[ad_1]

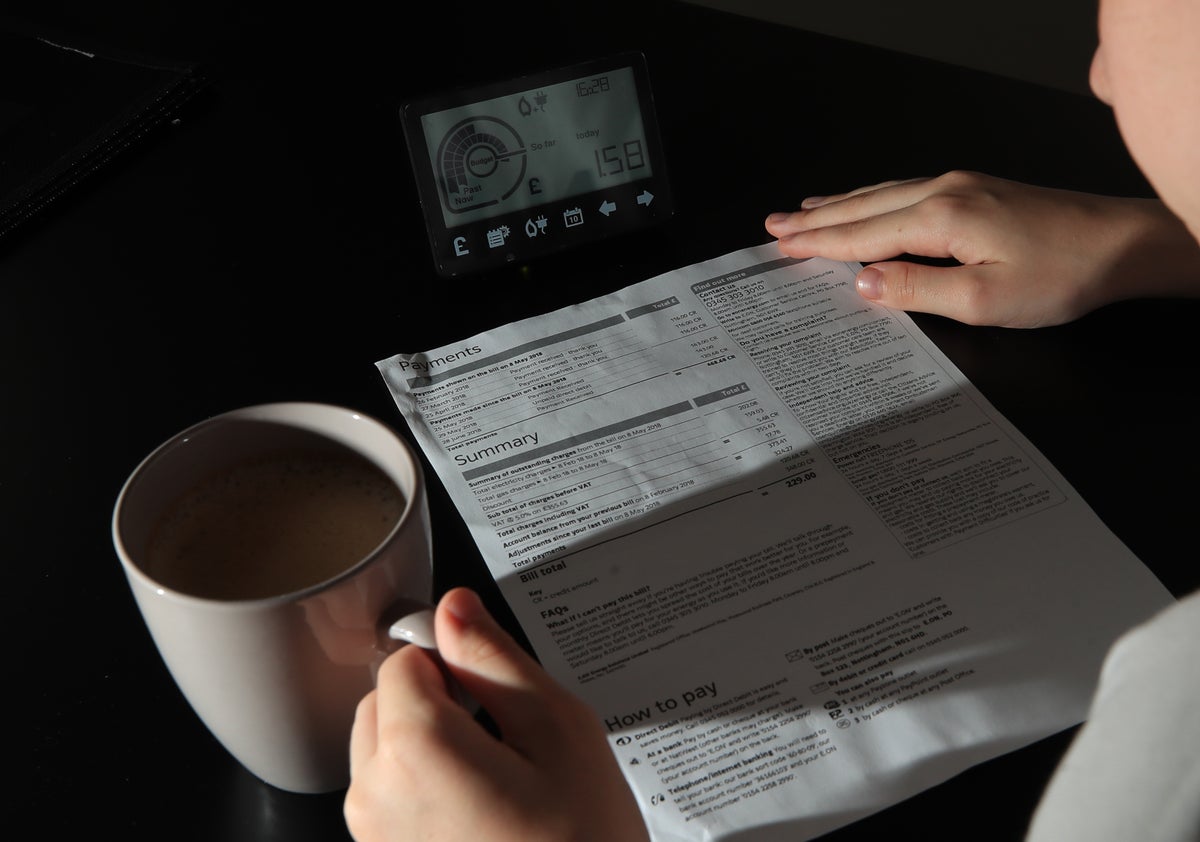

Households might see their gasoline payments price greater than their month-to-month mortgage funds subsequent yr as power costs skyrocket, power consultants have warned.

Many individuals are set to see their disposable incomes shrink considerably within the new yr with some seeing the price of their utility payments catching up with, or overtaking, their mortgage.

Vitality costs might spike at as a lot as £6,823 per yr for the typical family from subsequent April, in response to the most recent forecast by power consultancy Auxilion, which quantities to about £569 a month.

Compared, the typical invoice in October 2021 was £1,400 a yr.

Owners with fixed-rate mortgages pay £741 a month on common, in response to the most recent information from commerce physique UK Finance, compiled in December.

Which means owners might see only a £172 distinction in the price of paying their mortgage and heating their house.

For these with a normal variable price (SVR) mortgage, the figures are even starker.

The common SVR mortgage month-to-month compensation, which debtors might be transferred to as soon as their fastened or tracker mortgage deal involves an finish, quantities to £516, UK Finance mentioned.

That signifies that some households might find yourself paying £53 extra on their utility payments than their mortgage as runaway power costs overtake the price of proudly owning a house.

It’s changing into more and more clear that skyrocketing costs will swallow up all the assist that has been introduced thus far

Dame Clare Moriarty, chief govt of Residents Recommendation

In the meantime, folks tied to a tracker mortgage, which immediately monitor the Financial institution of England’s base price, will see round £50 added to their typical prices, in response to calculations by the commerce physique.

And renters are set to face much more drastic mounting prices amid the cost-of-living disaster.

Rents have spiralled over the previous few years and the typical month-to-month price of a newly let property reached £1,166 in July, or £2,008 for Higher London, in response to figures from property brokers Hamptons.

Such fast worth development signifies that the typical two-bed house, at £1,068pcm, now prices what the typical three-bed price simply 16 months in the past. Whereas the typical one-bed, at £929pcm, is now value what the typical two-bed price two years in the past, Hamptons mentioned.

The mixed impact of upper mortgage repayments or month-to-month hire and surging payments might put some folks beneath severe monetary stress within the months forward.

A number of excessive road banks have put aside a whole bunch of tens of millions of kilos to arrange for a rise in prospects defaulting on their mortgage repayments.

Lloyds Banking Group mentioned it had put apart £377 million to cowl mortgage losses, whereas Barclays reported it put aside £341 million in July because the financial outlook worsened.

Charities have warned that many individuals might face hardship through the colder months of the yr when they might be pressured to decide on between “consuming or heating”.

Residents Recommendation mentioned {that a} quarter of individuals within the UK will be unable to afford to pay their power payments in October primarily based on present forecasts, leaping to a 3rd of individuals in January when costs will soar larger.

It mentioned its evaluation took into consideration the power rebate and cost-of-living funds provided by the Authorities, exhibiting that the assist on provide doesn’t go far sufficient to guard households from spiralling prices.

Dame Clare Moriarty, chief govt of Residents Recommendation, mentioned: “Each single day at Residents Recommendation we’re already serving to folks in probably the most heart-breaking circumstances, attempting to scrape collectively sufficient to feed their youngsters and maintain the lights on. This can get far, far worse except the Authorities acts.

“It’s changing into more and more clear that skyrocketing costs will swallow up all the assist that has been introduced thus far.”

Moreover, incapacity charity Scope mentioned that disabled persons are more likely to be more durable hit when October’s power worth hikes come into pressure.

“Scope has been inundated with calls from disabled individuals who have been pressured to make dire cutbacks on private care, hygiene, meals and power due to rampaging inflation,” mentioned Tom Marsland, coverage supervisor at Scope.

“That is having a devastating impression on disabled folks’s lives, and the assist from Authorities simply gained’t contact the aspect.”

Scope mentioned it had heard from people who find themselves pressured to cease heating their houses to energy lifesaving tools and others who’re skipping meals so their youngsters can eat, the charity informed the PA information company.

It additionally famous that referrals to its incapacity power assist service had elevated five-fold between February and July, in comparison with the identical interval final yr, partly due to rising prices.

[ad_2]

Source link