[ad_1]

I’ve written in nice element about my choices buying and selling methods previously. The choice wheel is one among my favorites as it’s comparatively low danger and simple to know particularly for brand spanking new comers. If you happen to haven’t already learn my posts in regards to the possibility wheel and monitoring my choices trades then ensure that to take action earlier than studying this publish!

For this publish, one among my readers really emailed me to inform me about their very own choices buying and selling expertise after discovering my weblog. He defined to me how he misplaced cash buying and selling choices earlier than however after discovering the wheel technique, was in a position to generate constant passive revenue and fund his nomadic way of life touring via the USA.

This publish is from his personal writing and goes over simply how he did it!

What’s the Possibility Wheel?

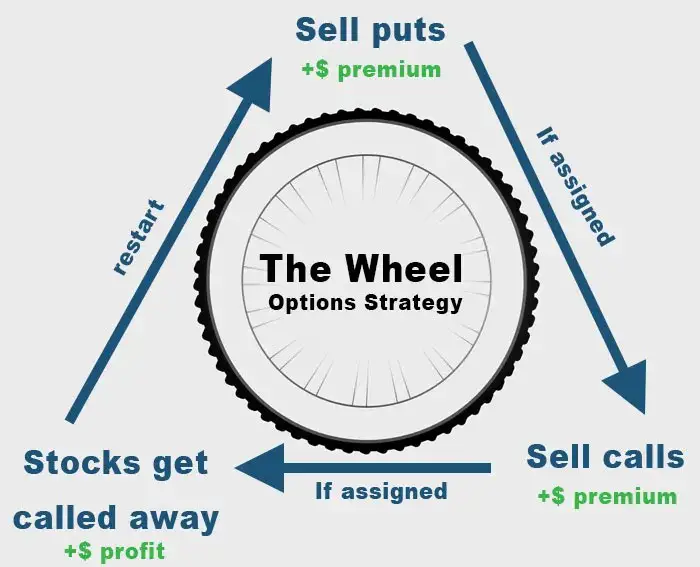

Earlier than we go into James’ private expertise with the choices wheel, let’s summarize what the choice wheel really is.

The Possibility Wheel Technique is a scientific and really highly effective method to promote money secured places and coated calls as a part of a long-term buying and selling technique. It’s a method to accumulate constant possibility premiums and is one among my favourite passive revenue strategies from buying and selling shares.

As any possibility buying and selling technique carries with it dangers, I believe the choice wheel has one of many decrease danger profiles within the choices universe. I take advantage of the choices wheel as a method to generate further revenue throughout early retirement and as a approach for me to remain engaged within the markets. It is only one of many passive revenue methods I make use of so ensure that to learn up on my different methods. Utilizing this technique, I goal about $600-$1,000 every week in premiums relying on the state of the market. This technique shouldn’t be a alternative for my long run investments, which I’ve written intimately right here.

Who is that this publish on the choice wheel for?

When you have no thought what choices are, then you need to in all probability learn up on fundamental possibility principle and perceive what you’re moving into earlier than placing your cash on the road. Nonetheless, I believe the choices wheel technique is among the best methods to implement and perceive. Due to this fact, in case you have a fundamental understanding of name and put choices, you need to have the ability to get use out of this information.

As a reference, I had by no means offered choices earlier than moving into this technique. I used to all the time purchase name and put choices, dropping most of the time.

In case you are searching for a method with significantly much less danger (and fewer upside), then ensure that to additionally learn my name unfold possibility information the place I am going intimately about name spreads and put spreads (bull name, bear name, bull put, bear put spreads).

As I’ve already achieved monetary independence, I commonly withdraw from my portfolio of shares sufficient to stay the life I need. That is one thing between $30k and $50k a yr. I additionally ensure that I pay 0% in revenue taxes by benefiting from the long run capital positive aspects price.

Choices are dangerous

Choices are inherently simply approach riskier than shopping for customary shares or bonds. The Wheel technique is maybe one of many most secure choices buying and selling methods however that’s nonetheless not saying a lot. If you happen to possibility wheel a meme type progress inventory, you’re sure to get destroyed when the markets crash.

Be sure to know the dangers of choices buying and selling earlier than participating in it! In any other case, an alternate you may contemplate is shopping for I Bonds (Inflation bonds) that are paying a danger free 9.62% as of 2022!

