropolis Fed’s two-day annual financial symposium, in Jackson Gap, Wyoming, on the finish of the week.

Federal Reserve Chair Jerome Powell will ship his keynote deal with on Friday, and will sign how excessive U.S. borrowing prices might go and the way lengthy they might want to keep there to deliver down hovering inflation.

UK barristers are ready for the outcomes of an all-out strike poll for industrial motion subsequent month as a part of a row with the Authorities over jobs and pay.

Members of the Prison Bar Affiliation (CBA) have been strolling out on alternate weeks however have been balloted on an indefinite, uninterrupted strike that may begin on September 5.

The poll closed at midnight on Sunday and the result’s anticipated this morning.

The agenda

[ad_2]

Source link