[ad_1]

Britain’s economic system rising at quickest tempo in a yr: PMIs present

Newsflash: The UK non-public sector is rising at its quickest tempo in a yr, as corporations are boosted by a pick-up in new orders.

The newest survey of British buying managers has discovered that enterprise exercise is rising for the third month operating this month, and on the quickest tempo since April 2022.

The UK’s dominant service sector is driving the restoration, with corporations reporting that client spending was resilient. This could cool considerations that the UK dangers falling into recession this yr.

Knowledge supplier S&P International says {that a} “additional strong rise” in new orders dded to indicators of an bettering financial panorama.

However whereas there was sturdy progress within the service economic system, manufacturing unit manufacturing is falling once more this month. Items producers stated that demand had been hit by “buyer destocking” and efforts to chop prices.

Total, the Flash UK PMI composite output index rose to 53.9 to this point this month, up from March’s 52.2, a 12-month excessive. Any studying over 50 exhibits progress.

#UK non-public sector companies signalled an extra enhance in enterprise exercise with the speed of growth accelerating to its quickest in a yr (#PMI at 53.9; Mar: 52.2). The speed of enter value inflation slowed, however output prices elevated steeply. Learn extra: https://t.co/lByqsf9t6N pic.twitter.com/eU9raeLl9R

— S&P International PMI™ (@SPGlobalPMI) April 21, 2023

Chris Williamson, Chief Enterprise Economist at S&P International Market Intelligence says the repost exhibits progress accelerating this month:

Development is lopsided, nevertheless, with surging demand for providers contrasting with an ongoing downturn in demand for items, Williamson factors out, including:

“Nonetheless, for now the important thing takeaway is that the economic system as an entire isn’t solely displaying encouraging resilience however has gained progress momentum heading into the second quarter, the newest PMI studying broadly indicative of GDP rising at a sturdy quarterly fee of 0.4%.

Key occasions

Value rises may result in Might rate of interest hike

UK companies additionally continued to carry their costs this month, including to pressures on households.

The PMI report exhibits that non-public sector companies “as soon as once more sought to defend margins” from quickly rising workers prices, particularly these within the service economic system. Value rises accelerated barely this month.

That, and the pick-up in progress final month, is more likely to spur the Financial institution of England to boost rates of interest for the twelfth time in a row subsequent month, when it units borrowing prices on 11 Might.

S&P International Market Intelligence’s Chris Williamson says:

Inflationary pressures have in the meantime continued to chill in manufacturing, however value pressures have picked up in providers following the resurgence of demand.

This mix of sooner progress and elevated value pressures put a twelfth fee hike by the Financial institution of England an more and more achieved deal when it subsequent meets on eleventh Might, and can add to hypothesis that additional hikes could also be wanted

Britain’s economic system rising at quickest tempo in a yr: PMIs present

Newsflash: The UK non-public sector is rising at its quickest tempo in a yr, as corporations are boosted by a pick-up in new orders.

The newest survey of British buying managers has discovered that enterprise exercise is rising for the third month operating this month, and on the quickest tempo since April 2022.

The UK’s dominant service sector is driving the restoration, with corporations reporting that client spending was resilient. This could cool considerations that the UK dangers falling into recession this yr.

Knowledge supplier S&P International says {that a} “additional strong rise” in new orders dded to indicators of an bettering financial panorama.

However whereas there was sturdy progress within the service economic system, manufacturing unit manufacturing is falling once more this month. Items producers stated that demand had been hit by “buyer destocking” and efforts to chop prices.

Total, the Flash UK PMI composite output index rose to 53.9 to this point this month, up from March’s 52.2, a 12-month excessive. Any studying over 50 exhibits progress.

#UK non-public sector companies signalled an extra enhance in enterprise exercise with the speed of growth accelerating to its quickest in a yr (#PMI at 53.9; Mar: 52.2). The speed of enter value inflation slowed, however output prices elevated steeply. Learn extra: https://t.co/lByqsf9t6N pic.twitter.com/eU9raeLl9R

— S&P International PMI™ (@SPGlobalPMI) April 21, 2023

Chris Williamson, Chief Enterprise Economist at S&P International Market Intelligence says the repost exhibits progress accelerating this month:

Development is lopsided, nevertheless, with surging demand for providers contrasting with an ongoing downturn in demand for items, Williamson factors out, including:

“Nonetheless, for now the important thing takeaway is that the economic system as an entire isn’t solely displaying encouraging resilience however has gained progress momentum heading into the second quarter, the newest PMI studying broadly indicative of GDP rising at a sturdy quarterly fee of 0.4%.

