[ad_1]

Nigeria’s Central Financial institution one-year treasury Payments fee for the month of September 2022 rose to a document 12% from 8.5% recorded within the earlier month, someday after the apex financial institution raised the benchmark rate of interest to fifteen.5%.

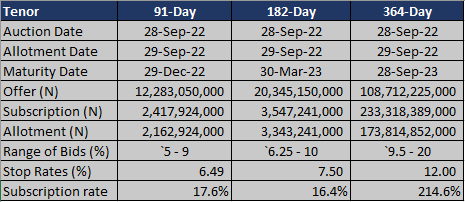

In response to the results of the public sale seen by Nairametrics, the Central Financial institution provided to lift a complete of N108.71 billion for the one-year treasury and recorded a complete subscription of N233.32 billion, representing an oversubscription of 114.6%.

In the meantime, solely N173.81 billion was allotted by the apex financial institution, which is 59.9% larger than the meant supply of N108.71 billion. The Central Financial institution throughout the 287th MPC assembly raised the financial coverage fee for the third consecutive assembly to its highest degree in twenty years.

In a bid to tame the rising inflationary strain within the nation, the CBN raised the MPR by 150 foundation factors to fifteen.5% on Tuesday, twenty seventh September 2022, instantly triggering a 350-basis factors uptick within the one-year treasury payments.

The speed change by the apex financial institution was obligatory given rising inflationary strain within the nation as Nigeria’s headline inflation accelerated to a 17-year excessive of 20.52% in August 2022. It’s nonetheless value noting that regardless of the numerous enchancment within the t-bills fee, it produced a unfavourable yield of 8.52%.

Highlights of the public sale

- The 91-day tenor of the treasury payments recorded a cease fee of 6.49% and attracted a complete subscription to the tune of N2.42 billion, representing a 17.6% subscription fee when in comparison with the supply quantity of N12.28 billion.

- Additionally, the speed for the 91-day treasury payments improved from 4% recorded within the month of August 2022 to six.49%.

- In the identical vein, the 182-day treasury recorded a complete subscription of N3.55 billion in distinction to the supply quantity of N20.35 billion. This represents a subscription fee of 16.4%, whereas the cease fee stood at 7.5%.

What the CBN mentioned

- The Financial Coverage Committee of the CBN voted unanimously to lift the Financial Coverage Price (MPR) and the Money Reserve Requirement (CRR). Notably, the apex financial institution raised the MPR to fifteen.5% and the CRR to a minimal of 32.5%.

- The CBN famous that the tight coverage stance would assist consolidate the influence of the final two coverage fee hikes, which is already mirrored within the slowing development fee of the cash provide within the economic system.

- It additionally felt that an aggressive fee hike would sluggish capital outflows and sure appeal to capital inflows and recognize the naira.

In the meantime, the oversubscription of the 364-day treasury invoice (NTB) signifies buyers’ constructive sentiments in direction of long-term securities, regardless of the true unfavourable returns. It’s also value including that the 12% fee for the one-year treasury payments is the best since October 2019, when the cease fee stood at 12.94%.

The shorter tenor property have been unattractive to buyers in September as seen by the underneath subscription recorded in each the 91-day and 182-day treasury payments, the identical as recorded within the earlier month.

Associated

[ad_2]

Source link