[ad_1]

I’ve been a reader of Jamie Catherwood’s Investor Amnesia because it launched. It’s all the time crammed with fascinating reminders from the previous.

Investor Amnesia is an excellent reminder that we are inclined to overlook that which got here earlier than. Ray Dalio put it much more starkly, noting that nothing is really unprecedented, and we have a tendency to make use of that phrase to consult with these issues we’ve not skilled in our lifetimes.

In the direction of that finish, take a look at Catherwood’s newest challenge: The Ages Of Finance: A Timeline Of Markets. You’ll be able to type the lengthy historical past of finance on a timeline, both by particular subjects — Equities, Milestones & Improvements, Commodities, Debt, and Manias & Crashes — or by “All Market Historical past.” It’s one more reminder of how uncommon actually novel occasions are, and the way every little thing outdated turns into new once more.

I’ve included some samples beneath, however you must go take a look at the Timeline in its entirety….

~~~

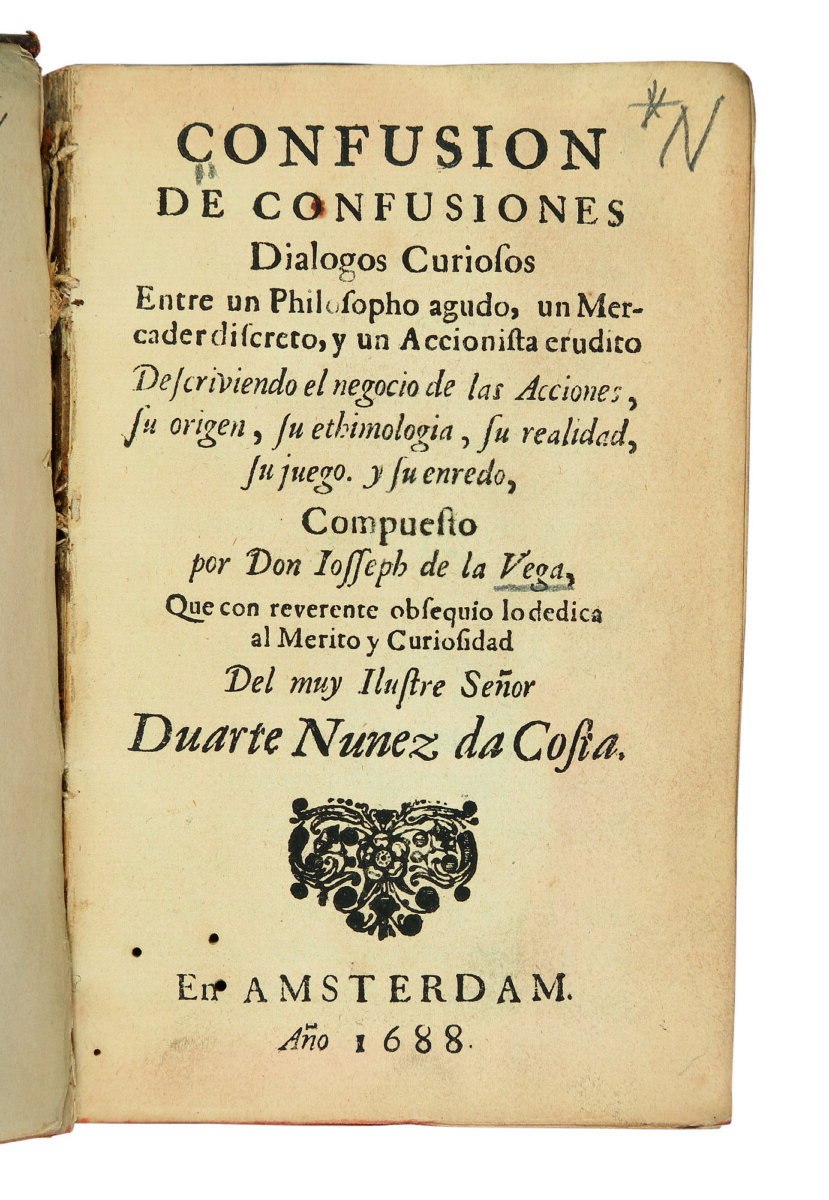

Joseph de la Vega wrote the primary ever behavioral finance ebook in seventeenth century Holland. His ebook, Confusion de Confusiones, is a dialog between an Investor, Thinker and Service provider by which the Investor explains how the inventory market features. This excerpt affords simply one of many sensible descriptions of markets:

“This enterprise of mine [investing] is a mysterious affair, and that, even because it was essentially the most honest and noble in all of Europe, so it was additionally the falsest and most notorious enterprise on this planet. The reality of this paradox turns into understandable, when one appreciates that this enterprise has essentially been transformed right into a sport, and retailers [concerned in it] have change into speculators…“

–First Behavioral Finance E-book

