[ad_1]

Throughout the previous couple of years, cryptocurrencies have been built-in into conventional finance instruments like automated teller machines (ATMs), loadable debit playing cards, point-of-sale units, and direct funds for all types of products and companies. Digital property have additionally been added to retirement account choices issued by monetary giants like Constancy. In latest occasions, cryptocurrencies will be additional capitalized to place a down cost on a mortgage or get a traditional house mortgage utilizing bitcoin as collateral.

Crypto-Backed Standard House Loans

Lately, no less than in america, banks require no less than 20% down if an individual or a pair needs to buy a house by leveraging a traditional mortgage. Sometimes, folks use money for collateral or a down cost, however Individuals may make the most of issues like enterprise gear, stock, invoices, blanket liens, and even different types of actual property to safe a standard mortgage.

As of April 8, 2022, the median house value within the U.S. was $392,000, which implies a purchaser wants $78,400 in collateral to safe a traditional financial institution mortgage. Whereas crypto property will be utilized to load debit playing cards and pay for gadgets by way of point-of-sale commerce, there’s not many companies that permit folks to make use of digital currencies for a crypto-backed mortgage.

Nevertheless, there are a few corporations proper now, both providing loans that make the most of crypto property for collateral or which are planning to take action within the close to future. Furthermore, some companies that deliberate to supply crypto-backed loans gave up on the concept shortly after.

As an example, the second-largest mortgage lender within the U.S., United Wholesale Mortgage, introduced it might settle for bitcoin (BTC) for mortgages on the finish of August 2021. Nevertheless, a number of months later, United Wholesale Mortgage revealed the corporate determined to not provide the crypto companies.

The corporate’s CEO, Mat Ishbia, informed CNBC in October 2021 that the lender didn’t assume it was value it. “As a result of present mixture of incremental prices and regulatory uncertainty within the crypto house we’ve concluded we aren’t going to increase past a pilot at the moment,” Ishbia defined to CNBC’s MacKenzie Sigalos.

Crypto-Backed House Loans Offered by Abra and Milo

In the meantime, a monetary companies agency that only recently introduced crypto-backed house loans is the cryptocurrency agency Abra. The corporate, based in 2014 by former Goldman Sachs fastened revenue analyst Invoice Barhydt, has offered digital asset buying and selling companies and a cryptocurrency pockets for over seven years.

