[ad_1]

Yearly, Credit score Suisse places out an in-depth take a look at wealth world wide (I usually pull a chart or two for the reads). The information at all times has some fascinating findings about how the very rich are investing, consuming, and in any other case spending their money and time. I don’t at all times reference it, however intriguing and anomalous findings are at all times value sharing.

This 12 months is a type of occasions.

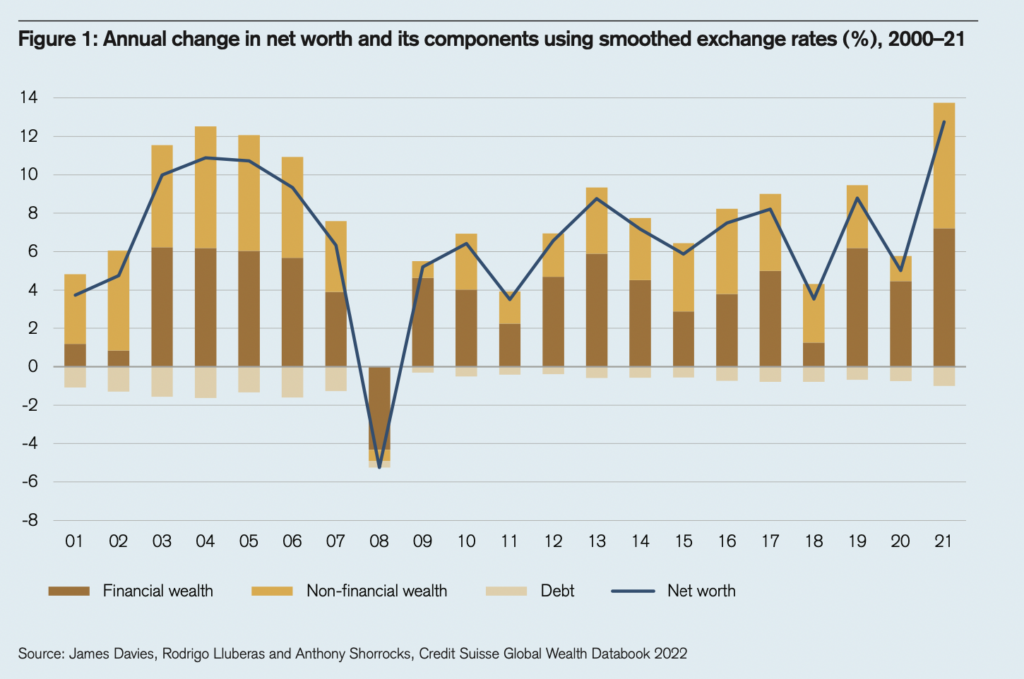

International wealth, in each greenback totals, and proportion features, every hit all-time highs. The precise information had some very fascinating highlights, together with some ginormous numbers:

-International Wealth: $463.6 trillion (finish of 2021)

-Improve versus 2020: +9.8%

-Annual common features: +6.6% (Avg 2001-2021)

-Combination world wealth: +12.7% (Quickest annual price ever).

-Wealth per grownup: $87,489

-Actual (inflation-adjusted) Wealth: +8.2%.

