[ad_1]

Introduction: Gold at all-time excessive on fee reduce hopes

Good morning, and welcome to our rolling protection of enterprise, the monetary markets, and the world economic system.

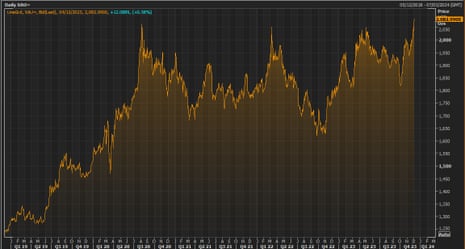

Gold has climbed to a document excessive for the second session in a row, as traders flock to the normal secure haven asset amid hopes of rate of interest cuts within the months forward.

The gold worth has hit $2,111.39 per ounce, taking it over the document set on Friday evening and additional above the earlier document set in August 2020.

Gold has strengthened amid hopes that the cycle of rate of interest will increase during the last couple of years has now ended, and that central banks will flip their consideration to slicing borrowing prices in 2024.

That has led to a weaker US greenback, which pushes up the gold worth (because it’s priced in {dollars}).

As this chart reveals, gold has climbed fairly steadily because the begin of October, when it was altering palms at $1,820 per ounce.

Crypto belongings are additionally on a cost, with bitcoin hitting $40,000 for the primary time this yr immediately, with some merchants betting the US Federal Reserve might begin slicing US rates of interest subsequent spring.

Kyle Rodda, senior monetary market analyst at Capital.com, explains:

Markets are piling in on bets of Fed fee cuts subsequent yr, presumably as quickly as March. That pushed gold and Bitcoin to vital ranges, with the previous busting to document highs and the latter hitting $US40,000 for the primary time since Could 2022.

Gold’s transfer boasted all of the hallmarks of a technical melt-up, because the break of earlier all-time highs set off stops and purchase orders.

A decrease rate of interest setting would favour gold, which doesn’t generate a yield (in contrast to bonds, equities or present money financial savings accounts).

Additionally developing immediately

The UK economic system can be beneath the microscope, because the Decision Basis thinktank holds an all-day occasion inspecting a greater financial technique for the nation.

Its work has proven that British employees are lacking out on £10,700 a yr after greater than a decade of weak financial progress and excessive inequality.

Decision will hear from Labour chief Sir Keir Starmer, who is anticipated to warn that he wouldn’t “activate the spending faucets” if he wins the following election

The Guardian studies this morning that Starmer will say:

“Anybody who expects an incoming Labour authorities to shortly activate the spending faucets goes to be disenchanted … It’s already clear that the selections the federal government are taking, to not point out their document over the previous 13 years, will constrain what a future Labour authorities can do.”

“This parliament is on observe to be the primary in trendy historical past the place dwelling requirements on this nation have really contracted. Family earnings progress is down by 3.1% and Britain is worse off.

“This isn’t dwelling requirements rising too slowly or unequal concentrations of wealth and alternative. That is Britain going backwards. That is worse than the Seventies, worse than the recessions of the Eighties and Nineties, and worse even than the nice crash of 2008.”

The agenda

-

7am GMT: German commerce balane statistics for October

-

9.30am GMT: Decision Basis holds occasion inspecting UK economic system in 2030

-

2pm GMT: ECB president Christine Lagarde provides a speech on the Académie des Sciences Morales et Politique’s convention in Paris

-

3pm GMT: US manufacturing facility orders for October

Key occasions

In addition to lifting inflation for mortgage-holders (see earlier submit), increased rates of interest are more likely to result in extra mortgage defaults.

Credit standing company S&P World has forecast an additional rise in U.S. and European default charges subsequent yr, following the fast improve in international rates of interest.

It says the important thing dangers for 2024 are an prolonged interval of excessive real-interest-rate ranges, deeper than anticipated recessions taking maintain, or that property markets in main economies begin to buckle considerably.

In a brand new report, they are saying:

“Defaults will probably rise additional, to five% within the U.S. and three.75% in Europe, above their long-term historic developments.”

“We anticipate see extra credit score deterioration in 2024, largely at decrease finish of rankings scale, the place near 40% of credit are liable to downgrades”.

In higher information for mortgage holders, the common fee on fixed-term loans has dropped once more immediately.

Knowledge supplier Moneyfacts studies that:

-

The typical 2-year mounted residential mortgage fee immediately is 6.03%. That is down from a mean fee of 6.04% on the earlier working day.

-

The typical 5-year mounted residential mortgage fee immediately is 5.64%. That is down from a mean fee of 5.65% on the earlier working day.

Full story: Spotify cuts nearly 1,600 jobs amid rising prices

Jasper Jolly

Spotify is slicing nearly 1,600 jobs because the music streaming service blamed a slowing economic system and better borrowing prices within the newest spherical of redundancies at huge tech corporations.

Daniel Ek, Spotify’s billionaire founder and chief government, revealed that the corporate had determined to chop 17% of its workforce, the third and steepest spherical of redundancies of 2023.

