[ad_1]

Editors’ notice: This column is a part of the Vox debate on the financial penalties of conflict.

The conflict in Ukraine exposes as soon as extra the dangers related to the interconnected nature of world commerce. The reliance on overseas enter producers can result in the disruption of manufacturing when supply nations expertise a destructive shock, resembling a conflict that results in financial sanctions. A number of observers argue that corporations will reply to this shock – and the geopolitical tensions it triggered – by reconsidering the steadiness between effectivity and safety, resulting in long-term modifications within the construction of world worth chains (GVCs) within the type of reshoring or nearshoring (e.g. Posen 2022). Just like the talk on the long-term penalties of Covid-19 (Javorcik 2020, Kilic and Marin 2020, Lund et al. 2020), the recurring query is whether or not these shocks will result in the corrosion and even the top of globalisation.

In latest work (Ruta 2022), I take advantage of a easy framework to achieve some insights on the long-term results of the conflict in Ukraine on world worth chains. The upshot is twofold. As geopolitical dangers have elevated in a number of nations, corporations might reply to the shock by revising the construction of their provide chains. This reorganisation away from nations perceived as riskier will have an effect on completely different sectors and merchandise in another way. However the identical technological and financial components which have underpinned the worldwide fragmentation of manufacturing in latest many years make a reversal of world worth chains unlikely, except insurance policies transform.

