[ad_1]

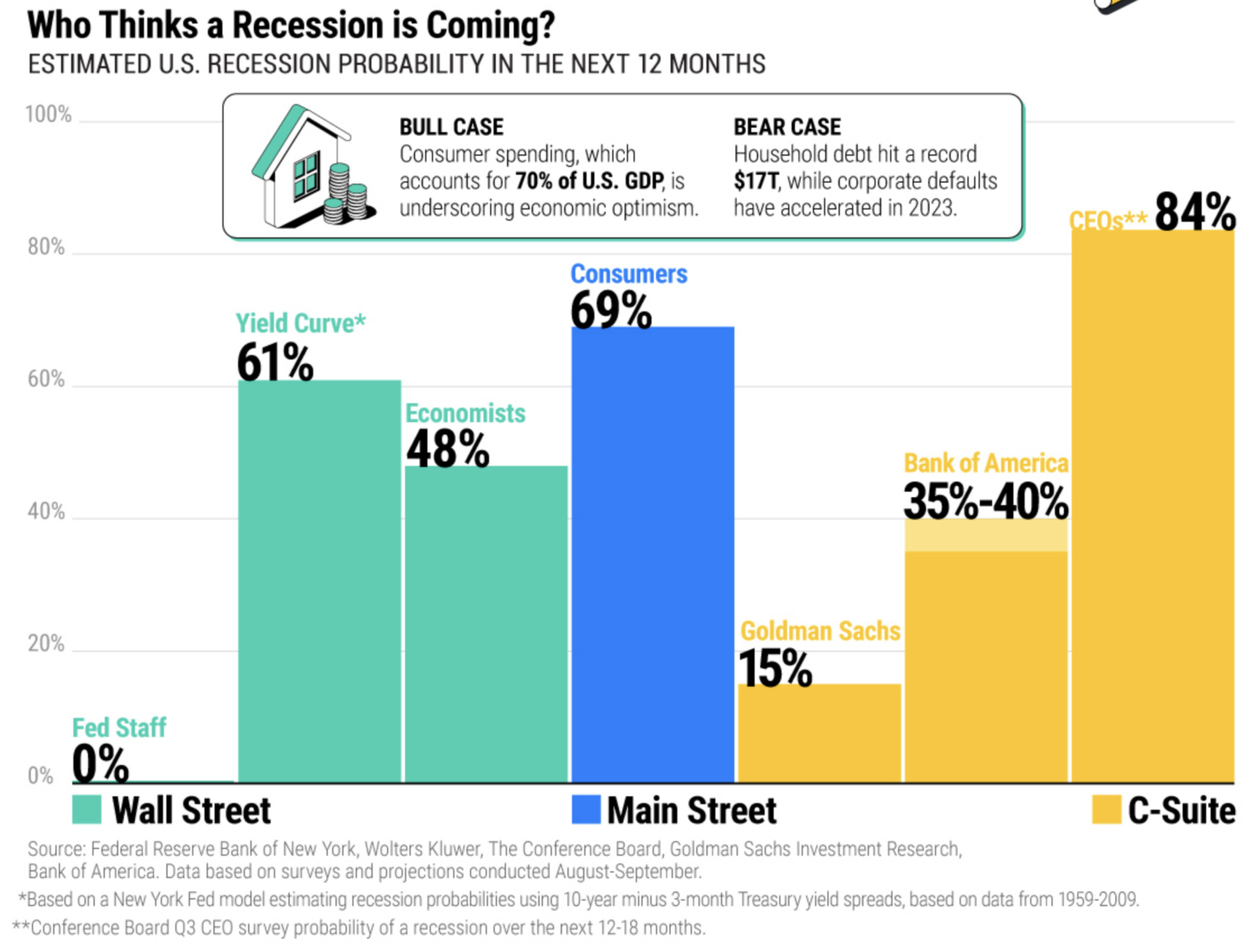

The chart above exhibits that 84% of CEOs are forecasting a recession over the subsequent 12 months, 69% of Customers saying the identical factor, with the yield curve predicting a 61% likelihood of a contraction.

The issue is these units of forecasts is already 2 months previous, dated October 3, 2023. It was earlier than the very encouraging CPI, Unemployment, and GDP information releases.

I’ve spent a number of time discussing why forecasts are a waste of time. This got here up yesterday on Portfolio Rescue with Ben Carlson. We talked about how it’s best to take into consideration Wall Avenue forecasts in regards to the financial system. The TL:dr is the brief time period is simply too random, and so solely serves as advertising and marketing for institutional buying and selling companies.

The place the exception comes from are individuals like ISI’s Ed Hyman, who at all times laid out a number of potentialities — consensus and the outliers in every path — and what the market reactions could be to that.

Your entire dialogue is value watching, however the video beneath is teed up for the financial forecasting dialogue.

Beforehand:

Slowing U.S. Economic system, State by State (November 22, 2023)

Can Economists Predict Recessions? (September 29, 2023)

Why Recessions Matter to Traders (July 11, 2022)

Forecasting & Prediction Discussions

Supply:

U.S. Financial Forecasts: What’s the Likelihood of a Recession in 2024?

By Dorothy Neufeld

Visible Capitalist, October 3, 2023

[ad_2]

Source link