My Private Choices Buying and selling Expertise

In ‘22 I hit backside buying and selling choices, about mid July. I’d been messing round with it for years unsuccessfully, extraordinarily poorly. Nonetheless, I used to be intent on buying and selling with a system that I might depend on. One that might internet me 20%+ annually, so I might begin incomes revenue, not working my life away.

Tl:dr see screenshot under, I discovered a system and a method to keep accountable and surpassed my objective.

I couldn’t see what set me other than each different “profitable” dealer on-line.

Mid July I’d put an alternative choice commerce in and sat gazing my telephone, realizing I’d simply positioned a boneheaded commerce. I didn’t even know why I did it or what it was, simply that I had impulsively traded on a guess. I closed the commerce in my small account and needed to surrender.

Discovering the Choices Wheel technique

Then I began to actually analysis. Why have been others succeeding whereas I failed? I began to note my lack of a system. After just a few days of studying, I’d landed right here on Johnny Africa about possibility wheel methods (hyperlink right here), however I didn’t know if I trusted it. I went again to him and located a nugget, probably crucial factor to alter my buying and selling – Choices Monitoring Spreadsheet https://johnnyafrica.com/trade-option-wheel-bear-market/.

Items began to return collectively. Inside just a few weeks I had utterly modified how I traded. Within the spreadsheet I knew what I wanted to trace. I’d discovered one technique that I might wrap my mind round and I now had a spot for my dedication to be recorded, for good or dangerous.

My Possibility Wheel Commerce log

So I began hacking away at it, week after week. There’s some psychology behind why this labored, however for me, I believe it boiled down to 2 issues. I wanted to trace my trades to know I used to be bettering and I wanted to know what to trace. Johnny couldn’t assist me put within the reps, however he did assist a TON by offering what monitoring works for him. Because the 2023 began, I’m up 26% in opposition to my precept of $2500 and I’ve included a screenshot of the trades I took under in his spreadsheet. This yr I’m up roughly 11% by March.

| Opened | Ticker | C / P | Purchase/Promote | Expiration | Strike | QTY | Premium | Standing | Date Closed | Closing Value | Credit score | Debit | Revenue | Revenue Yield |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 06/28/2022 | ARKF | Put | Promote | 07/01/2022 | $17.00 | 1 | $0.30 | Assigned | 07/01/2022 | $0.00 | $30 | $0.00 | $30 | 1.76% |

| 07/05/2022 | ARKF | Name | Promote | 07/15/2022 | $17.50 | 1 | $0.30 | Closed | 07/15/2022 | $0.00 | $30 | $0.00 | $30 | 1.71% |

| 07/18/2022 | ARKF | Name | Promote | 07/29/2022 | $18.00 | 1 | $0.44 | Closed | 07/25/2022 | $0.45 | $44 | -$45.00 | -$1 | 2.44% |

| 07/25/2022 | ARKF | Name | Promote | 08/05/2022 | $19.00 | 1 | $0.35 | Closed | 07/27/2022 | $0.14 | $35 | -$14.00 | $21 | 1.84% |

| 07/27/2022 | ARKF | Name | Promote | 08/05/2022 | $19.00 | 1 | $0.20 | Assigned | 08/05/2022 | $0.00 | $20 | $0.00 | $20 | 1.05% |

| 08/08/2022 | ARKF | Put | Promote | 08/19/2022 | $19.00 | 1 | $0.26 | Closed | 08/10/2022 | $0.20 | $26 | -$20.00 | $6 | 1.37% |

| 08/15/2022 | ARKF | Put | Promote | 09/16/2022 | $19.00 | 1 | $0.25 | Assigned | 08/26/2022 | $0.00 | $25 | $0.00 | $25 | 1.32% |

| 09/07/2022 | ARKF | Name | Promote | 09/23/2022 | $19.00 | 1 | $0.15 | Closed | 09/08/2022 | $0.30 | $15 | -$30.00 | -$15 | 0.79% |

| 09/08/2022 | ARKF | Name | Promote | 09/16/2022 | $19.00 | 1 | $0.10 | Rolled | 09/13/2022 | $0.15 | $10 | -$15.00 | -$5 | 0.53% |

| 09/13/2022 | ARKF | Name | Promote | 09/23/2022 | $19.50 | 1 | $0.20 | Closed | 09/16/2022 | $0.10 | $20 | -$10.00 | $10 | 1.03% |

| 09/16/2022 | ARKF | Name | Promote | 09/23/2022 | $17.00 | 1 | $0.40 | Closed | 09/22/2022 | $0.20 | $40 | -$20.00 | $20 | 2.35% |

