[ad_1]

Hamdan bin Mohammed: Dubai’s potential to keep up its prime rating in attracting Greenfield FDI tasks displays town’s potential to create unparalleled progress alternatives and worth for international traders

– “Guided by Mohammed bin Rashid’s visionary management, Dubai has intensified its drive to speed up financial diversification and innovation”

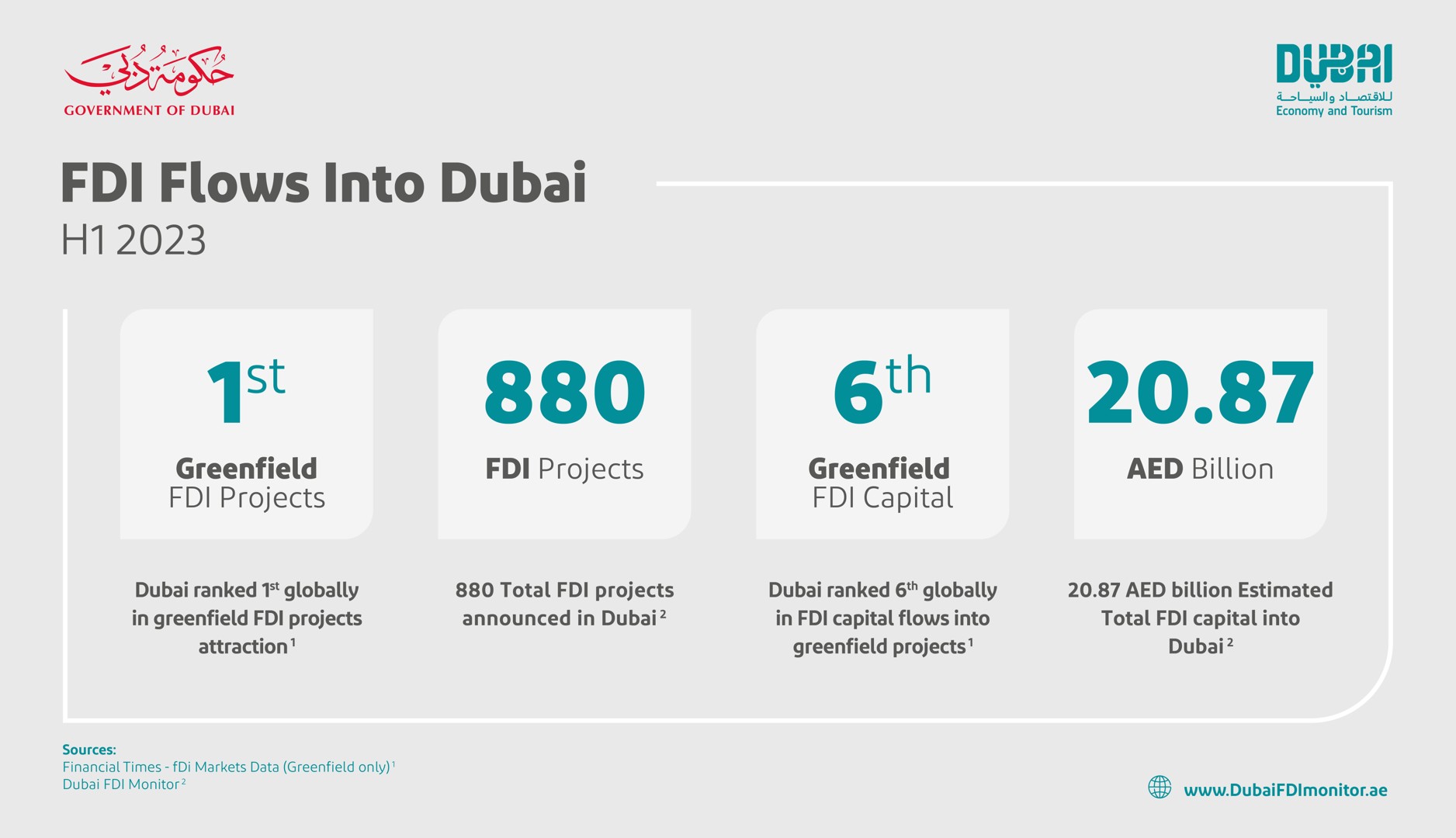

– Dubai information 70% YoY progress in complete introduced FDI tasks in H1 2023, with Greenfield FDI tasks accounting for 65% of the overall

– The emirate climbs from eighth to sixth globally in Greenfield FDI capital attraction with an influx of AED20.87 billion between January and June this yr

– Dubai ranks fourth globally in job creation from FDI, with 43.3% progress in H1 2023 in comparison with the identical interval final yr, with the creation of 24,236 new jobs

– Medium and high-tech funding tasks account for 63% of complete FDI tasks, underlining town’s dedication to innovation and the digital financial system

Dubai stays the highest international vacation spot for attracting Greenfield Overseas Direct Funding (FDI) tasks, with the emirate attracting 511 Greenfield tasks in H1 2023, as per Monetary Instances ‘fDi Markets’ knowledge – the great on-line database on cross-border greenfield investments.

