[ad_1]

Equities, valuable metals, and cryptocurrencies have been on a tear over the last three weeks of 2023, and all eyes are actually centered on the following Federal Open Market Committee (FOMC) assembly, which is 11 days away. On Friday, Federal Reserve governor Christopher Waller stated that he favors a quarter-point benchmark price enhance on the subsequent FOMC assembly. Analysts imagine that present market trajectories can be depending on the result of the following Fed assembly.

Markets Nonetheless on Edge Forward of Fed Assembly Regardless of Equities, Cryptocurrencies, and Valuable Metals Rallying in 2023

On Saturday, Jan. 21, 2023, at 2:45 p.m. Japanese Time, the worldwide cryptocurrency market capitalization was up 5.87% over yesterday and hovering round $1.06 trillion in worth. The main crypto asset, bitcoin (BTC), had climbed 11.63% increased in opposition to the U.S. greenback up to now seven days. The second-leading digital forex by way of market valuation, ethereum (ETH), had risen 8.33% that week in opposition to the dollar. The rise in worth of those two crypto belongings has additionally elevated the U.S. greenback worth of the hundreds of digital currencies under BTC and ETH.

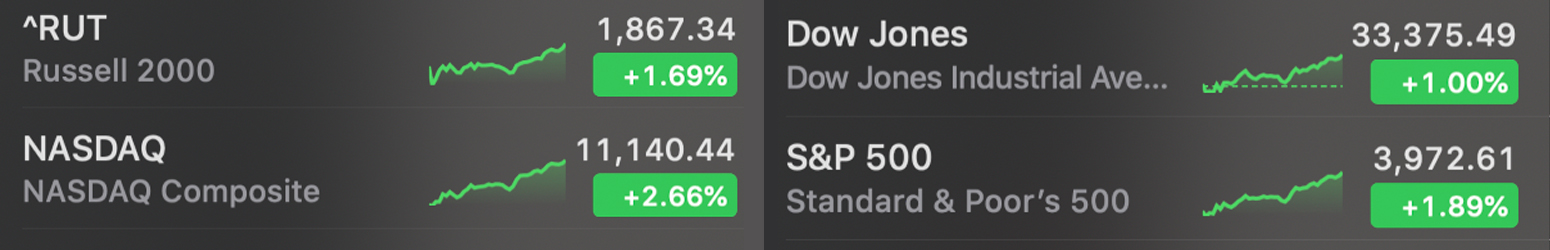

The day prior, on Friday, Jan. 20, fairness markets closed the day within the inexperienced. The highest 4 benchmark shares (S&P 500, Dow Jones, Nasdaq, and Russell 2000) ended the day between 1% and a pair of.66% increased in opposition to the U.S. greenback. The Nasdaq Composite was the very best, rising 2.66%, the S&P 500 rose by 1.89%, the Russell 2000 index (RUT) jumped 1.69% increased, and the Dow elevated by 1% on Friday. U.S. equities have posted their second consecutive week of features up to now this 12 months. The small-cap inventory market index RUT has risen 7.1% this 12 months, with small-cap shares main the equities race in 2023.

