[ad_1]

Hedge fund co-founded by Jacob Rees-Mogg to shut

The hedge fund co-founded by Conservative MP Jacob Rees-Mogg is about to wind down after its largest shopper left.

Somerset Capital Administration misplaced about £2bn in belongings from its largest shopper, St James’s Place, leaving it managing solely about £1bn, a degree that’s typically thought of small in institutional hedge fund phrases.

The agency stated it was “closing its wider institutional enterprise in London”.

Rees-Mogg co-founded the agency in 2007, and was actively concerned for a number of years. He stopped receiving wages in 2019 when he grew to become a minister underneath then prime minister Boris Johnson, however continued to obtain dividends as an fairness accomplice, together with an estimated £500,000 for 2022.

Somerset had held talks a few potential sale of the agency valued at between £70m and £100m, however these fell by on the finish of 2022.

Somerset’s UK funds and their managers have been looking for a brand new residence that might permit them to retain the present fund and third-party infrastructure, the agency stated.

Oliver Crawley, a accomplice at Somerset, stated:

It has been a privilege to handle capital for world-leading establishments and shoppers for over 16 years. I’m extremely pleased with all we have now achieved in that point by the arduous work and ability of our devoted staff.

The present groups have delivered robust efficiency for his or her traders and proceed to take action. We hope a transition will be secured which we consider will give the funds a shiny future.

Key occasions

Jacob Rees-Mogg is just not the one Tory politician concerned with Somerset Capital: his co-founder Dominic Johnson stepped down as chief govt final yr to function a minister underneath Liz Truss. He’s now Rishi Sunak’s minister for funding.

Somerset Capital specialised in investing in so-called rising markets – poorer nations. Buyers need to steadiness the alternatives for financial development with potential points reminiscent of a shaky rule of legislation.

The agency was capable of appeal to main shoppers, garnering belongings underneath administration of as a lot as $10bn (£8bn) at its peak. Nonetheless, that had fallen to $3.5bn by November.

That left St James’s Place as its key shopper. When it withdrew $2.5bn it reportedly left Somerset with comparatively excessive prices in contrast with its belongings underneath administration. Hedge funds are inclined to take a proportion of belongings as a administration payment annually, so massive outflows will be very financially damaging.

The Monetary Occasions experiences that: “SJP’s exit unsettled remaining shoppers, which embrace the State Board of Administration of Florida and the Civil Service Superannuation Board of Manitoba in Canada.”

Somerset Capital Administration got here underneath nearer scrutiny than most hedge funds due to Jacob Rees-Mogg’s part-ownership.

Generally the right-wing Conservative MP’s views appeared at odds with the views of the corporate. In 2018 Somerset described Brexit as a monetary threat in a prospectus to a brand new fund it launched, at a time when Rees-Mogg was among the many most outstanding proponents of a “arduous” Brexit by which the UK left the EU’s single market – a path that the Conservative authorities ultimately selected.

The Guardian has beforehand reported that Somerset Capital Administration was an investor in oil and coal mining. Rees-Mogg has been an advocate of continued extraction of fossil fuels.

Hedge fund co-founded by Jacob Rees-Mogg to shut

The hedge fund co-founded by Conservative MP Jacob Rees-Mogg is about to wind down after its largest shopper left.

Somerset Capital Administration misplaced about £2bn in belongings from its largest shopper, St James’s Place, leaving it managing solely about £1bn, a degree that’s typically thought of small in institutional hedge fund phrases.

The agency stated it was “closing its wider institutional enterprise in London”.

Rees-Mogg co-founded the agency in 2007, and was actively concerned for a number of years. He stopped receiving wages in 2019 when he grew to become a minister underneath then prime minister Boris Johnson, however continued to obtain dividends as an fairness accomplice, together with an estimated £500,000 for 2022.

Somerset had held talks a few potential sale of the agency valued at between £70m and £100m, however these fell by on the finish of 2022.

Somerset’s UK funds and their managers have been looking for a brand new residence that might permit them to retain the present fund and third-party infrastructure, the agency stated.

Oliver Crawley, a accomplice at Somerset, stated:

It has been a privilege to handle capital for world-leading establishments and shoppers for over 16 years. I’m extremely pleased with all we have now achieved in that point by the arduous work and ability of our devoted staff.

The present groups have delivered robust efficiency for his or her traders and proceed to take action. We hope a transition will be secured which we consider will give the funds a shiny future.

Kalyeena Makortoff

The Monetary Conduct Authority is getting the wheels in movement to make sure there’s “affordable entry to money” for private and enterprise clients throughout the UK.

The session comes months after the federal government promise in August that it could introduce guidelines that might assure money entry inside three miles of shoppers’ native communities.