| 10/04/2022 | ARKF | Name | Promote | 10/07/2022 | $17.00 | 1 | $0.30 | Closed | 10/04/2022 | $0.45 | $30 | -$45.00 | -$15 | 1.76% |

| 10/04/2022 | ARKF | Name | Promote | 10/14/2022 | $17.00 | 1 | $0.45 | Closed | 10/07/2022 | $0.20 | $45 | -$20.00 | $25 | 2.65% |

| 10/17/2022 | ARKF | Name | Promote | 10/21/2022 | $17.00 | 1 | $0.20 | Closed | 10/20/2022 | $0.08 | $20 | -$8.00 | $12 | 1.18% |

| 11/14/2022 | TQQQ | Put | Promote | 11/18/2022 | $20.00 | 1 | $0.25 | Closed | 11/14/2022 | $0.15 | $25 | -$15.00 | $10 | 1.25% |

| 11/14/2022 | GPRO | Put | Promote | 11/18/2022 | $5.50 | 1 | $0.06 | Closed | 11/15/2022 | $0.04 | $6 | -$4.00 | $2 | 1.09% |

| 11/14/2022 | ARKF | Put | Promote | 11/25/2022 | $15.50 | 1 | $0.20 | Closed | 11/15/2022 | $0.10 | $20 | -$10.00 | $10 | 1.29% |

| 11/15/2022 | TQQQ | Put | Promote | 11/18/2022 | $20.00 | 1 | $0.18 | Closed | 11/15/2022 | $0.23 | $18 | -$23.00 | -$5 | 0.90% |

| 11/15/2022 | TQQQ | Put | Promote | 11/25/2022 | $20.00 | 1 | $0.46 | Closed | 11/17/2022 | $0.36 | $46 | -$36.00 | $10 | 2.30% |

| 11/17/2022 | TQQQ | Put | Promote | 11/25/2022 | $20.00 | 1 | $0.38 | Closed | 11/18/2022 | $0.24 | $38 | -$24.00 | $14 | 1.90% |

| 11/17/2022 | ARKF | Put | Promote | 11/25/2022 | $15.00 | 1 | $0.15 | Closed | 11/23/2022 | $0.05 | $15 | -$5.00 | $10 | 1.00% |

| 11/23/2022 | ARKF | Put | Promote | 11/25/2022 | $15.50 | 1 | $0.37 | Closed | 12/01/2022 | $0.05 | $37 | -$5.00 | $32 | 2.39% |

| 12/01/2022 | ARKF | Put | Promote | 12/16/2022 | $15.50 | 1 | $0.40 | Closed | 12/02/2022 | $0.35 | $40 | -$35.00 | $5 | 2.58% |

| 12/01/2022 | ARKF | Put | Promote | 12/09/2022 | $16.00 | 1 | $0.20 | Assigned | 12/09/2022 | $0.00 | $20 | $0.00 | $20 | 1.25% |

| 12/01/2022 | ARKF | Put | Promote | 12/09/2022 | $15.00 | 1 | $0.20 | Closed | 12/09/2022 | $0.00 | $20 | $0.00 | $20 | 1.33% |

| 12/07/2022 | ARKF | Put | Promote | 12/16/2022 | $15.00 | 1 | $0.60 | Closed | 12/08/2022 | $0.40 | $60 | -$40.00 | $20 | 4.00% |

| 12/09/2022 | ARKF | Put | Promote | 12/16/2022 | $15.50 | 1 | $0.55 | Assigned | 12/16/2022 | $0.00 | $55 | $0.00 | $55 | 3.55% |

| 12/12/2022 | ARKF | Name | Promote | 12/16/2022 | $16.00 | 1 | $0.26 | Closed | 12/14/2022 | $0.29 | $26 | -$29.00 | -$3 | 1.63% |

| 12/22/2022 | ARKF | Put | Promote | 12/23/2022 | $14.00 | 1 | $0.30 | Assigned | 12/23/2022 | $0.00 | $30 | $0.00 | $30 | 2.14% |

| 12/22/2022 | ARKF | Put | Promote | 12/30/2022 | $14.00 | 1 | $0.50 | Closed | 12/30/2022 | $0.00 | $50 | $0.00 | $50 | 3.57% |

| 12/22/2022 | TQQQ | Put | Promote | 12/30/2022 | $17.00 | 1 | $0.81 | Closed | 12/30/2022 | $0.00 | $81 | $0.00 | $81 | 4.76% |

