[ad_1]

Financial institution of England chief economist sees ‘vital’ response to mini-budget

The Financial institution of England is more likely to ship a “vital coverage response” to final week’s announcement of tax cuts by finance minister Kwasi Kwarteng, its chief economist says.

However Huw Tablet additionally argued that the Financial institution ought to wait till its subsequent scheduled assembly within the first week of November (relatively than by way of an emergency charge hike).

Tablet advised the CEPR Barclays Financial Coverage Discussion board that:

“It’s laborious not to attract conclusion that this may require a major financial coverage response.”

💥BoE’s Tablet: “Arduous not to attract conclusion that this may require vital financial coverage response.”

— Andy Bruce (@BruceReuters) September 27, 2022

A ‘vital’ response is central bank-speak for a massive rate of interest rise.

Tablet explains that the Financial institution’s financial coverage committee is just not detached to the repricing of economic belongings [which have plunged alarmingly since Friday morning’s mini-budget].

And he stated he wished to ‘flag clearly’ that the federal government’s fiscal announcement will “act as a simulus”.

That’s an indication that Tablet thinks financial coverage should reply to Kwarteng’s tax cuts plan, with greater rates of interest.

BoE’s Tablet says there’s “clearly” a UK-specific factor to repricing belongings

— Andy Bruce (@BruceReuters) September 27, 2022

“We’re actually not detached to the repricing of economic belongings that we have seen.”

“We can’t be detached”

— Andy Bruce (@BruceReuters) September 27, 2022

BoE’s Tablet: We’re counting on communication and expectations till Nov assembly – this depends on confidence in UK financial framework

— Andy Bruce (@BruceReuters) September 27, 2022

Key occasions

Filters BETA

NEW: Huw Tablet, BoE chief economist, warns of rate of interest rises following Kwasi Kwarteng’s (not very mini) price range.

“Arduous not to attract conclusion that this may require vital financial coverage response.”

— Pippa Crerar (@PippaCrerar) September 27, 2022

Financial institution of England chief economist sees ‘vital’ response to mini-budget

The Financial institution of England is more likely to ship a “vital coverage response” to final week’s announcement of tax cuts by finance minister Kwasi Kwarteng, its chief economist says.

However Huw Tablet additionally argued that the Financial institution ought to wait till its subsequent scheduled assembly within the first week of November (relatively than by way of an emergency charge hike).

Tablet advised the CEPR Barclays Financial Coverage Discussion board that:

“It’s laborious not to attract conclusion that this may require a major financial coverage response.”

💥BoE’s Tablet: “Arduous not to attract conclusion that this may require vital financial coverage response.”

— Andy Bruce (@BruceReuters) September 27, 2022

A ‘vital’ response is central bank-speak for a massive rate of interest rise.

Tablet explains that the Financial institution’s financial coverage committee is just not detached to the repricing of economic belongings [which have plunged alarmingly since Friday morning’s mini-budget].

And he stated he wished to ‘flag clearly’ that the federal government’s fiscal announcement will “act as a simulus”.

That’s an indication that Tablet thinks financial coverage should reply to Kwarteng’s tax cuts plan, with greater rates of interest.

BoE’s Tablet says there’s “clearly” a UK-specific factor to repricing belongings

— Andy Bruce (@BruceReuters) September 27, 2022

“We’re actually not detached to the repricing of economic belongings that we have seen.”

“We can’t be detached”

— Andy Bruce (@BruceReuters) September 27, 2022

BoE’s Tablet: We’re counting on communication and expectations till Nov assembly – this depends on confidence in UK financial framework

— Andy Bruce (@BruceReuters) September 27, 2022

The surge in UK long-dated bond yields is kind of severe…..

30-year gilt yield yields now up by 30 bps. Horrid.

— Andy Bruce (@BruceReuters) September 27, 2022

UK gilts beneath strain once more

Kwarteng’s feedback haven’t introduced any apparent aid to the bond market.

UK gilt costs are falling once more, pushing up the yield (or rate of interest) on 10-year gilts to the very best since late 2008, at 4.377%

The 30-year gilt yield has continued to rise, hitting the very best stage since 2007 at 4.838%.

The hole between UK and safe-haven German authorities debt has widened too – to probably the most since 1991.

That exhibits that buyers are imposing a better danger premium to carry UK belongings, as confidence in Britain stays in shorter provide.

Certainly, it prices London twice as a lot as Berlin to borrow for a decade. UK 10-year gilts are buying and selling at a 4.28% yield, in comparison with simply 2.15% for German bunds.

Listed below are some pictures from Kwasi Kwarteng’s assembly with prime bosses from the UK’s monetary companies business.

As flagged earlier, the assembly was meant to be a well mannered dialog about Kwarteng’s plans to unleash progress. It seemed relatively extra fraught because of the plunge in sterling, and the surge in bond yields.

As Bloomberg reported this morning, earlier than the assembly:

Two veteran financiers stated the chancellor’s offhand tone additionally appeared to disregard the seriousness of loading Britain up with debt. That may have rattled watching buyers, they added, complaining that Kwarteng – who did a PhD thesis on a Seventeenth-century sterling disaster – hasn’t proven sufficient willingness to be guided by what’s really occurring within the markets.

That received’t assist as he turns to the Metropolis for help promoting the £100 billion ($106.5 billion) or extra in authorities bonds wanted to fund his plan, they added.

The chancellor additionally insisted that he was proper to announce tax cuts final Friday, telling main bankers, insurers and asset managers that:

“We have now responded within the instant time period with expansionary fiscal stance on power as a result of we needed to. With two exogenous shocks – Covid-19 and Ukraine – we needed to intervene. Our 70-year-high tax burden was additionally unsustainable.