Whereas the brand new guidelines received’t stop financial institution department closures, the proposals will pressure excessive road banks and constructing societies to:

-

Launch money entry “assessments” once they make any modifications or closures, to know whether or not new companies are wanted to fill native gaps.

-

Reply to requests from native residents, neighborhood organisations and representatives to think about, assess and plug these gaps.

-

Ship “affordable extra money companies” if gaps are left by these modifications.

-

Guarantee they don’t shut money amenities, together with financial institution branches, till these gaps are closed.

-

Sheldon Mills, the FCA’s director accountable for shoppers and competitors stated:

We all know that, whereas there’s an growing shift to digital funds, over 3m shoppers nonetheless depend on money – significantly individuals who could also be susceptible – in addition to many small companies. It’s essential that we assist shoppers impacted by latest improvements.

These proposals set out how banks and constructing societies might want to assess and plug gaps in native money provision. It will assist handle the tempo of change and be sure that folks can proceed to entry money in the event that they want it.

The session will run till 8 February.

Australian oil and gasoline firms in talks over £42bn merger

Two of Australia’s largest fossil gasoline producers are in talks to merge, in a possible A$80bn (£42bn) deal.

Woodside Power and Santos are value A$57bn, whereas Santos is valued at A$22bn.

In a inventory market announcement in response to “media hypothesis” (it’s hardly “hypothesis” if it’s correct), Woodside stated:

Discussions stay confidential and incomplete, and there’s no certainty that the discussions will result in a transaction.

It might not be the primary oil mega-merger in the previous couple of years, as firms attempt to get as massive as attainable to remain worthwhile because the world tries to chop oil and gasoline use.

ExxonMobil purchased US driller Pioneer in October, whereas Chevron purchased smaller rival Hess.

The UK’s massive three monetary regulators are consulting on new powers to supervise so-called important third events due to the potential dangers to monetary stability.

The Financial institution of England, its Prudential Regulation Authority (PRA) and the Monetary Conduct Authority (FCA) stated that managing the dangers from third events was “past the power of any particular person agency” or infrastructure supplier to resolve.

Sam Woods, the Financial institution of England’s deputy governor for prudential regulation and chief govt of the PRA, stated:

Third-party service suppliers usually play a significant position within the supply of essential companies by banks and insurers. These preparations deliver advantages, but additionally potential dangers. We’re consulting at the moment on proposals to implement new powers given to us by parliament to handle these dangers for these suppliers who might current dangers to monetary stability, in an efficient and proportionate method.

Halifax has stated the UK’s power housing scarcity is the explanation for the rise in costs in November. For an perception into why that is the case, taking a look at bricks is a helpful trick.

Noble Francis, economics director on the Development Merchandise Affiliation, highlighted authorities information on brick deliveries that counsel that housebuilding is nicely under the pre-pandemic common.

UK brick deliveries are a helpful proxy for home constructing begins within the absence of month-to-month begins information. UK brick deliveries in October 2023 have been 1.5% increased than September & 27.6% decrease than a yr in the past in response to the Division for Enterprise & Commerce. (1/n)#ukhousing #housing pic.twitter.com/7YCIZcSHiM

— Noble Francis (@NobleFrancis) December 7, 2023

He stated that the decline in brick deliveries “is according to the unfavourable views of housebuilders, who acknowledged that summer time was poor, September didn’t have the same old choose up and October was solely a marginal enchancment.”

Britain’s homes are ageing, and the UK is just not constructing wherever close to the numbers authorities has stated it needs to.

Hedge fund boss pays himself £276m

Rupert Neate

The billionaire British hedge fund supervisor Sir Chris Hohn paid himself $346m (£276m) this yr – greater than £1m for each working day.

Nonetheless, the payout from his TCI hedge fund, the place Rishi Sunak labored between 2006 and 2009, is half the £574m Hohn collected a yr earlier.

The dividend fee was decreased to mirror a 48% decline in pre-tax income at TCI Fund Administration to $371m within the yr to February 2023 however remains to be 8,000 occasions the typical UK wage and about 1,700 occasions that collected by Sunak as prime minister.

The £276m fee works out at £1.1m for each working day of the yr. Accounts filed at Firms Home on Thursday present the cash was paid to a different firm managed by Hohn. It’s understood that Hohn reinvested the windfall within the Kids’s Funding (TCI).

You’ll be able to learn the total report on “the UK’s most beneficiant man” right here:

Accountant KPMG is planning to merge its UK and Swiss items in a transfer it hopes would permit it to develop quicker.

KPMG UK had began talks with the Swiss unit to discover working collectively carefully to profit shoppers and companions, Jon Holt, CEO of KPMG UK, informed Reuters in an emailed assertion. It confirmed a report within the Monetary Occasions.

