[ad_1]

An obvious enhance in demand for safe-haven property, rising curiosity in Bitcoin ETFs within the US, and anticipation of a extra accommodating place from the Federal Reserve have been the purported drivers of the cryptocurrency market’s restoration this yr, which led to a big achieve within the worth of Bitcoin.

Whereas the spot and futures markets for bitcoin have been on the focal point at first, choices associated to the cryptocurrency have not too long ago come to the fore. By introducing a brand new side to the market dynamics, these choices give a handy approach to speculate on potential worth swings.

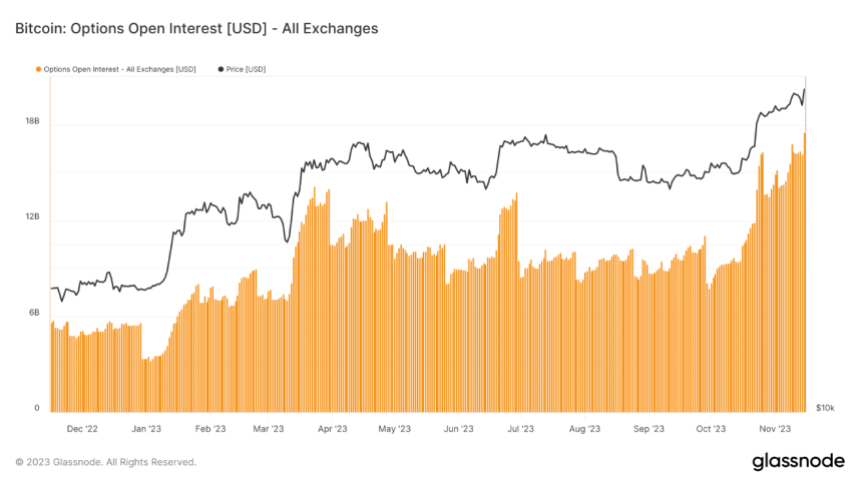

In keeping with figures from Glassnode, the open curiosity in Bitcoin’s choices has reached a brand new excessive level by exceeding $16 billion. This large enhance in open curiosity occurs on the similar time that Bitcoin’s worth efficiently reclaimed the $37,000 mark on November 15.

Choices Open Curiosity On The Rise

The rise in open curiosity for choices exhibits that the market is extra energetic and traders are keen on Bitcoin futures. The $16 billion determine exhibits how essential choices buying and selling is changing into as a significant a part of the bitcoin market.

On November 10, the Choices Open Curiosity, a measure of the whole amount of cash invested in choices contracts, reached a document excessive of $18.05 billion, or 491,000 Bitcoin, Coinglass knowledge exhibits.

Deribit, which has contributed about $14.5 billion, is generally answerable for this surge, in response to Coinglass.

The cryptocurrency derivatives alternate has additionally disclosed a virtually peak worth of $14.6 billion for its total open curiosity notional worth.

Supply: Coinglass

Bitcoin was buying and selling at $36,550 on the time of publishing. Utilizing statistics from CoinMarketCap, the final time BTC traded on the $37K worth was in Could 2022. The coin has gained 5% in worth over the previous day.

In a noteworthy growth, BTC choices open curiosity has outpaced that of BTC futures, marking a big stride in what Deribit described as “rising market sophistication.”

The platform reported this shift earlier within the week, with Deribit’s Chief Industrial Officer, Luuk Strijers, emphasizing that the surpassing of BTC choices open curiosity over futures open curiosity serves as a transparent indicator of the market’s maturation.

BTCUSD buying and selling slightly over $36K immediately. Chart: TradingView.com

Bitcoin And The Broader Shift In Market Dynamics

In keeping with Strijers, this transition suggests a rising inclination amongst contributors to leverage choices as strategic devices for positioning, hedging, or capitalizing on the current surge in implied volatility.

This evolution underscores a “broader shift in market dynamics,” reflecting an enhanced understanding and utilization of economic devices throughout the cryptocurrency house.

In the meantime, including to the upbeat narrative, the eagerly anticipated Bitcoin halving scheduled for April 2024 emerges as a beacon of positivity. With a historic monitor document of instigating a shortage impact by halving miners’ rewards, this occasion has constantly propelled upward momentum in Bitcoin’s worth.

Analysts and fanatics alike are brimming with optimism, viewing the upcoming halving as a possible catalyst that would robustly reinforce Bitcoin’s place and intrinsic worth throughout the market, paving the way in which for heightened anticipation and market dynamics.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes danger. Whenever you make investments, your capital is topic to danger).

Featured picture from Freepik

[ad_2]

Source link