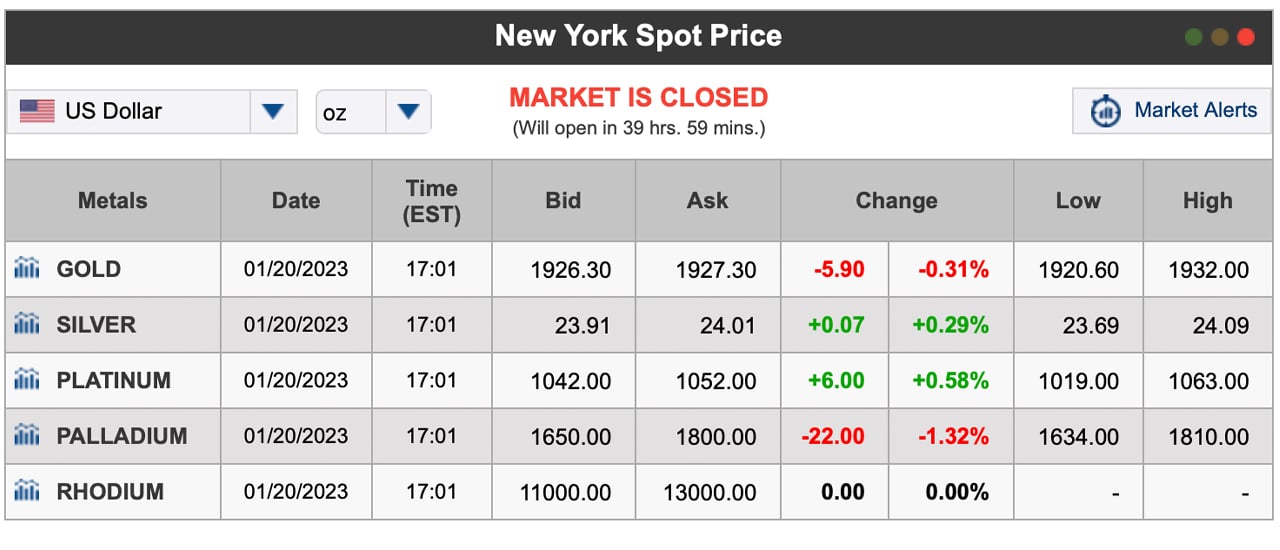

Valuable metals have accomplished properly too with a troy ounce of gold buying and selling for $1,927.30 per unit and silver buying and selling for $24.01 per ounce. Like cryptocurrencies and shares, valuable metals have rallied in 2023, erasing the losses that passed off in Dec. 2022. Gold fanatic Peter Schiff believes the value of the dear yellow metallic will develop increased this 12 months. “Gold is now buying and selling above $1,934, its highest value since April of 2022,” Schiff tweeted on Jan. 19. “Gold shares, nevertheless, nonetheless haven’t even taken out final week’s excessive. In reality, gold shares have to rise 30% from right here simply to get again to the place they have been buying and selling in April of 2022. This sale might not final lengthy,” he added.

Talking with Kitco Information, OANDA senior market analyst Edward Moya detailed that gold costs will stay detached till the Federal Reserve’s February 2023 assembly. “It’s going to be uneven,” Moya stated. “I’m impartial on gold till the Fed’s assembly on February 1. Main resistance is at $2,000. However I’d be shocked if we transfer above $1,950. We’re more likely to consolidate right here till the Fed assembly,” the market analyst added. Market analysts and macroeconomic consultants do not know what the Fed will do on the FOMC assembly. Some imagine an aggressive tightening schedule will proceed, whereas others count on the Fed to ease up and pivot with a ‘smooth touchdown.’

The Biden administration and White Home economist Heather Boushey advised Reuters that present leaders don’t count on a recession. “The steps have been taken and it appears to be like like we’re in an excellent place to have that smooth touchdown that everybody’s speaking about,” Boushey insisted. On Friday, Federal Reserve Governor Christopher Waller advised reporters at a Council on International Relations convention in New York that he favors a smaller price hike than the earlier seven. Thus far, the Fed has applied seven price hikes in 2022, two of which have been half-point rises and 5 have been three-quarter-point will increase. Waller can envision a quarter-point enhance on the subsequent FOMC assembly subsequent month.

“I presently favor a 25-basis level enhance on the FOMC’s subsequent assembly on the finish of this month,” Waller advised the press. “Past that, we nonetheless have a substantial method to go towards our 2 % inflation aim, and I count on to help continued tightening of financial coverage,” the Fed governor added.

It’s fairly possible that every one three main markets (valuable metals, cryptocurrencies, and shares) will react in a roundabout way or one other after the Fed’s subsequent resolution. Many imagine the following FOMC assembly resolution can be totally depending on inflation gauges. U.S. President Joe Biden has been tweeting concerning the U.S. economic system in the course of the course of the weekend as he believes the nation is on the street to restoration. “Annual inflation has fallen for six straight months and fuel is down $1.70 from its peak,” Biden tweeted on Saturday morning at 10:25 a.m. Japanese Time. “We’re efficiently shifting from financial restoration to secure development,” Biden added.

What do you assume the result of the following FOMC assembly can be and the way do you imagine it is going to have an effect on the present market trajectories for equities, valuable metals, and cryptocurrencies? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link