[ad_1]

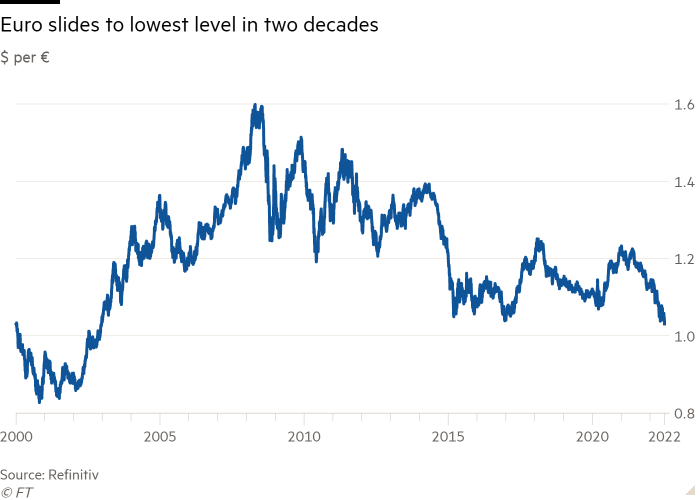

European shares and US inventory futures fell on Tuesday, whereas the euro hit its weakest stage in opposition to the greenback in twenty years, as fears intensified in regards to the well being of the worldwide economic system.

The regional Stoxx Europe 600 fairness index misplaced 0.8 per cent, after opening larger, whereas the FTSE 100 dropped 1.2 per cent. In Asia, Hong Kong’s Hold Seng closed up 0.1 per cent, trimming earlier good points, whereas mainland China’s CSI 300 slipped 0.1 per cent.

In an indication of worsening sentiment in regards to the progress outlook, the euro dropped as a lot as 1.2 per cent in opposition to the greenback to $1.0296 — its lowest level since 2002.

Guilhem Savry, head of macro and dynamic allocation at Unigestion, advised markets had additional to fall. “The recessionary theme has made a comeback,” he stated. “Though markets at the moment are beginning to worth in a cooling of inflation and central financial institution hawkishness, we now have but to achieve the lows in fairness markets the place we’d be comfy to re-engage danger.”

Futures contracts monitoring Wall Avenue’s S&P 500 and the Nasdaq 100 misplaced 0.6 and 0.7 per cent, with US markets set to reopen on Tuesday after a vacation.

In authorities debt markets, the yield on the 10-year German Bund — seen as a proxy for borrowing prices throughout the eurozone — dropped 0.07 proportion factors to 1.27 per cent. The shorter-dated two-year yield slipped 0.12 proportion factors to 0.51 per cent. Bond yields fall as their costs rise.

Yields on Bunds and Treasury notes had marched larger earlier this yr, because the European Central Financial institution and the US Federal Reserve signalled aggressive rate of interest rises and the deliberate withdrawal of huge bond-buying programmes in a bid to sort out scorching inflation.

The Fed lifted its benchmark charge by 0.75 proportion factors in June, its largest such enhance since 1994.

However traders have in latest weeks scaled again their expectations of how excessive the world’s most influential central financial institution will elevate borrowing prices within the coming months, amid mounting proof of an financial slowdown.

Particulars of the Fed’s most up-to-date financial coverage assembly, as a consequence of be revealed on Wednesday, could give additional clues in regards to the extent to which the central financial institution is keen to tighten financial coverage. A intently watched US jobs report on Friday will even sign the extent of warmth within the nation’s labour market, a criterion that will additionally affect Fed decision-making.

The S&P had closed larger on Friday, its final buying and selling day earlier than the lengthy weekend, and bond markets had rallied after a dismal report on America’s manufacturing facility sector intensified worries in regards to the financial outlook.

[ad_2]

Source link