Ek instructed workers they’d obtain a calendar invitation “inside the subsequent two hours from HR for a one-on-one dialog” in the event that they have been affected by the cuts, in a message to employees revealed on Spotify’s web site on Monday. Extra right here.

Motoring physique the RAC has criticised UK gasoline retailers for failing to go on the complete advantages of cheaper petrol and diesel to drivers.

Its Gas Watch reveals that the common worth of petrol fell by 7.5p a litre to November 146.95p. Nevertheless, the RAC believes that that is nonetheless 10p extra per litre than it needs to be, with the common retailer margin per litre of petrol now 17p – nicely above the long-term common of 7p.

Drivers at the moment are paying a mean of £80.62 to fill a typical 55-litre petrol household automobile – £5 greater than they need to be, says the RAC.

The worth of diesel fell by 7p in November to 154.40p, however that is stated to be an ‘overcharge’ of 5p per litre, and means filling a 55-litre automobile is round £2.50 costlier than it needs to be at £84.92.

UK mortgage debtors, and people with youngsters, face increased inflation

UK householders with a mortgage have been hit by the next fee of private inflation than renters, new statistics present, as rising rates of interest pushed up reimbursement prices.

The Workplace for Nationwide Statistics has reported that the common proprietor occupiers nonetheless paying for his or her home skilled an annual inflation fee of 9.3% in September.

That’s 2.1 share factors increased than the speed skilled by personal renters and was primarily due to mortgage curiosity funds, the ONS says.

It’s newest family price index, which measures of how altering prices have an effect on totally different subsets of the UK inhabitants, has additionally discovered that these of working age skilled the next inflation fee (8.3%) than retired households (whose prices rose by 7.8% during the last yr).

Households with youngsters skilled the next annual inflation fee of 8.4% in September 2023, in contrast with 8.1% for households with out youngsters.

General, UK family prices, as measured by the Family Prices Index (HCI), rose 8.2% within the 12 months to September 2023, the ONS says.

And it claims there was “little distinction in annual inflation charges for high- and low-income households”, which have been 8.3% and eight.2%, respectively in September 2023.

[However, poorer households may not have any spare resources to cover this increase]

The HCI’s are weighted to replicate spending habits. Poorer households spend a larger share on necessities like meals and vitality, whereas wealthier ones spend extra on mortgages, which grew costlier as UK rates of interest hit 15-year highs.

Our first quarterly Family Prices Indices (HCIs), UK: January 2022 to September 2023 article provides an perception into inflation as skilled by various kinds of households and most carefully displays their lived expertise.

➡️ https://t.co/oE1TlXIFDo pic.twitter.com/u3XzrVIWQw

— Workplace for Nationwide Statistics (ONS) (@ONS) December 4, 2023

Jeremy Hunt, chancellor of the exchequer, then takes the stage at Decision Basis’s occasion on the necessity for a brand new financial technique for Britain.

And he will get a reminder of political mortality, with Zanny Minton Beddoes, editor-in-chief of The Economist, introducing Hunt as “a minimum of for the second” the person in command of checking out the UK economic system.

Hunt presses for a clarification, can’t we are saying “topic to the following election”?

“Topic to the following election, blah blah blah”, Minton Beddoes concedes.

However then she asks Hunt for his view of why the UK is in such a large number – how a lot blame ought to the federal government take?

Hunt replies that it’s improper to take the view that the UK has been an outlier.

We have been been hit by the worst monetary disaster because the second world battle, he factors out, including that since 2010 the UK has grown sooner than Spain, Portugal, France, Italy, the Netherlands, Austria, Germany and Japan.

Hunt says:

It’s completely proper to say ‘why have all of us fallen into this low-growth paradigm and what can we do to get out of it?’

However I don’t suppose that is one thing we’re uniquely in a foul scenario with respect to.

That is affecting all westen nations, and it’s a must to have a plan to get out of it.

Q: We now have been doing considerably worse, although, in the event you have a look at dwelling requirements during the last 15 years. Is there something, with hindsight, you’d have achieved otherwise?

Hunt prefers to speak about what he’s doing now. He says productiveness is the important thing to elevating dwelling requirements, and factors to his determination within the autumn assertion to make ‘full expensing’ everlasting (permitting companies to offset funding towards their tax payments).

That can assist carry enterprise funding by £20bn a yr, Hunt says, closing half of the hole between the UK and France, Germany and the US.

The chancellor then claims that the UK has probably the most untapped potential to change into probably the most affluent twenty first century economic system.

Why? Partly as a result of the UK’s introspection, and in addition as a result of the UK’s potential in expertise and innovation.

Q: However what’s your progress technique?

Hunt says he needs to enhance productiveness, by growing enterprise funding

Secondly, you want a really clear view as to the place the UK’s aggressive benefit lies. Outdoors the US, it has the perfect increased training sector, and the perfect monetary sector, he says.

He says it must give attention to innovation, to create a world-beating expertise sector and a brand new Silicon Valley.

