[ad_1]

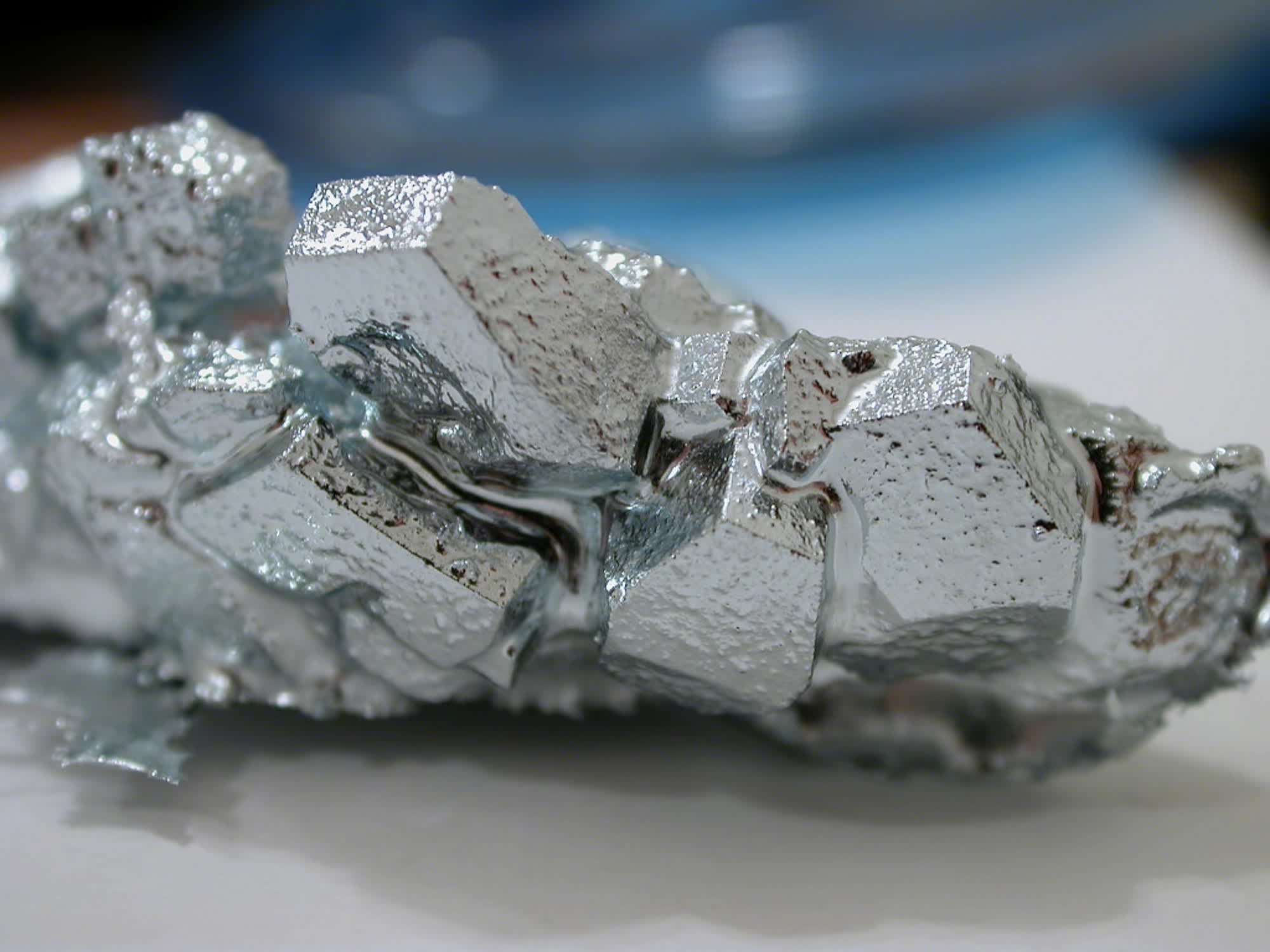

In context: Germanium and gallium are instrumental in manufacturing energy chips, radio frequency amplifiers, LEDs, and plenty of different silicon-based elements. They are not scarce metals, however China has been offering the world with low-cost germanium and gallium for many years. Nevertheless, new coverage modifications may have an effect on world provides.

China lately introduced new export restrictions on germanium and gallium – two elementary components for chip manufacturing. As of Tuesday, Chinese language corporations eager about doing enterprise overseas have to safe a correct export license from Beijing authorities. “Pure” germanium and gallium export, in addition to export of any product which incorporates the 2 components, are affected by the brand new restrictions. The Ministry of Commerce stated that so long as exporting corporations will adjust to nationwide safety protocols and different native rules, export operations will proceed as normal.

The timing of the brand new restrictions suggests they’re in retaliation in opposition to the US for tightening export restrictions on “AI chips” in July, and so they may have exceptional penalties on chip producers everywhere in the world. China controls greater than 90% and round 60% of worldwide productions of gallium and germanium. The announcement of the proposed restrictions brought about a 20 p.c worth hike for gallium within the US and Europe in July.

China’s dominance in exporting these metals has relied closely on its skill to refine them cheaply. The supplies have change into a part of Beijing’s effort to say its financial place within the geopolitical conflict with the US and different Western nations. The export restrictions mustn’t severely affect the manufacturing of silicon elements like CPUs and GPUs. Nevertheless, the compounds gallium nitride and gallium arsenide, utilized in manufacturing LEDs, radio amplifiers, and different important know-how elements, may really feel a extra important sting.

Japan might be the nation most affected by the brand new export coverage. Based on stats from the Japan Group for Metals and Power Safety, Japan imports 60 p.c of its gallium provide. Of that portion, 70 p.c is imported from China, making the nation the world’s largest shopper of economic gallium.

Japanese compounding corporations declare to have sufficient provide to keep away from points within the brief time period. Mitsubishi Chemical Group, an organization making compound semiconductors and different merchandise, is betting on its “ample” inventories. The identical goes for gallium nitride substrate producer Sumitomo Chemical and LED maker Nichia Corp. All stated they’re monitoring the scenario carefully.

The long-term prospects for Western international locations, worldwide firms, and Japan might be to transform their funding in native manufacturing or materials restoration from digital waste, lowering their reliance on China’s sources. So this geopolitical transfer might be a double-edged sword for the communist nation in the long term.

[ad_2]

Source link

/cdn.vox-cdn.com/uploads/chorus_asset/file/25524175/DSCF8101.jpg)