[ad_1]

This is why rates of interest will increase and decrease implied volatility make Apple a possible excellent pullback put play.

Shares total appear to be stalling out a serious resistance. $4200 continues to be a wall for the S&P 500.

The largest market cap inventory, Apple, is definitely no exception. Apple inventory is the place it was again then a yr in the past. Whether or not it heads even larger now could be the query.

Here’s a fast comparability of then (April 2002) versus now in Apple. And why now you could wish to contemplate a comparatively low cost put purchase.

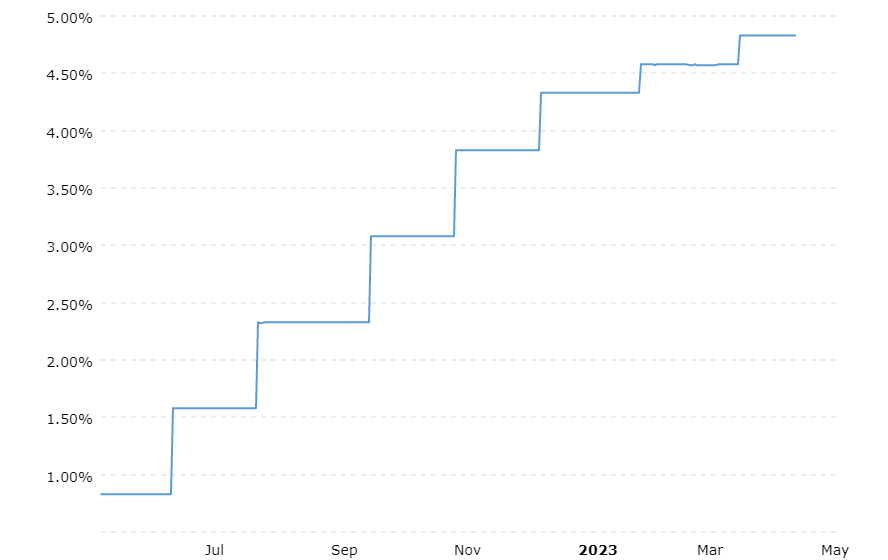

Curiosity Charges

The Fed has raised charges dramatically over the previous 12 months. Presently, the Fed Funds price stands at 4.75% to five%. This time final April the Fed Funds price was nicely below 1%.

10-year Treasury yield can also be a lot larger at this time than a yr in the past. Again then it yielded below 2.75%. At present it’s over 3.5%. Unquestionably a big rise in rates of interest. But shares like Apple don’t appear to care.

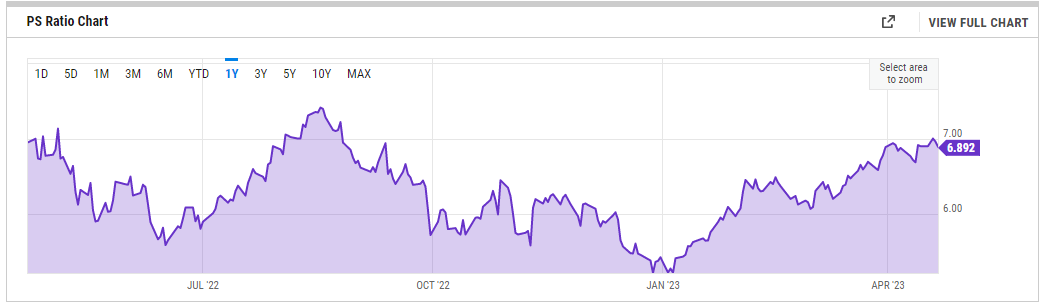

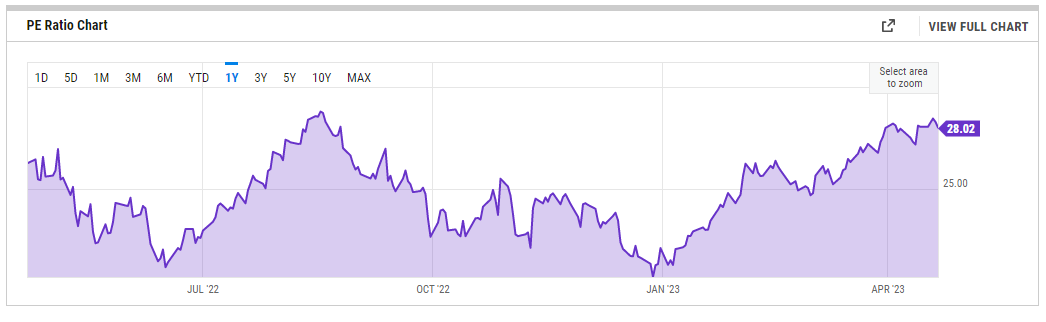

Valuations

This magnitude of improve in rates of interest ought to make valuation metrics resembling Worth/Earnings (P/E) and Worth Gross sales (P/S) noticeably contract. As an alternative, the AAPL P/E ratio is up a full level from 27 to twenty-eight. The P/S ratio for Apple stands at nearly the identical place from a yr in the past at slightly below 7.

