[ad_1]

- Dubai led prime residential capital worth progress, growing 17.4% in 2023, versus the typical 2.2% throughout the 30 cities monitored by Savills.

- Sydney and Dubai are forecast to be the 2 high performers for the yr forward, with each cities set to learn from the rise of their high-net-worth inhabitants.

- Savills anticipates costs to develop in Dubai by an extra 4%-5.9% in 2024.

- Dubai additionally recorded rental value will increase in the course of the yr at a bit below 10%, versus the typical 5.1% throughout different international cities.

Dubai continues to be the most popular prime residential property market, with capital values growing 17.4% for the yr, with a extra modest 5.6% recorded within the second half. This efficiency is recorded towards a mean value progress of two.2% throughout 30 international cities coated within the Savills Prime Residential World Cities Index.

The (Dubai) market remains to be comparatively competitively priced by international requirements, at $850 per sq. foot, affords a relatively low value of dwelling, a comparatively simple visa course of, and a hotter local weather, which continues to draw worldwide and home consumers, Savills researchers mentioned within the report.

The (Dubai) market remains to be comparatively competitively priced by international requirements, at $850 per sq. foot, affords a relatively low value of dwelling, a comparatively simple visa course of, and a hotter local weather, which continues to draw worldwide and home consumers, Savills researchers mentioned within the report.

Different Asia Pacific cities led capital values progress in 2023, with Mumbai main the pack. In the meantime, some cities felt international financial turbulence greater than others, significantly within the second half of 2023. New York and San Francisco, with the previous seeing a muted return to workplace and the latter nonetheless weathering tech-turbulence, recorded some declines for the complete yr. Hong Kong’s ongoing political and financial uncertainty continued to hamper its prime residential markets, with capital values falling 3.7% over the yr.

Trying forward into 2024, capital values for international cities will stay in constructive territory, Savills says. Prime residential value progress of a modest 0.6% is forecast throughout the 30 international cities monitored by Savills, down from the two.2% achieved in 2023.

“Within the face of ongoing financial uncertainty and the next rate of interest atmosphere, prime residential markets in world cities have been muted in 2023 following two years of great beneficial properties. Progress is forecast to sluggish additional in 2024 as markets return to extra regular situations, however will broadly stay in constructive territory,” mentioned Kelcie Sellers, Affiliate, Savills World Analysis.

Sydney and Dubai to see the strongest forecast progress in 2024

Sydney and Dubai are forecast to be the 2 high performers for the yr forward, with each cities set to learn from will increase of their high-net-worth populations. Sydney is seeing excessive ranges of demand for high quality prime properties, however provide stays low. It’s possible that this imbalance will persist via 2024 and push up costs, that are forecast to extend by 8%-9.9%.

Dubai elevated by a big 17.4% over the yr, however it’s possible that this charge of progress will sluggish this yr because it returns to extra regular exercise. Savills anticipates costs to develop within the emirate by an extra 4%-5.9%.

Savills World Cities Prime Residential Index: 2023 prime capital worth progress forecast vs capital progress worth in 2023

