[ad_1]

In response to Dappradar’s newest crypto business report that covers 2022’s third quarter, the crypto economic system and its contributors are “driving out the bear market.” Nonetheless, lately a variety of macroeconomic occasions have influenced the crypto market, and Dappradar researchers say it’s at present “unimaginable to foresee a worldwide growth of cryptocurrencies with no common restoration in standard monetary markets.”

Dappradar Report Highlights Crypto Financial system’s Gradual however Regular Restoration

The crypto business continues to be coping with the crypto winter and the newest report from Dappradar signifies that markets and contributors are trucking by means of the storm. For example, following the Terra collapse, the decentralized finance (defi) and decentralized app (dapp) business has consolidated after taking heavy losses.

Dappradar’s report reveals that bitcoin (BTC) and ethereum (ETH) have remained roughly across the similar worth because the finish of June, however the two main crypto belongings have a excessive correlation with fairness markets.

“In Q3, the correlation between BTC and the S&P 500 elevated, exhibiting that traders nonetheless take into account cryptos in the identical class as dangerous shares,” Dappradar’s researcher Sara Gherghelas particulars.

Furthermore, whereas Ethereum’s transition from proof-of-work to proof-of-stake by way of The Merge pushed costs up, crypto markets “cooled down after the occasion.” Furthermore, whereas Dappradar’s Gherghelas says The Merge was a technical success, a 36% drop in layer two (L2) transactions was recorded.

Regardless of the general crypto market efficiency, know-how adoption noticed a big upswing. “In July, Polygon and Nothing firm introduced a partnership to construct a Web3-native smartphone, whereas Disney, Ticketmaster, Mastercard, and Starbucks grew to become the newest main manufacturers to announce the combination of NFTs as a part of their Web3 technique,” Dappradar’s Q3 report additional notes.

In response to the Dappradar researchers, $428.71 million in losses had been recorded throughout 2022’s third quarter. Many of the losses had been stolen from Nomad Bridge, Dappradar explains, as $190 million was siphoned away from the bridge.

“On a constructive notice, these figures point out a decline of 62.9% in comparison with the third quarter of 2021, when hackers and fraudsters stole $1,155,334,775,” Dappradar’s researchers add. Over the last quarter, the research notes that on the whole, the defi ecosystem has proven enchancment.

