[ad_1]

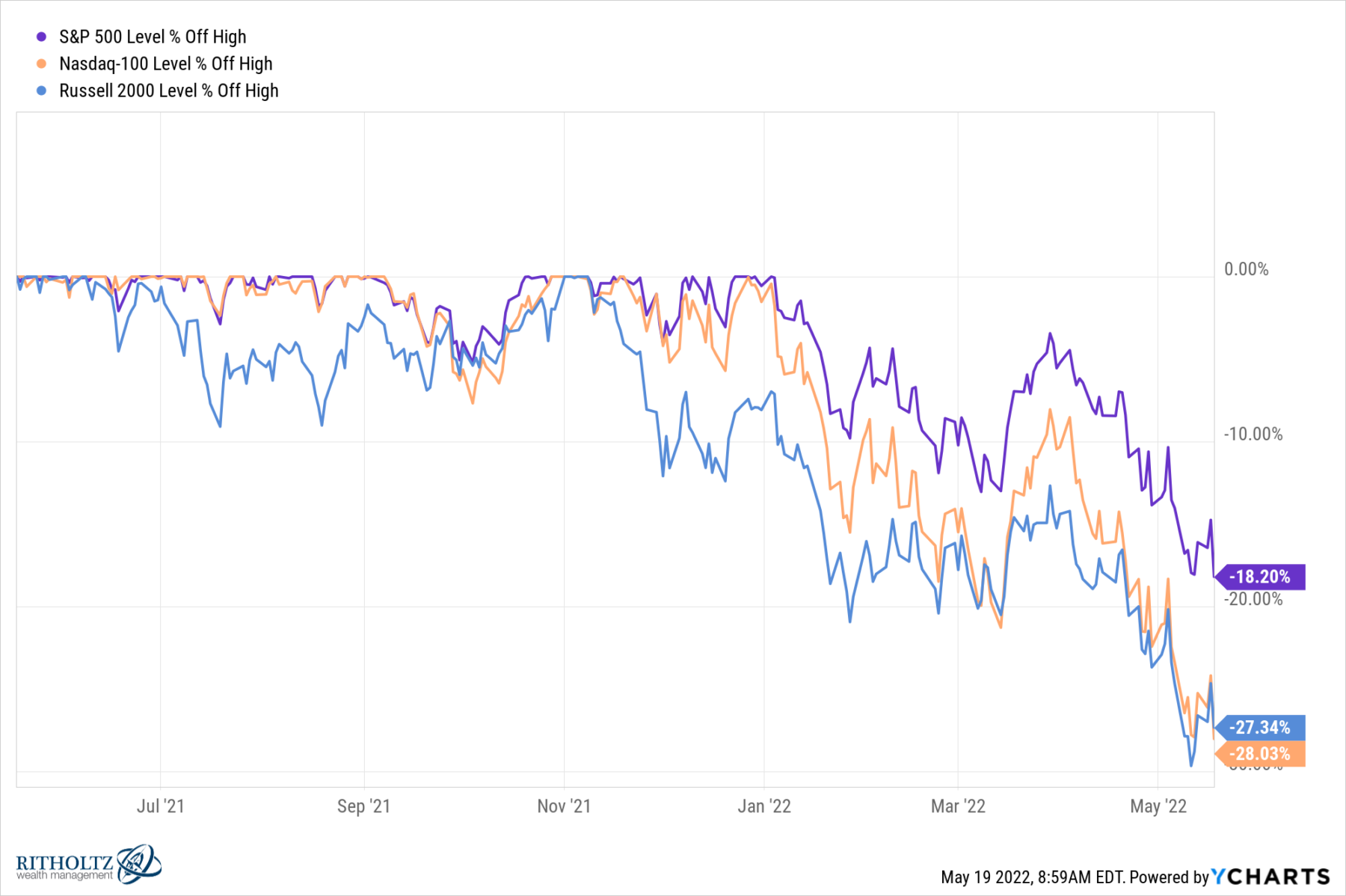

Yesterday’s market massacre introduced the S&P 500 down greater than 18% from its highs; the NASDAQ is now greater than 27% off its peak and the Russell 2000 greater than 28%.

