[ad_1]

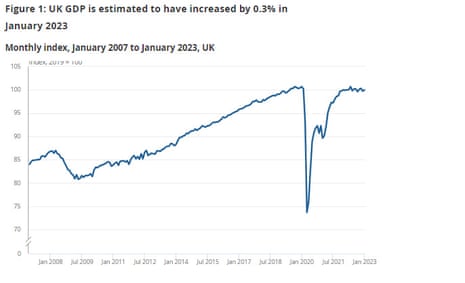

UK GDP: economic system grew by 0.3% in January

Newsflash: The UK economic system has returned to development.

The Workplace for Nationwide Statistics experiences that GDP grew by 0.3% throughout January, after shrinking by 0.5% in December.

That’s a quicker restoration than anticipated after the economic system stalled within the last quarter of 2022.

Analysts had anticipated modest development of simply 0.1% (see opening submit), as strike motion and the price of residing disaster prevented a restoration in shopper and enterprise exercise.

The newest GDP determine might give the chancellor, Jeremy Hunt, a slight enhance earlier than subsequent week’s funds, when he’ll set out the federal government’s tax and spending insurance policies.

Key occasions

Yael Selfin, chief economist at KPMG UK, fears a UK recession is “nonetheless on the playing cards” regardless of the brightening financial outlook.

Selfin says:

“The marked fall in wholesale fuel costs and easing of provide chain disruptions supplied a great addition to financial prospects at the beginning of 2023. However this is probably not ample to stave off a recession within the first half of this 12 months, as shopper spending stays weak with households persevering with to be squeezed by elevated costs and better rates of interest.

“Nonetheless, we count on the present downturn to be shallower and shorter than beforehand thought, with stronger enterprise sentiment and a gentle fall in inflation anticipated to assist the restoration within the second half of the 12 months. Though our newest forecasts see the UK set for a 0.4% fall in GDP this 12 months and solely 0.6% development in 2024 general because of the weak begin and the dearth of fiscal momentum and enterprise funding to bolster medium time period restoration.

UK GDP report a lift to Hunt

The return to development in January signifies the UK could keep away from falling right into a recession, says Victoria Scholar, Head of Funding at interactive investor:

“UK GDP got here in flat year-on-year within the three months to January, above expectations for a drop of 0.1%. The month-to-month determine rose by 0.3% following a fall of 0.5% in December and topping forecasts for an increase of 0.1%.

Driving January’s acquire was an uptick within the service sector output which grew by 0.5% following a drop of 0.8% in December with schooling and a return to regular ranges of faculty attendance in addition to a choose up in postal and courier actions. Actual property actions nevertheless was the one companies subsector in detrimental territory amid the rise in mortgage charges and subdued housing market exercise.

Shopper-facing companies grew by 0.3% in January recovering from a drop of 1.2% in December due to the resumption of Premier League soccer which strengthened demand for sports activities and recreation. Nonetheless they’re caught 8.6% beneath their pre-covid ranges from February 2020.

Whereas companies improved, manufacturing shrank falling by 0.4% with over half of its subsectors in decline and development additionally fell sharply by 1.7%.

Heavy industrial motion weighed on schooling and postal service exercise in December, with a discount in strikes in January prompting a rebound in exercise to start out the 12 months. The tip of the FIFA World Cup and the resumption of the Premier League additionally helped drive demand for soccer associated spending.

For now it seems to be just like the UK is on observe to keep away from a recession with January’s month-to-month development determine touchdown fractionally above zero. When mixed with the federal government’s surprising funds surplus in January, the info is nicely timed for the Treasury and will give Chancellor Jeremy Hunt some wiggle room round his Funds plans subsequent Wednesday.

In gentle of the info, the pound is gaining some power towards the US greenback going towards the decline over the previous 12 months. An appreciating sterling helps to supply a pure offset to UK inflationary pressures.”

It’s “encouraging” that the economic system expanded a bit of as we entered the New Yr, following the contraction in December, says Kitty Ussher, chief economist on the Institute of Administrators.

Ussher factors out that the financial image is healthier than feared final November, which might give Jeremy Hunt extra ‘room to manoeuvre’ within the Funds subsequent Wednesday.

