[ad_1]

Delta launched the idea of MQDs (Mileage Qualifying {Dollars}) again in 2016 which shocked the complete world of frequent flyers and journey aficionados. This added a second layer of complexity to acquire frequent flyer standing by forcing you spend a specific amount of {dollars} along with flying a specific amount of miles. Gone have been the times the place one may discover the most affordable flights and fly on them purely to earn miles to acquire standing!

MQDs are very onerous for the typical particular person to satisfy thereby making incomes standing way more tough to acquire. Nevertheless, there’s a approach across the MQD requirement; a waiver of types, which if used efficiently means you’ll as soon as once more solely want to fret about distance flown.

What are Delta MQDs?

Previous to this modification, Delta together with all the opposite main airways within the US (United and American) solely had a distance primarily based mileage requirement which made it very simple to acquire standing.

Since 2014/2015, Delta launched the idea of MQDs which implies you additionally should spend a sure amount of cash to acquire standing. Previous to this, frequent flyer boards have been awash with “mileage run” specials the place individuals looked for the most affordable flights attainable that lined essentially the most distance with a view to acquire standing.

I bear in mind seeing loopy routes the place individuals would fly from San Francisco to Boston to Minneapolis to Florida to St Louis, and again to San Francisco for $200 and subsequently acquire elite standing due to it. I suppose the Airways took be aware of this and didn’t need individuals to abuse the system anymore.

MQDs favor enterprise vacationers closely

Ultimately, it’s all in regards to the cash. Airways are publicly traded firms and have to generate profits. Subsequently, the introduction of MQDs meant that solely individuals that would spend critical cash on flights with Delta may acquire elite standing.

For the typical particular person, spending $5k-$10k with one airline in a 12 months could be very unlikely. For enterprise vacationers, that is a lot simpler. Should you’re consistently flying for work, you don’t care in regards to the worth of the ticket because the firm is paying. As well as, for enterprise vacationers that will fly quick distances, the idea of MQMs didn’t make sense since you would spend some huge cash however solely acquire just a few miles because the distances have been so quick. MQDs solves this drawback.

What are the Delta Standing Ranges and Necessities?

Delta standing tiers are the next:

Delta has 4 standing tiers from Silver all the best way to Diamond. Silver would require you to spend $3,000 USD with Delta and companion airways whereas Diamond would require a whopping $15,000.

I don’t find out about you, however spending this a lot cash with one airline is a tall feat for those who’re looking for low-cost flights. Silver is doable for the typical particular person however something Gold and above is fairly ridiculous. That is why the brand new standing system from the airways closely favors enterprise vacationers.

Should you’re firm is paying so that you can journey, you’re not fearful about taking the most affordable flights. Should you’re firm can pay so that you can fly enterprise class, you’ll hit these thresholds in only a handful of flights.

Waive MQDs by utilizing Delta bank cards

The principle technique to waive MQD necessities is to make use of the Delta branded bank cards. There are six such bank cards out there to vacationers from American Specific:

- AMEX Delta Skymiles Gold

- AMEX Delta Skymiles Gold Enterprise

- AMEX Delta Skymiles Platinum

- AMEX Delta Skymiles Platinum Enterprise

- AMEX Delta Skymiles Reserve

- AMEX Delta Skymiles Reserve Enterprise

These bank cards all the time include massive signal on bonuses that fluctuate and are typically fairly ineffective playing cards for spending. As a part of my journey hacking, I’ve opened these bank cards on quite a few events simply to pocket the signal on bonuses. I received’t go into the churning of those bank cards nonetheless however primarily to deal with the MQD waiver.