APPL inventory is again to comparable multiples that signaled tops prior to now. The final time P/E was this wealthy round 28 was final August-right earlier than a punishing pullback.

On condition that the Fed has signaled it’s unlikely to chop charges anytime quickly, a continued growth of valuation multiples is unlikely from these present lofty ranges. This may present a substantial headwind to AAPL inventory worth over coming months. Plus fascinating to notice that the magnitude of the present rally equates nearly exactly to the magnitude of the earlier main rally that led to August-as seen within the chart.

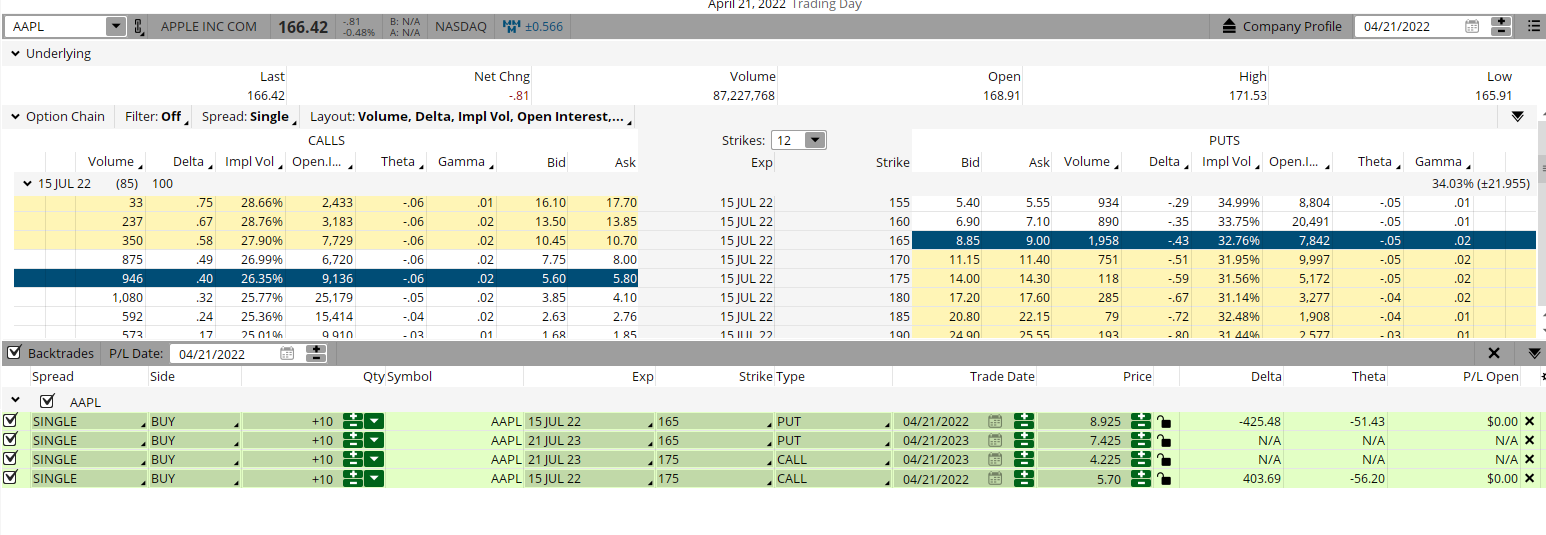

Implied Volatility (IV)