The information has been helped by a resumption of business-as-usual within the schooling and postal sectors, and a return to the total Premier League schedule following the tip of the World Cup. It is usually encouraging that the retail sector demonstrated development, albeit slight, given pressures on family budgets.

“Whereas a flat economic system general just isn’t often grounds for celebration, the truth that these outcomes are extra constructive than was anticipated on the time of the Chancellor’s Autumn Assertion in November provides him extra room for manoeuvre in subsequent week’s Funds. The precedence now’s to make use of that flexibility to assist put Britain on a sustainable development path for the remainder of the 12 months and past.”

Hunt: UK economic system has proved extra resilient than many anticipated

The UK economic system has been “extra resilient” than anticipated, chancellor Jeremy Hunt says, after rising by a better-than-expected 0.3% in January.

“Within the face of extreme world challenges, the UK economic system has proved extra resilient than many anticipated, however there’s a lengthy option to go.

“Subsequent week, I’ll set out the following stage of our plan to halve inflation, scale back debt and develop the economic system – so we are able to enhance residing requirements for everybody.’’

Personal healthcare boosted GDP

The was elevated demand for personal healthcare in January, the GDP report reveals, as NHS ready lists grew longer.

Human well being and social work actions grew by 0.7% in January, following a fall of two.8% in December 2022.

January noticed development of 1.1% in human well being actions pushed by “elevated output within the personal sector”, the ONS says.

One in eight adults within the UK paid for personal medical care in 2022, knowledge final December confirmed, because of lengthy delays for NHS exams or remedy. Analysts have warned that ready lists are unlikely to fall in 2023.

There was a bounceback in exercise in postal exercise in January, after Royal Mail employees held a collection of strikes in December.

Transport and storage companies grew by 1.6% in January; the primary contributor was a rise of 6.4% in postal and courier actions.

“This development comes after a fall of 10.5% in December 2022, which was partly due to the impression of postal strikes,” the ONS says.

In January 2023, college attendance ranges returned to regular ranges following a major drop in December 2022, the ONS says.

That lifted exercise within the schooling sector (as extra kids had been being educated).

ONS: Zero development over final 12 months

The economic system “partially bounced again from the big fall seen in December” in January, says ONS director of financial statistics Darren Morgan.

However, Morgan additionally factors out that the UK economic system has stagnated over the past 12 months.

Morgan explains:

“Throughout the final three months as a complete and, certainly over the past 12 months, the economic system has, although, confirmed zero development.

“The primary drivers of January’s development had been the return of kids to lecture rooms, following unusually excessive absences within the run-up to Christmas, the Premier League golf equipment returned to a full schedule after the tip of the World Cup and personal well being suppliers additionally had a powerful month.

“Postal companies additionally partially recovered from the results of December’s strikes.”

Month-to-month GDP was broadly flat in January 2023 in contrast with the identical month final 12 months, the ONS says.

Which means the UK economic system has not managed to develop over the past 12 months.

UK GDP: the small print

The UK’s companies sector drove development in January, by increasing by 0.5% throughout the month.

The primary contributing sectors had been schooling (2.5%), as college attendance returned to November 2022 ranges, and humanities leisure and recreation following the resumption of Premier League soccer.

However the UK’s manufacturing sector shrank by 0.3% whereas development output decreased by 1.7%.

Listed here are the small print:

-

The companies sector grew by 0.5% in January 2023, after falling by 0.8% in December 2022, with the biggest contributions to development in January 2023 coming from schooling, transport and storage, human well being actions, and humanities, leisure and recreation actions, all of which have rebounded after falls in December 2022.

-

Output in consumer-facing companies grew by 0.3% in January 2023; this follows a fall of 1.2% in December 2022.

-

Manufacturing output fell by 0.3% in January 2023, following development of 0.3% in December 2022.

-

The development sector fell by 1.7% in January 2023 after being flat in December 2022.

Regardless of rising in January, the UK economic system remains to be 0.2% smaller than in February 2020, when the Covid-19 pandemic hit.

Wanting on the broader image, although, GDP was flat within the three months to January 2023.