Eurozone restoration unexpectedly gathering tempo

The eurozone’s financial restoration has unexpectedly strengthened this month, lifted by a leap in exercise at service sector companies.

The flash Composite Buying Managers’ Index (PMI), compiled by S&P International, has jumped to an 11-month excessive of 54.4 in April from March’s 53.7.

That signifies that the economic system is accelerating this month.

Cyrus de la Rubia, chief economist at Hamburg Business Financial institution, which co-produces the report, explains:

“The HCOB Buying Managers’ Indices for the euro zone present a really pleasant general image of an economic system that continues to get well,”

“Nonetheless, a better look reveals that progress may be very erratically distributed. For instance, the hole between the partly booming providers sector on the one hand and the weakening manufacturing sector on the opposite has widened additional.”

The pound has dipped within the monetary markets this morning, after UK retail gross sales fell in March.

Sterling misplaced half a cent to beneath $1.24 this morning, away from the 10-month highs round $1.255 seen per week in the past.

⚠️ STERLING DIPS AGAINST U.S. DOLLAR AFTER DATA SHOWS UK MONTHLY RETAIL SALES FELL MORE THAN EXPECTED IN MARCH; LAST DOWN 0.2% AT $1.24205

— PiQ (@PriapusIQ) April 21, 2023

The pound had been the best-performing G10 forex this yr, because it recovered from its losses throughout 2022.

Victoria Scholar, Head of Funding at interactive investor, explains:

Poor climate within the UK weighed on retail gross sales in March following a rise within the earlier month, notably on non-food gadgets. It was the sixth wettest March on report since 1836, with retailers similar to backyard centres and jewelry shops negatively. Meals retailer gross sales volumes additionally declined in March, partly due to the latest meals shortages.

Meals retailer gross sales are nonetheless down 3% versus pre-pandemic ranges from February 2020 due to meals value inflation and the price of residing disaster. One brilliant spot got here from motor gas gross sales which rose by 0.2% in March versus a fall of 1.2% in February however stays 8.5% beneath pre-covid ranges.

The pound bought off barely after the info, however cable (GBPUSD) continues to be up 2.7% this yr. Nonetheless the dollar is on monitor for its first weekly acquire in a month.”

Radio and tv presenter Greg James factors out that Elon Musk additionally skilled a loss yesterday, when the most important and strongest rocket ever constructed blew up.

I misplaced my blue tick however your rocket blew up so who’s the actual loser

— Greg James (@gregjames) April 20, 2023

Though the take a look at flight of the Starship rocket solely lasted round 4 minutes, SpaceX and NASA say it was a hit, and can have yielded loads of helpful knowledge.

Though the Starship spacecraft did not separate from the lower-stage Tremendous Heavy rocket, it did take-off – succeeding in not blowing up the launch pad. So it’s an necessary milestone in SpaceX’s ambition of sending astronauts again to the moon and in the end to Mars.

The Pope has additionally been blessed with certainly one of Musk’s ‘gray ticks’ (for these with authorities or multilateral group accounts).

God’s gaze by no means stops with our previous crammed of errors, however seems with infinite confidence at what we will develop into.

— Pope Francis (@Pontifex) April 20, 2023

Researcher John Scott-Railton has been inspecting the confusion attributable to the elimination of the previous verification on Twitter.

He exhibits how smaller US authorities companies, and people abroad, are actually unverified, which dangers creating confusion for customers.

US public security companies are everywhere in the map,

A very good # of the largest federal ones have a gray badge.

However the decrease you go into regional places of work, state & native, the more serious it seems.

And scenario is much more dire internationally. pic.twitter.com/FshAf0OB9R

— John Scott-Railton (@jsrailton) April 20, 2023

For each sector of officialdom, from federal all the way in which to cities Musk made a multitude.