MQD Waiver on AMEX Delta bank cards

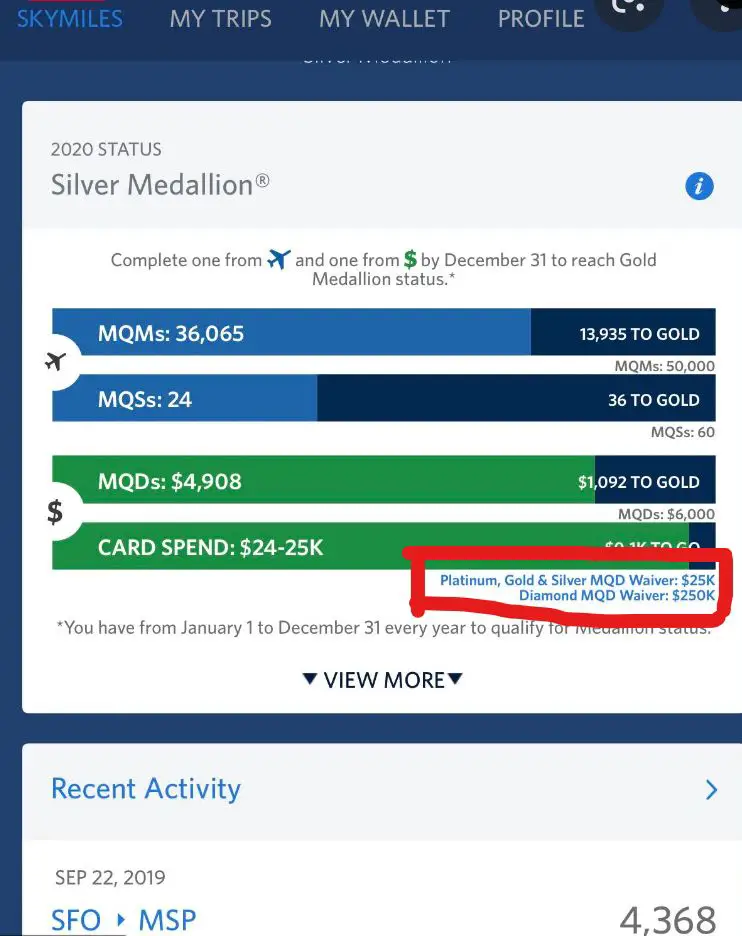

The MQDs requirement will be waived by reaching the MQD Waiver.

To achieve Platinum, Gold or Silver Medallion Standing, the MQD Waiver will be achieved by making $25,000 or extra in Eligible Purchases in the course of the calendar 12 months with eligible Delta SkyMiles Credit score Playing cards from American Specific.

To achieve Diamond Medallion Standing, the MQD Waiver will be achieved by making $250,000 or extra in Eligible Purchases in the course of the calendar 12 months with eligible Delta SkyMiles Credit score Playing cards

Spending $25,000 a 12 months just isn’t tremendous tough for most individuals which might be making an attempt to acquire standing. That’s $2,000 a month which is doable. The MQD waiver for Diamond standing was $25,000 however they’ve since modified it to $250k as a result of it was making diamond standing too simple. With a $250k spend, this weeds out 99% of individuals making an attempt to make use of MQD waivers to get Delta’s highest standing.

I discover the MQD waiver to be helpful when you’ve got the spend functionality and actually need Delta standing. Nevertheless, spending $25k on a Delta bank card means giving up factors with different packages. $25k of spend is price way more if you’re spending it on an AMEX (non branded) bank card or a Chase bank card.

25k of Delta miles is price a lot lower than say 25k Chase Final Rewards factors. You probably have playing cards just like the Sapphire Reserve, you’re more likely to be spending lots of that cash on journey and eating associated bills which earns factors at 3 factors to $1, which implies you’re extra more likely to find yourself with one thing nearer to 50-75k Chase UR factors.

I discover Delta miles to be significantly ineffective when touring overseas. Delta eradicated award charts a few years in the past so that you by no means know the way a lot a ticket goes to price by way of miles. Subsequently, the MQD waiver solely is smart for those who actually worth Delta standing and might’t fulfill the MQD requirement by yourself, or have a lot spend per 12 months that $25k just isn’t a giant deal.

Waive MQDs by dwelling overseas

Lastly, we get to the meat of the submit. Along with the bank card waiver system within the above part, there’s one a lot a lot easier technique to waive the MQDs.

