[ad_1]

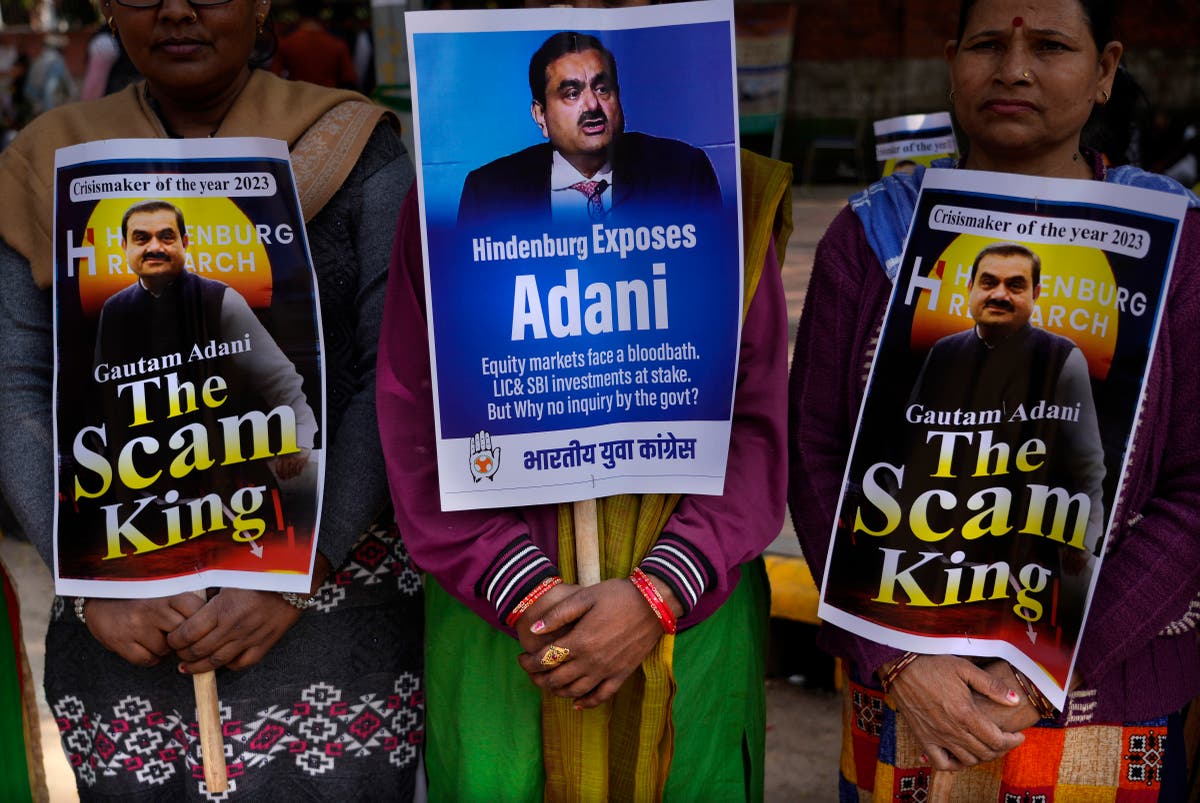

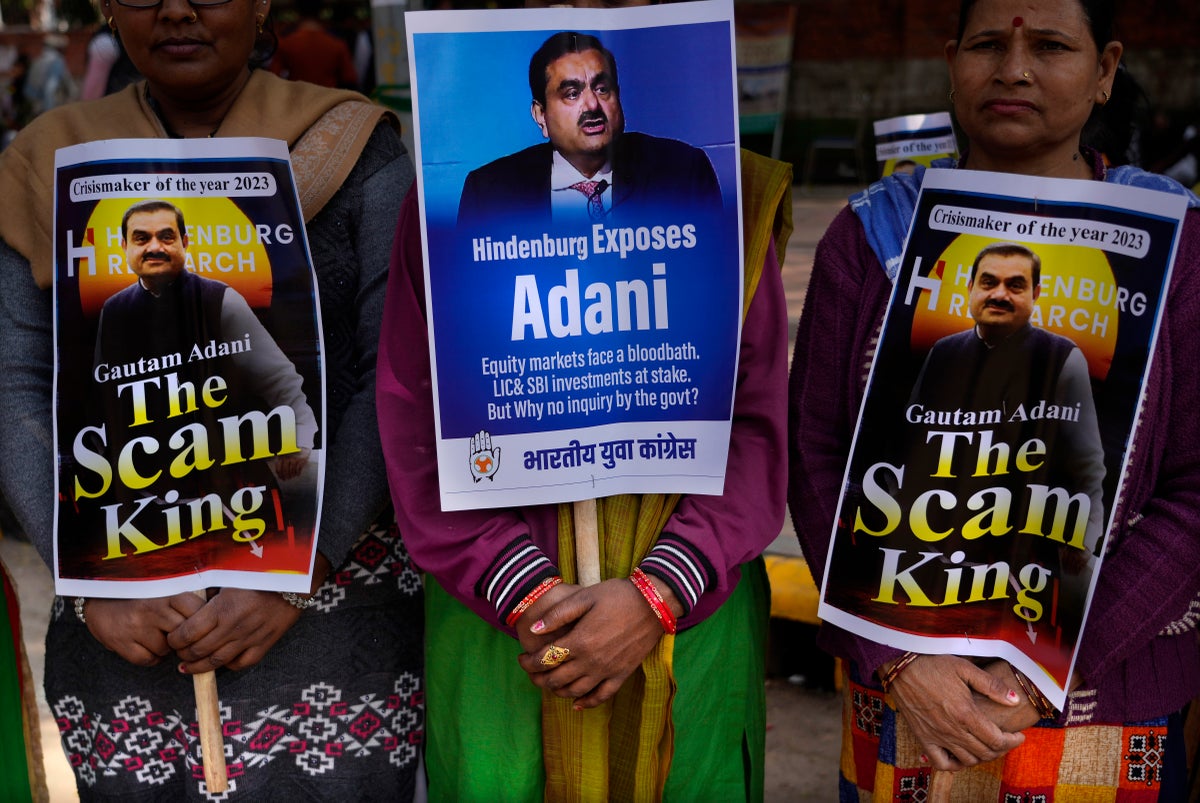

India’s Supreme Courtroom has proposed forming a panel of specialists, together with a choose, to research the fallout from fraud allegations towards the Adani Group that has wiped off billions of {dollars} from businessman Gautam Adani’s wealth.

Listening to a petition on Friday that referred to as for the apex court docket’s intervention within the row, India’s chief justice DY Chandrachud stated he would recommend forming an knowledgeable panel to look into it.

“We now have prompt an knowledgeable committee for the general state of affairs and examination if the federal government of India is on this train,” he stated.

The chief justice additionally prompt together with a choose among the many specialists, insisting that investor pursuits have to be protected.

The advice from the court docket comes amid rising calls to research the fraud allegations towards one of many world’s largest conglomerates, because it sees its wealth deplete following a report by a US-based brief vendor.

The accusation towards the conglomerate of inflating its inventory costs through the use of shell firms by Hindenburg group, a New York-based activist brief vendor, has worn out vital investor wealth and raised questions concerning the tycoon’s meteoric rise and the function of regulators.

In the meantime, the Securities and Alternate Board of India (SEBI) is wanting on the concern from a regulatory perspective, whereas the Adani Group denies any wrongdoing.

