[ad_1]

In my earlier posts about the best way to promote lined calls and the best way to promote money secured places, I’m going over the choice concept and the how-tos of this more and more widespread possibility technique. Now it’s time to place all of it collectively and present how precisely I promote lined calls to generate revenue throughout early retirement. That is one in all many passive revenue streams I make use of along with writing my weblog.

Promoting lined calls on an present portfolio is usually a nice different to conventional dividends and when bond pursuits are low. Actually, attaining an annual return of 10% and even 15% is possible with out taking over aggressive positions. That is far higher than the standard 3% on a dividend development ETF or an analogous bond fund.

I’ve written lined calls for a few years now and repeatedly execute dozens of trades a yr producing a strong $3-5k per thirty days. Earlier than you get too excited, there’s in fact at all times threat relating to buying and selling choices so there’s by no means a free lunch. However, the way in which I promote my choices are most likely among the many lowest threat choices buying and selling methods on the market. If you’re eager to study, this put up will cowl every little thing it is advisable to know!

What’s a lined name?

Earlier than we get began, we have to perceive what a lined name is and what promoting calls actually means.

A lined name is the other of the money secured put. As a substitute of promoting places, you might be promoting calls. Which means that if the value of the underlying inventory goes above your strike worth, you will have to promote the inventory on the strike worth.

It’s referred to as lined as a result of it is advisable to already personal the underlying shares in an effort to promote calls. For those who didn’t have the 100 shares to start with, then that is referred to as a unadorned promote which most brokerages gained’t mean you can do as a result of they’d basically simply be lending you cash (in case the choice was referred to as away).

Let’s proceed with the under instance:

You buy 100 shares of AAPL at $150 per share (complete of $15,000 market worth). You then promote a name possibility expiring on the finish of the week with a strike of $155 for a premium of $1 (or $100). Two outcomes can happen:

- The worth of AAPL is $154 on the finish of the week. Your possibility expires nugatory and you retain the $100 in premiums as a result of the value is underneath the $155 strike worth

- The worth of AAPL is $156 on the finish of the week. Your possibility is exercised which implies you should promote your 100 shares of AAPL at $155. You additionally get to maintain your premium nevertheless as the choice has expired. This state of affairs means your possibility has been “referred to as away”.

Utilizing the above instance, if the value of AAPL was $175 on the finish of the week, you’d nonetheless want to supply the 100 shares of AAPL at $155 which implies you’ve locked in a $20 loss per share (Complete $2,000). Nonetheless, because you already personal 100 shares, you’ll by no means lose cash when the value

How do you promote a lined name?

There’s no higher option to clarify the best way to promote lined name choices than by instance. I’ll use QQQ as my instance after which use the choice chains in Robinhood for example my level.

I exploit Robinhood to commerce choices as a result of it’s 100% free. Robinhood, together with Webull and Sofi are a number of the absolute free choices to commerce choices. Whereas Chase Youinvest or Etrade mean you can commerce vanilla shares at no cost, choices nonetheless carry a worth of $0.5-$1 per contract. This provides up rapidly and may rapidly eat into your income.

Right here is the value historical past of the QQQ:

As of Nov 12, 2021, it’s buying and selling at $391 per share. To promote a lined name, you first have to promote a name on the inventory.

I like to make use of weekly shares with a delta of 0.2. This reduces the possibility of the inventory reaching my strike worth from my expertise permitting me to maintain the premium.

