[ad_1]

The UK authorities has opted to dam the sale of Newport Wafer Fab to Chinese language-owned Nexperia on nationwide safety grounds after months of wrangling that has left the most important British chipmaker in limbo.

Nexperia, which is owned by China’s Wingtech Expertise, should divest 86 per cent of the corporate, leaving it with the 14 per cent stake it held earlier than launching a takeover in 2021, in line with a last order launched by the federal government on Wednesday.

Kwasi Kwarteng, then the enterprise secretary, introduced in Might that he was “calling in” the acquisition of Newport underneath the Nationwide Safety and Funding Act, new powers underneath which the federal government is ready to restrict or block transactions involving strategic nationwide belongings.

Nexperia, which turned Newport Wafer Fab’s second-biggest shareholder in 2019, launched a takeover of the chipmaker two years later, when the Welsh firm was struggling to pay its money owed and confronted potential chapter. The plant has since offered its wares solely to Nexperia, stoking fears of tech switch from the UK to China.

“We’re shocked with the choice. The employees are additionally shocked,” stated Toni Versluijs, UK head of Nexperia. “We are going to carry on preventing. We consider [the decision] is intrinsically flawed. We are going to attraction it. We intend to overturn it.”

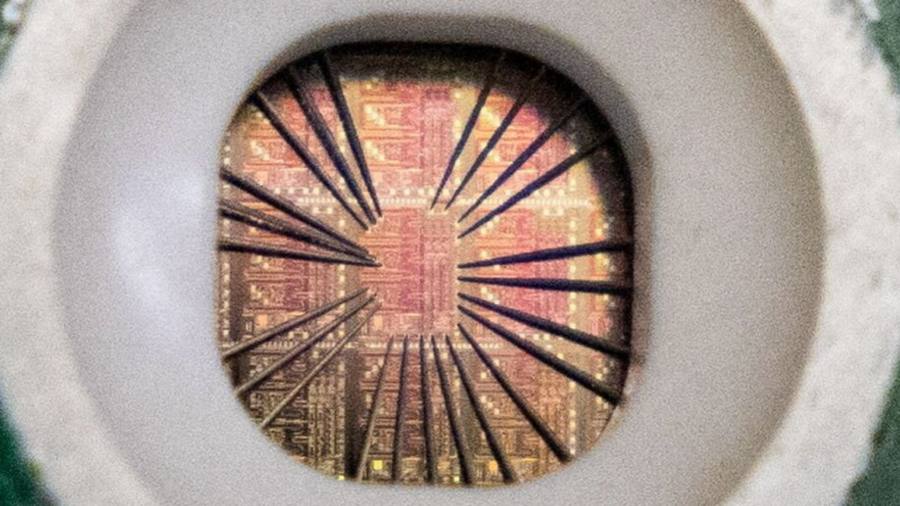

The British chip producer has grow to be a touchstone within the world battle for chips, among the most complicated and essential elements in all trendy expertise. As nations world wide search to shore up home chip provide chains, the sale of one in every of Britain’s solely strategic semiconductor belongings to a Chinese language firm confronted a extreme backlash from British politicians, business executives and overseas powers.

A call on whether or not the transaction can be unwound has been delayed a number of occasions since Might, as the federal government has gone by way of three administrations.

“Not one of the three secretary of states from the previous three months has been keen to even converse to us, after which a call comes from the ivory tower,” stated Versluijs. “We’ve introduced far-reaching treatments for the safety threat. This isn’t levelling up, it’s levelling down.”

The federal government decided that there was a threat to nationwide safety stemming from the “potential reintroduction of compound semiconductor actions to the Newport website”, referring to the truth that Nexperia sits in the midst of a high-tech semiconductor cluster in that a part of Wales to which China may achieve entry.

Nexperia disputed these grounds, saying it had addressed the federal government’s issues by providing treatments that dominated out any future compound semiconductor growth or exercise on the Newport Wafer website.

The choice additionally discovered that the location may facilitate Nexperia’s “entry to technological experience” that would stop different chip producers within the cluster from being “engaged in future initiatives related to nationwide safety”.

Peter Lu, who leads authorized agency Baker & McKenzie’s China apply within the UK, stated: “The next impact this can have on Chinese language funding will likely be vital: traders (particularly, SOEs) will critically look to re-evaluate their quick and long-term methods with the UK as a industrial accomplice.

“As the target of the NSI Act has at all times been to impose the least intrusive treatment to alleviate nationwide safety issues, a easy discount within the total shareholding can be a much more real looking — and conducive — treatment.”

In September, the Monetary Instances reported that the earlier proprietor of the semiconductor producer, Drew Nelson, was seeking to purchase again the corporate, which employs about 450 folks within the Welsh metropolis of Newport.

Nelson owned Newport Wafer Fab till 2021 and oversaw its sale to Netherlands-based Nexperia for a reported £63mn. He teamed up with personal fairness group Palladian Funding Companions to bid for the corporate, in line with two folks briefed on the matter.

Underneath the phrases of the 2021 sale, Nelson was provided first refusal to purchase again the corporate if its belongings had been made obtainable once more, the folks stated.

Extra reporting by Yuan Yang

[ad_2]

Source link