[ad_1]

On October 6, Grayscale Investments introduced a brand new enterprise that offers accredited traders the chance to spend money on the mining infrastructure that powers the digital asset ecosystem. In line with the announcement, the co-investment automobile is known as Grayscale Digital Infrastructure Alternatives (GDIO), and the crypto mining agency Foundry will deal with the brand new product’s operations. GDIO is supposed to “seize the upside of crypto winter,” Grayscale’s announcement on Thursday particulars.

Grayscale’s New Co-Funding Automobile GDIO Seems to be for Alternatives Throughout the Crypto Financial system’s Market Cycles — Day-to-Day Operations to be Managed by Foundry Digital

The world’s largest digital forex asset supervisor, Grayscale Investments, introduced the launch of a brand new co-investment alternative on Thursday, a monetary automobile that goals to reap the benefits of the crypto economic system’s market cycles. The brand new co-investment product is the primary of its variety for Grayscale and the bitcoin mining, and staking infrastructure agency Foundry Digital will “handle the day-to-day operations” of the Grayscale Digital Infrastructure Alternatives (GDIO) co-investment automobile.

Over the last 12 months, Foundry has been the biggest bitcoin mining pool when it comes to complete hashrate. The agency’s mining pool captured 19.38% of the worldwide hashrate this yr, or found roughly 10,375 out of the 53,532 BTC blocks discovered through the previous 12 months. The bear market has been troublesome for miners this yr and Grayscale believes that the crypto winter can present distinctive alternatives for funding.

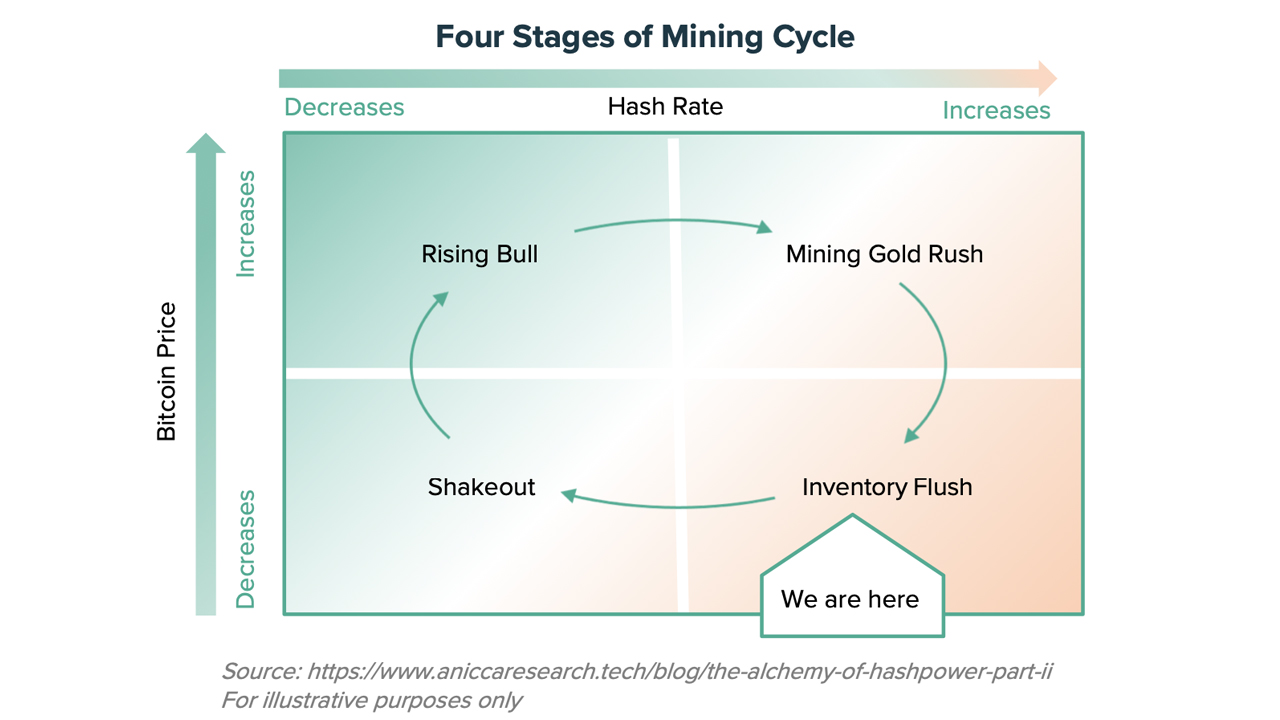

Grayscale’s funding thesis states:

As bitcoin costs have fallen dramatically, leveraged miners have skilled significant stress on their working margins. Within the coming months, we anticipate that some miners can be compelled to liquidate their mining gear. We imagine GDIO could have a possibility to buy mining gear at distressed ranges and to profitably mine bitcoin sooner or later.

As an example, the crypto miner Cleanspark defined this previous summer season that the crypto economic system’s downturn has produced “unprecedented alternatives.” On the finish of June, a report famous that $4 billion in bitcoin mining loans had been in misery. Furthermore, In September, Jihan Wu’s Bitdeer launched a $250 million fund to assist distressed miners. Grayscale CEO Michael Sonnenshein says his agency has an edge above the remaining that enables Grayscale to seek out alternatives throughout the crypto winter cycle.

“Grayscale’s distinctive place on the heart of the crypto ecosystem allows us to create choices that enable traders to place capital to work via differing market cycles,” Sonnenshein remarked through the announcement. “Our staff has lengthy been dedicated to decreasing the barrier for investing within the crypto ecosystem – from direct digital asset publicity, to diversified thematic merchandise, and now infrastructure via GDIO.”

What do you concentrate on Grayscale’s co-investment automobile that goals to seek out alternative within the crypto winter and market cycles? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Grayscale Emblem

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link