[ad_1]

Pakistan laid a supplementary finance invoice earlier than parliament on Wednesday, proposing to boost the items and companies tax (GST)to 18% from 17% to assist elevate 170 billion rupees ($639 million) in further income in the course of the fiscal yr ending July.

The nation has held talks with the Worldwide Financial Fund (IMF) for the discharge of vital bailout funds, and with roughly sufficient reserves to fulfill solely three weeks of imports, it’s seeking to improve income regardless of multi-decade excessive inflation of 27%.

Fahad Rauf, head of analysis at Ismail Iqbal Securities, a neighborhood brokerage, stated the one silver lining of the finance invoice was that it will take Pakistan a step nearer to the IMF programme resumption.

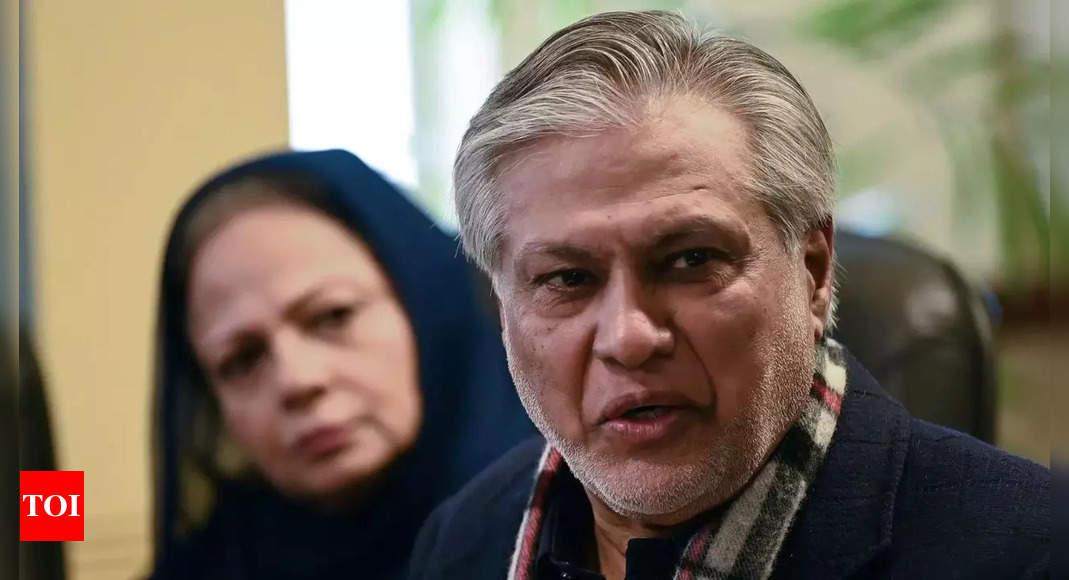

The invoice set earlier than Parliament by Finance Minister Ishaq Dar proposed the exemption from the GST rise of “every day use” gadgets comparable to wheat, rice, milk and meat, to cut back the influence of the funds on these most weak to rising inflation.

“It is unlucky that we solely know how you can improve oblique taxation, and burden the present taxpayers,” Rauf stated. “However, there isn’t a revenue tax assortment from retailers, actual property, and agriculture segments.”

Rauf famous that elevating the GST could be inflationary even with the exemptions. A senior economist with Moody’s Analytics instructed Reuters on Wednesday that inflation in Pakistan might common 33% within the first half of 2023 earlier than trending decrease.

The finance invoice additionally proposed to boost taxes on luxurious gadgets to 25%, whereas hikes in taxes on first- and business-class air journey, cigarettes and sugary drinks have been additionally proposed.

The federal government has additionally proposed an adjustable withholding tax on marriage halls and occasions at 10%.

To offset the inflationary influence of the funds, the federal government proposed that handouts beneath the Benazir Revenue Help Programme (BISP) – a welfare scheme – to be elevated to a complete of 400 billion rupees from 360 billion.

The responsibility on cement was additionally introduced again to pre-COVID ranges of two rupees per kilogram.

The federal government is seeking to move the invoice from parliament as quickly as potential, and even mentioned bringing it into power immediately by means of a Presidential Ordinance.

Nevertheless, President Arif Alvi, a member of the get together of opposition chief Imran Khan, turned down the request on Tuesday, forcing the federal government to take the route of parliament which it referred to as a rushed session of.

Khan instructed journalists in Lahore that his get together will oppose the invoice.

“PTI senators would oppose this invoice as a result of it’s anti-people,” he stated, including “I’ve directed my get together senators to not depart any stone unturned whereas opposing it.”

Khan’s get together doesn’t have the numbers to cease the invoice from being handed, however will ratchet up political stress on the federal government that’s already in a rush to unlock the delayed tranche from the IMF.

The nation has held talks with the Worldwide Financial Fund (IMF) for the discharge of vital bailout funds, and with roughly sufficient reserves to fulfill solely three weeks of imports, it’s seeking to improve income regardless of multi-decade excessive inflation of 27%.

Fahad Rauf, head of analysis at Ismail Iqbal Securities, a neighborhood brokerage, stated the one silver lining of the finance invoice was that it will take Pakistan a step nearer to the IMF programme resumption.

The invoice set earlier than Parliament by Finance Minister Ishaq Dar proposed the exemption from the GST rise of “every day use” gadgets comparable to wheat, rice, milk and meat, to cut back the influence of the funds on these most weak to rising inflation.

“It is unlucky that we solely know how you can improve oblique taxation, and burden the present taxpayers,” Rauf stated. “However, there isn’t a revenue tax assortment from retailers, actual property, and agriculture segments.”

Rauf famous that elevating the GST could be inflationary even with the exemptions. A senior economist with Moody’s Analytics instructed Reuters on Wednesday that inflation in Pakistan might common 33% within the first half of 2023 earlier than trending decrease.

The finance invoice additionally proposed to boost taxes on luxurious gadgets to 25%, whereas hikes in taxes on first- and business-class air journey, cigarettes and sugary drinks have been additionally proposed.

The federal government has additionally proposed an adjustable withholding tax on marriage halls and occasions at 10%.

To offset the inflationary influence of the funds, the federal government proposed that handouts beneath the Benazir Revenue Help Programme (BISP) – a welfare scheme – to be elevated to a complete of 400 billion rupees from 360 billion.

The responsibility on cement was additionally introduced again to pre-COVID ranges of two rupees per kilogram.

The federal government is seeking to move the invoice from parliament as quickly as potential, and even mentioned bringing it into power immediately by means of a Presidential Ordinance.

Nevertheless, President Arif Alvi, a member of the get together of opposition chief Imran Khan, turned down the request on Tuesday, forcing the federal government to take the route of parliament which it referred to as a rushed session of.

Khan instructed journalists in Lahore that his get together will oppose the invoice.

“PTI senators would oppose this invoice as a result of it’s anti-people,” he stated, including “I’ve directed my get together senators to not depart any stone unturned whereas opposing it.”

Khan’s get together doesn’t have the numbers to cease the invoice from being handed, however will ratchet up political stress on the federal government that’s already in a rush to unlock the delayed tranche from the IMF.

[ad_2]

Source link