Replicated in each nation world wide.

I am selecting nationwide customs providers at random to make the purpose. pic.twitter.com/kFatzM9Z4h

— John Scott-Railton (@jsrailton) April 20, 2023

This ‘recklessness’ by Elon Musk may have severe penalties if there may be an emergency or nationwide disater, fears Scott-Railton, who’s a senior researcher at The Citizen Lab:

The weak spot in UK retail gross sales in March was “widespread”, says Paul Dales of Capital Economics, though it could partly be blamed on the dangerous climate:

Meals gross sales dropped by 0.7% m/m, partly resulting from shortages on the cabinets, and gross sales fell in 4 of the opposite six foremost classes.

The three.2% m/m and 1.7% m/m respective declines in division retailer and clothes gross sales have been reportedly resulting from March being the wettest March in 40 years.

Regardless of the poor climate conserving buyers at dwelling, on-line gross sales dipped by 0.8% m/m. Family items and gas gross sales eked out rises of 0.1% m/m and 0.2% m/m respectively.

Nonetheless, Dales is inspired that retail gross sales rose over the past quarter, by 0.6%.

That’s the primary rise in a full quarter since Q2 2021 and means that the 18-month retail “recession” might have come to an finish.

UK shops felt the brunt of the dangerous climate in March, with gross sales volumes dropping by 3.2% for the month.

Clothes retailers reported a 1.7% fall, whereas gross sales volumes at different non-food shops, similar to jewelry shops and backyard centres, fell by 0.6%.

Authorities accounts on Twitter have gray ticks that observe their reference to authorities companies, which ought to assist customers spot the actual Joe Biden from presidential impersonators, for instance.

UK prime minister Rishi Sunak has the gray tick too, as does the @10DowningStreet account…. and Labour chief Keir Starmer, and Liberal Democrat chief Ed Davey too.

However the gray tick might not prolong to each politician.

The Australian prime minister, Anthony Albanese, has been given a gray tick, however the opposition chief, Peter Dutton, has a blue tick indicating he has subscribed to Twitter Blue.

Right here’s a information to recognizing who’s actually who on Twitter:

The drop in UK retail spending final month signifies that gross sales volumes are 0.7% beneath their ranges earlier than the Covid-19 pandemic started:

Darren Morgan, ONS director of financial statistics, says:

“Retail fell sharply in March as poor climate impacted on gross sales throughout virtually all sectors.

“Nonetheless, the broader pattern is much less subdued as a robust efficiency from retailers in January and February means the three-month image exhibits optimistic progress for the primary time since August 2021.

“Within the newest month, shops, clothes retailers and backyard centres skilled heavy declines as important rainfall dampened enthusiasm for procuring.

“Meals retailer gross sales additionally slipped, with retailer suggestions suggesting the elevated value of residing and climbing meals costs are persevering with to have an effect on client spending.”

Whereas shedding their blue tick may prick the egos of some Twitter customers, it additionally will increase the dangers of impersonation by faux accounts.

In a single day, the US Citizenship and Immigration Companies warned its followers to be careful for imposters.

Although we now have misplaced our checkmark, that is the official USCIS twitter account. Please watch out for imposter accounts.

When unsure, go to https://t.co/069mgZuKzZ for the newest immigration and citizenship info, with direct hyperlinks to our social media.

— USCIS (@USCIS) April 20, 2023

Twitter has beforehand suggested authorities entities to use for a free blue examine by a particular program, however some have reported that they had to date been unable to take action, my colleague Kari Paul explains, including:

Consultants have acknowledged that the failure to confirm such entities will increase the dangers of scams and even threatens to break down catastrophe response on-line, with companies just like the Nationwide Climate System now check-less.

Musk chips in, for a number of celebs….

Horror novelist Stephen King discovered that he nonetheless has a blue tick following the purge of legacy verified accounts on Thursday.

Final November, King had declared he wouldn’t sigh up for Twitter Blue, telling his seven million followers that Musk ought to pay him for producing content material on the social media web site.

King, who had promised to be ‘gone like Enron’ if Elon Musk began charging a price for verification, insists he hasn’t subscribed….

My Twitter account says I’ve subscribed to Twitter Blue. I haven’t.