It’s by no means too early to start getting ready for no matter capitulation happens and market lows are ultimately made, whether or not they end up to have been yesterday or occur six months from now.

I’ve had some luck — and some disasters — shopping for into massive messes over time. Listed below are some concepts which have labored for me over the previous few a long time. Contemplate if any of those is likely to be helpful to you as you begin making a want listing and start desirous about the best way to use this drawdown opportunistically:

1. Start Humbly: We by no means understand how far these drawdowns will go or how lengthy they are going to final. Is that this a shallow 20% pullback? A 30% crash? Worse? (We don’t know). 2020’s 34% crash barely lasted a month, the 2008-09 GFC ran for 18 months, and 1966-1982 bear market was 16 years lengthy.

Start your plan by acknowledging you’re venturing into the unknown. By no means guess the farm or assume a lot danger that a whole portfolio will be destroyed if the underlying premise seems to be early (aka “improper”).

2. Search Asymmetry: Search for alternatives which have a lot higher upside than potential draw back. Merchants by no means know which of their positions will work out or not prematurely. There may be worth in creating a possible for web beneficial properties, even when you solely bat .300.

3. Automate: One of the best-intentioned backside patrons usually fail to execute trades (regardless of their very own needs) out of worry and emotion. Take away your limbic system from the method by deciding upon a collection of entries, after which automating them.

4. Purchase Over Time: Reasonably than guessing a particular “preferrred” entry date mid-sell off, take into account spreading out your purchases throughout months. Choose six dates over the following yr with chunks of your discretionary buying and selling capital. This ensures you can be each early and late – nevertheless it additionally creates a excessive chance your common buy worth might be significantly decrease than the place the market is six months into the restoration.

5. Purchase Throughout Costs Ranges: One other strategy to keep away from guessing the underside is to make a number of purchases at totally different worth ranges: Instance: Set GTC restrict buy orders to purchase a broad index down 19%, 26%, 33%, 42%, even 53%. (I prefer to keep away from spherical numbers). If solely half of your orders get executed it means markets prevented matching a few of the worst downturns of the previous 50 years – however you have been nonetheless a purchaser at advantageous costs.

6. Favourite Shares: As a lot as I like broad indices, some people have their favourite corporations. Contemplate those that will have run away from you final cycle that you simply want to personal long run. Whether or not its Nvidia or Apple or no matter your private fave, observe the identical technique of creating a number of purchases throughout totally different worth ranges.

7. Use Choices Sparingly: We maintain listening to anecdotes about Robin Hood/Reddit merchants who used choices to nice impact in 2021 however noticed horrible ends in 2022. The Execs use choices as option to handle their danger – basically defining their losses prematurely.

Instance: As a substitute of shopping for $100k of a place with a ten% cease loss, they buy $10k in long-dated calls. Time decay makes the chance parameters between shares and choices differ dramatically, but when used correctly this generally is a helpful technique.

8. Shorting is Arduous: To get a brief commerce proper, you must first establish one thing which heading appreciably decrease; second, get your timing proper, and final, borrow the shares. All of that is more durable than it sounds: Shorts can get squeezed, borrowed inventory will get referred to as away, prices accumulate, and the timing will be notoriously troublesome.

9. Keep away from Leverage: Utilizing borrowed cash to make speculative market crash purchases is a recipe for catastrophe. Don’t do it! As Gerald Loeb wrote in 1935, that is about greater than mere beneficial properties, it’s a battle for funding survival.

10. Be affected person + Keep on with Your Plan: Shopping for right into a correction or a bear market or a crash is a problem that only a few individuals can do nicely. It takes planning, persistence, and plenty of time to unfold.

These 10 concepts have confirmed useful to me over time; your listing would possibly embody 10 fully totally different approaches. However no matter your strategy is to purchasing right into a correction or crash, pondering it by and having a plan is one of the best recipe for fulfillment, whatever the particular elements.

[ad_2]

Source link