[ad_1]

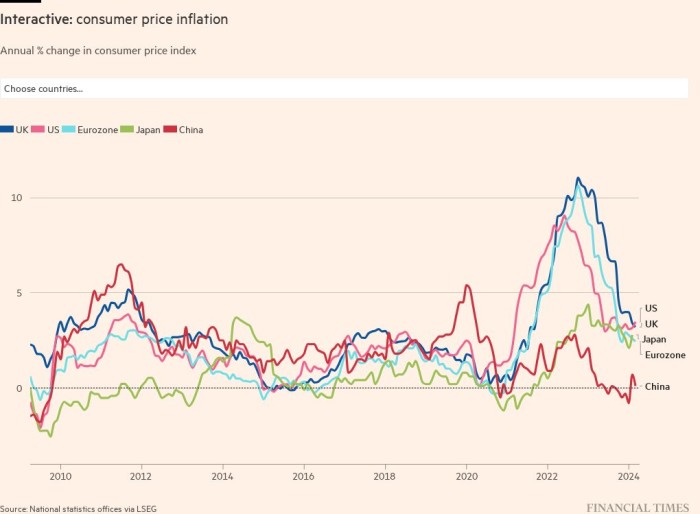

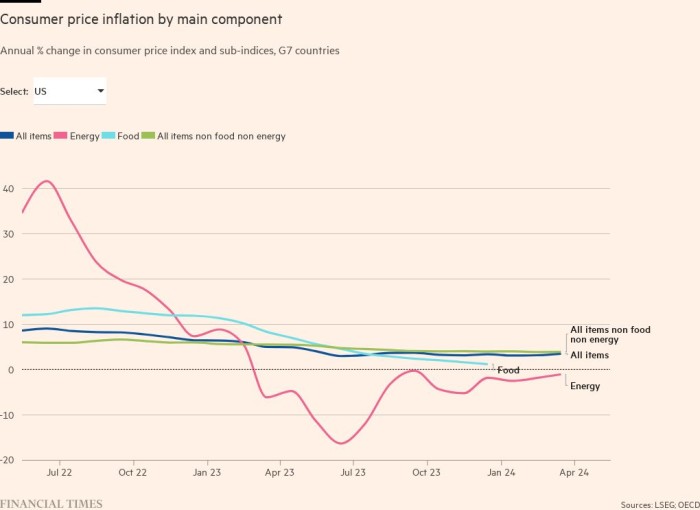

Inflation has began to indicate indicators of easing from the multi-decade highs reached in lots of international locations following Russia’s full-scale invasion of Ukraine.

The most recent figures for many of the world’s largest economies nonetheless make for worrying studying, with value pressures remaining excessive because the warfare in Ukraine continues to maintain vitality and meals costs elevated. However in some international locations pressures have eased and vitality and meals wholesale costs have declined. Economist and traders additionally anticipate inflationary ranges to stabilise within the subsequent few years.

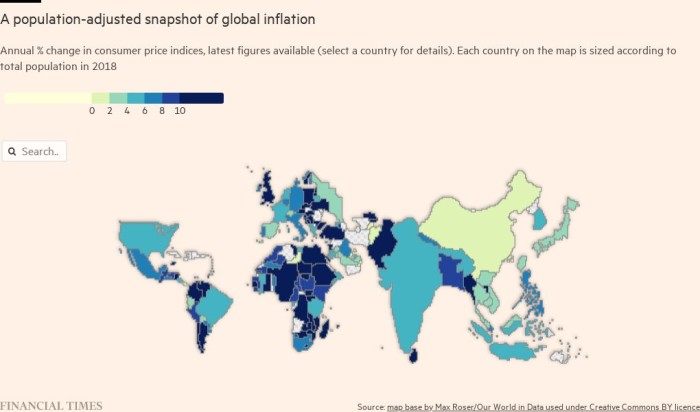

Excessive inflation stays geographically broad-based, even whether it is decrease in lots of components of Asia.

Central banks have reacted with a collection of rate of interest rises, though larger borrowing prices might exacerbate the squeeze on actual incomes.

This web page supplies a frequently up to date visible narrative of client value inflation around the globe.

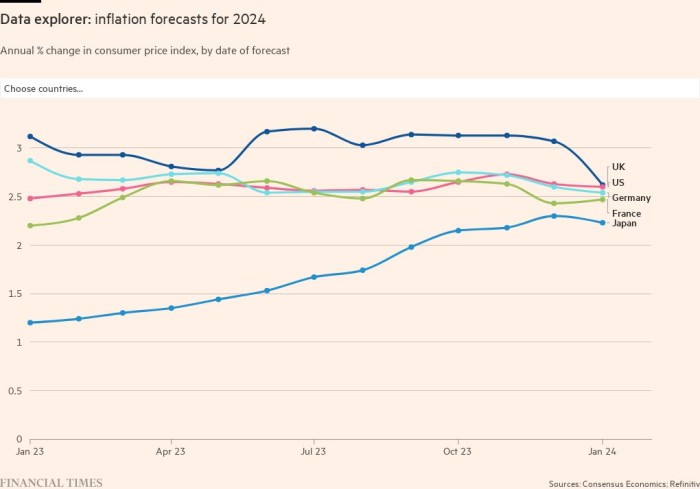

It contains economists’ expectations for the longer term, which nonetheless present 2023 inflation projections being revised up for a lot of international locations, though they’ve stabilised elsewhere together with Germany, in line with main forecasters polled by Consensus Economics.