Altering geopolitical dangers

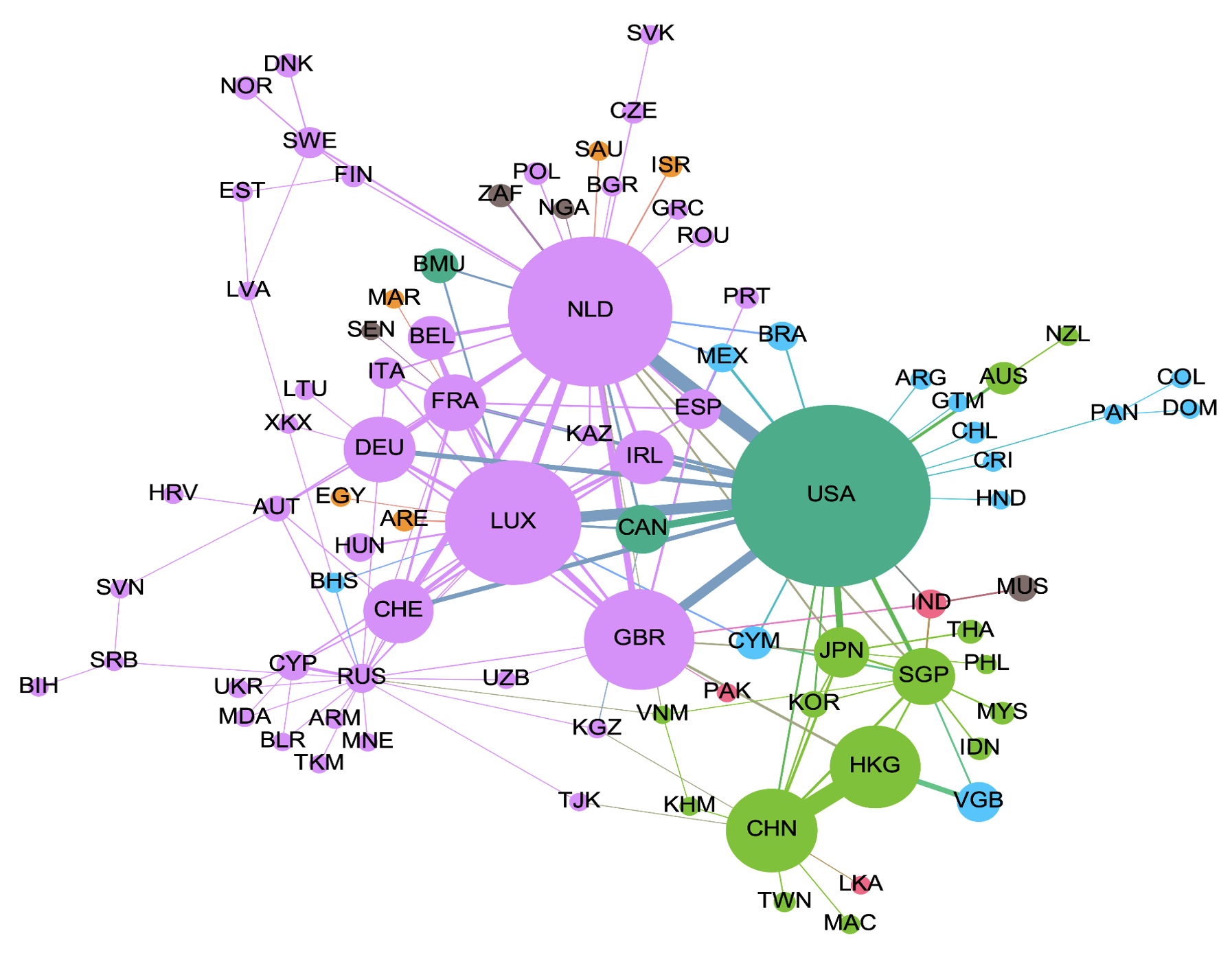

The conflict has direct results on the corporations working in Russia and Ukraine and on corporations counting on suppliers from these markets (Winkler et al. 2022). However the shock attributable to the conflict goes properly past these two nations, as geopolitical dangers have elevated globally. The worldwide Geopolitical Danger Index1 (Caldara and Iacoviello 2022) has greater than doubled because the starting of the yr, reaching ranges not seen because the outset of the conflict in Iraq in March 2003. The information additionally present substantial modifications in geopolitical dangers in a number of economies which might be extra built-in than Russia and Ukraine in world worth chains, together with China, Finland, Sweden, Taiwan, amongst others, pointing to altering perceptions on the dangers of future conflicts and sanctions (Determine 1).

Determine 1 The worldwide community of overseas direct funding

Supply: Liu (2022)

How do corporations reply to greater geopolitical dangers?

