[ad_1]

Summer time 2021, Florence, Italy. The 422 staff on the Campi Bisenzio department of the multinational GKN obtain a letter saying their redundancy. The automotive firm has determined to “nearshore” its manufacturing to different websites held by the group in Europe. A number of investments had been made lately to modernise manufacturing on the plant.

However the offshoring was not a symptom of a disaster; quite the opposite, it was merely geared toward boosting the multinational’s earnings. In response, the employees occupied the manufacturing facility. For the previous two years, they’ve been campaigning in opposition to the closure of the location and for another answer of renovating it to be greener.

January 2018, Amiens, France. The Whirlpool tumble-dryer manufacturing facility offshores its manufacturing to Poland to benefit from decrease labour prices. 300 staff are disregarded within the chilly. The motivation was apparent: in 2018, in line with Eurostat, French staff earned a mean of €35.80 an hour, in contrast with €10.10 in Poland, taking into consideration social-security contributions.

Since then, the hole has not narrowed a lot. In 2021, within the EU, the common hourly price of labour (in trade, building and commerce companies) for corporations with 10 or extra staff was €28.70. However there are large variations from nation to nation, notes the French statistics workplace INSEE: their ratio is 1:7 between Bulgaria (€6.90) and Denmark (€48.30).

Attention-grabbing article?

It was made attainable by Voxeurop’s neighborhood. Excessive-quality reporting and translation comes at a value. To proceed producing impartial journalism, we want your help.

Subscribe or Donate

Whirlpool exhibits no indicators of adjusting monitor. Within the area of just some years, the corporate has minimize 3,000 jobs in Europe as a part of a restructuring. Right now, virtually all of the group’s European factories are situated in Italy and Poland.

“The issue is that [industrial relations in] the European Union [have been] constructed on a mannequin that’s extra conflictual than collaborative”, says Silvia Borelli, professor of European labour legislation on the College of Ferrara. “Regardless of guidelines to harmonise labour legislation, there are nonetheless huge variations between nations.”

European nearshoring

It’s onerous to place a determine on the phenomenon of regional offshoring, or nearshoring, from one nation to a different in Europe. The primary problem is the dearth of transparency: “There isn’t a official database. When an organization offshores manufacturing, it would not declare it to anybody”, explains Silvia Borelli.

In 2017, a number of media retailers quoted figures printed by Eurofound, the European Basis for the Enchancment of Residing and Working Circumstances. These detailed 752 instances of offshoring talked about in press articles between 2003 and 2016, 352 of which concerned one other EU nation.

By way of jobs, of the practically 200,000 jobs misplaced in 13 years, 118,760 might be attributed to a switch of manufacturing to different EU nations. This took the final type of a west-east motion, from the EU-15 to the newer member states, together with Slovakia, Poland and Hungary.

The reasoning is obvious: both labour prices, or tax. The latter was the case in Spain in April 2023, when the shareholders of the development big Ferrovial voted 93% in favour of a “reverse merger”, i.e. the absorption of the Spanish dad or mum firm by the Dutch subsidiary. This meant Ferrovial’s head workplace and tax domicile could be transferred to the Netherlands, with its advantageous tax regime for corporations and for dividends paid to shareholders.

Ineffectual, pro-business guidelines

Such methods have penalties for the safety of staff. Theoretically, at EU stage, within the occasion of an inner firm relocation, transferred staff should retain the identical rights, underneath the aegis of trade-union negotiators. In apply, nonetheless, the EU directive in query is nearly at all times inapplicable, because it considerations conditions the place the identical employment is sustained within the vacation spot nation. That is “very troublesome to show as a result of there can at all times be small modifications”, explains Silvia Borelli. “The directive is de facto designed for corporations that stay in the identical state, so its scope is proscribed.”

For Borelli, the present laws isn’t solely ineffectual, within the sense that it doesn’t stop offshoring, “it’s hypocritical: we have now guidelines which can be designed to not be relevant”.