Traders’ expectations of the place inflation shall be 5 years from now have stopped rising, reflecting central banks’ extra aggressive tightening and a weakening financial outlook.

In some international locations, significantly in Europe, governments’ fiscal packages to offset the upper value of vitality are having an impression.

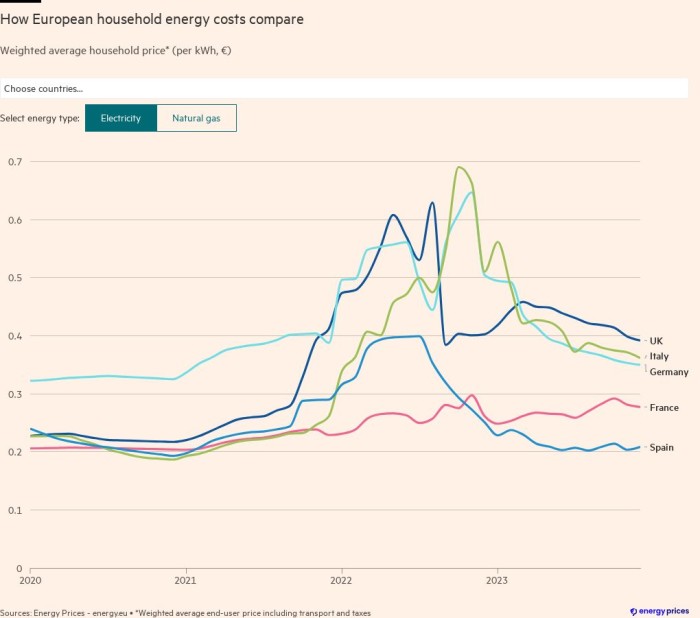

The rise in vitality costs was the primary driver of inflation in lots of international locations, even earlier than Russia invaded Ukraine. Every day information present how the stress has intensified on the again of a battle that has compelled Europe to seek for different fuel provides.

Nevertheless, wholesale costs have now eased on account of weakening international demand and European fuel storage amenities being crammed near capability.

The pass-through from wholesale to client costs isn’t fast and family and enterprise prices stay elevated in Europe, the place the vitality disaster has been extra intense due to the area’s larger dependence on Russia’s fuel.

Greater inflation has additionally unfold past vitality to many different objects, with rising meals costs hitting the poorest customers specifically.

Rising costs restrict what households can spend on items and providers. For the much less well-off, this might result in individuals struggling to afford fundamentals similar to meals and shelter.

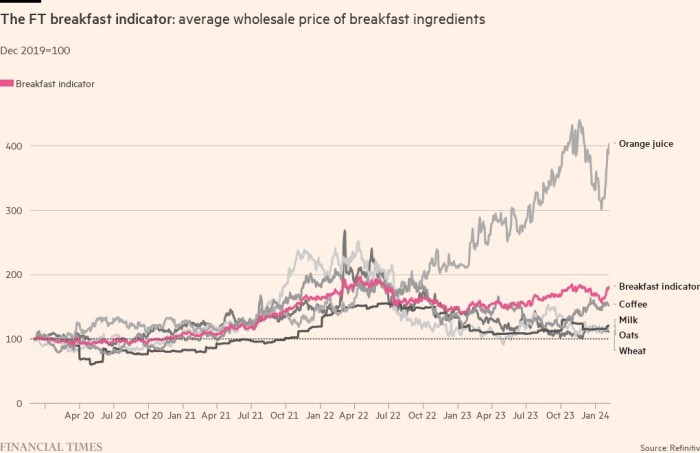

Every day information on staple items, such because the wholesale value of breakfast substances, present an up-to-date indicator of the pressures confronted by customers. Whereas they’ve eased in current months, they continue to be at excessive ranges.

In creating international locations, the wholesale value of those substances has a bigger impression on closing meals costs; meals additionally accounts for a bigger share of family spending.

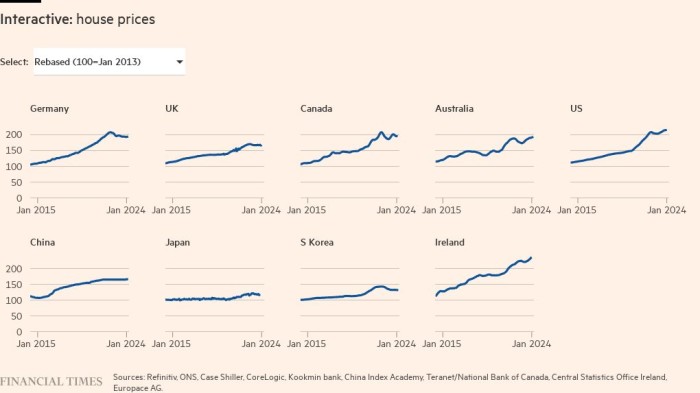

One other level of concern is asset costs, particularly for homes.

These soared in lots of international locations through the pandemic, boosted by ultra-loose financial coverage, homeworkers’ need for more room and authorities revenue help schemes. Nevertheless, larger mortgage charges are already resulting in a big slowdown in home value development in lots of international locations.

[ad_2]

Source link