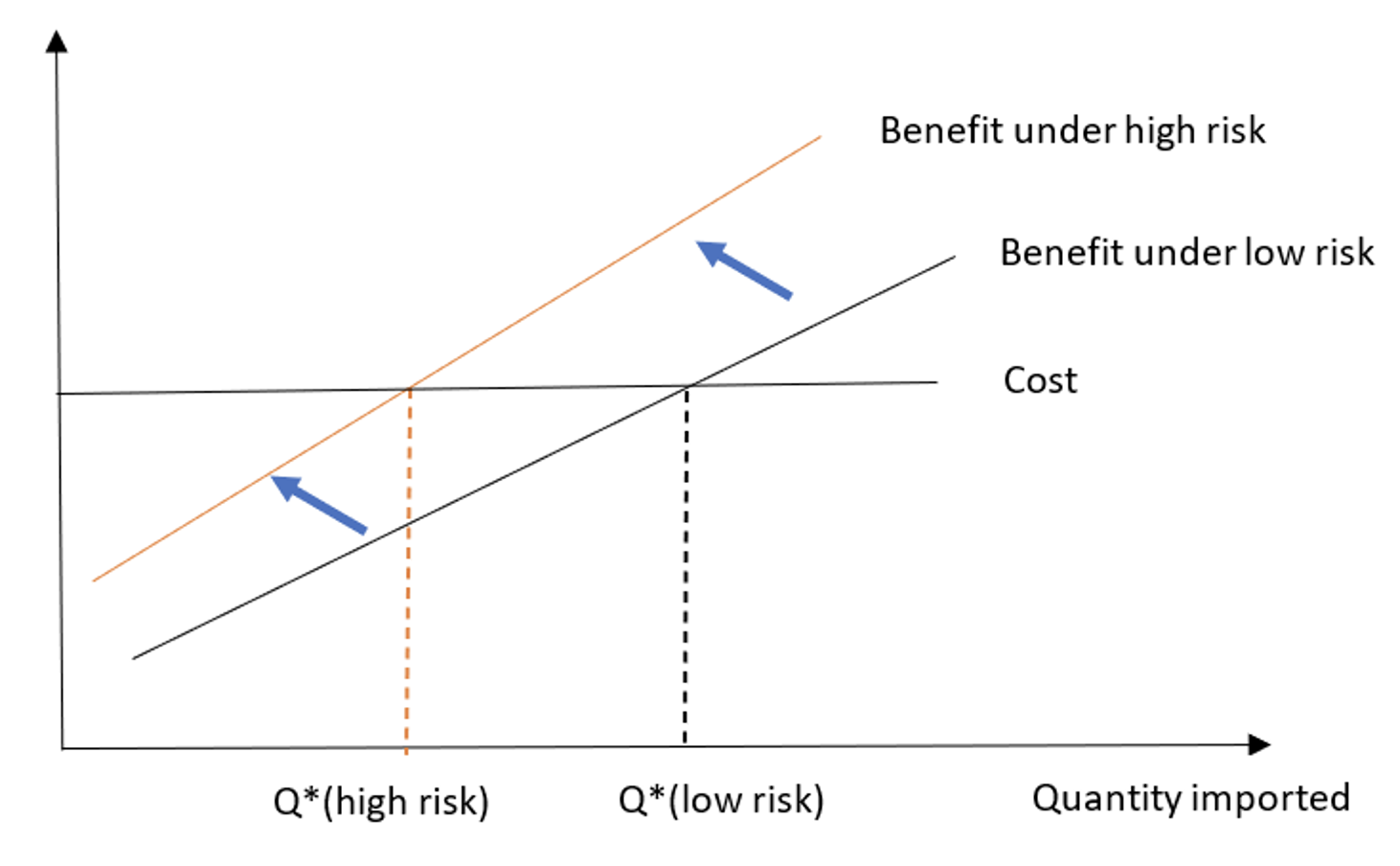

To repair concepts, Determine 2 (primarily based on Freund et al. 2021) focuses on the relocation alternative from the attitude of a multinational agency (however an identical logic applies to arm’s size commerce). Assume that the agency imports key inputs from a subsidiary in another country and {that a} geopolitical shock creates safety considerations in that nation. Underneath what situations does the brand new danger lead the multinational agency to maneuver its subsidiary to a brand new location?

The agency’s choice to relocate manufacturing is set by a cost-benefit evaluation. The good thing about relocation is dependent upon the subsidiary’s scale of manufacturing within the overseas nation as extra uncovered corporations will likely be extra affected by manufacturing disruptions. Its inclination additionally is dependent upon the per-unit value distinction, which captures components just like the wage differential between the completely different places, and the per-unit insurance coverage premium distinction, which captures the insurance coverage value {that a} agency should pay to cowl the danger of manufacturing disruptions on account of geopolitical or different shocks. The good thing about relocation is in comparison with the fee, as relocation would entail constructing a brand new manufacturing facility and establishing new relationships in a distinct location.

A surge in geopolitical danger will increase the per-unit insurance coverage premium distinction, making the profit schedule steeper (implying that extra uncovered corporations must pay extra for insurance coverage). Because the outdated location is immediately riskier, relocating to a brand new low-risk location turns into extra engaging. The opposite components, resembling per-unit value variations between places and the relocation prices, are usually not affected by the shock. Within the new equilibrium, the place the safety concern is excessive, extra uncovered multinational corporations – i.e. those who supply from the overseas nation greater than Q*(excessive danger) in Determine 2 – relocate their subsidiaries. People who supply lower than Q*(excessive danger) don’t have any incentive to depart even after the geopolitical shock.

Determine 2 Advantages and prices of switching import sources induced by modifications in geopolitical dangers

How the conflict might reshape world worth chains

This easy framework brings some insights on the present debate on the conflict and deglobalisation.