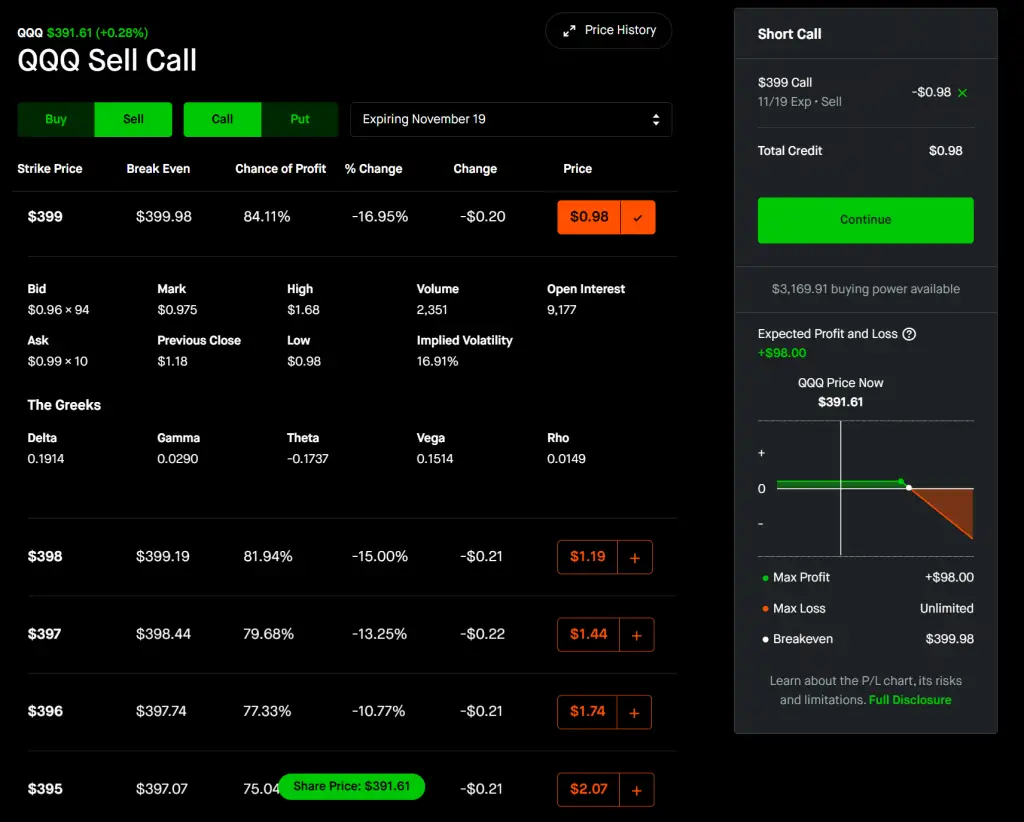

Here’s a screenshot of promoting a name on QQQ. I selected the 399 strike which has a Delta of 0.19 and an opportunity of revenue of 84%. As you may see from the anticipated revenue and loss graph, my max revenue on this commerce is $98 as a result of whenever you promote an possibility, your max revenue is capped on the premium you acquire.

Nonetheless, Robinhood is not going to mean you can promote a unadorned a name as a result of if the value goes above 399, somebody is on the hook to supply the shares at $399 to whomever purchased the decision (the opposite aspect of your commerce). That is why you will have 100 shares of the inventory in an effort to promote lined calls.