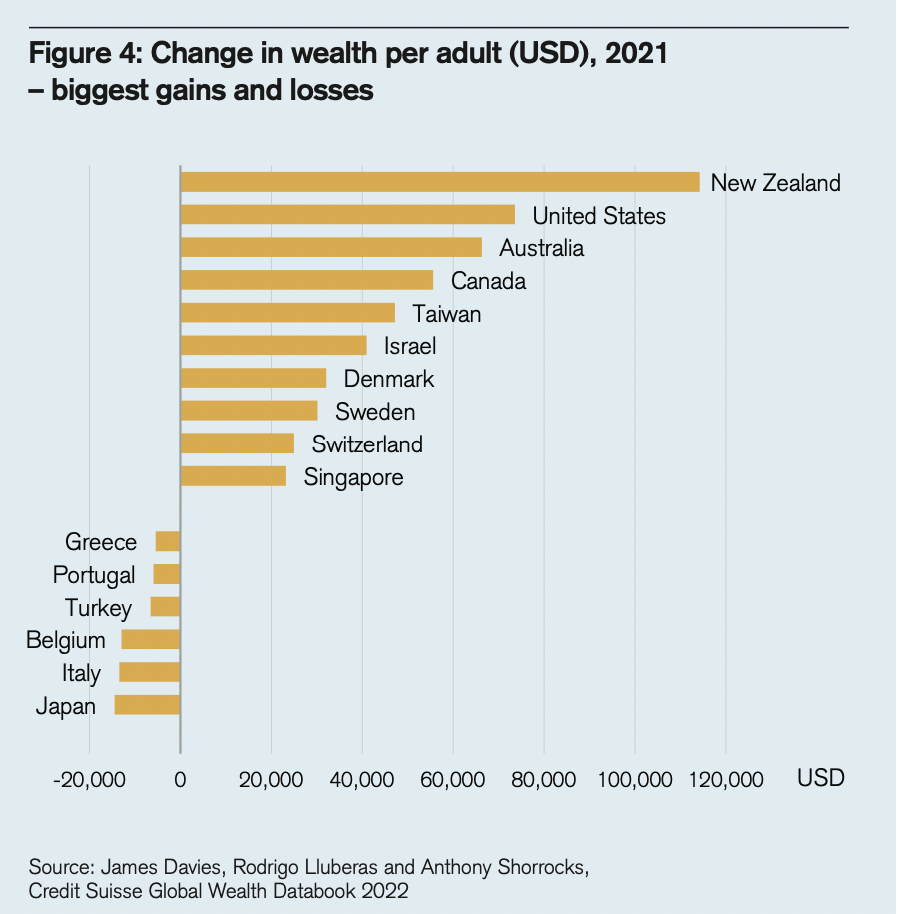

Beneficial properties by nation

1. United States

2. China

3. Canada

4. India

5. Australia

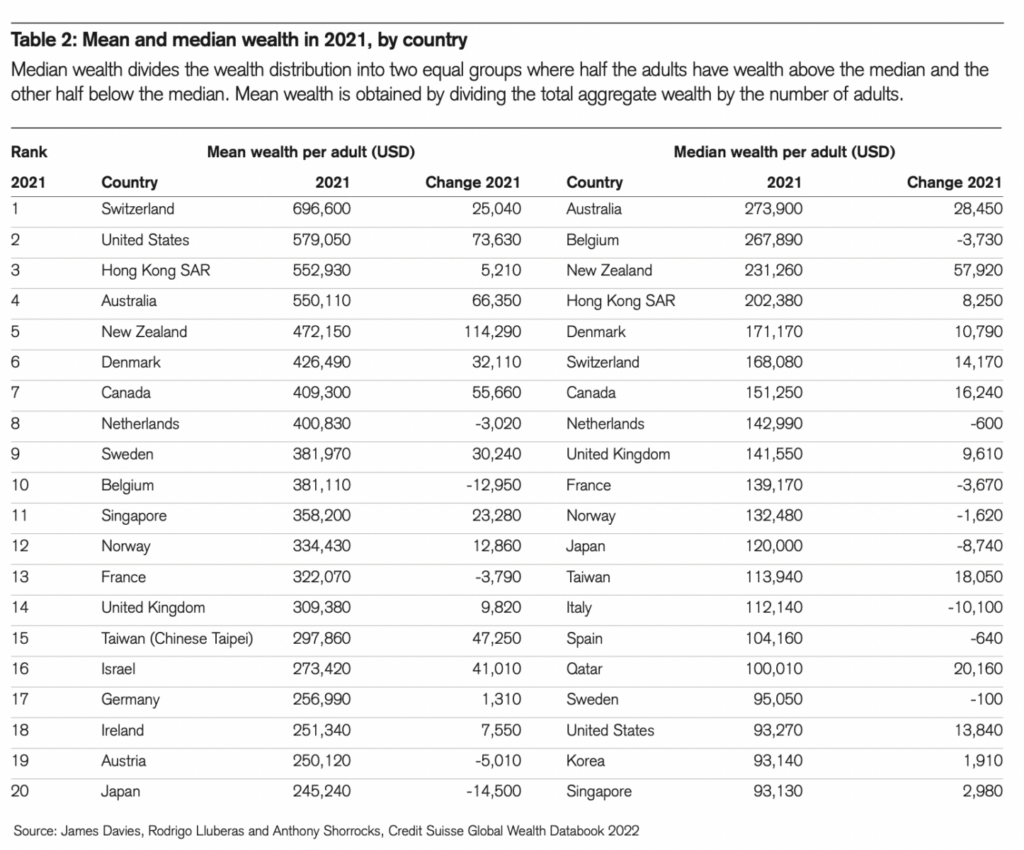

Whole Wealth per capita

1. Switzerland ($696,600)

2. United States

3. Hong Kong

4. Australia,

5. Belgium