First, the conflict will reshape world worth chains, significantly for corporations that rely closely on nations the place geopolitical dangers have surged, however this doesn’t indicate the top of globalisation. Larger geopolitical danger raises the insurance coverage premium that corporations have to pay to cowl the danger of future manufacturing disruptions on account of financial sanctions or battle. For a agency, the danger of disruption rises alongside its reliance on imports from the nation in danger, so extra uncovered corporations usually tend to go away. However a number of components create inertia, suggesting {that a} reshaping of some world worth chains doesn’t indicate sudden deglobalisation. Value differentials between nations are usually not affected by geopolitical danger. This makes reshoring to high-cost nations unlikely. Relocating manufacturing can be costly, as a result of sunk value of constructing new infrastructure and the search value of creating new relationships in a distinct nation.

Second, the war-induced reshaping of world worth chains will have an effect on completely different sectors and merchandise in another way. Sectors with greater fastened prices and complicated intermediate merchandise are much less prone to relocate in response to greater geopolitical dangers – except coverage intervenes. Corporations in an trade like autos, which requires excessive upfront funding in infrastructure, and corporations that depend on subtle intermediate merchandise, which depend on relationship-specific funding, face greater prices of relocating manufacturing and are thus much less prone to go away a rustic in presence of upper geopolitical danger. Even when the character of the shock differs, this instinct is confirmed by proof on the reconfiguration of world worth chains within the aftermath of the 2011 Japan earthquake (Freund et al. 2021). Corporations in these sectors and merchandise might not reorganise manufacturing primarily based solely on market incentives, however fairly in the event that they anticipate a change within the coverage stance that impacts commerce prices.

What position for coverage?

The world economic system will likely be harm by the reshaping of world worth chains induced by greater geopolitical dangers, however some nations will achieve and others lose. As corporations modify their manufacturing and commerce construction to the brand new atmosphere within the pursuit of financial effectivity, they could search new suppliers in creating nations which have a latent comparative benefit and decrease geopolitical dangers. Whereas the high-risk economies, and the worldwide economic system as an entire, are worse off in a extra unsure world, the brand new suppliers would profit from the elevated funding and commerce alternatives. On this context, the true danger comes from measures that intention at reshoring, nearshoring, or fragmenting the commerce system. Moderately, authorities insurance policies ought to deal with defusing tensions and strengthening world worth chains in opposition to future disruptions.

Authors’ notice: The views expressed on this column are these of the creator and they don’t essentially symbolize the views of the World Financial institution Group.

References

Caldara, D and M Iacoviello (2022), “Measuring Geopolitical Danger”, American Financial Assessment 112(4): 1194-1225.

Freund, C, A Mattoo, A Mulabdic and M Ruta (2021), “Pure Disasters and the Reconfiguration of World Worth Chains”, World Financial institution Coverage Analysis Working Paper n. 9719.

Javorcik, B (2020), “World provide chains won’t be the identical within the post-COVID-19 world”, in R Baldwin and S Evenett (eds), COVID-19 and Commerce Coverage: Why Turning Inward Received’t Work, CEPR Press.

Kilic, Ok and D Marin (2020), “How COVID-19 is remodeling the world economic system”, VoxEU.org, 20 Might.

Liu, Y (2022), “Results on World FDI”, in M Ruta (ed.), The Impression of the Battle in Ukraine on World Commerce and Funding, World Financial institution, Washington DC.

Lund, S, J Manyika, J Woetzel, E Barriball, M Krishnan, Ok Alicke, M Birshan, Ok George, S Smit and D Swan (2020), “Danger, resilience, and rebalancing in world worth chains”, McKinsey World Institute.

Posen, A (2022), “The Finish of Globalization? What Russia’s Battle in Ukraine Means for the World Financial system”, International Affairs, 17 March.

Ruta, M (2022), “Lengthy-term results of the conflict in Ukraine on world worth chains”, in M Ruta (ed.), The Impression of the Battle in Ukraine on World Commerce and Funding, World Financial institution, Washington DC.

Winkler, D, L Wuester and D Knight (2022), “The Results of Russia’s world value-chain participation”, in M Ruta (ed.), The Impression of the Battle in Ukraine on World Commerce and Funding, World Financial institution, Washington DC.

Endnotes

1 https://www.matteoiacoviello.com/gpr.htm

[ad_2]

Source link