Dubai continues to set new benchmarks in international efficiency as an funding vacation spot, surpassing second-placed Singapore by 325 tasks. In the course of the first half of 2023, Dubai’s international share within the attraction of Greenfield FDI tasks stood at 6.58% – up from 3.83% over the identical six-month interval final yr. The outcomes, which underscore the emirate’s standing as a key funding hub, aligns immediately with town’s 10-year Dubai Financial Agenda D33, which goals to double the dimensions of the emirate’s financial system over the following decade.

His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of The Government Council of Dubai, stated: “Dubai’s potential to keep up its prime rating in attracting Greenfield FDI tasks displays town’s potential to create unparalleled progress alternatives and worth for international traders. Guided by the visionary management of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, the emirate has intensified its drive to speed up financial diversification and innovation. This dedication, coupled with the adoption of superior applied sciences, is shaping a future stuffed with limitless alternatives for progress and prosperity. With the clear progress roadmap set out by the Dubai Financial Agenda D33, we proceed to work to create an funding setting that not solely wins the belief of traders from everywhere in the world but additionally encourages them to contribute to Dubai’s transformation.”

In parallel, new knowledge launched by Dubai FDI Monitor at Dubai’s Division of Economic system and Tourism (DET), exhibits town logged a complete of 880 introduced FDI tasks between January and June of this yr, a year-on-year progress of 70%. The Dubai FDI Monitor tracks, substantiates and analyses all kinds of FDI tasks introduced inside the emirate.

Dubai FDI Monitor knowledge additionally signifies that Dubai’s Greenfield FDI tasks account for 65% of complete introduced FDI tasks. The report additionally states year-on-year Reinvestment FDIs elevated from 3% to 4.4% when evaluating H1 2023 with the identical interval in 2022.

In the meantime, Dubai additionally noticed a year-on-year rise in international Greenfield FDI capital attraction, reaching AED20.87 billion (USD5.68 billion). In response to Monetary Instances Ltd. “fDi Markets” knowledge, Dubai climbed from eighth in H1 2022 to sixth globally in H1 2023,

Moreover, Dubai ranks first globally within the attraction of HQ FDI tasks, in accordance with Monetary Instances Ltd. “fDi Markets” knowledge, by attracting 33 HQ tasks within the first half of this yr, forward of London and Singapore. The achievement additional highlights the emirate’s rising profile as a world hub for the headquarters of main firms.

His Excellency Helal Saeed Almarri, Director Basic of Dubai’s Division of Economic system and Tourism, commented: “We’re persevering with to speed up efforts to ship the Dubai Financial Agenda D33 launched by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai.

“As we work to boost town’s competitiveness and enterprise setting internationally, these sturdy will increase in introduced FDI tasks for H1 2023 drive residence how our progressive coverage enablers and numerous attraction programmes are resonating with international traders and determination makers alike.”

The Monetary Instances Ltd. “fDi Markets” knowledge additionally exhibits Dubai rose from ninth in H1 2022 to fourth place globally in H1 2023 in employment creation from FDI tasks. The climb follows a 43.3% surge in job creation in H1 2023 in comparison with H1 2022, equating to a complete of 24,236 jobs created via FDI.

According to DET’s financial diversification initiatives, Dubai’s efforts to retain and entice extremely expert expertise had been illustrated within the prime six sectors contributing to estimated job creation by FDI in H1 2023: Enterprise Providers at 5,212 jobs (21.5% share), Software program and IT at 3,525 jobs (14.5%), Meals & Drinks at 3,090 jobs (12.7%), Monetary Providers at 1,813 jobs (7.5%), Shopper Merchandise at 2,104 jobs (8.3%) and Actual Property at 921 jobs (3.8%).

Dubai FDI Monitor states the emirate continued to draw medium-to-high-technology and low-technology FDI tasks in H1 2023, with charges of 63% and 37%, respectively, unchanged from final yr. The info illustrates the prevalence of medium-high expertise FDI ventures in Dubai, underscoring town’s standing as a world hub for cutting-edge FDI tasks and a nexus for specialised expertise within the digital financial system.

By way of key sectors bringing FDI capital into Dubai, Monetary Providers (52%), Enterprise Providers (12.8%), Software program & IT Providers (7.5%), Actual Property (6.9%) and F&B (3%) paved the way. The Dubai FDI Monitor confirmed the highest 5 sectors accounted for 82% of complete FDI capital influx and 70% of complete FDI tasks. Main sectors by FDI tasks embrace Enterprise Providers (22.4%), Software program & IT (17.8%), F&B (12.2%), Monetary Providers (9%) and Shopper Merchandise (8.3%).

![]() Comply with Emirates 24|7 on Google Information.

Comply with Emirates 24|7 on Google Information.

[ad_2]

Source link