[ad_1]

Over the past two years, various private and non-private firms, exchange-traded merchandise (ETPs), and nations have added bitcoin to their stability sheet. Nevertheless, over the last 9 months of 2022, the variety of bitcoin saved in some of these treasuries dropped by 57,481 bitcoin, value round $1.1 billion utilizing right now’s change charges.

$1.1 Billion Price of Bitcoin Has Been Eliminated From the Treasuries Checklist

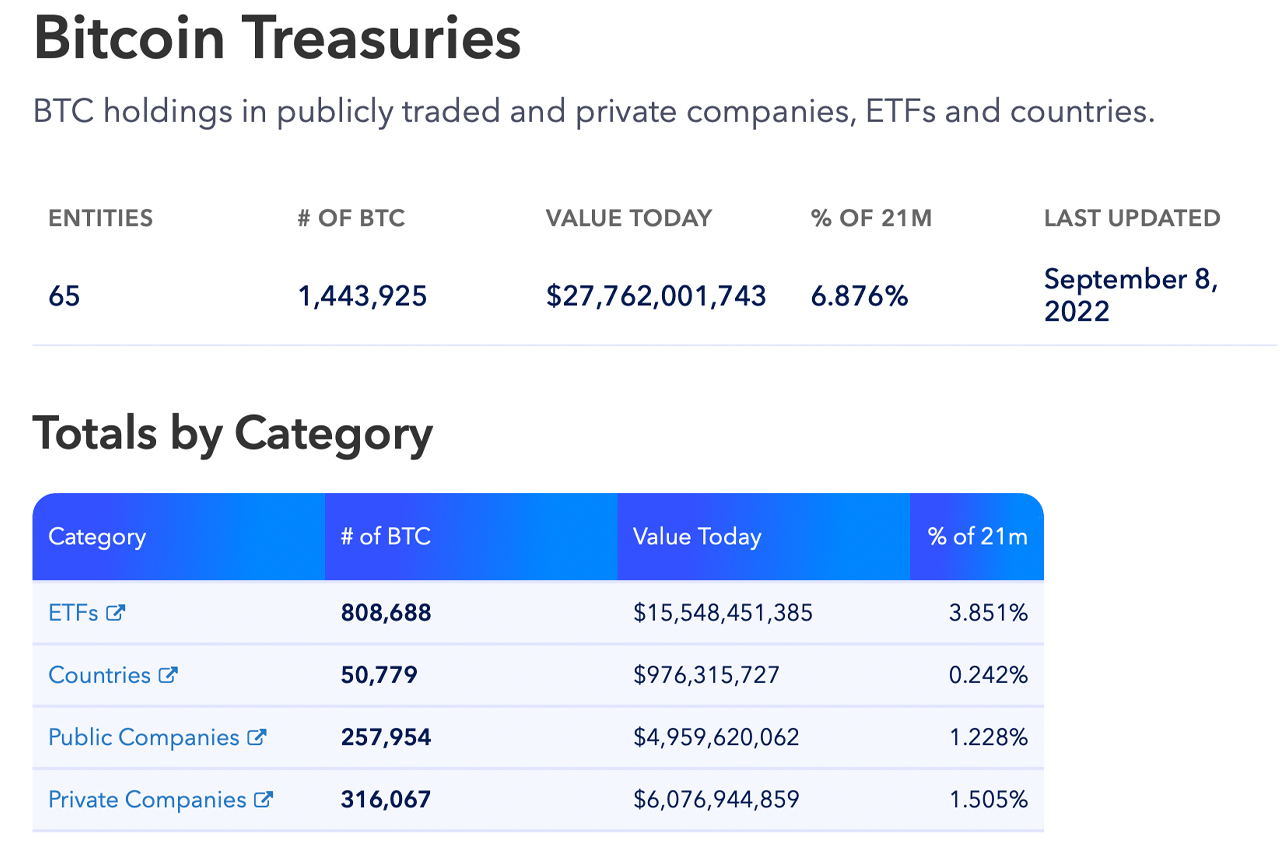

On October 17, 2022, 65 firms, ETPs, and nations maintain bitcoin (BTC) on their stability sheet. The information stems from the bitcoin treasuries record, which aggregates the present bitcoin holdings in publicly traded and personal firms, ETPs, and nations.

On the time of writing and as of September 8, 2022, the bitcoin treasuries record signifies that roughly 65 of the aforementioned forms of entities personal roughly 1,443,925 BTC or 6.876% of the 21 million capped provide. Whereas the stability is a big sum, 57,481 BTC value $1.1 billion has been erased from the bitcoin treasuries record because the begin of 2022.

The 1.44 million BTC in treasuries right now is value roughly $27.76 billion utilizing present spot market values. Information saved through archive.org exhibits that when 2022 began, the 65 publicly traded and personal firms, ETPs, and nations held 1,501,406 BTC.

On the time, the 1.501 million BTC was value $63.25 billion utilizing change charges on January 2, 2022. The biggest change over the last 9 months was Tesla’s stability sheet, which noticed 32,177 BTC faraway from the agency’s treasury.

Tesla as soon as had 42,902 BTC and right now, the agency’s treasury holds 10,725 BTC. The 32,177 BTC represents 55.98% of the 57,481 BTC erased from the bitcoin treasuries record because the begin of the yr.

4 out of 65 Entities Maintain Extra Than 100,000 Bitcoin

Whereas corporations like Tesla unloaded BTC, the record additionally exhibits just a few firms rising their stash. As an illustration, Microstrategy had 124,391 BTC on January 2, 2022, and right now, the corporate holds roughly 130,000 BTC.

Microstrategy’s cache grew by 4.51% because the begin of the yr. Tesla’s stability sheet, however, noticed a lower of round 75% of its bitcoin holdings.

The biggest treasury holder on the bitcoin treasuries record is the ETP managed by Grayscale Investments. Grayscale’s Bitcoin Belief (OTCMKTS: GBTC) holds 643,572 BTC in accordance with the bitcoin treasuries record, which equates to $12.37 billion in USD worth utilizing right now’s change charges.

Out of the 21 million provide, the BTC held by GBTC represents 3.065% and GBTC’s cache additional equates to 44.57% of the 1.44 million BTC in treasuries right now. Out of all 60 entities that maintain BTC on their stability sheets, solely 4 entities maintain greater than 100,000 BTC.

The 4 organizations holding greater than 100K BTC embody Grayscale’s Bitcoin Belief (643K), Microstrategy (130K), Mt Gox (141K), and Block.one (140K). These 4 entities alone command 1,054,000 BTC of the 1.44 million BTC held by 65 entities.

Regardless of erasing 57,481 BTC since January 2, the record has grown since July 17, 2022 because the variety of BTC held by treasuries was round 1,325,396 BTC. With 1.44 million held right now, roughly 120,000 bitcoins have been added to stability sheets since July 17.

Statistics for the present bitcoin treasuries record talked about on this article are derived from the net portal buybitcoinworldwide.com, and archive.org metrics saved on January 2, 2022, from the identical web site.

What do you concentrate on the 57,481 bitcoin that’s been erased from the bitcoin treasuries record? What do you concentrate on the truth that 4 entities command a majority of the 1.44 million held by 65 entities? Tell us your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link