[ad_1]

Kayla Camacho was midway by her grasp’s diploma when federal scholar mortgage funds had been paused in March 2020.

When she graduated final 12 months, Camacho put the cash she would have spent paying off her $68,000 debt towards financial savings and her youthful siblings, shopping for flights again residence to Orange County for one sister and dance sneakers for one more. The primary in her household to graduate from faculty, Camacho grew to become the household’s security internet.

However the pandemic aid was at all times meant to be momentary. Camacho and tens of hundreds of thousands of different debtors have braced for months because the pause’s expiration date approached, solely to be postponed a number of occasions — it’s now set for Aug. 31.

“The uncertainty and the ready sport — the not realizing — is sort of as worrying,” she mentioned.

The pause and accompanying zero-interest fee have given debtors an opportunity to breathe and regroup, permitting them to spend the final two years paying off bank cards and automotive notes, saving for down funds on houses and build up emergency funds, typically for the primary time of their grownup lives.

Now, forward of the midterm elections, the Biden administration should give you a scholar debt aid plan that doesn’t contribute to issues over inflation whereas being beneficiant sufficient to fulfill debtors who’ve had a preview of what debt cancellation may appear like. After months of delays, President Biden is anticipated to announce in coming weeks that the federal government will forgive no less than $10,000 in debt for folks making lower than $125,000, in line with information stories.

If the transfer survives a possible authorized problem, it might remove a major chunk of debt for hundreds of thousands of debtors — the common federal scholar mortgage burden is $37,000. In complete, 43 million Individuals collectively owe the federal authorities $1.6 trillion, the very best quantity of client debt within the U.S. after mortgages. In California alone, 3.8 million residents owe $141.8 billion, the most important share of any state.

Camacho earned a bachelor’s diploma in English in 2014 from Chapman College, returning in in 2018 for a grasp’s diploma in management improvement.

(Dania Maxwell / Los Angeles Instances)

However relying upon who’s requested, $10,000 in forgiveness for some debtors would go too far — or not far sufficient. Opponents of mortgage forgiveness say it might be costly and regressive, with the most important profit going to debtors with graduate levels, who are inclined to have increased incomes.

“My important concern is that it’s a very poor use of cash,” mentioned Marc Goldwein, senior coverage director on the Committee for a Accountable Federal Price range, a nonpartisan assume tank. The plan “is basically going to assist some folks, nevertheless it’s disproportionately going to go to individuals who don’t want it.”

[The plan] is basically going to assist some folks, nevertheless it’s disproportionately going to go to individuals who don’t want it.

— Marc Goldwein

Supporters of debt cancellation need the president to go increased than $10,000, guarantee the help is granted robotically — not by an utility course of — and take away the earnings cap, which they argue will damage Black and Latino debtors who’ve much less generational wealth and are disproportionately impacted by scholar loans.

Black and Latino debtors take longer to repay their loans and usually tend to fall behind on funds than white and Asian debtors.

“We’d like debt cancellation that basically is designed in a approach that advantages as many Individuals as attainable,” mentioned Cody Hounanian, the chief director of the Pupil Debt Disaster Middle, which advocates for debtors and backs full mortgage forgiveness.

Biden has additionally confronted growing stress to finish the compensation pause. Republicans have complained about the price, an estimated $5 billion per thirty days, and say it’s an try to enhance Biden’s polling numbers forward of the election and a gateway to debt cancellation.

In the meantime, some Democrats have pushed for the president to cancel as much as $50,000 in debt. They warn that doing nothing to assist all debtors isn’t a viable possibility, notably forward of midterm elections by which Democrats want the backing of youthful voters to assist keep slim majorities within the Home and Senate.

The federal government’s federal scholar mortgage portfolio has grown greater than fivefold since 2004, when it totaled $250 billion. That enhance has been spurred by extra college students going to varsity, borrowing bigger quantities and taking longer to pay the cash again, in line with the Congressional Price range Workplace.