UK GDP: economic system grew by 0.3% in January

Newsflash: The UK economic system has returned to development.

The Workplace for Nationwide Statistics experiences that GDP grew by 0.3% throughout January, after shrinking by 0.5% in December.

That’s a quicker restoration than anticipated after the economic system stalled within the last quarter of 2022.

Analysts had anticipated modest development of simply 0.1% (see opening submit), as strike motion and the price of residing disaster prevented a restoration in shopper and enterprise exercise.

The newest GDP determine might give the chancellor, Jeremy Hunt, a slight enhance earlier than subsequent week’s funds, when he’ll set out the federal government’s tax and spending insurance policies.

Alvin Tan of RBC Capital Markets predicts the UK grew by 0.1% in January – however that may not cease the economic system shrinking throughout the present quarter….

January’s UK dataflow has been considerably combined, however the particulars of the January PMIs, the companies PMI specifically, painted a extra constructive image than the headline readings advised in our view. We search for January GDP (Friday) to develop at 0.1% m/m.

Though such an final result would nonetheless imply it’s potential for Q1 GDP as a complete to fall, it equally signifies that any contraction might be small and sure momentary.

Introduction: UK GDP report in the present day after financial institution share selloff

Good morning

We’re about to find if the UK economic system has returned to development after struggling on the finish of final 12 months.

January’s GDP report, due at 7am, will present if the economic system expanded or not within the first month of 2023. It’s the ultimate healthcheck on the economic system earlier than subsequent Wednesday’s funds.

Economists predict UK GDP could have crept up by 0.1% in January, after the economic system stagnated within the last quarter of 2022.

A month in the past, we discovered that in December alone, the economic system shrank by 0.5% as strikes within the public sector, rail and postal companies.

There have been indicators that the economic system could be a bit of stronger than feared.

The British Chambers of Commerce (BCC) forecast on Wednesday that the UK economic system is on observe to shrink lower than anticipated this 12 months and keep away from the 2 quarters of detrimental development which mark a technical recession.

And final week, the Financial institution of England’s chief economist stated Britain’s economic system is exhibiting barely extra momentum than anticipated.

As Huw Capsule put it:

“Survey indicators which have turn into obtainable because the publication of the forecast have stunned to the upside, suggesting that the present momentum in financial exercise could also be barely stronger than anticipated.”

Additionally developing in the present day

A heavy selloff in US financial institution shares final evening has despatched jitters by the monetary markets in the present day.

European shares are anticipated to fall over 1% when buying and selling begins:

Final evening’s sell-off in JPMorgan Chase (-5.4%), Financial institution of America (-6.2%), Citigroup (-4%) and Wells Fargo (-6.2%) got here after a small technology-focused lender known as Silicon Valley Financial institution announcd a capital increase, which despatched its inventory collapsing by 60%.

Reuters explains:

SVB, which does enterprise as Silicon Valley Financial institution, launched a $1.75 billion share sale on Wednesday to shore up its stability sheet. It stated in an investor prospectus it wanted the proceeds to plug a $1.8 billion gap attributable to the sale of a $21 billion loss-making bond portfolio consisting principally of U.S. Treasuries. The portfolio was yielding it a median 1.79% return, far beneath the present 10-year Treasury yield of round 3.9%.

Buyers in SVB’s inventory fretted over whether or not the capital increase could be ample given the deteriorating fortunes of many expertise startups that the financial institution serves. The corporate’s inventory collapsed to its lowest degree since 2016, and after the market closed shares slid one other 26% in prolonged commerce.

One other California financial institution, Silvergate Capital Corp, had introduced a voluntary liquidation this week, after mass withdrawal of deposits after collapse of FTX alternate.

The newest US Non-Farm Payroll is anticipated to point out that round 205,000 new jobs had been created in America final month, down from the unexpectedly robust 517,000 in January.

The agenda

-

7am GMT: UK GDP report for January

-

1.30pm GMT: US Non-Farm Payroll report

-

3pm GMT: European Central Financial institution president Christine Lagarde visits German Federal Chancellor Olaf Scholz

[ad_2]

Source link