Collectively, we’d develop quicker, be extra worthwhile and accomplish that in a sustainable method.

All evening summits on key insurance policies are one of many weirder EU traditions: there should not many walks of life the place it’s typically agreed that the one strategy to get issues executed is to lure folks in a room for hours till they compromise within the small hours.

The wrangle happening in the intervening time is on the difficulty du jour: synthetic intelligence.

Reuters has some reported some good particulars from the talks, which have gone on for greater than 17 hours with out attending to meaty subjects reminiscent of using AI in biometric surveillance, and who can entry supply code for fashions.

There’s a damaged drinks machine, and meals and low ran out at 2am, Reuters reported. There’s, nevertheless, “a provisional deal on easy methods to regulate fast-growing generative AI programs reminiscent of ChatGPT”.

A press convention has been rescheduled from 7am to 2pm CET, so possibly we are going to hear extra later.

South East Water pays traders £2.3m regardless of losses growing

South East Water has paid out £2.3m in dividends to traders at the same time as losses for its half yr elevated to £18m.

The corporate, which serves about 2.2m households and companies in Surrey, Kent, Sussex, Hampshire and Berkshire, is underneath investigation by Ofwat, the regulator, over poor service to clients.

South East Water’s dividend was decrease than the £4.5m paid out a yr earlier and the corporate stated it was “decrease than Ofwat’s view of what’s an inexpensive nominal dividend yield”.

On the similar time, elevated financing prices pushed South East Water’s losses to £18m within the six months to the top of September, up from £13m final yr. Prospects paid £15m in increased tariffs.

Ofwat final month introduced an investigation into South East Water’s attainable failures in sustaining the availability to households, after the corporate blamed elevated working from residence within the south-east of England for a hosepipe ban.

In an announcement reported by PA Media, South East Water’s bosses stated:

Unprecedented excessive climate occasions have been the reason for the vast majority of provide interruptions, however we recognize that issues skilled by our clients will lead to decrease ranges of buyer satisfaction.

We’re deeply sorry to clients who’ve been affected by provide interruptions and proceed to work tirelessly to get better. Now we have 52 groups actively repairing leaks, and 40 technicians proactively searching for them.

The disruption introduced further prices. The corporate paid £700,000 for bottled water to assist clients with no faucet water.

Corks are undoubtedly popping* this morning on the London Inventory Change as English glowing winemaker Chapel Down – the UK’s largest – lists its shares there.

The corporate has benefited in recent times from elevated curiosity in wines from the British Isles – not least from the UK authorities, which has been eager to advertise “Brexit juice” as an alternative choice to European vintages.

Chapel Down already had its shares listed on Acquis, a smaller rival alternate. Nonetheless, Andrew Carter, the corporate’s chief govt, stated the shift to the LSE’s Different Funding Market (Purpose) “displays the maturity of the enterprise and the formidable development plan we’re dedicated to delivering within the years forward.”

Chapel Down says it owns, leases and sources from 1,023 acres of vineyards in south east England, of which 750 acres are totally productive, making it the biggest wine producer within the UK. The corporate offered 1.4m bottles of wine in 2022.

Carter stated:

We consider {that a} transfer to AIM will appeal to a wider pool of traders to take part in Chapel Down’s development because the main producer on this planet’s latest world wine area and as we proceed to pursue our nicely progressed and totally funded plan to double the dimensions of the enterprise within the 5 years to 2026.

In November we confirmed a file 2023 harvest, with tonnage 86% increased than 2022 and 75% increased than the earlier file posted in 2018.

*Due to a colleague for this one

Frasers warns over up-market gross sales, however Sports activities Direct boosts income

Sarah Butler

Frasers Group has warned of “softening within the world luxurious market” as underlying gross sales at its up-market division, which incorporates Home of Fraser malls and the Flannels chain, dived greater than 11%.

Michael Murray, the chief govt of Frasers, which additionally consists of Sports activities Direct, Evans Cycles and gaming retailer Recreation UK, stated gross sales of luxurious items had been partly affected by the price of residing disaster however stated the group would “proceed to speculate with confidence in our distinctive proposition, though it’s probably that progress will stay subdued for the quick to medium time period within the face of a softer luxurious market.”

Frasers, which is managed by former Newcastle United proprietor Mike Ashley who owns greater than 72% of its inventory, opened 20 extra of its Flannels shops, which promote designer casualwear, taking the full to 76. Nonetheless, it closed 5 Home of Fraser shops, taking the full to 29, half the quantity the group purchased out of administration in 2018.