| 12/28/2022 | TQQQ | Put | Promote | 01/06/2023 | $16.50 | 1 | $0.85 | Closed | 01/06/2023 | $0.00 | $85 | $0.00 | $85 | 5.15% |

| 12/29/2022 | ARKF | Name | Promote | 01/13/2023 | $15.00 | 1 | $0.31 | Assigned | 01/13/2023 | $0.00 | $31 | $0.00 | $31 | 2.07% |

| 01/04/2023 | ARKF | Name | Promote | 01/13/2023 | $15.50 | 1 | $0.25 | Assigned | 01/13/2023 | $0.00 | $25 | $0.00 | $25 | 1.61% |

| 01/04/2023 | ARKF | Name | Promote | 01/21/2023 | $16.00 | 1 | $0.20 | Open | $20 | $0.00 | $20 | 1.25% | ||

| 01/18/2023 | ARKF | Put | Promote | 01/21/2023 | $16.00 | 1 | $0.25 | Open | $25 | $0.00 | $25 | 1.56% |

Typical disclaimer! That is my expertise, my journey, I’m no professional. I simply haven’t seen many articles or movies of individuals within the thick of beginning out, shifting right into a extra intermediate degree, so I needed to share my experiences and the receipts and Johnny was sort sufficient to let me share some right here.

The technique is easy, primarily based off the choice wheel. I promote places for 1% bi weekly returns (objective) after which repeat after I internet about 75% of the commerce, or I simply allow them to expire. If I’m assigned, I’ll simply anticipate an increase available in the market and exit with a name set at my entry. Generally I make extra, typically much less. Generally I maintain the underlying asset for just a few weeks, as a result of the market is staying low (which was the majority of 2022). However the technique works.

Initially I began with $1700 and traded it on ARK Fintech Innovation (ARKF) & UltraPro QQQ (TQQQ).

For anybody who’s new to possibility buying and selling, right here’s a extra detailed have a look at my mindset:

You need to use this on typical shares, I’m not saying I simply use Alternate-Traded Funds (ETF). Nonetheless, the draw again I see in shares if ETFs are rather a lot much less inclined to black swan occasions (like chapter). Worst case for me, I’m caught with an ETF to carry until I can get my cash returned. Even TQQQ is more likely to return constructive returns with the rise of the QQQ if I used to be caught in a commerce.

My technique carries an possession mindset inside it. I’m buying and selling to insure different individuals’s positions with my small account. If I’m put (that means I’ve to purchase the ETF on the finish of the contract), I personal the shares. And if I’m known as (that is the closing place of the technique) and the market rallies (like this January), then I’ve simply misplaced out on that rally, however nonetheless taken revenue.

Sounds a bit carefree and cliche, even after I sort it, however having lived it, that possession mindset and decrease danger brings lots of peace of thoughts. I all the time should remind myself, excessive returns (general) and minimal danger = a very good combo for regular progress. And I’m on this for month-to-month returns.*

Buying and selling from anyplace

And I get to commerce any spot I occur to be touring! Like discovering lake caves in Northeast, PA, consuming road tacos in Tucson, AZ, mountaineering via the Zion Nationwide Park, exploring Bartlett Lake, AZ or mountaineering throughout Acadia, ME. Now, insert the place you’d wish to be when you grow to be financially free and use among the nice assets right here on this website to make it occur.

To me, I’m working a small time (enjoyable) job that pays me bi-weekly. Treating it like a ability to hone, a way to a monetary freedom finish has triggered me to focus and study. I’m not there but, however I hope that that is one other proof that you simply wanted to see to know, it may be accomplished, it’s being accomplished and it really works. Don’t let worry overcome a mindset that places you accountable for one other stream of revenue. Make efforts to study and in case you have questions, you’re studying in the appropriate place.

*This model of the choice wheel technique shouldn’t be tax environment friendly, I’ll throw that proper on the market. However with my account dimension and objectives, I’m not involved about that but. I ought to be producing usable money move with this technique and I’ve put aside taxes for that goal. I would change that after I can later, however that’s an FYI.

**I began monitoring my trades in mid July, when the crash was in full swing and costs falling down. Not on the backside, however nearer then the height. I really feel that my returns early this yr are exhibiting it’s nonetheless a excessive yielding technique, however once more, that’s one thing I see as skewing my share returns a bit.

Proceed Studying:

[ad_2]

Source link