“I’m assured that with our progress plan and the upcoming medium-term fiscal plan – with shut co-operation with the Financial institution – our strategy will work.”

However as you already know far too effectively, virtually all these tax cuts go to the richest 5%….

Kwasi Kwarteng additionally advised Metropolis buyers that he’ll produce a ‘credible plan’ to start out bringing down debt, as a share of the financial system, at his deliberate assertion in November (two entire months away…)

“Cupboard ministers will set out extra supply-side measures over coming weeks to make significant change. Proper throughout Authorities, departments must be focussed on this.

“As I stated on Friday, each division shall be a progress division.

“We’re dedicated to fiscal self-discipline, and received’t re-open the spending assessment. We have now a Medium Time period Fiscal Plan approaching 23 November, alongside an OBR forecast. That shall be a reputable plan to get debt to GDP falling.

Kwarteng: I am assured our plan will work

UK chancellor Kwasi Kwarteng has advised main bankers, insurers and asset managers at at this time’s assembly that he’s “assured” that his financial technique will work.

In his assembly with Metropolis chiefs this morning, Kwarteng stated he was assured that the long-term technique to drive financial progress by way of tax cuts and provide aspect reform would work.

In an try to reassure the Metropolis of London, rocked by days of turmoil, the chancellor reiterated the federal government’s dedication to fiscal sustainability (days after annoucing unfunded tax cuts that may require a surge in borrowing…).

He additionally argued that offer aspect reforms would cool inflation, as elevated capability brings down costs.

Kwarteng stated:

“I’m assured that with our progress plan and the upcoming medium-term fiscal plan — with shut co-operation with the Financial institution — our strategy will work.”

⚠️ UK FINANCE MINISTER KWARTENG TOLD LEADING BANKERS, INSURERS AND ASSET MANAGERS HE IS “CONFIDENT” THAT HIS ECONOMIC STRATEGY WILL WORK – FT

– Reuters through https://t.co/ymHY6xloQb

— PiQ (@PriapusIQ) September 27, 2022

It exhibits that Kwarteng plans to stay to his financial technique within the face of a market selloff that despatched the pound crashing.

However after all it’s the arrogance of worldwide markets – not the chancellor – that actually issues, and can decide whether or not the disaster abates, or intensifies.

What would it not take to immediate the Financial institution of England into an emergency charge hike, forward of their scheduled assembly in early November?

Professor Costas Milas of the College of Liverpool’s Administration College tells us {that a} credit standing downgrade may be a potential set off for emergency motion to spice up sterling.

He explains:

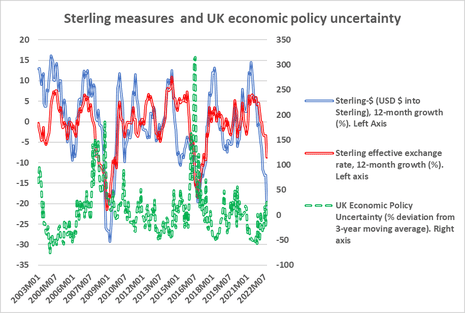

I imagine that the Financial institution of England should act if credit standing companies (CRAs) downgrade the UK sovereign debt. This, for my part, is probably going. CRAs normally take motion when both financial coverage uncertainty rises considerably and/or debt rises to unsustainable ranges.

Financial coverage uncertainty (measured right here) is at its highest stage for the reason that starting of the COVID-19 pandemic.

That is ‘hammering’ each the sterling efficient change charge and sterling in opposition to the greenback. On the similar time, UK debt will rise considerably following the chancellor’s min-Funds.

What stays to be seen is how excessive the UK debt will go since, presently, we should not have official estimates of the extra debt burden. One thing that may tempt CRA’s to assume severely a few credit standing downgrade.

The Treasury and the Financial institution of England may, and will, have accomplished a greater job in serving to the UK by way of the very troublesome winter forward, argues Dario Perkins, managing director for World Macro at TS Lombard.

It ought to have been potential to discover a monetary-fiscal coverage combine that helped get the UK financial system by way of this winter with no disaster or deep recession.

However this ain’t it— Dario Perkins (@darioperkins) September 27, 2022

Perkins, a former Treasury economist, has additionally argued that the UK is now affected by a “Moron Risk Premium” (MRP).

Mainly, as a result of the markets assume authorities coverage is essentially incoherent, and don’t belief the Financial institution of England to step in, they downgrade UK belongings throughout the board, from the pound to gilts.

The issue is not that the UK price range was inflationary, its that it was moronic. And a small open financial system that appears to be run by morons will get a wider danger premium on its belongings – foreign money down, yields up https://t.co/Oyc8rIOc2h

— Dario Perkins (@darioperkins) September 24, 2022

Economist Jonathan Portes has lined this compelling principle within the i, right here.

As an apart, Perkins additionally got here up with the excellent “Paolo Maldini information to central banking”, coined after the legendary defender recognized for his excellent positioning and timing.

The thought is easy: as soon as inflation is an issue, there is no such thing as a actual likelihood of a “comfortable touchdown” as a result of the central financial institution has already tousled.

Extra right here: Don’t Guess On A Tender Touchdown

As of late, Italian defenders use cruder techniques once they’re caught out of place – and the Financial institution could must do the identical to drag again runaway inflation….

This is a vital level in regards to the pound’s modest restoration at this time:

The £ has had a greater day at this time, however that is as a result of foreign money markets count on a) Financial institution to boost rates of interest & b) large cuts in public spending to pay for large tax cuts. Each strikes penalise bizarre folks; each work in opposition to progress. If neither occur £ will fall once more.

— Ben Fenton (@benfenton) September 27, 2022

[ad_2]

Source link