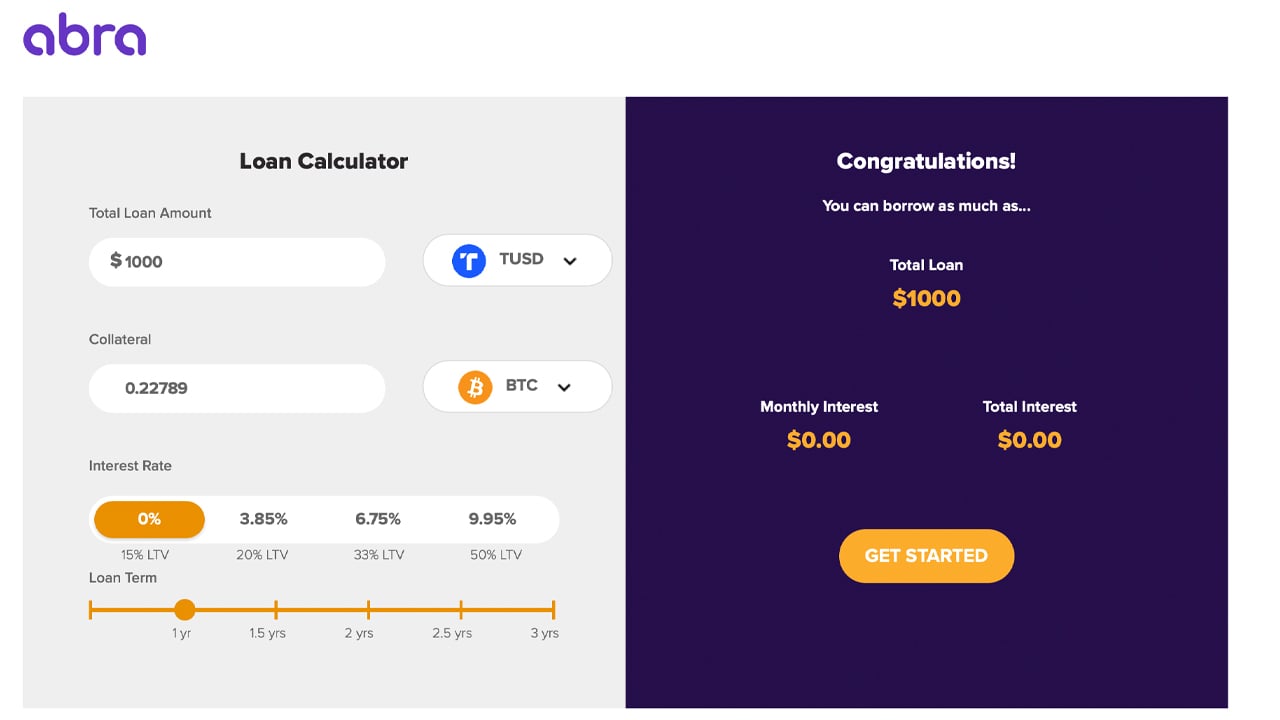

On April 28, 2022, Abra introduced it has partnered with the corporate Propy and homebuyers can safe a house mortgage utilizing crypto as collateral by way of the Abra Borrow platform. The Abra lending software has varied rates of interest, relying on how a lot crypto collateral is added, from 0 to 9.95%.

“Whereas digital asset funding has skyrocketed, most traders are unable to make use of their cryptocurrency holdings to immediately fund a very powerful buy of their life, a house,” Abra’s CEO Invoice Barhydt defined through the announcement. “Our partnership with Propy solves this and is a significant step in bridging the hole between crypto and actual property,” the Abra govt added.

Along with Abra, an organization referred to as Milo is providing crypto-backed mortgages for folks all for buying actual property. Milo is a Florida-based startup that raised $17 million on March 9, 2022, in a Sequence A funding spherical. The California-based enterprise capital agency M13 led the funding spherical and QED Buyers and Metaprop participated.

Milo provides 30-year loans for debtors seeking to leverage as much as $5 million. Milo accepts stablecoins, bitcoin (BTC), ethereum (ETH), and rates of interest are between 5.95% and 6.95%, with loans which have two to three-week closing occasions. When Milo raised $17 million final March, Milo CEO Josip Rupena mentioned the corporate’s efforts purpose to allow crypto contributors.

“This [funding] spherical of financing is a validation of Milo’s imaginative and prescient to empower world and crypto shoppers and the chance to bridge the digital world with real-world actual property property,” Rupena mentioned on the time. “This can be a multibillion-dollar alternative, and we’re proud to be pioneering the efforts within the U.S. for shoppers which have unconventional wealth.”

Ledn and Determine Applied sciences Plan to Supply Crypto-Backed Mortgage Merchandise

The crypto lender and financial savings platform Ledn revealed in December 2021 that it was readying “the upcoming launch of a bitcoin-backed mortgage product.” On the similar time, the agency mentioned that it raised $70 million from a handful of well-known traders.

Ledn was based in 2018 and the corporate has raised a complete of $103.9 million thus far. On the time of writing, Ledn’s bitcoin-backed mortgage shouldn’t be but out there, however folks can join Ledn’s mortgage product waitlist.

“By combining the appreciation potential of bitcoin with the worth stability of actual property, this first-of-its-kind mortgage provides a balanced mix of wealth-building collateral,” Ledn’s mortgage net web page says. “With the Bitcoin Mortgage, you need to use your holdings to purchase a brand new property, or finance the house you already personal. Get a mortgage equal to your bitcoin holdings, with out promoting a satoshi.”