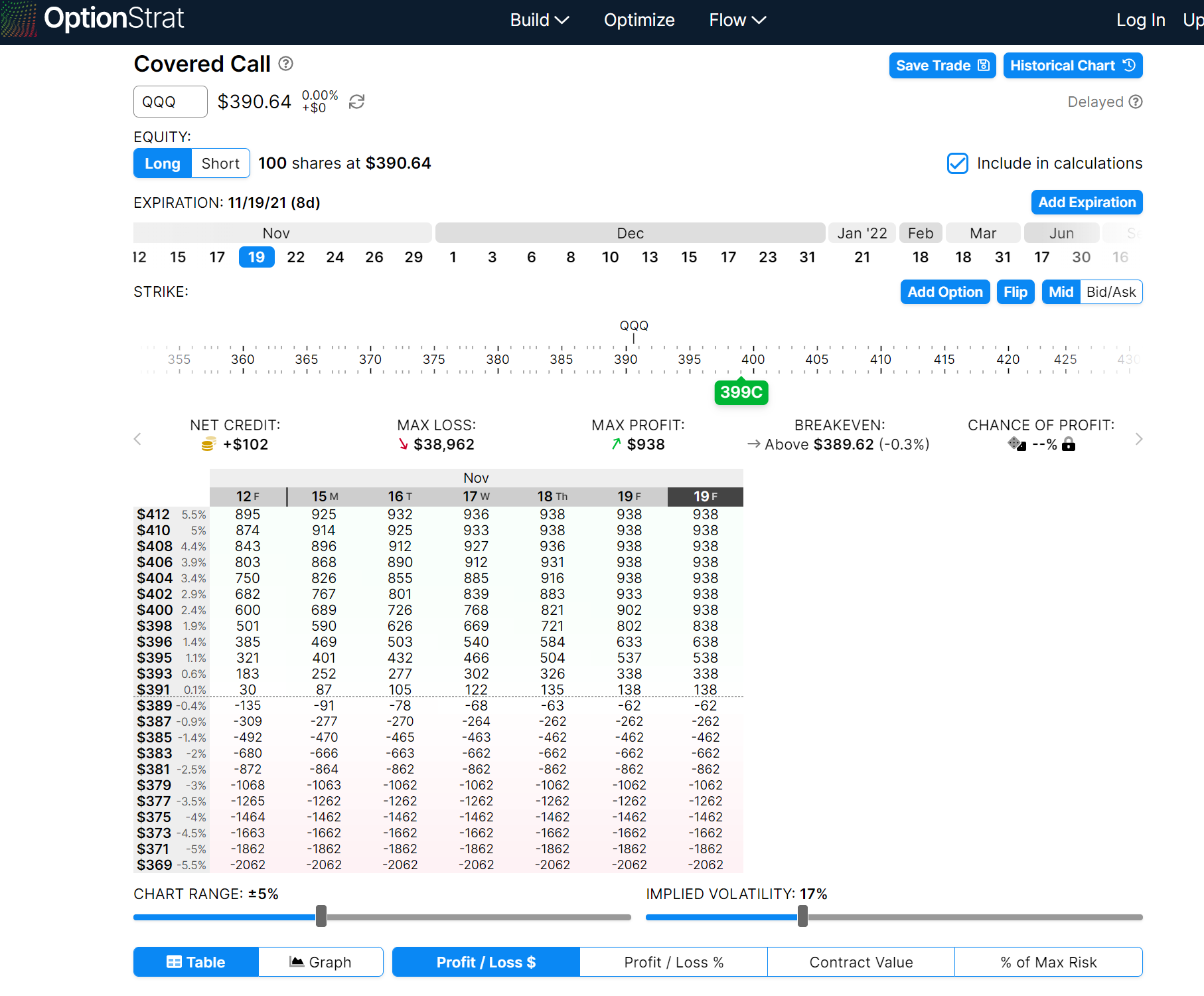

So now I’ll purchase 100 shares of QQQ in addition to promoting this selection and you’re going to get a revenue loss graph like the next:

As you may see, OptionStrat.com illustrates this out completely. If I promote a 399 strike name in opposition to 100 shares, this implies I obtain a $102 premium. My max revenue of $938 in response to this chart means if the inventory reaches $399, I not solely preserve the $100 premium, but in addition notice the positive aspects on the underlying inventory. On this case, QQQ reaching 399 from a worth of 391 means a revenue of $836.

How a lot cash do it is advisable to cowl retirement bills from lined calls?

Now that you’ve got sufficient data of promoting choices, how a lot do cash do you really want to generate sufficient revenue for retirement?

This in fact differs relying in your spending and your necessities on your each day life. For the aim of this put up, I’ll preserve it at a very simple to digest $50,000 USD. $50k is some huge cash for dwelling nearly anyplace on the earth. It’s definitely greater than sufficient to reside a lavish way of life in Bali as I witnessed first hand.

Utilizing the 4% rule of economic independence

For $50,000 per yr, utilizing the 4% rule which is the cornerstone of the monetary independence motion means I would like a portfolio of $1.25m invested. With this quantity, I can merely withdraw $50k over a yr and my funding will nearly at all times final me till demise. Nonetheless, that’s some huge cash to have and now simple for a lot of.

Promoting Coated Calls

By promoting lined calls, I can feasibly generate 10% to fifteen% per yr. Utilizing the decrease finish of this vary, this implies I would wish about $500k in an effort to generate $50k of lined name revenue. That is lower than half the quantity of the earlier instance!

This implies if I had a $1.25m portfolio already, I’d solely have to allocate 40% of the quantity to masking my obligatory bills. Along with this, I might nonetheless withdraw per the 4% rule if I wanted additional revenue or if I really feel just like the market isn’t in a great state to promote calls.

Promoting lined calls on present positions

Now that you know the way a lot cash it is advisable to promote lined calls, let’s put all of this into apply.

Let’s say I would like a $500k portfolio to realize my yearly bills from promoting lined calls. This portfolio consists of a mix of my QQQ shares. I prefer to promote my calls with 3-4 weeks to expiry as I typically discover that’s capturing essentially the most quantity of theta decay. I typically additionally promote my calls with 0.15 Delta (0.2 on the most) so the danger of them being referred to as away is decrease. This in fact can nonetheless occur which implies you’ll have to roll your choices or promote at a loss.