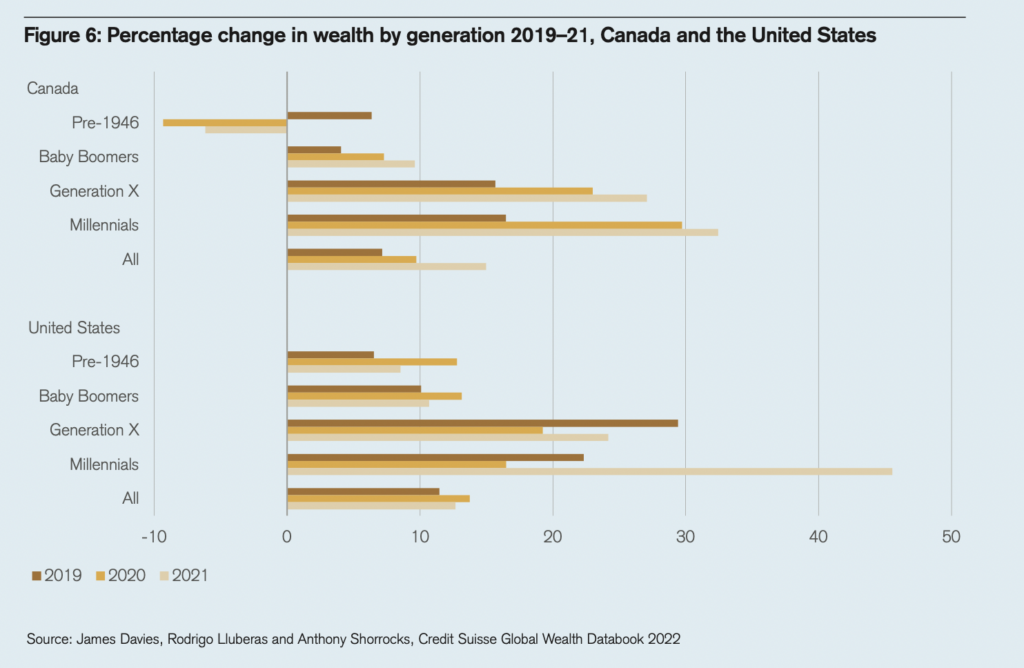

In the USA, African American and Hispanic households noticed very largest proportion will increase in wealth (+22.2% and +19.9%), however an the largest shock was the generational features by Millennials and Gen X: They grew their wealth most between 2019 and 2022 dramatically:

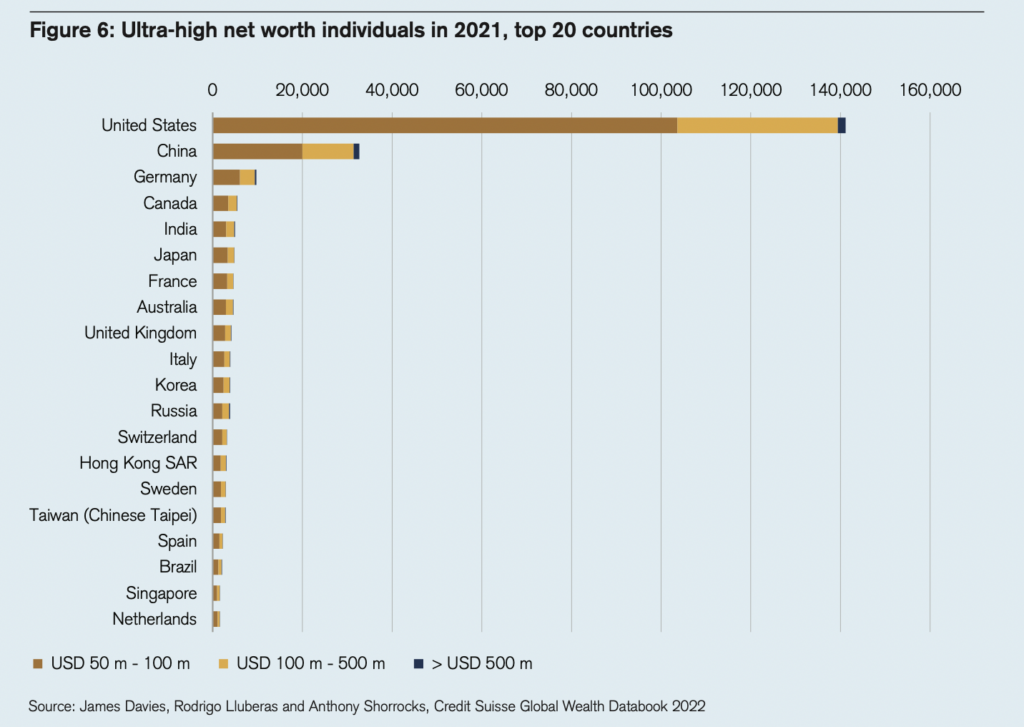

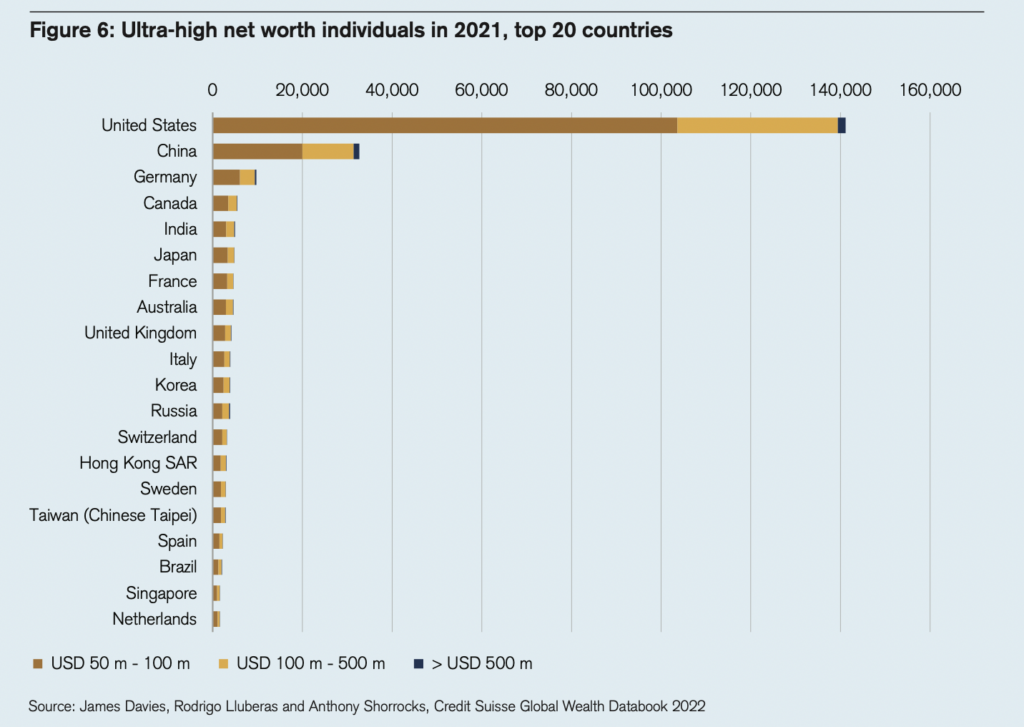

Most ultra-high-net-worth people

United States with over 140,000 2

China 32,710

Worldwide there are 62.5 million millionaires (+ 5.2 million from 2020)

The 5-year outlook is world wealth will enhance by $169 trillion by 2026; by 2024, world wealth per grownup ought to move $100,000 and the variety of millionaires will exceed 87 million people over the following 5 years. A lot of the media targeted on a foolish quantity – a forecast of the variety of world millionaires by 2026 at >87 million from 62 million in 2021 – a acquire of ~40%.

Your complete 72-page PDF is certainly value trying out…

Beforehand:

Wealth Distribution Evaluation (July 18, 2019)

Wealth Distribution in America (April 11, 2019)

Composition of Wealth Differs: Center Class to the Prime 1% (June 5, 2019)

No, Your iPhone Does Not Make You Rich (June 4, 2018)

Supply:

International Wealth Report 2022 Main views to navigate the long run

Credit score Suisse, September 2022

PDF

See additionally:

Bloomberg WealthScore

____________

1. Notice: Wealth losses virtually at all times related to forex depreciation towards the US greenback, affecting for instance Japan, Italy and Turkey.

2. Wealth share of backside 50% of households in the USA elevated from 1.84% to 2.64%, principally because of an increase within the worth of actual property.

[ad_2]

Source link