|

Metropolis |

2024 Forecast |

Capital worth progress in 2023 |

Prime capital worth Dec 2023 (US$ psf) |

|

Sydney |

+8% to 9.9% |

6.8% |

$ 1,830 |

|

Dubai |

+4% to five.9% |

17.4% |

$ 750 |

|

Cape City |

+2% to three.9% |

3.1% |

$ 250 |

|

Tokyo |

+2% to three.9% |

8.2% |

$ 1,950 |

|

Rome |

+2% to three.9% |

3.3% |

$ 1,410 |

|

Kuala Lumpur |

+2% to three.9% |

-1.0% |

$ 250 |

|

Athens |

+2% to three.9% |

6.1% |

$ 1,130 |

|

Madrid |

+2% to three.9% |

4.0% |

$ 750 |

|

Barcelona |

+2% to three.9% |

3.4% |

$ 680 |

|

Amsterdam |

+2% to three.9% |

-2.4% |

$ 960 |

|

Geneva |

>0% to 1.9% |

1.8% |

$ 2,550 |

|

Milan |

>0% to 1.9% |

2.5% |

$ 1,520 |

|

Lisbon |

>0% to 1.9% |

1.6% |

$ 1,330 |

|

Bangkok |

>0% to 1.9% |

9.1% |

$ 1,050 |

|

Mumbai |

>0% to 1.9% |

10.3% |

$ 1,140 |

|

Miami |

>0% to 1.9% |

4.9% |

$ 1,510 |

|

Beijing |

0.0% |

2.1% |

$ 1,520 |

|

Shanghai |

0.0% |

4.3% |

$ 2,060 |

|

Los Angeles |

-1.9% to <0% |

-2.2% |

$ 1,550 |

|

Berlin |

-1.9% to <0% |

-3.5% |

$ 1,150 |

|

Seoul |

-1.9% to <0% |

0.8% |

$ 1,730 |

|

Guangzhou |

-1.9% to <0% |

2.1% |

$ 1,510 |

|

Hangzhou |

-1.9% to <0% |

0.9% |

$ 1,230 |

|

London |

-1.9% to <0% |

-0.9% |

$ 1,920 |

|

Paris |

-1.9% to <0% |

-2.7% |

$ 1,550 |

|

Shenzhen |

-1.9% to <0% |

-4.9% |

$ 1,530 |

|

New York |

-1.9% to <0% |

-3.7% |

$ 2,560 |

|

San Francisco |

-3.9% to -2% |

-6.1% |

$ 1,400 |

|

Singapore |

-3.9% to -2% |

1.3% |

$ 1,800 |

|

Hong Kong |

-10% or decrease |

-2.0% |

$ 3,970 |

Supply: Savills Analysis

Affected by weaker sentiment related to increased rates of interest and the difficult financial backdrop, the prime residential markets of Los Angeles, New York, San Francisco, Seoul, London, Singapore, and Hong Kong are all forecast to see value falls this yr.

Sellers says, “We count on it to be a yr to observe the markets globally. International locations which account for about 40% of the worldwide inhabitants will go to the polls this yr, and housing will possible be entrance of thoughts for a lot of voters and policymakers alike. The potential for central banks to additionally reduce rate of interest throughout mid to late 2024 might also increase exercise throughout prime property markets and will shock on the upside for pricing within the latter a part of the yr.”

Rental efficiency and yields

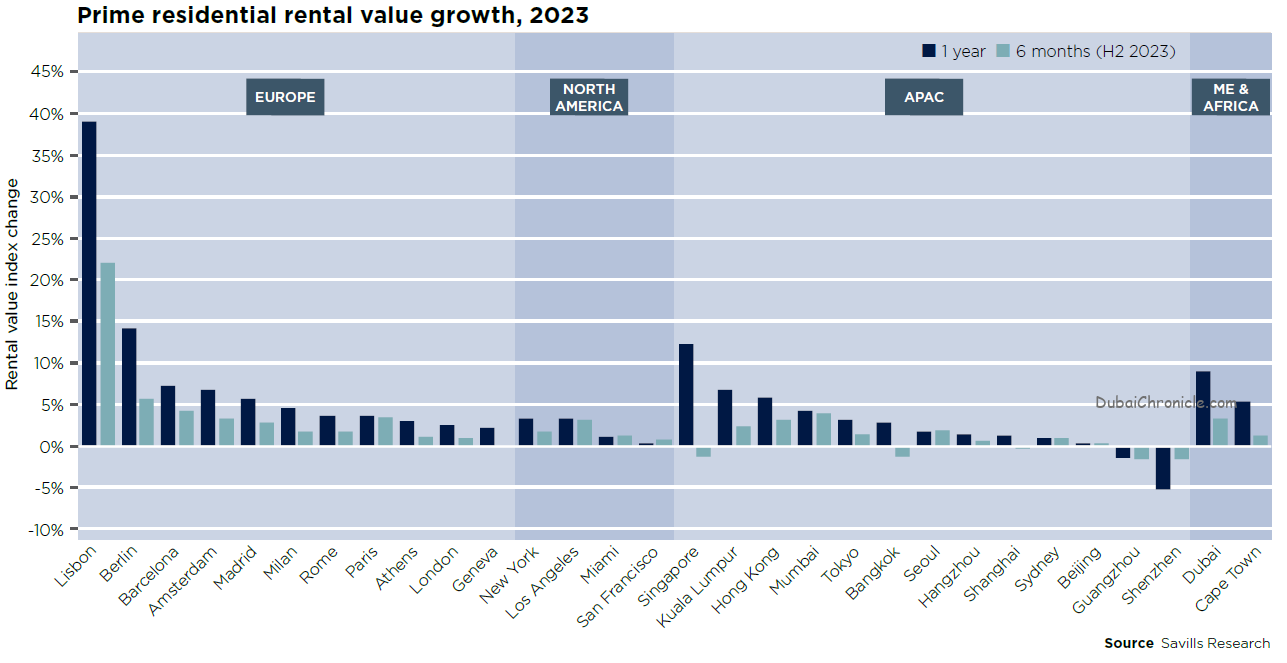

Dubai additionally recorded rental value will increase in the course of the yr at a bit below 10%, versus the typical 5.1% recorded amongst different international cities within the Savills index.

Lisbon led prime rental progress among the many 30 cities within the index, growing 39% final yr.

Commenting on leases, Sellers mentioned, “Within the face of financial uncertainty, the prime residential rental market proved resilient in 2023. Persevering with a pattern from the previous yr, prime rental worth progress outpaced capital values, largely pushed by a scarcity of inventory in international prime markets and elevated ranges of demand from people and households who would look to buy a property, however are holding off till the financial and rate of interest conditions stabilise.”

By way of yields, Dubai stands out as a excessive yielding metropolis by world metropolis requirements, with returns of 4.8%. Throughout all world cities, prime gross yields stood at 3.1% as international rental markets recorded stronger progress than the gross sales markets.

The price of shopping for, holding, and promoting a property in Dubai can also be among the many lowest, at lower than 10% of the property buy value, versus 15%, on common, throughout the 30 international cities.

[ad_2]

Source link