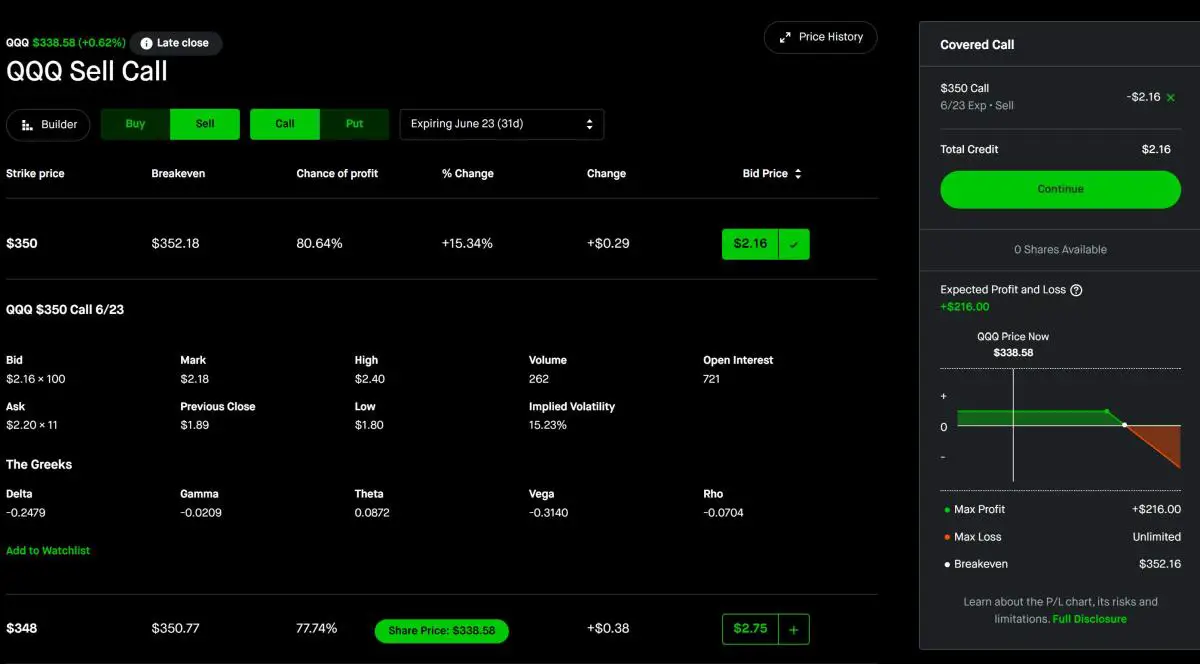

Through the use of QQQ with a present worth of $338, we would wish roughly 1500 shares of the inventory to succeed in $500k.This implies we will promote 15 calls directly. In actuality, it’s extra probably your shares might be break up between extra shares/ETFs however for the aim of this instance, we are going to use QQQ.

As you may see from my put up about what’s in my portfolio, I’ve outsized positions in a Tech ETF and a broad market (S&P 500) ETF. Actually, I’ve so many positions, that is how I generate sufficient passive revenue to outlive on.

As you may see, with a delta of just below 0.25, I can get $2.16 per possibility contract by promoting this particular strike with a 30 day expiration. This implies I’ll generate

15 contracts * $2.16 * 100 = $3,240

I’ll generate $3.2k over the course of a month. This equates to nearly $40k per yr which is a yield 8%. Whereas this isn’t as excessive because the 10-15% I focused earlier on this part, it’s nonetheless a lot greater than a comparable bond fund would pay.

On this particular instance, you may see the Implied Volatility is just 15%. That is very low for the QQQ contract however this was throughout a interval within the markets the place VIX was close to multi yr lows leading to decrease than regular IV. Usually, QQQ trades someplace within the 20-25% Implied Volatility so premiums might simply be 20-30% greater than on this particular instance. After all, the flipside of elevated volatility is the upper probability that the underlying exceeds your strike worth!

Don’t get too grasping when promoting lined calls on present positions

My fundamental recommendation is to not get overly grasping when it come to promoting lined calls to generate retirement revenue. The worst factor that may occur is you promote a name that’s too near the cash and the underlying worth strikes above the strike at expiration forcing you to promote, or to promote at a loss.

Completely stick with a plan and don’t deviate even if you’re sure the markets can’t go up anymore. There have been many situations in my buying and selling profession the place after taking a look at each technical indicator, I used to be completely satisfied the markets wouldn’t rise rather more and I offered a name with the next delta and pocketed a juicier premium. Typically this has labored out for me very properly however different occasions, it’s actually backfired.