My Twitter account says I’ve given a telephone quantity. I haven’t.— Stephen King (@StephenKing) April 20, 2023

…prompting Musk to answer that King was ‘welcome’:

The world’s second-richest man seems to be chipping in for a number of accounts, together with basketball participant LeBron James and actor William Shatner, because the Verge explains right here.

I’m paying for a number of personally

— Elon Musk (@elonmusk) April 20, 2023

Elon Musk’s Twitter pulls plug on ‘verified’ blue ticks

Kari Paul

Twitter has lastly eliminated its “legacy” blue checks from previously verified Twitter accounts, as insurance policies applied beneath new proprietor Elon Musk started to take maintain, my colleague Kari Paul writes.

Musk, who bought the corporate for $44bn in 2022 and has to date struggled to make it worthwhile, has been threatening to take away what he referred to as “legacy blue checks” for months now. The checkmark beforehand denoted accounts that had been verified for authenticity and was given to accounts of celebrities, journalists and media shops.

Now customers looking for verification should pay for Twitter Blue, a controversial $8 a month subscription program beneath which any account can receive a blue checkmark.

The rollout of the modifications on Thursday was chaotic. Quite a few high-profile customers took to the platform to claim they’d not pay for blue checkmarks beneath the brand new coverage, whereas others introduced they would depart the platform solely.

Nonprofit organizations Human Rights Watch and the NAACP have tweeted they won’t be paying for Twitter Blue.

Well-known names similar to Hillary Clinton, Invoice Gates, Kim Kardashian and Justin Bieber are amongst those that are now not verified.

Economist Mariana Mazzucato is certainly one of many criticising the transfer, accusing Musk of ‘capricious whim’:

Misplaced my @Twitter blue tick tonight resulting from capricious whim of little boy @elonmusk. So be it. However why oh why would anybody pay for his little video games, greed and brief consideration span. An insult to human intelligence. Play on.

— Mariana Mazzucato (@MazzucatoM) April 20, 2023

Introduction: UK retail gross sales drop in moist March

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

British customers purchased much less stuff final month, as inflation ate into family budgets and moist climate drove buyers from the excessive avenue.

Retail gross sales volumes throughout Nice Britain dropped by 0.9% in March, new figures from the Workplace for Nationwide Statistics present.

That follows a 1.1% rise in February 2023, which had lifted hopes for financial progress this yr.

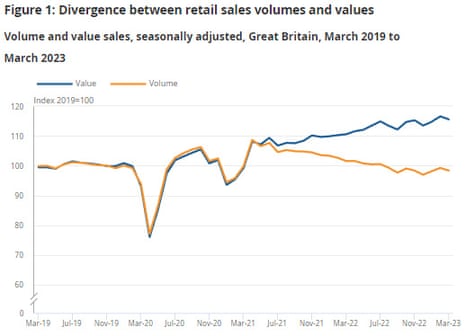

On an annual foundation, general retail gross sales volumes fell by 3.1% final monh in comparison with March 2022. However, buyers spent 4.5% extra to purchase much less, reflecting value will increase over the past yr – as this chart exhibits:

The ONS stories that gross sales volumes at “non-food shops” fell by 1.3% throughout March, following an increase of two.4% in February. Retailers blamed “poor climate circumstances all through most of March” for affecting gross sales.

Meals retailer gross sales volumes fell by 0.7% in March 2023, following an increase of 0.6% in February 2023.

Meals costs have been rocketing increased, with foods and drinks inflation at a 45-year excessive over 19%.

However, there are some indicators that client confidence is bettering. The buyer confidence index issued by market researcher GfK has risen by six factors to minus 30 in April.

That follows a two-point enhance within the earlier month, and could possibly be an early signal of an financial restoration.

The newest PMI surveys from the UK, throughout the eurozone, and the US, will present how corporations are faring this month.

The agenda

-

7am BST: UK retail gross sales figures for March

-

9am BST: Eurozone ‘flash’ buying supervisor surveys for April

-

9.30am BST: UK ‘flash’ buying supervisor surveys for April

-

2.45pm BST: US ‘flash’ buying supervisor surveys for April

[ad_2]

Source link