Merely, when you’ve got a global handle and might show you reside there, Delta will can help you waive the MQD requirement no questions requested. Sure, for those who dwell and/or work out of the country, you not want to fret about MQDs.

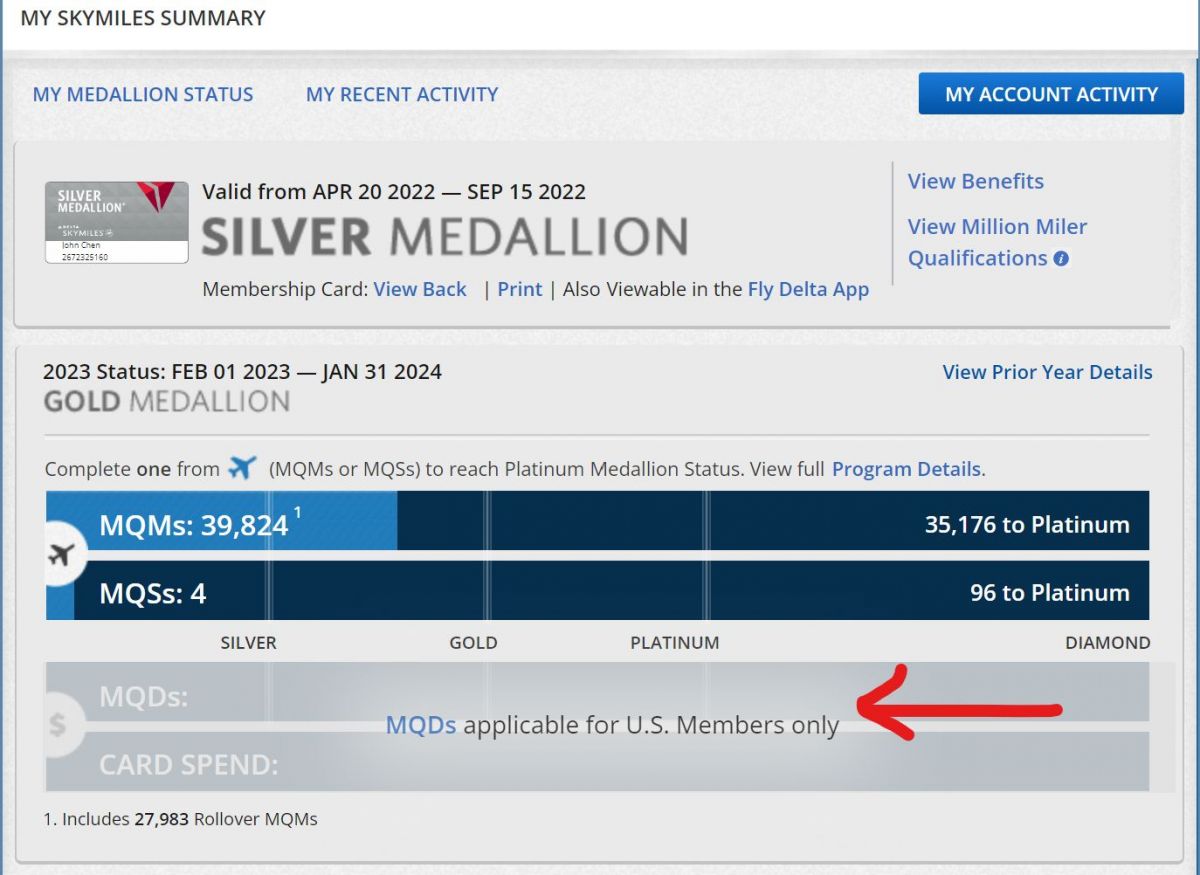

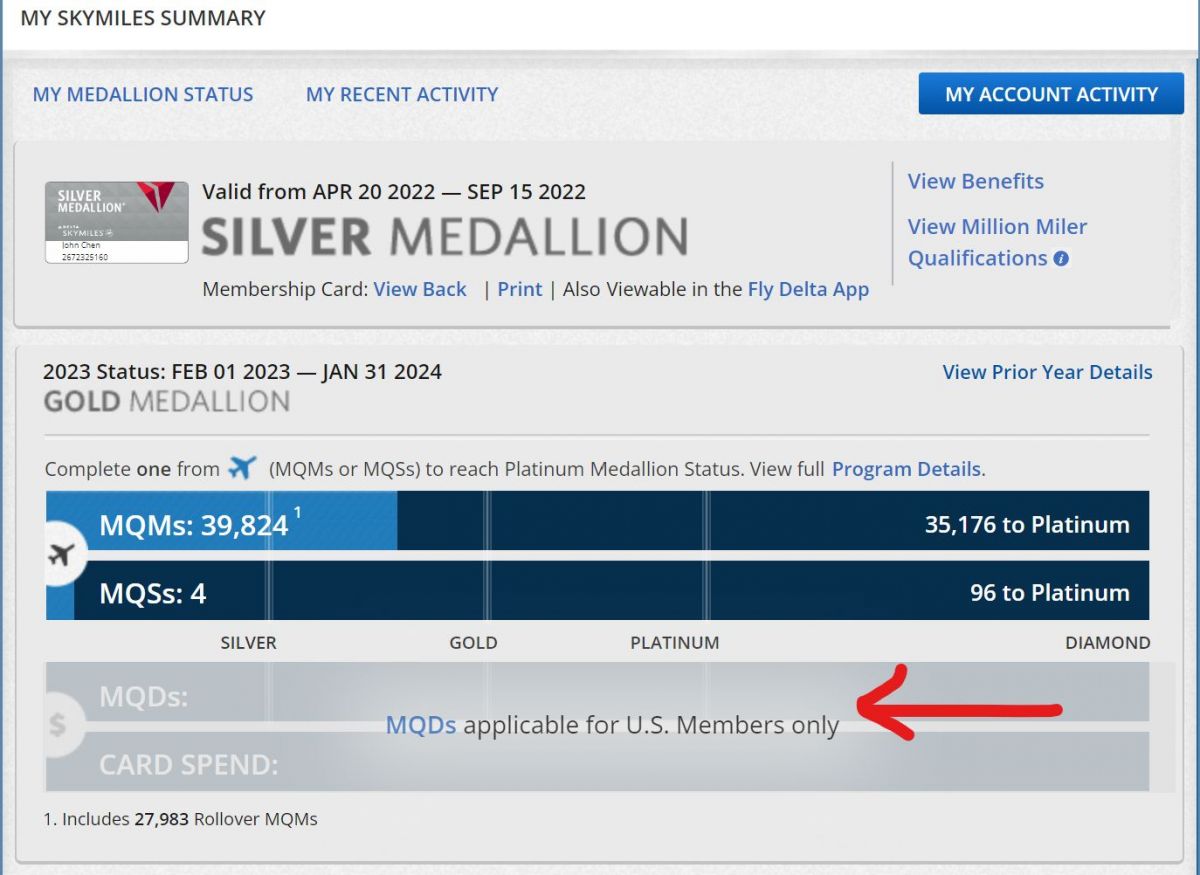

It is a typical SkyMiles standing window for somebody who must fulfill MQD and MQMs.

After you carry out this trick to waive the MQDs, your standing will look one thing like this.

As you possibly can see, Delta acknowledges my account as not being a US member and due to this fact MQDs will not be required.

Why is that this you ask?

I don’t have a concrete reply for this. If I needed to speculate, I feel that is to make it simpler for foreigners to earn standing the place they might in all probability go to a unique frequent flyer program from their residence nations. For instance, somebody in France would virtually certainly go together with Air France as a part of SkyTeam and never Delta however maybe making it simpler to get Delta standing would possibly persuade a tiny share of individuals to change. Lots of the frequent flyer packages on the market nonetheless don’t have any greenback (or every other forex) spend necessities to attain standing.

On the finish of the day, the quantity of foreigners trying to acquire Delta standing or the quantity of People dwelling overseas is such a low quantity that it doesn’t transfer the needle.

What paperwork are required?