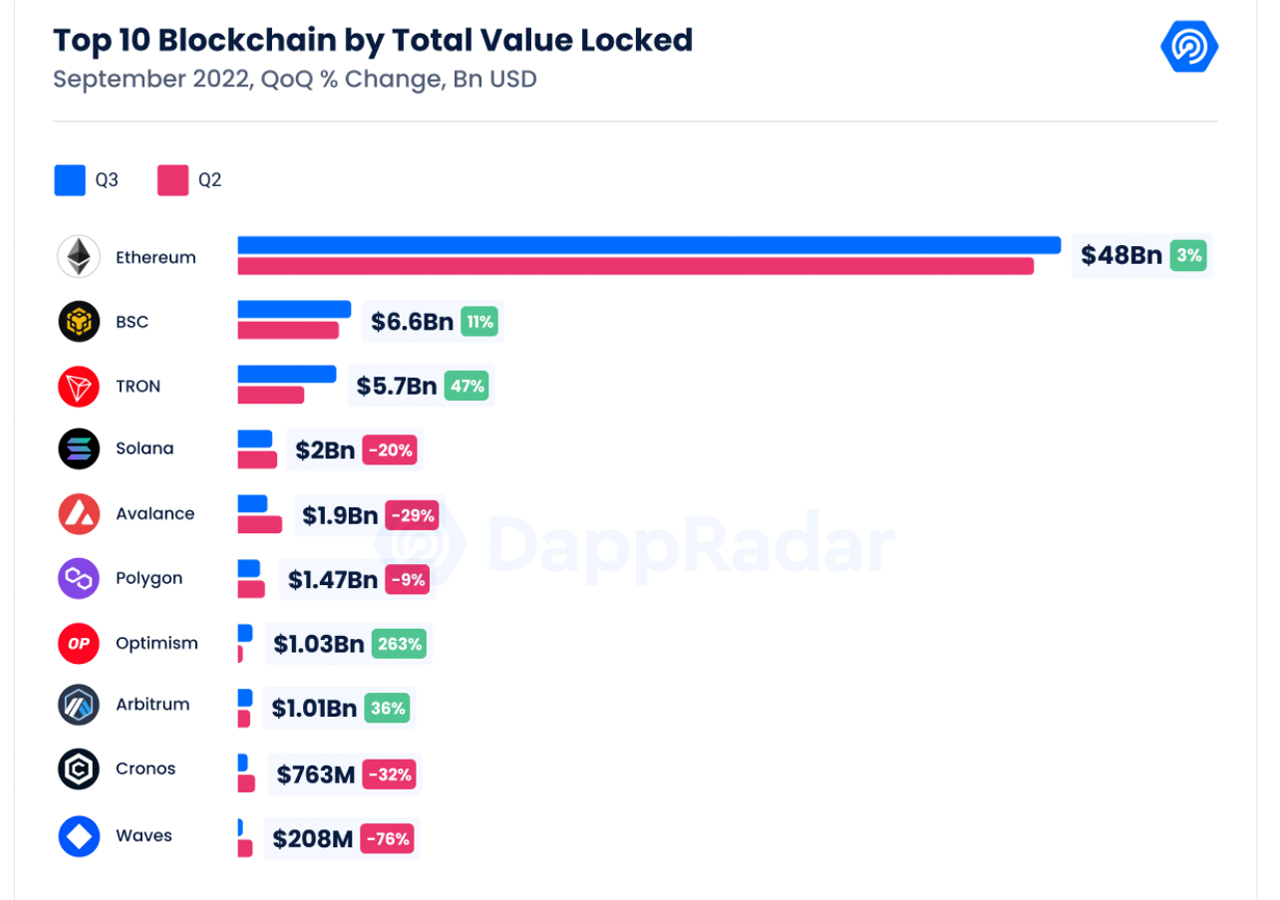

“Defi as an entire confirmed indicators of restoration with a 2.9% progress in TVL [total value locked] from Q2,” Dappradar’s research notes. “Ethereum stays essentially the most dominant chain with its dominance rising to 69% with $48 billion, a 3.17% progress from Q2.”

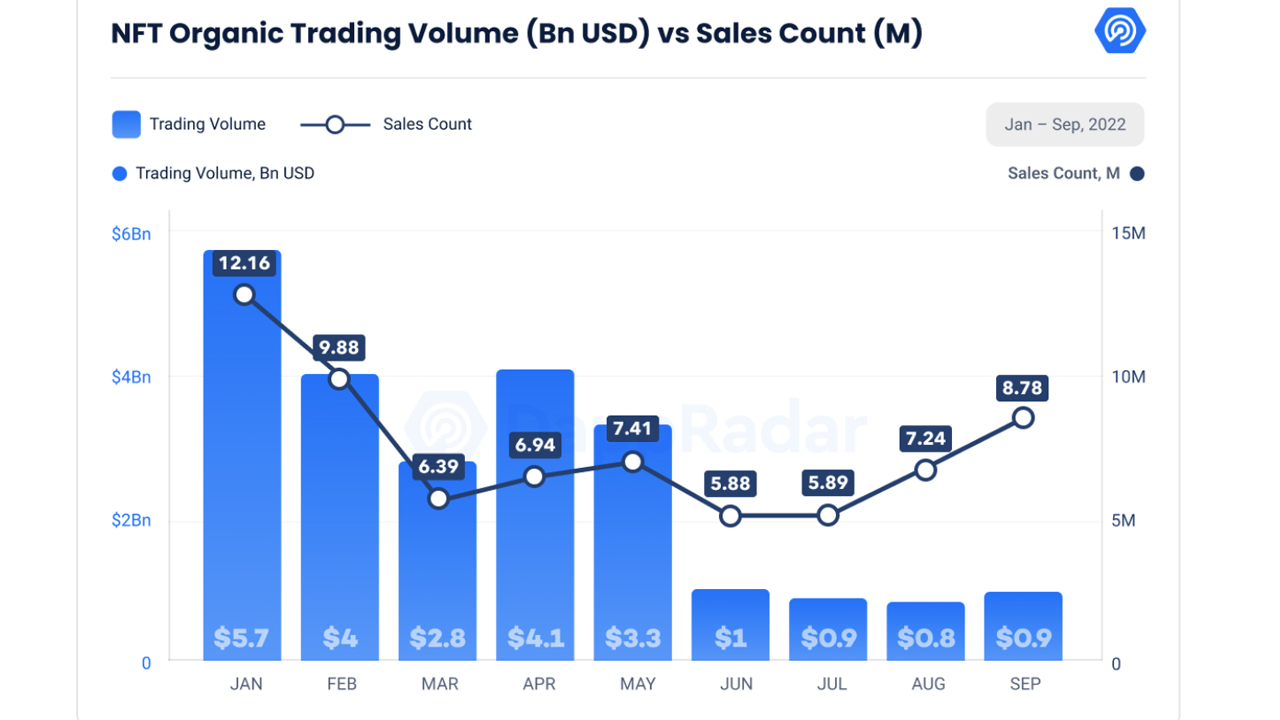

Whereas the defi ecosystem and crypto economic system as an entire noticed declines within the third quarter, non-fungible token markets additionally recorded a decline in buying and selling quantity exercise. Dappradar’s analysis reveals NFT commerce quantity is down 67% however NFT gross sales quantity elevated 8.3% greater from Q2.

“The rise in gross sales signifies that the NFT enterprise continues to be in nice demand, whereas general the drop in buying and selling quantity could also be attributable to the decline in cryptocurrency values,” Dappradar’s analysis report suggests.

Dappradar’s report concludes that the worldwide economic system is coping with “excessive challenges” and in some individuals’s opinions, the tides could worsen. The researchers notice that it’s potential “we could also be at first part of the disaster” however when the tides do flip, a bullish runup will ultimately materialize.

“Undoubtedly, an additional bull run will happen, and it might be a lot stronger than the final one,” the Dappradar report’s closing statements element. “Every time the market has difficulties, it will definitely turns into stronger, and the standard of initiatives will increase.”

What do you concentrate on Dappradar’s Q3 Trade report? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Pictures by way of Dappradar’s Q3 Trade Report

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link