[ad_1]

This text is an on-site model of our FirstFT publication. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Good morning. Liz Truss has vowed Britain will “journey out the storm”, as the brand new UK prime minister started confronting an financial disaster with a large vitality bailout for households and companies that would price greater than £150bn.

Truss dodged torrential rain outdoors 10 Downing Avenue to inform the nation that she would create an “aspiration nation”, including: “As sturdy because the storm could also be, I do know that the British individuals are stronger.”

Inside minutes of coming into Quantity 10, Truss set about forming a cupboard and finalising an vitality reduction bundle that may set the tone for her premiership and sharply improve authorities borrowing.

Truss’s allies prompt the family bundle would price £90bn, with an estimated £40bn-£60bn for the enterprise aspect, which continues to be being finalised, over two years.

The estimated scale of the bundle is larger than any single Covid-19 help scheme. Ahmed Farman, an analyst at Jefferies, stated it might quantity to the “largest welfare programme within the UK’s current historical past”.

-

Cupboard Truss remakes authorities, appointing Kwasi Kwarteng as chancellor of the exchequer, Suella Braverman as house secretary, Thérèse Coffey to the publish of deputy prime minister and well being secretary and James Cleverly as her successor as overseas secretary.

-

Financial system Britain’s new chief dangers organising a coverage conflict with the Financial institution of England that economists suppose will result in soar in rates of interest earlier than Christmas.

Thanks for studying FirstFT Europe/Africa — Gary

5 extra tales within the information

1. EU’s windfall taxes to counter ‘astronomic’ vitality payments Brussels is pushing for nationwide windfall taxes on vitality firms to counter what European Fee president Ursula von der Leyen described as “astronomic” electrical energy payments. The proposed levies would goal fossil gasoline producers and low-carbon energy mills which have reaped further earnings because of artificially inflated electrical energy costs.

2. Revolut axes grad job provides throughout price evaluate British fintech group Revolut is in the course of a significant cost-cutting evaluate codenamed “Venture Prism” and has revoked job provides to graduates with simply days of warning, as the corporate valued at $33bn tries to protect itself from the financial downturn.

3. European metals sector warns of ‘existential risk’ In a letter to EU leaders, the bloc’s nonferrous metals commerce physique Eurometaux has stated the vitality disaster poses an “existential risk” to the European business’s future. Executives worry many smelters face everlasting shutdown with out emergency motion from the EU.

4. China’s huge banks really feel pinch from failing loans China’s 4 greatest banks — the Industrial and Industrial Financial institution of China, China Building Financial institution, Agricultural Financial institution of China and Financial institution of China — have been hit by a greater than 50 per cent improve in overdue loans from the property sector over the previous 12 months, as the true property market’s liquidity crunch spills into the monetary sector.

5. Prime Fed official warns charges should keep excessive In an interview with the Monetary Instances, Thomas Barkin, president of the Federal Reserve’s Richmond department, has stated the US central financial institution should raise rates of interest to a stage that restrains financial exercise and maintain them there till policymakers are “satisfied” that rampant inflation is subsiding.

The day forward

Financial information Germany releases July industrial manufacturing figures. Italy publishes retail gross sales information, whereas Halifax releases its month-to-month home value index within the UK. The US is to launch client credit score figures.

Outcomes British residential property developer Barratt Developments and Italian luxurious footwear firm Tod’s publish their most up-to-date figures. UK retailers Halfords and WHSmith will launch buying and selling updates.

Apple launch Apple holds its annual occasion to unveil its newest merchandise, together with a brand new collection of iPhones. Late final week, the corporate formally overtook Android units to account for greater than half of smartphones used within the US.

US Federal Reserve Beige E-book The Fed will publish its report of financial situations right now. Michael Barr, vice-chair of the US central financial institution, may even talk about the best way to make the monetary system safer and fairer on the Brookings Establishment, in his first public feedback since taking the position.

What else we’re studying and listening to

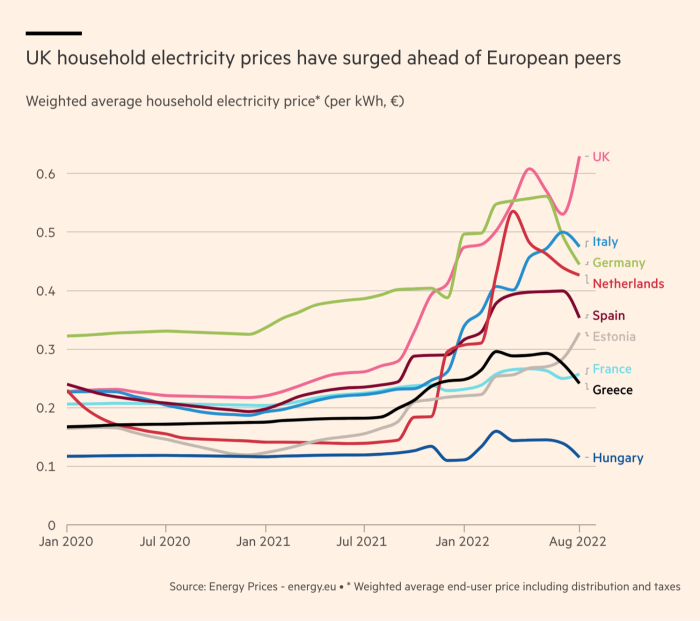

How do vitality payments examine throughout Europe? The affect of lowered oil and gasoline flows from Russia on European households varies broadly relying on the vitality combine of every nation. The common UK family electrical energy value is not less than 30 per cent increased than in lots of its European neighbours due to its better reliance on pure gasoline for energy era.

Europe can — and should — win the vitality conflict How Europe responds to this disaster will form its quick and longer-term future, writes Martin Wolf. It should resist Putin’s blackmail. It should modify, co-operate and endure. That’s the coronary heart of the matter.

-

Associated learn: With out quick political intervention, the vitality disaster threatens to escalate into an avoidable well being emergency that may widen inequality and shorten lives.

Russia’s melancholy oligarchs More and more offended at western governments for freezing their financial institution accounts and forcing them out of their Mediterranean mansions, many Russian oligarchs are resigned to returning house. These in Moscow have quietly accepted their diminished standing in a rustic at conflict.

The rising pains of a Blackstone-backed music rights machine Hipgnosis raised greater than £1bn and snapped up music catalogues from the likes of Blondie and Neil Younger, pledging to make common music a reliable asset class. However the Hipgnosis Songs Fund has grow to be an instance of what can occur to unique investments when the market turns.

A sceptic’s information to crypto Even after the crypto markets crashed this 12 months, there are nonetheless individuals who imagine there’s a future for digital belongings and blockchain know-how. FT columnist and avowed crypto sceptic Jemima Kelly just isn’t so positive. In season 4 of Tech Tonic, she takes a visit deep into cryptoland to listen to from critics, converts and hardcore believers.

Journey

Kill time and zombies at 4 of Tokyo’s most enjoyable recreation centres. From retro-tastic classics to mind-blowing VR adventures — through good previous pinball machines — each gaming style is catered on this FT Globetrotter record.

Really helpful newsletters for you

Disrupted Instances — Documenting the adjustments in enterprise and the financial system between Covid and battle. Enroll right here

Asset Administration — Enroll right here for the within story of the movers and shakers behind a multitrillion-dollar business

[ad_2]

Source link