[ad_1]

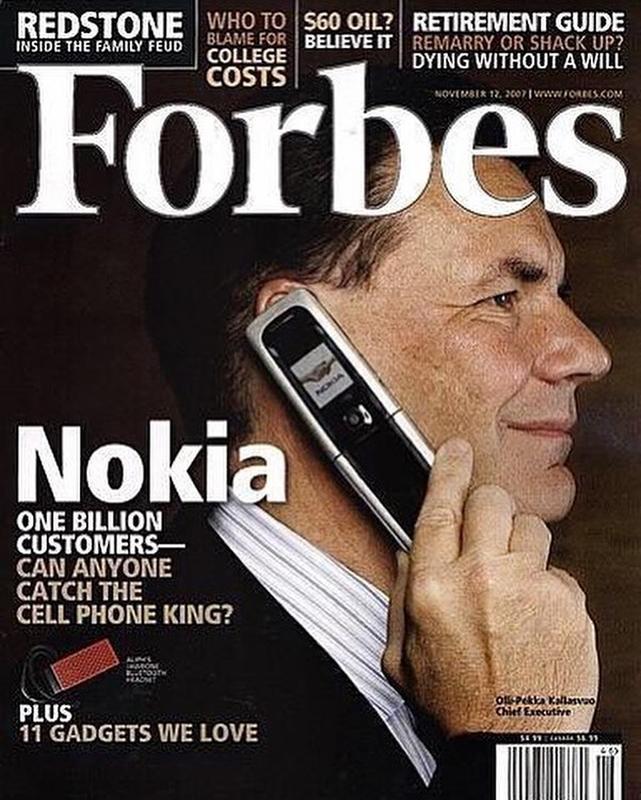

In the present day’s version of “No one Is aware of Something” is a couple of once-dominant cell phone maker. Precisely 15 years in the past, Forbes’s new cowl story lauded Olli-Pekka Kallasvuo, Nokia’s CEO. The headline trumpeted:

“Nokia, one billion clients – can anybody catch the mobile phone king?”

It was posted on-line October 26, 2007 — 15 years in the past as we speak.

In a basic model of the innovator’s dilemma, Nokia was unwilling to cannibalize its already very profitable handset enterprise. Maybe they failed to acknowledge the shift towards extra highly effective smartphones that gave higher cell computing capabilities to customers. Or, they had been merely unable to make the flip.

Regardless, Apple had already been engaged on a touchscreen cell computing machine for a number of years. In 2007, the exact same yr of the Nokia Forbes cowl, Apple rolled out the iPhone; not lengthy after, the decline of Nokia’s cell phone enterprise started. A mere 5 years later (2013), Nokia bought its total telephone enterprise to Microsoft.

It’s yet one more reminder of what we are likely to overlook:

1. The long run is unknown and unknowable: Ignore anybody who pretends they know with certainty what’s coming subsequent — they don’t, as a result of they’ll’t. As a substitute, its higher to consider the world in probabilistic phrases: What’s extra possible or much less prone to happen. You’ll nonetheless get this mistaken (and sometimes), however your errors will probably be smaller and you’ll be extra versatile in your pondering.

2. This too, shall move: There are many explanation why firms typically crash and burn from nice success: Benefits achieved might not be long-lasting; the abilities that led to greatness might not be the identical as what it takes to take care of these benefits. Generally, the world adjustments earlier than we acknowledge it. However its simple to overlook this, and easily assume domiannt firms will stay that method. BlackBerry, Lucent, Nokia, NT had been the dominant telecom gamers within the Nineteen Nineties/2000s, and shortly pale. Which dominant firms within the 2020s will endure comparable fates?

3. We fail to correctly consider content material we eat: Every thing you learn, hear ot or watch ought to to be analyzed for its integrity and accuracy. Every bit of knowledge must be evaluated by itself deserves. Traders can’t merely settle for (or reject) one thing as a result of it’s in {a magazine} or on tv. My expertise has been its higher to depend on the person writers than publications. Don’t assume something is true or mistaken with out understanding the supply’s monitor file.

4. We underappreciate cycles: Tendencies really feel like they’re everlasting, particularly as they attain turning factors: Nokia appeared unbeatable in 2007 however the seeds of its destruction had been planted years prior. Now we have a tough time wanting past the right here and now, as we reside on the intersection of the previous and the longer term. This usually prevents us from understanding the long run life cycles of the economic system, markets and corporations.

5. Change is Fixed: It’s east to overlook incremental shifts over time. The universe is dyanamic and ever altering. We’re consultants in the way in which the world was once. Flux is a persistent state of affairs. This implies we should continually test our personal data base because it ages out of forex and decays over time.

If you happen to take note of historical past, you will notice this type of factor repeatedly. Grand pronouncements about why a brand new service or product will probably be nice or will fail miserably; forecasts about what is going to occur. Our personal priors are so in-built that it’s simple to overlook when one thing — or every thing — has modified.

Recognizing how little you truly know is a superpower. If we had been much less sure of ourselves and possessed extra humility, we may all change into higher buyers.

Beforehand:

Don’t Learn This Weblog Put up! (Might 18, 2022)

Regularly, Then All of a sudden (October 1, 2021).

Why the Apple Retailer Will Fail (Might 20, 2021)

No one Is aware of Nuthin’ (Might 5, 2016)

How Information Seems When Its Previous (October 29, 2021)

Predictions and Forecasts

Supply:

The Subsequent Billion

by Bruce Upbin

Forbes, Oct 26, 2007

https://www.forbes.com/forbes/2007/1112/048.html?sh=7e94dc6639e4

[ad_2]

Source link