Responding to feedback by the Supreme Courtroom concerning the necessity for investor safety, finance minister of India Nirmala Sitharaman famous that Indian regulators are conscious of the state of affairs and are working to guard investor pursuits.

The regulators had been skilled and seized of the matter, Ms Sitharaman instructed reporters after assembly the central financial institution’s administrators in Delhi on Saturday.

She declined to elaborate on what the federal government deliberate to inform the Supreme Courtroom.

The group’s seven firms misplaced greater than $100bn in market worth and Mr Adani, who briefly surpassed Jeff Bezos to develop into the world’s second richest individual final yr, dropped down on Forbes’s record of billionaires and was overtaken by rival Mukesh Ambani because the richest Indian.

The Gujarat-based billionaire’s meteoric rise within the final decade has typically been seen in connection together with his shut ties to prime minister Narendra Modi.

In the meantime, three Adani group firms have pledged shares for lenders to the Indian conglomerate’s flagship Adani Enterprises, which pulled a $2.5bn share sale throughout a latest market rout.

SBICAP Trustee stated it had obtained the pledges in its capability as “safety trustee” of the lenders of Adani Enterprises.

The Adani publicity of Indian banks is just not sufficient to have an effect on their credit score profiles, two international ranking companies have stated. Nevertheless, there are considerations over the affect the fallout can have on Indian public sector firms which have vital publicity to the corporate.

[ad_2]

Source link