[ad_1]

My back-to-work morning practice WFH reads:

• Economist Says His Indicator That Predicted Eight US Recessions Is Fallacious This 12 months: Cambell Harvey’s work confirmed hyperlink between curve inversion and development Robust labor demand, threat avoidance help US economic system now. (Bloomberg)

• Wall Road’s sleuth of bears is rising: Shares kicked off the brand new 12 months on a optimistic observe, with the S&P 500 climbing 1.4% final week. The index is now up 8.9% from its October 12 closing low of three,577.03 and down 18.8% from its January 3, 2022 closing excessive of 4,796.56. In the meantime, the market’s many bears obtained extra firm. (Sam Ro) however see Every thing Is Up In This Bull Market: When you’re not earning money on this setting, it’s not as a result of it’s a “bear market”. Don’t be a kind of traders left holding the bag within the few remaining shares that aren’t working, whereas virtually all the pieces else is. (All Star Charts)

• Your Investing Technique Simply Failed. It’s Time to Double Down. The usual portfolio of 60% shares and 40% bonds simply delivered one in every of its worst years in historical past. That doesn’t imply it’s a foul method. (Wall Road Journal)

• Enterprise capital’s reckoning looms nearer: Valuations on holdings must converge sooner moderately than later with listed tech sector (Monetary Instances)

• Romer: Fed faces ‘tough’ name to keep away from overdoing charges shock: The Federal Reserve’s effort to shock the economic system again to decrease inflation is in its early days, making it robust for the U.S. central financial institution to keep away from overdoing it with higher-than-needed rates of interest, a high financial adviser within the Obama White Home stated after a recent assessment of Fed coverage since World Warfare Two. (Reuters)

• Your stuff is definitely worse now: How the cult of consumerism ushered in an period of badly made merchandise. (Vox)

• What Can We Be taught from Barnes & Noble’s Shocking Turnaround? Digital platforms are struggling, in the meantime a 136-year-old ebook retailer is rising once more. However why? (Sincere Dealer) see additionally Amoeba Music asks, ‘What’s in your bag?’ and no algorithm can compete: Within the long-running YouTube collection, musicians expose what they’ve purchased on the legendary report retailer. Their solutions present an schooling in find out how to uncover music. (Washington Put up)

• ‘Consciousness’ in Robots Was As soon as Taboo. Now It’s the Final Phrase. The pursuit of synthetic consciousness could also be humankind’s subsequent moonshot. However it comes with a slurry of inauspicious questions. (New York Instances)

• Riddle solved: Why was Roman concrete so sturdy? An sudden historic manufacturing technique could maintain the important thing to designing concrete that lasts for millennia. (MIT)

• Is Chelsea goal Enzo Fernandez value £105million after solely 80 senior matches? Throughout the area of six months, the 21-year-old went his first 22 matches unbeaten together with his new membership, saying himself on the European stage by shining in midfield as Benfica topped a Champions League group that includes Paris Saint-Germain and Juventus, then broke into Argentina’s beginning XI throughout the World Cup and instantly established himself as an indispensable contributor to a historic triumph in Qatar. (The Athletic)

You’ll want to try our Masters in Enterprise interview this weekend with John Mack, former CEO of Morgan Stanley. He was the architect of the agency’s merger with Dean Witter after which returned as CEO to guide the agency via the monetary disaster. He’s the creator of a brand new autobiography, “Up Shut and All In: Life Classes from a Wall Road Warrior.”

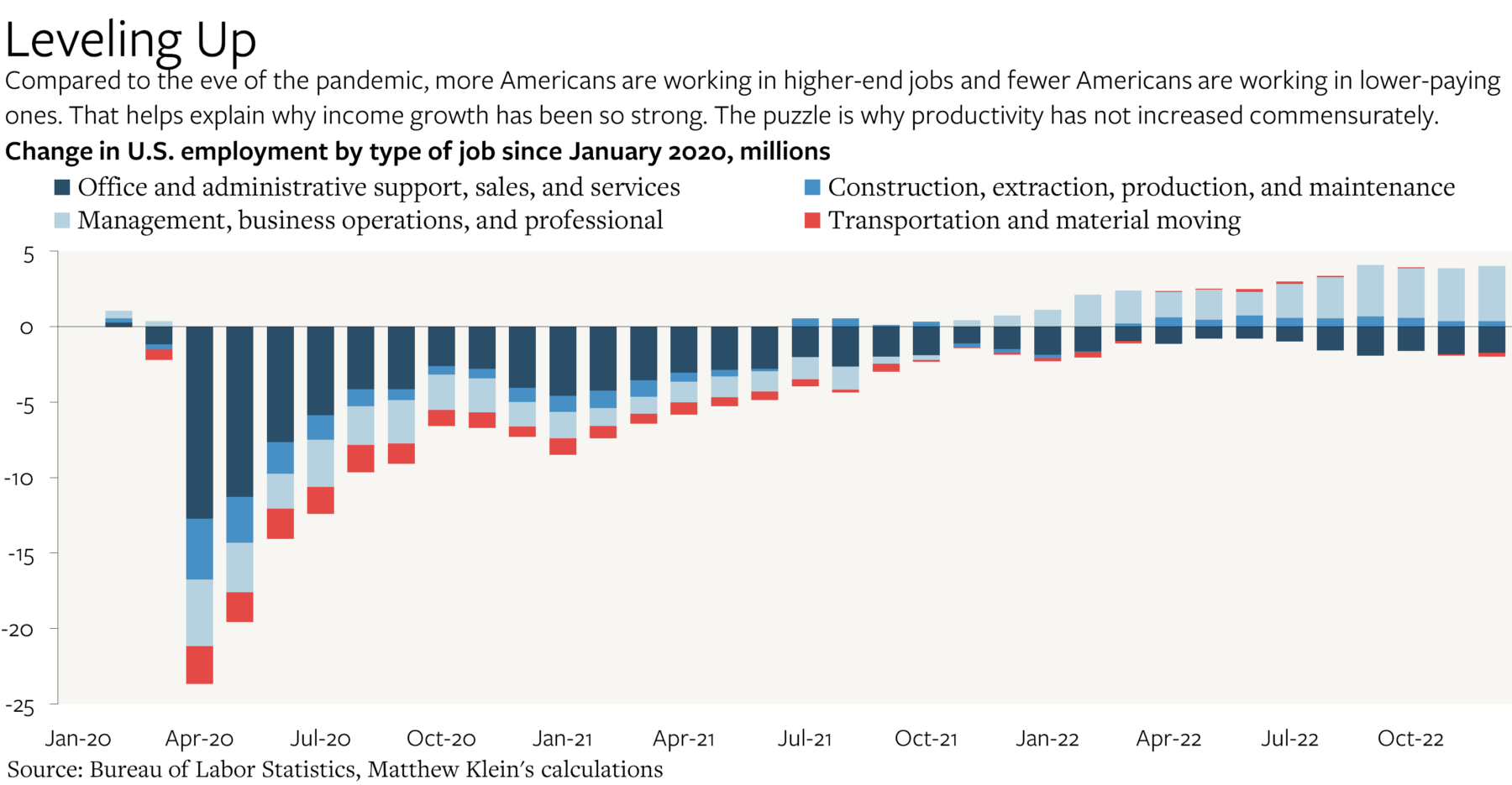

Is the U.S. Job Market Disinflationary Now?

Supply: The Overshoot

Join our reads-only mailing listing right here.

[ad_2]

Source link