Murray, the previous membership promoter and property adviser who took the reins from father-in-law Ashley in Could final yr, stated he was gaining additional expertise of working in retail by spending time serving at Sports activities Direct’s Oxford Avenue flagship in London – which is reverse the group’s base within the capital.

Complete gross sales for the group’s luxurious division rose 3.1%, helped by the acquisition of 37 shops and a collection of 15 manufacturers, together with former Oasis frontman Liam Gallagher’s Fairly Inexperienced and Nineteen Eighties model Tessuti, from JD Sports activities a yr in the past. The group stated it had seen “constructive demand because of our distinctive proposition” regardless of the softer luxurious market.

Complete retail gross sales rose 4% to nearly £2.7bn, behind inflation, however pre-tax income rose 8% as the corporate boosted revenue margins at its Sports activities Direct chain because of higher relationships with manufacturers reminiscent of Nike, which are actually offering the chain with extra of their most wanted merchandise.

Europe’s foremost inventory indices have dropped again, following Wall Avenue and Asian declines.

London’s FTSE 100 is down by 0.4% within the first couple of minutes of buying and selling, whereas Germany’s Dax and France’s Cac 40 are each down by 0.2%.

Listed below are the opening snaps from Reuters:

-

EUROPE’S STOXX 600 DOWN 0.2%

-

BRITAIN’S FTSE 100 DOWN 0.3%

-

FRANCE’S CAC 40 DOWN 0.2%, SPAIN’S IBEX DOWN 0.2%

-

EURO STOXX INDEX DOWN 0.2%; EURO ZONE BLUE CHIPS DOWN 0.2%

-

GERMANY’S DAX DOWN 0.2%

UK home costs up 0.5% in November; Aldi raises minimal fee to £12 per hour

Good morning, and welcome to our reside, rolling protection of enterprise, economics and monetary markets.

First up this morning: UK home costs rose for the second consecutive month in November, defying a limping economic system due to a scarcity of properties, in response to the most recent information from lender Halifax.

The typical worth of homes tracked by the lender elevated by 0.5% in November – or £1,394 in money phrases – to £283,615.

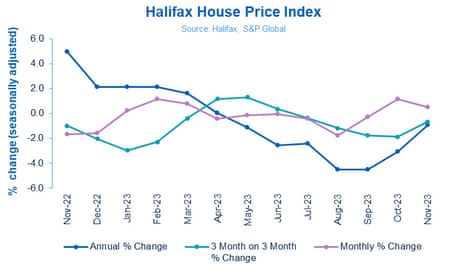

That signifies that the typical remains to be decrease than a yr in the past, however solely by 1%. The chart reveals that the tempo of annual worth drops is slowing:

Kim Kinnaird, director at Halifax Mortgages, stated:

Over the past yr, regardless of the broader financial headwinds, property costs have held up higher than anticipated, falling by a comparatively modest -1.0% on an annual foundation, and nonetheless some £40,000 above pre-pandemic ranges.

The resilience seen in home costs throughout 2023 continues to be underpinned by a scarcity of properties obtainable, reasonably than any important strengthening of purchaser demand. That stated, latest figures for mortgage approvals counsel a slight uptick in exercise ranges, which is probably going because of an enhancing image on affordability for homebuyers. With mortgage charges beginning to ease barely, this can be resulting in elevated purchaser confidence, seeing folks extra inclined to push forward with their residence purchases.

Nonetheless, the financial situations stay unsure, making it arduous to evaluate the extent to which market exercise will likely be maintained. Different pressures – like inflation, the broader value of residing, total employment charges and affordability – imply we anticipate to see downward strain on home costs into subsequent yr.

Aldi raises pay for staff to £12 minimal

Aldi has raised the minimal pay for staff in its outlets and warehouses to £12 per hour, in an indication of the competitors for staff within the UK amid low unemployment.

The brand new minimal fee will increase to £13.55 throughout the M25 to account for the next value of residing in London. Retailer assistants’ pay will rise to £12.95 nationally, and £13.85 throughout the M25, in response to size of service.

Aldi stated the change means it’s the first grocery store to supply charges according to the actual residing wage that was set by the Residing Wage Basis in October this yr. The modifications will value £67m yearly, Aldi stated.

Aldi is the UK’s fourth-largest grocery store after overtaking Morrisons final yr for the primary time. It has greater than 1,000 shops, 11 regional distribution centres and 40,000 staff throughout Britain.

Giles Hurley, chief govt of Aldi UK and Eire, stated the corporate was “dedicated to being the highest-paying grocery store within the sector.”

The agenda

-

10am BST: Eurozone GDP third estimate (Q3; earlier: 0.2%; consensus: -0.1%)

-

1:30pm BST: US preliminary jobless claims (December; prev.: 218,000; cons.: 222,000)

[ad_2]

Source link