“Earlier than the funds had been paused, one other scholar mortgage borrower defaulted on a mortgage each 26 seconds,” mentioned Mike Pierce, govt director of Pupil Borrower Safety Middle advocacy group, referring to people who find themselves 270 days behind on funds. “Nobody ought to be dashing to return to that world with out truly fixing scholar loans and debt.”

“I didn’t have any more money,” Camacho mentioned of her funds with scholar loans. “That [loan] auto pay simply turns into a looming factor that you simply attempt to neglect about, nevertheless it’s at all times behind your thoughts.”

(Dania Maxwell / Los Angeles Instances)

The debt has damage debtors’ means to purchase houses and save for retirement. For a lot of, the debt has develop into an impediment to attaining the middle-class life faculty was meant to assist present.

Camacho mentioned she at all times thought-about increased schooling a given. Paying for it was the query.

“Going to varsity was one thing that was considered as, ‘It is advisable to go to varsity so you may get a great job, and so that you don’t need to proceed that cycle of poverty,’” mentioned the 29-year-old, who pays $1750 a month for a studio house in Anaheim.

Her mother and father, highschool sweethearts who had her younger, struggled at occasions to make ends meet. Camacho recalled that sudden emergencies akin to a automotive breaking down meant the household needed to ask for assist or flip to payday loans. In 2012, whereas she was in faculty, they misplaced their residence.

Her mother and father rented flats in a rich Orange County suburb with good colleges so Camacho and her three youthful siblings would have extra alternatives. It paid off: She took Superior Placement lessons and obtained good grades. She spent six years in present choir and wrote in regards to the expertise in her faculty essays.

In 2010, Camacho enrolled in Chapman College, a non-public four-year establishment close to her hometown that supplied a beneficiant monetary assist bundle. She lived at residence and paid for college with a mixture of scholarships, cash earned from retail and on-campus jobs, and hundreds in federal scholar loans.

Camacho earned a bachelor’s diploma in English in 2014, began working as a highschool English trainer by Educate for America that very same 12 months and commenced to pay again the mortgage.

“On the finish of the month it might be zero,” she mentioned, referring to her financial institution stability. “I didn’t have any more money … That [loan] auto pay simply turns into a looming factor that you simply attempt to neglect about, nevertheless it’s at all times behind your thoughts.”

She returned to Chapman in 2018 for a grasp’s diploma in management improvement, taking up much more debt.

George Washington College college students put up posters close to the White Home selling scholar mortgage debt forgiveness.

(Evan Vucci / Related Press)

If she may do it once more, she would ignore the recommendation she acquired as a highschool senior: Enroll in the very best faculty attainable, whatever the price.

“Fortunately, all of it led me to the place I’m as we speak, which is nice — however with a really hefty bottle of loans,” she mentioned.

When compensation resumes, she’ll owe $429 a month underneath the phrases of her 20-year compensation plan for each her undergraduate and graduate debt, about 12% of her take residence pay.

Supporters and opponents of mortgage forgiveness agree that extending the present moratorium just isn’t sustainable. For debtors, the longer the pause lasts, the tougher it is perhaps to remain present with funds.

“All hell will break free if and when this factor is restarted,” mentioned Dalié Jiménez, director of the Pupil Mortgage Legislation Initiative on the College of California at Irvine College of Legislation, of resuming mortgage compensation. “This requires fairly a little bit of ramp up … to be executed effectively.”

Debtors might have modified addresses, making it more durable for his or her mortgage servicers to succeed in them, or they could have did not funds for compensation, Jiménez mentioned.

Then there’s the price. The Training Division estimated that mortgage forbearance as a result of COVID-related hardships resulted in $98.4 billion in misplaced income within the 2020 and 2021 fiscal years.

Based on the Committee for a Accountable Federal Price range, that quantity is double what it might have price to fund two years of neighborhood faculty for Individuals over the course of 5 years, a provision in Biden’s failed social spending invoice.