The very definition of the apply makes monitoring troublesome. Offshoring is outlined because the relocation of a manufacturing unit from one nation to a different. On the whole, this interprets right into a switch of operations from one website to a different. However offshoring may develop into overseas outsourcing: closing a manufacturing unit in a single nation in favour of subcontracting to a different agency abroad. That is typical in instances of company restructuring.

Raphaël Dalmasso, a authorized specialist on the College of Lorraine, checked out French laws governing redundancies and offshoring (in Offshoring, an previous drawback needing new responses: the necessity for efficient coverage implementation, 2024): “The primary large-scale offshoring operations [in France] within the Nineties concerned the switch of a office, typically absolutely geared up, from one manufacturing facility to a different. The offshoring phenomenon that’s extra frequent right this moment is tougher to explain. For instance, during the last 20 years, France’s primary carmakers have significantly diminished their home wage invoice whereas opening factories in Jap Europe and North Africa. But formally there was no relocation of jobs. Such modifications are due to this fact considerably hidden, and extra sophisticated to explain from a authorized standpoint.”

Dalmasso says that restructuring, whether or not in distinctive circumstances or in response to financial pressures, is seen as a “regular, on a regular basis mode of administration” for firm administrators. “Offensive” offshoring, with the intention of conquering markets, doesn’t due to this fact require any particular financial justification. “Such measures might be carried out each time the employer considers that there’s an financial justification. In being exempted from the necessity to justify its decisions, the employer is not topic to judicial evaluate. The final concept is that the employer continues to be the only real arbiter of the theoretical appropriateness of the restructuring operation.”

Help with out oversight or circumstances

The introduction of the Inflation Discount Act in america in 2022 brought about a stir within the EU. Offered as an anti-inflation measure, it supplies for €340 billion in inexperienced subsidies for industries based mostly within the US. That is producing fears in Europe about the potential for offshoring throughout the Atlantic. In response, the European Fee has introduced a “Inexperienced Industrial Plan” geared toward boosting the competitiveness of European zero-emissions industries by 2030 via a variety of measures together with simplified authorisations and rules – and subsidies.

For Silvia Borelli, who has analysed European industrial coverage (i.e. the direct funding of companies by member states or the EU), the dearth of oversight is an issue: “We have now, for instance, funds as a part of the inexperienced deal or digital transition which can be given to corporations in furtherance of sure industrial insurance policies, however there is no such thing as a management as soon as the businesses have acquired the cash. To allow them to legally offshore their manufacturing.”

The educational attracts a parallel with the monitoring of profit recipients. “When a state pays cash to the unemployed, it at all times tries to manage what they do with the cash. However there aren’t any circumstances for corporations, underneath the pretext of freedom of enterprise”. Nor are there any penalties. Within the occasion of an offshoring, the state will discover itself obliged to refund to the European Fee, or else to get better the cash from the corporate.

“Right now, what occurs in apply is the opposite manner spherical”, says Borelli. “We have now incentive insurance policies run by governments to draw overseas corporations. It is a system of competitors based mostly on freedom of motion and freedom of enterprise. In such a system, stopping offshoring quantities to limiting the liberty of motion of corporations, and due to this fact goes in opposition to the precept of European integration.”