As a common guideline, in the event you don’t want the cash, why tackle the danger? Whether or not I get $3 or $1.5 on a premium, it gained’t transfer the needle that a lot. As properly, there’ll at all times be one other alternative to earn cash once more.

Stick with your technique and in my case, I take Deltas of 0.15 to 0.25 on all events.

Promoting lined calls in bear markets

Promoting calls throughout a bear market is a scary and unsure endeavor. When the market goes down, you might be holding onto MTM losses in your underlying positions however are capable of nonetheless pocket name premiums by promoting calls such as you usually would.

The issue arises when the market bounces again. Markets don’t go up or down without end or ever in a straight line. Markets crashed quite a bit in 2022, nevertheless it was additionally met with loads of reduction rallies of 10% or extra! For those who promote a lined name when the markets are closely down, you run the danger of a strong reduction rally pushing the underlying above the strike worth. Relying on how lengthy the reduction rally lasts, you would caught with losses or rolling your contract for a very long time.

Don’t take it from me although! Certainly one of my readers really wrote a put up about how he scaled via the bear market of 2022 by promoting choices. He had various levels of success managing his value foundation and producing constant revenue from choices as markets tanked.

What are the dangers of promoting lined calls?

Like actually each single factor in monetary markets, there is no such thing as a such factor as a free lunch. There’s ALWAYS threat related to a buying and selling technique regardless of how protected it’d look. Choices typically are only one large dumpster hearth of threat. It’s in comparison with a on line casino for a cause.

You win large, and also you lose even larger.

Coated calls are not any completely different. There are threat of promoting lined calls identical to another technique on the market.

When will you lose cash promoting calls?

Coated name technique has two downsides:

- The underlying inventory shifting down in worth

- The underlying inventory shifting approach above your strike worth

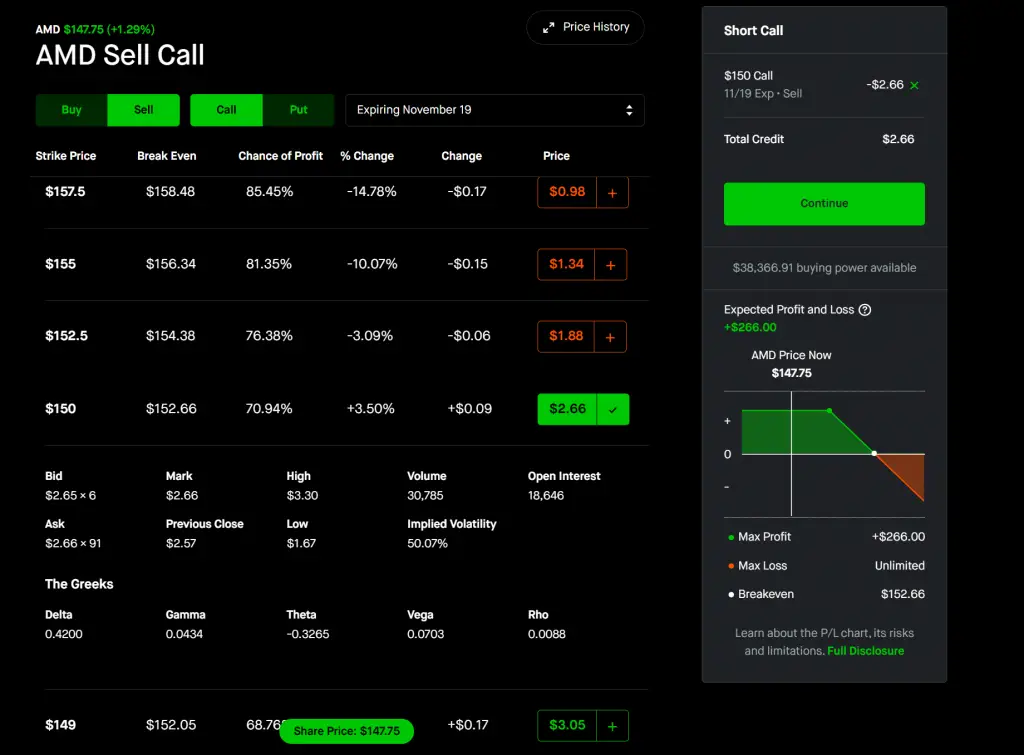

The primary possibility is fairly apparent. For those who purchase 100 shares of AMD inventory at $147.75 after which promote a $150 strike name for the following week expiry, you’ll acquire $2.66 (or $266 in premium).

If AMD inventory worth goes right down to $140 the following week, this implies you’re now sitting on a loss. This loss is mitigated by the premium you acquire nevertheless.

