[ad_1]

U.S. Bureau of Labor Statistics:

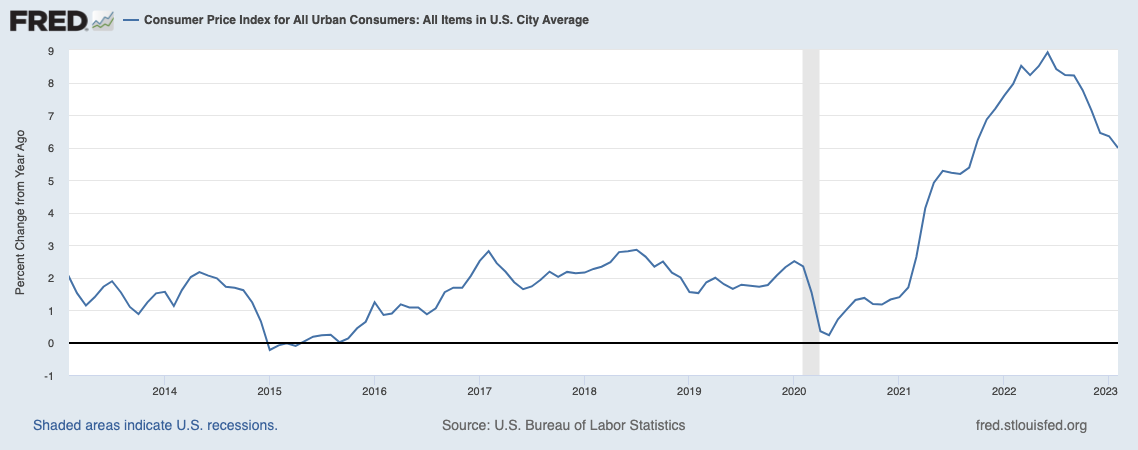

The Shopper Worth Index for All City Shoppers (CPI-U) rose 0.1 % in March on a seasonally-adjusted foundation, after growing 0.4 % in February. Over the past 12 months, the all gadgets index elevated 5.0 % earlier than seasonal adjustment. (April 2023)

As a lot as I need to leap up and down about 0.1% seasonally adjusted (after a 0.4% prior month), the massive quantity shouldn’t be so massive:

5.0%

A 5 deal with is a large improvement, even with the core remaining barely elevated.

Be aware the meals at residence index fell 0.3% over <arch — this was the primary decline since September 2020.

And regardless of a scorching battle on the Euro-Asian border, power costs dropped considerably. Gasoline plummeted 17.4% yr over yr, whereas the general power index fell 6.4 % over the previous 12 months, whereas

If the FOMC had been plugged in, they might understand that their work is finished, there isn’t a have to throw tens of millions out of labor as a result of now we have a scarcity of homes, semiconductors, and staff of every kind. Most items have returned to pre-pandemic value ranges. The most important driver of house costs is the scarcity of houses and the excessive value of mortgages. (Gee, whoever is accountable for that?)

Regardless, shopper costs proceed to fall. Even housing prices posted the smallest month-to-month will increase in a yr.

Beforehand:

For Decrease Inflation, Cease Elevating Charges (January 18, 2023)

Inflation Comes Down Regardless of the Fed (January 12, 2023)

Provide Chain Is 40% of Inflation (November 17, 2022)

Why Is the Fed At all times Late to the Get together? (October 7, 2022)

How the Fed Causes (Mannequin) Inflation (October 25, 2022)

Why Aren’t There Sufficient Staff? (December 9, 2022)

How Everyone Miscalculated Housing Demand (July 29, 2021)]

[ad_2]

Source link