You’ll need to indicate proof of your international residence which you are able to do by way of the next strategies:

- Passport

- ID Card

- Cellphone Invoice

- Utility Invoice

- Financial institution Statements

- Mortgage assertion

- Residence Allow/Visa

- The record goes on

Personally, I despatched them a financial institution assertion and my EU Blue card which is a residence allow to dwell and work in Europe. I’m unsure if they really wanted my residence allow however I hooked up it simply in case. Delta is simply making an attempt to establish that you just dwell outdoors of the USA.

Step by Step Course of

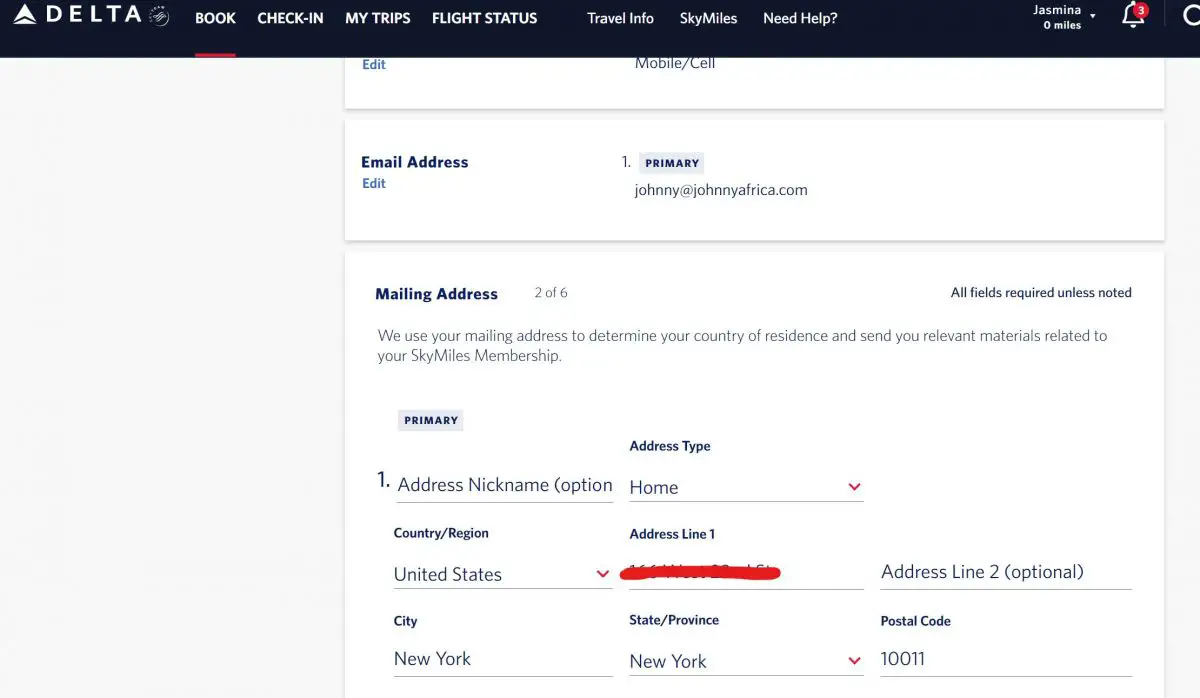

To provoke the change of handle course of, go to your profile web page and edit the mailing handle:

You may add a second handle so that you don’t have to take away your US handle. Ensure you choose the nation outdoors of the USA.