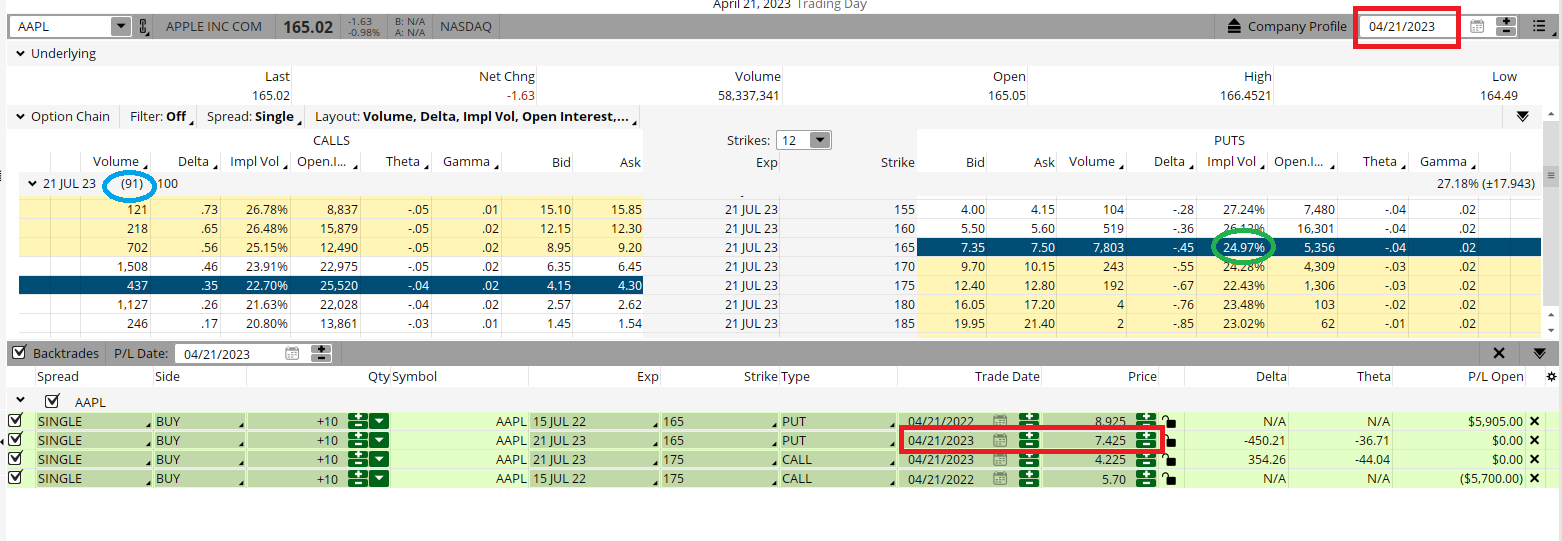

Implied volatility has dropped significantly in Apple choices from a yr in the past. Again then, at-the- cash July $165 places carried an IV slightly below 33. At present, comparable at-the-money places commerce with an IV of roughly 25. This 25% drop in IV implies that possibility costs are less expensive now than 12 months earlier (for each calls and places).

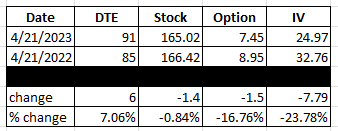

How less expensive? The desk beneath places issues all collectively.

Now and Then

- Now the July $165 places have 91 days till expiration (DTE). Then the identical places had 85 DTE. Every little thing equal, the places at this time must be extra a bit dearer since they’ve 6 days extra till expiration (7.06% higher)

- Now AAPL inventory closed at $165.02. Then Apple closed at $166.42. Every little thing being equal, the places at this time must be a bit dearer because the inventory is $1.40 decrease (0.84%)

- Now the AAPL July $165 places are priced at $7.45. Then the AAPL July $165 places had been priced at $8.95. Why are the places at this time a lot cheaper (16.76%) than the places a yr in the past?

- Now IV is at 24.97. Then IV was at 32.76. So, the large drop (23.78%) in implied volatility makes what must be a bit dearer now based mostly on extra DTE and decrease inventory worth rather a lot cheaper now based mostly on a lot decrease IV.

Traders and merchants seeking to take a brief place in shares like Apple could be clever to think about the advantages of shopping for low cost places. Defining the chance and reducing the associated fee to play for a pullback makes extra sense now than it has at any time prior to now 12 months.

POWR Choices

What To Do Subsequent?

When you’re in search of the most effective choices trades for at this time’s market, you must try our newest presentation How one can Commerce Choices with the POWR Scores. Right here we present you the right way to constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to study extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

How one can Commerce Choices with the POWR Scores

All of the Greatest!

Tim Biggam

Editor, POWR Choices E-newsletter

shares closed at $412.20 on Friday, up $0.32 (+0.08%). Yr-to-date, has gained 8.20%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the advanced world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

Extra…

The publish Apple Inventory Is Unchanged From A Yr In the past, However Some Issues Have Modified appeared first on StockNews.com

[ad_2]

Source link