In the meantime, if Biden opts to cancel $10,000 in debt for every scholar mortgage borrower, that might price $321 billion and wipe out debt for practically 12 million folks, in line with the Federal Reserve Financial institution of New York.

“It was an excellent emergency measure,” mentioned Sandy Baum, a senior fellow on the City Institute’s Earnings and Advantages Coverage Middle, of the prolonged moratorium. “However now the unemployment fee is basically low. It’s not that individuals don’t have jobs … persons are as effectively positioned to repay their loans as they had been earlier than the pandemic.”

There’s a main cause Biden has been hesitant to deal with scholar debt with out Congress.

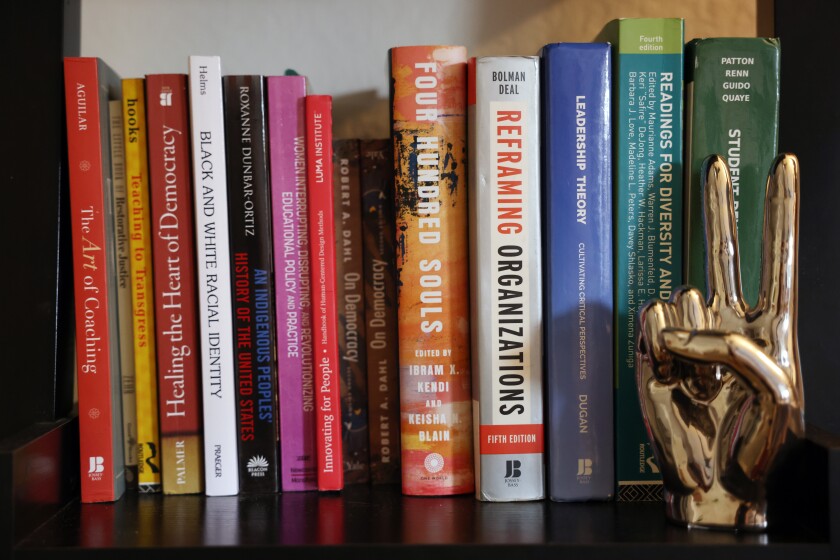

Kayla Camacho’s faculty books sit on a shelf in her house.

(Dania Maxwell / Los Angeles Instances)

“It’s very doubtless that it’ll get challenged in court docket, which might then delay or forestall any of the forgiveness that was promised to debtors,” mentioned Michelle Dimino, a senior schooling coverage advisor at Third Method, a centrist Democratic assume tank.

Dimino famous that, for many of his presidency, Biden has been extra centered on higher enforcement of current scholar mortgage debt aid legal guidelines, which has led to billions in forgiveness for college kids who’re disabled or had been defrauded by their colleges.

The administration additionally issued a brief waiver to make it simpler to have loans forgiven underneath a program for individuals who work in public service, which has led to $6.8 billion in debt cancellation for 113,000 debtors, in line with the Training Division.

However because the November midterm elections strategy, debt cancellation advocates say incremental change isn’t sufficient.

“Persons are in search of [Biden] to make good on the guarantees he made on the marketing campaign path,” mentioned Kristin McGuire, govt director of Younger Invincibles, a gaggle that promotes the pursuits of younger voters.

Latest polling means that there’s assist amongst Democrats and independents for no less than some type of mortgage forgiveness, notably if it’s focused to those that want it most.

A December 2021 Morning Seek the advice of ballot discovered that 62% of registered voters polled supported some kind of debt forgiveness, both for all debtors or these with low incomes. That included 85% of registered Democrats, 57% of independents and 43% of Republicans. Practically 80% of millennials supported some debt cancellation, and 34% backed canceling all debt, the very best assist of any age vary.

The query now could be whether or not debtors shall be joyful returning to the established order after two years of life with out scholar loans.

“I feel I’m only a fairly common millennial, and that there’s quite a lot of us,” Camacho mentioned. “We’ve got scholar loans, it’d be nice in the event that they had been forgiven, and we may do quite a lot of issues in our lives if that was the case.”

[ad_2]

Source link