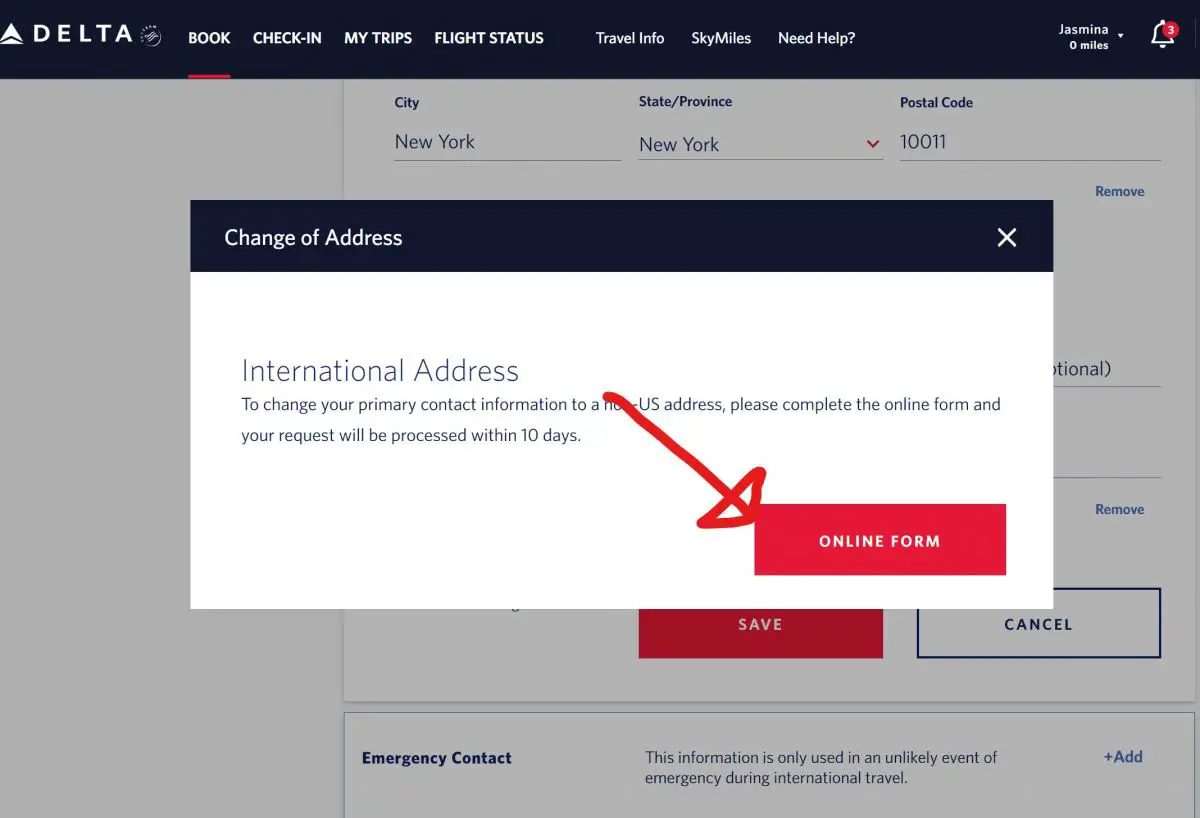

When you click on “Set as Major”, you will note a window pop up as beneath:

That is telling you that you’ll now change your handle to a global handle on Delta. You’ll then have to click on the web kind button.