The boundaries of commerce union motion

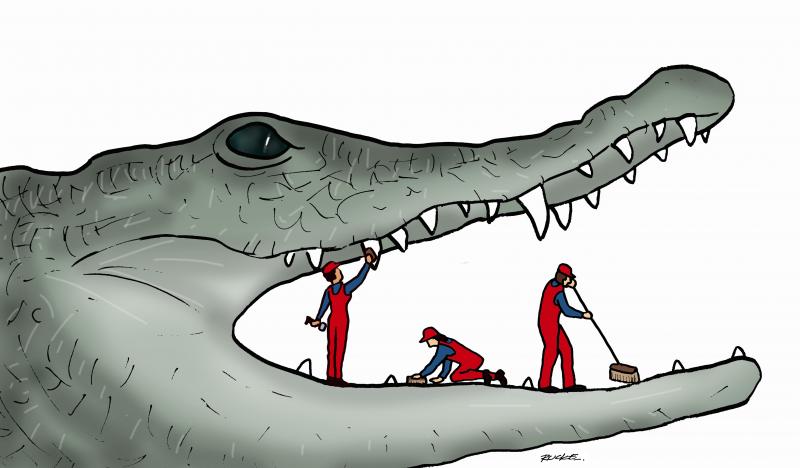

Though commerce unions are sometimes current in giant corporations and multinationals, their room for manoeuvre might be restricted. “When unions get entangled, it is normally when a redundancy plan is being carried out – the union is simply there to restrict the harm”, says Borelli. Actually, regardless of the type of motion – strikes, manufacturing facility blockades, media campaigns, and many others. – it usually occurs after the choice to offshore has been taken.

At current, commerce unions lack the proper to info and session that might allow them to take motion earlier. They could additionally come up in opposition to the issue of business secrecy. “As an illustration, Peugeot, in deciding to provide an electrical automobile in Poland, might invoke industrial secrecy”, says Borelli. Works councils might due to this fact have a task to play. “However their position is troublesome when the offshoring is intra-European, as a result of the works council would want to symbolize both the employees within the nation of origin or these within the vacation spot nation.”

Obtain one of the best of European journalism straight to your inbox each Thursday

Commerce unions are all of the extra weak on condition that offshoring exacerbates job insecurity, pay inequality, and employee safety. All that is taking place in opposition to a backdrop of competitors and fragmentation of the labour market. “We’d like to consider keep away from conflicts between commerce unions. How can we work collectively in order that this isn’t detrimental to both facet?”

Reshore?

The pandemic disaster of 2020 made EU nations conscious of their weak industrial capability. This was brought about partly by previous offshorings of manufacturing. “After we wanted masks, we found that there have been no factories in Europe”, as Silvia Borelli places it. A brand new coverage discourse on de-offshoring – or “reshoring” – has emerged. “Just lately, the European Fee launched guidelines to restrict offshoring exterior Europe, however these are nonetheless very weak. The Covid-19 disaster additionally prompted the EU to encourage reshoring to “pleasant” nations that share related social requirements. “There are directives to encourage reshoring, however these will solely be helpful if we management the motion of capital”, says Borelli.

In keeping with a examine printed by Capgemini in April 2024, 47% of European and American huge industrial corporations have already “reshored” a few of their manufacturing. 72% of them are engaged on a reindustrialisation technique or have already put one in place – the bulk inside within the final two years.

In France, for instance, the “France Relance” and “France 2030” plans intention to reshore trade and thus promote the “Made in France” label. The principle sectors involved are healthcare, agri-food, electronics, 5G and varied inputs.

Nonetheless, in a report printed in late November 2023, the Cour des Comptes (France’s auditor of state funds) identified a number of limitations. In its phrases: “Among the many levers accessible to the authorities to encourage reshoring and keep away from offshoring, the subsidy – which is straightforward to implement and widespread with companies – has been chosen. Nonetheless, mixed with broad focusing on, there was a excessive danger that public funds could be unfold too thinly, and in some instances that there could be a windfall impact.”

Governments and the EU have a number of methods ahead. One is to present the European Fee the authority to stop offshoring whereas creating a European industrial coverage. The opposite is to behave on the nationwide stage, utilizing industrial insurance policies inside every EU nation.

“We appear to be heading extra within the second course”, observes Silvia Borelli. “In any case, we will not go on like this, with a deregulated system that enables capital flight and worsens social inequalities. Right now, the wealthy are getting richer, low-paid staff are shedding their jobs, and it is unusual residents who pay the taxes which can be paid out to corporations that offshore. It is redistribution in reverse, and it would not work.”

[ad_2]

Source link