~~~

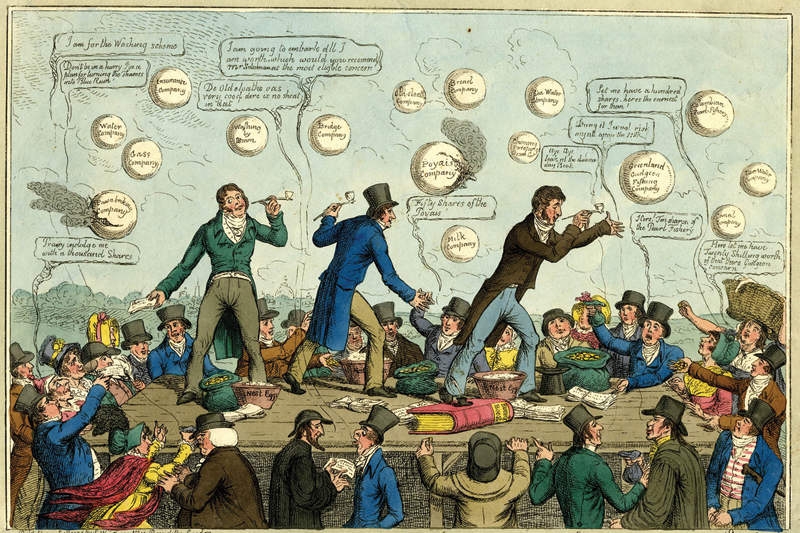

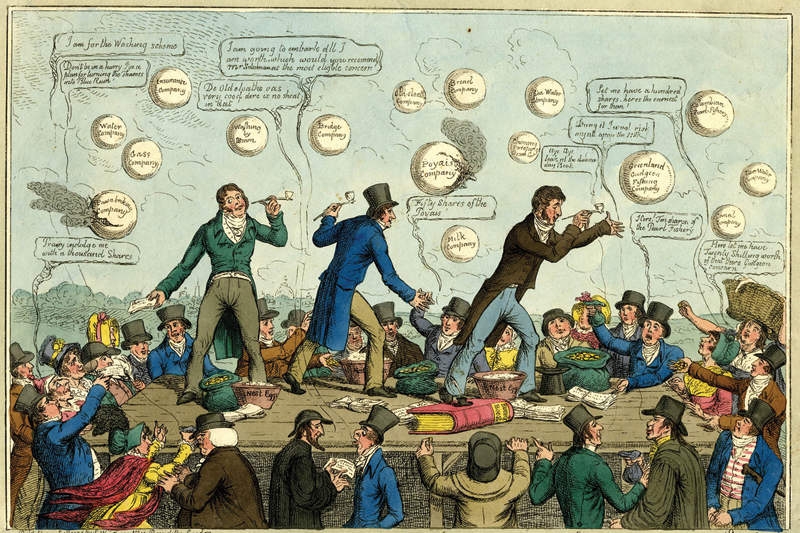

The Poyais Rip-off

Gregor MacGregor was deemed the ‘King of Con-Males’ by The Economist for pulling off the ‘biggest confidence trick of all time’. MacGregor earned this title by discovering an uninhabited piece of land on the coast of Honduras, making a fictitious nation known as Poyais, and promoting over a billion {dollars} price of ‘Poyais bonds’ in London by deceptive traders with lies about how Poyais was a developed society. MacGregor claimed that Poyais was house to stunning structure, an opera home, parliamentary constructing, cathedral, and extra. In actuality, it was an uninhabited jungle. –Poyais Rip-off

~~~

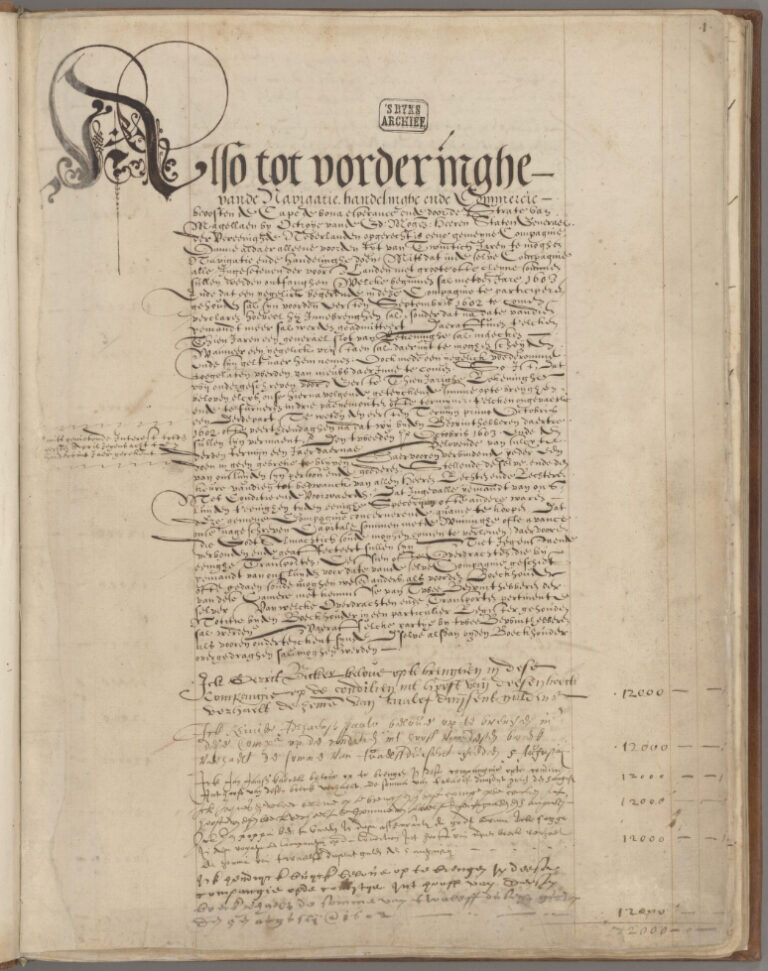

The First IPO

The Dutch East India Firm formally introduced its IPO within the company’s founding constitution on March 20, 1602. The corporate invited all Dutchmen to speculate when shares grew to become accessible for buy in August 1602. Most of the people’s capacity to speculate on this share providing was what made this primary “IPO” so distinctive, as beforehand corporations raised capital from small teams of rich traders. When the IPO subscription interval ended on August 31, some 1,100 traders had bought shares within the IPO. Learn Extra: The World’s First IPO

~~~

The Panic Of 1882

[ad_2]

Source link