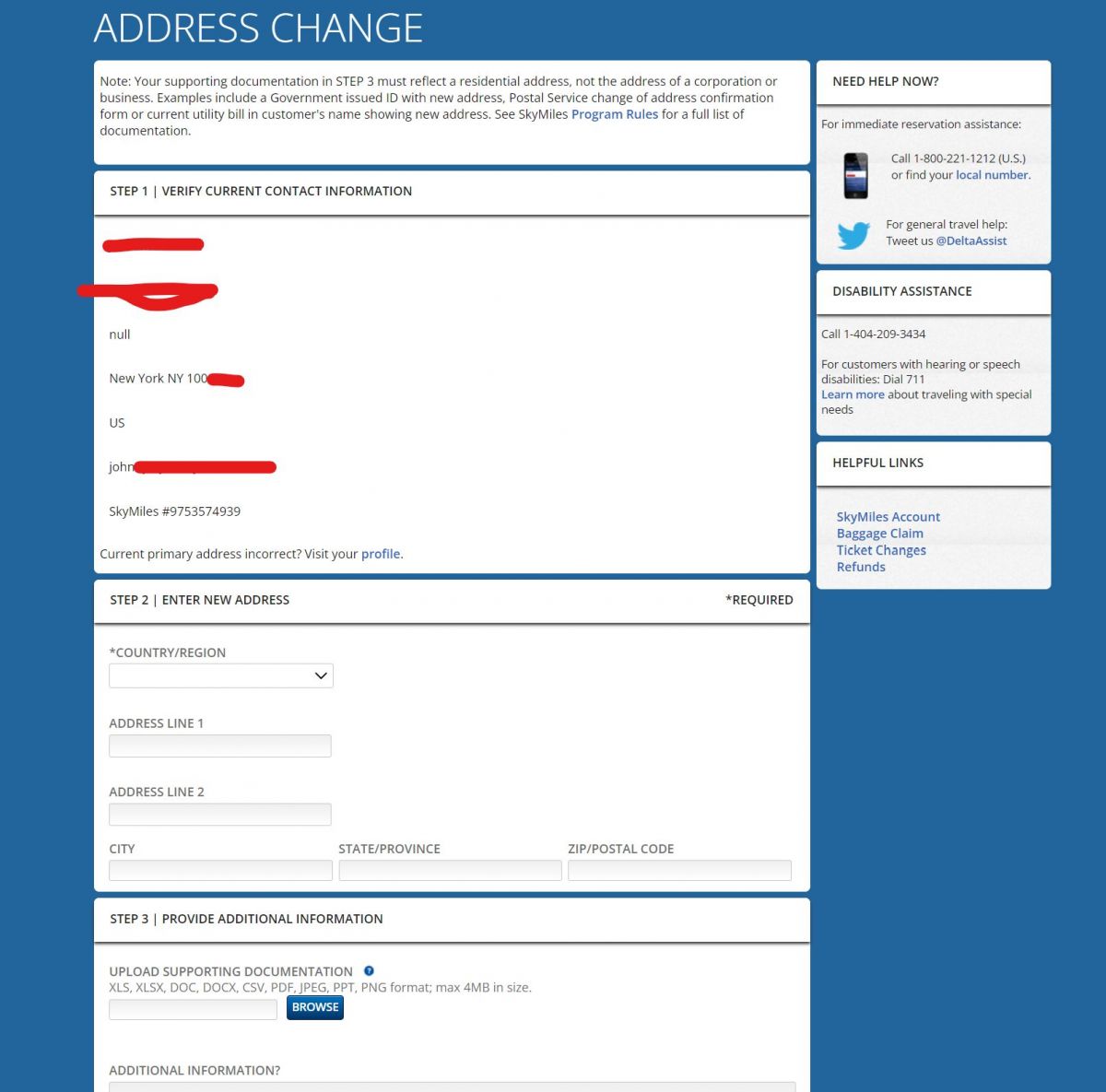

Fill out the web kind which is just about simply inputting your handle once more just like the earlier step. You’ll have one space to add your documentation. You may choose just one file so I really simply mixed my residence allow and a financial institution assertion into one PDF. I’m unsure what Delta requires precisely however this did the trick!

How lengthy does Delta take to vary your handle?

Delta claims it takes solely 10 days to motion the change however it was something however that. It took my many months to get this modified. I even needed to ship Delta a number of emails to ask what was occurring.

In whole, it took me 6 months to get this modified! This might have been due to the submit COVID resurgence of journey and Delta being quick staffed. Nonetheless, don’t be stunned to attend a very long time!

Does Delta observe or confirm your worldwide handle?

Delta is not going to ship any mail to your worldwide handle to confirm or something like that. From what I’ve learn, they could monitor your account in case you aren’t truthful of truly dwelling overseas.

The best approach for them to do that is to take a look at your flight schedules. In case your flights are constantly originating within the US, it could be a purple flag to say that you just don’t really dwell overseas (even for those who can show a international handle).

Does this work with United or American Airways?

Does this “hack” work with United Airways and American airways? From what I’ve learn, United and American don’t waive their greenback spend necessities if you’re a global resident. Each packages have PQD and EQD waivers for those who spend a sure amount of cash on their co-branded bank cards however there’s no program like Delta from what I’ve gathered.

This might change sooner or later however I might be uncertain.

Proceed Studying:

[ad_2]

Source link