Our Politics Dwell weblog has extra protection, right here:

Listed below are some extra highlights from Decision Basis’s report into the UK economic system.

It reveals that the UK is the second-biggest providers exporter within the UK, after the US, however forward of Germany and France:

However right here’s the injury brought on by over a decade of relative financial decline:

Productiveness progress has been half the speed seen throughout different superior economies. Wages have flatlined consequently, costing the common employee £10,700 a yr in misplaced pay progress. pic.twitter.com/E0SKOjqvHo

— Decision Basis (@resfoundation) December 4, 2023

Productiveness progress has been half the speed seen throughout different superior economies. Wages have flatlined consequently, costing the common employee £10,700 a yr in misplaced pay progress. pic.twitter.com/E0SKOjqvHo

— Decision Basis (@resfoundation) December 4, 2023

Again within the crypto market, Bitcoin continues to be buying and selling at an 18-month excessive.

Bitcoin is up over 7%, and has traded as excessive as $41,800, the very best since April 2022.

Rania Gule, market analyst at dealer XS.com, say the prospect of bitcoin exchange-traded fund profitable approval (as has been oft-rumoured) is one issue:

The cryptocurrency market is now eagerly anticipating the influence of each Concern of Lacking Out (FOMO) and Concern, Uncertainty, and Doubt (FUD) relating to the anticipated approval dates for the Trade-Traded Fund (ETF).

I consider developments within the Bitcoin ETF will affect the present upward development, pushing it in direction of $50,000. That is very true with indicators of slowing inflation, and traders gaining confidence that the Federal Reserve has concluded its collection of rate of interest hikes. Consideration has shifted to expectations of potential rate of interest cuts subsequent yr, supporting the present rise in international markets.

Decision Basis’s Torsten Bell then reveals the influence of the UK’s wage stagnation because the monetary disaster of 2008.

He reveals a graph displaying that French middle-income households at the moment are 9% richer than middle- earnings British households. German households are 20% richer.

Most individuals consider these international locations as ones we’re related too, however we aren’t any extra.

Low progress + excessive inequality = a poisonous mixture for low-and-middle earnings Britain, says @TorstenBell. Low-income households within the UK are 27% poorer than their French and German counterparts (we have included Italy on this chart to make us really feel just a little higher, Torsten provides…) pic.twitter.com/NPwb1jRkQP

— Decision Basis (@resfoundation) December 4, 2023

The squeeze is worse for low-income households, Bell says.

The everyday poor French and German family is 27% richer than its UK counterpart, or about £4,500 per yr.

That’s why many households struggled to deal with the price of dwelling disaster, as they didn’t have any spare cash to cowl the bounce in costs of important items.

Decision Basis convention on UK economic system underway

An all-day convention on ending Britain’s financial stagnation, organised by the Decision Basis, is beginning now in Londons QE II centre.

It’s the end result of three yr’s work into the UK’s gradual progress and excessive inequality, which is “proving poisonous for low- and middle-income Britain”, they warn (costing British employees over £10,000 a yr).

Decision’s chief government, Torsten Bell, begins by telling the viewers one of many key classes he discovered when he was particular adviser to Alistair Darling, the previous chancellor who sadly died final week.

Bell says Darling taught him that “financial coverage isn’t some summary sport”.

It’s not about your fancy charts…. it’s not about your theories. It’s in regards to the bread and butter of individuals’s lives.

In 2008, within the monetary disaster, Darling’s first thought was all the time about peculiar individuals who wouldn’t have the ability to into the retailers and do their weekly procuring if their financial institution failed, says Bell.

He provides that he can see a number of individuals at immediately’s convention who have been “thrown out of conferences” with chancellor Darling for “summary dialogue of fiscal guidelines”, as a result of he wished it to cease.

Out immediately: the Remaining Report of The Financial system 2030 Inquiry, our massively formidable three-year venture with @CEP_LSE, funded by @NuffieldFound – which we’re launching with an all-day convention! Attendees are grabbing copies of the report and preparing for our nice line up of… pic.twitter.com/7pDv7SnRZc

— Decision Basis (@resfoundation) December 4, 2023

Miles Brignall

Common home costs within the UK will fall by 1% subsequent yr as competitors will increase amongst sellers, Britain’s largest property web site has forecast.

Sellers have been more likely to have to cost extra competitively to safe a purchaser in 2024, whereas mortgage charges would cool down although “stay elevated”, stated Rightmove.

A yr in the past, Rightmove predicted that common asking costs would fall by 2% in 2023. On Monday, the corporate stated the common was 1.3% decrease than in 2022 because the property market continued to deal with considerably increased mortgage prices and a value of dwelling disaster that refused to go away.

The web site information asking costs fairly than the precise one properties are offered for. It stated it was predicting that these would sometimes be 1% decrease nationally by the top of 2024.

The market was persevering with its transition to “extra regular ranges” of exercise after the busy post-pandemic interval, it added. Extra right here.

[ad_2]

Source link