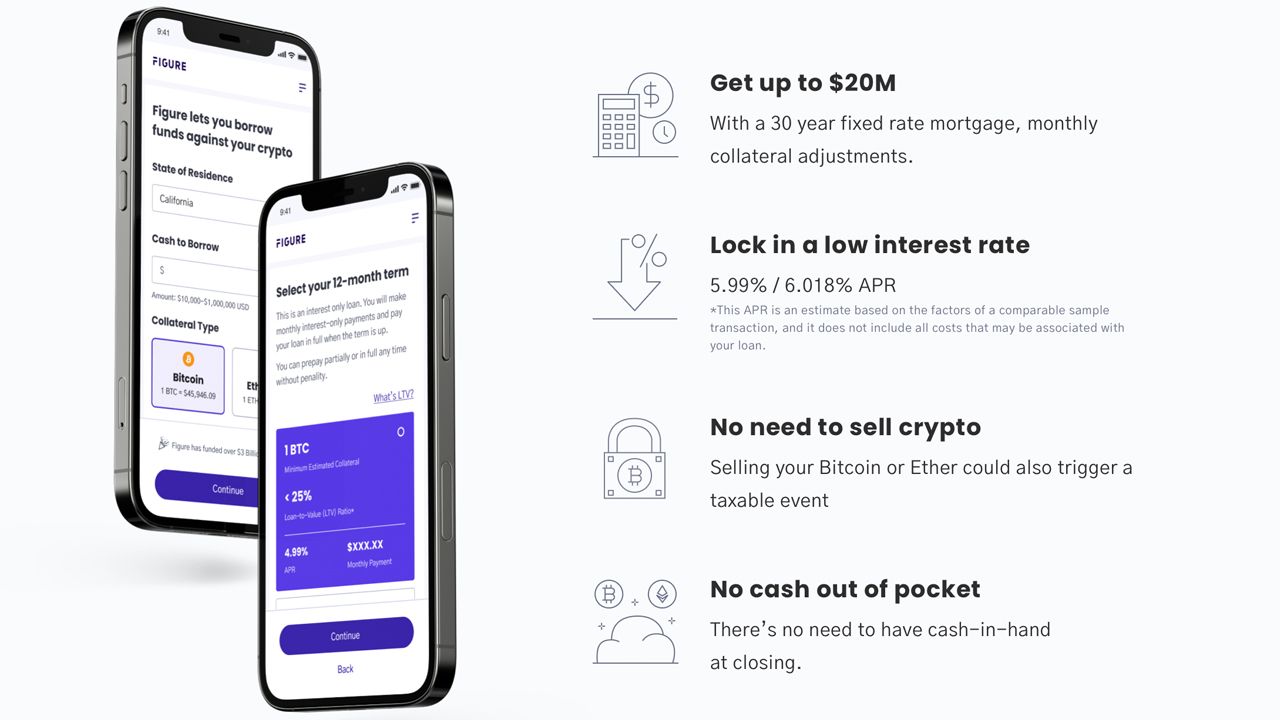

Determine Applied sciences additionally plans to supply a crypto-backed mortgage and other people can join a waitlist to be able to entry Determine’s upcoming product. Determine’s co-founder Mike Cagney defined on the finish of March that the corporate was launching the mortgage program.

“Determine is launching a crypto-backed mortgage in early April,” Cagney mentioned on the time. “100% LTV – you set up $5M in BTC or ETH, we provide you with a $5M mortgage. No painful course of, no cash-out, any quantity as much as $20M, for a 30-year mortgage. You can also make funds along with your crypto collateral. And we don’t rehypothecate your crypto.”

Whereas there’s not that many crypto-backed mortgage merchandise at present, the development is beginning to turn into a bit extra distinguished in 2022. If the development continues, like crypto’s integration with ATMs, debit playing cards, and the myriad of conventional monetary automobiles, the idea of shopping for a house with bitcoin will seemingly turn into a mainstay in society.

What do you concentrate on the idea of crypto-backed mortgage merchandise? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link