On the inventory, you’ll have a $147.75 – $140 = $7.75 loss per share

$7.75 – $2.66 (the premium for the decision) = $5.09 internet loss

This implies you should have an unrealized lack of $775 on AMD, however since you offered the choice and picked up the premium, your internet loss is $509. However, it’s nonetheless a loss. Nonetheless, in the event you’re promoting lined calls on prime quality long run shares like AMD, this isn’t as large of a difficulty. The inventory worth will get better in some unspecified time in the future sooner or later. It may very well be subsequent week, subsequent month, or subsequent yr. You may need to carry on longer than you hoped however it would get better ultimately.

Alternative Value of the underlying going above your strike

The second possibility is that if the value of the underlying goes above your strike worth. If AMD inventory goes to $155 the following week, this implies your positive aspects are capped at $150 since that’s the strike you selected. This implies, on the finish of the week, you could promote AMD shares at $150.

$150 – $147.75 = $2.25 (That is the revenue in your inventory)

$2.25 + $2.66 (premium collected on the choice) = $4.91 internet revenue

Had you not offered any name choices, you’d be sitting on a bigger revenue ($155 – 147.75 = $7.25).

Since you collected the premium on the choice, your internet revenue might be $491 as an alternative of $225. That is why there’s a column within the Robinhood structure for “Break Even”.

Purchase shares you need to maintain long run!

Maybe an important factor to do to handle threat when buying and selling lined calls or the Choices Wheel is to decide on shares you might be long run bullish on. These are shares that you just wouldn’t thoughts holding if the market had been to crash as a result of you realize it would get better in some unspecified time in the future.

This implies you must stick with largely blue chip shares to scale back threat. After all, there’s by no means a free lunch and extra steady shares means much less volatility which equates to smaller premiums.

Utilizing a spreadsheet to trace Promoting lined name choices

I’ve been “wheeling” and buying and selling lined requires awhile now. It’s definitely not essentially the most horny approach of buying and selling and also you gained’t see anybody from Reddit’s /r/thetagang (Choice Wheel afficionados) posting on /r/wallstreetbets anytime quickly. Choice wheel is about boring however constant revenue. It’s not a get wealthy fast technique however reasonably one that provides small positive aspects and doesn’t blow up your account.

When you begin buying and selling, you’ll rapidly notice you might be executing many trades. For those who choose 5-10 shares like I do to wheel on weekly choices, this implies you might be executing 5-10 trades every week at minimal. Typically, you may need to shut out of the choice or roll it to the following contract which implies executing much more trades.

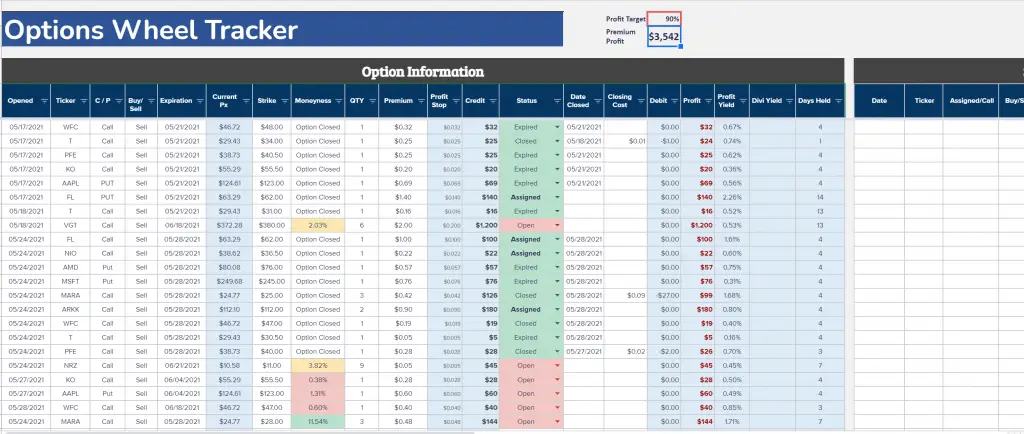

All of this provides up rapidly and no brokerage has a great monitoring technique for conserving tabs on the premiums your accumulating and what’s getting assigned and what’s not. It’s essential to do that by yourself which is why I exploit my private spreadsheet for this venture.

You’ll be able to entry my choices buying and selling spreadsheet and use it for your self to maintain observe of wheel trades.

Proceed Studying:

[ad_2]

Source link