[ad_1]

Amid the banking chaos of the twenty first century, some are trying again greater than 600 years in the past, to the Medici Financial institution — one of the vital highly effective banks of its time. It established its enterprise and have become one of the vital revered banks in Europe throughout its prime, and the distinguished Italian household of bankers had been early adopters of fractional reserve banking, a observe that Medici Financial institution clients had been unaware of, and that in the end led to the monetary establishment’s failure.

‘Nothing New’— How the Medici Financial institution Failure Is Nonetheless Very Related to As we speak’s Trendy Banking Practices

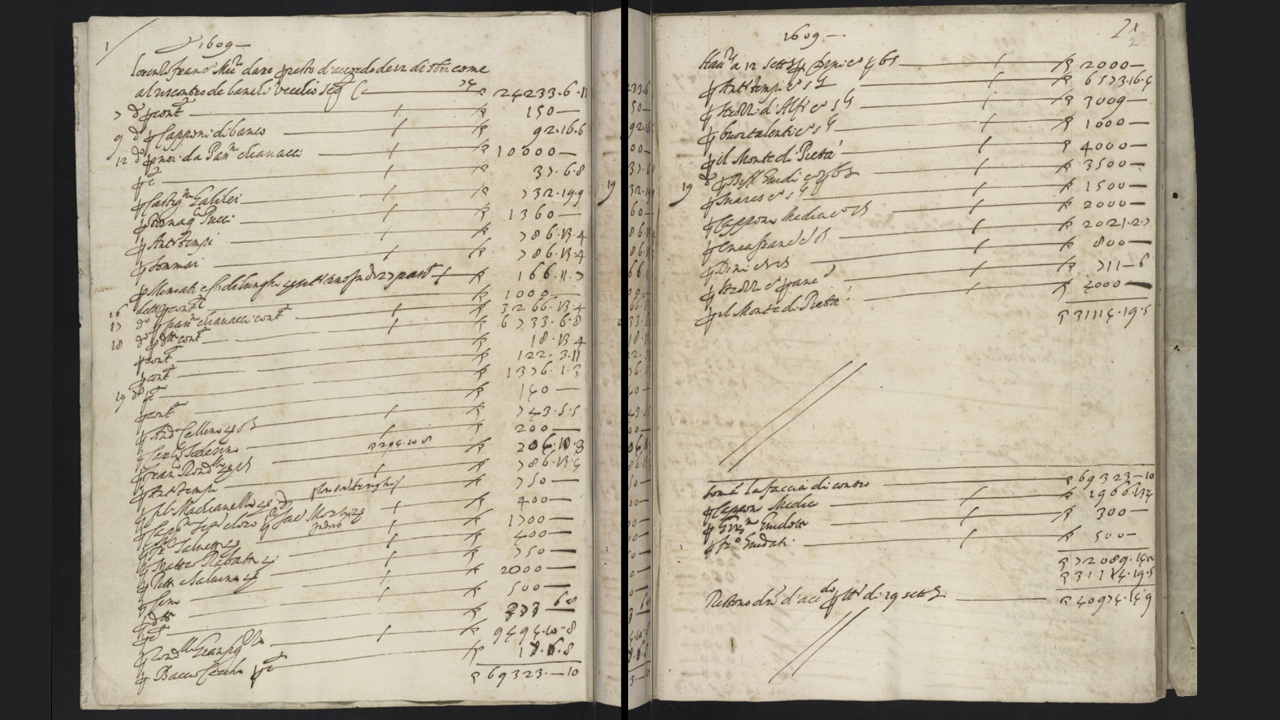

The collapse of three main banks in mid-March 2023 has induced folks to scrutinize the dangers of fractional reserve banking. The observe of fractional reserve banking is actually when a monetary establishment holds solely a fraction of deposits within the financial institution, and the remaining funds are used to lend or make investments with the intention to acquire a yield. One of many earliest recognized examples of fractional reserve banking was the Medici Financial institution, based in Florence, Italy, in 1397 by Giovanni di Bicci de’ Medici.

Within the first 5 years of operation, the Medici Financial institution grew quickly, and earlier than the monetary establishment’s demise, it established branches throughout Western Europe. Just like bankers within the early twentieth century like J.P. Morgan, Jacob Schiff, Paul Warburg, and George F. Baker, members of the Home of Medici had been extraordinarily highly effective. The Medici Financial institution was recognized to be one of many largest enterprise enterprises throughout the Renaissance however in the end failed after near 100 years of operation.

Philip J. Weights, the president of the Swiss Finance and Know-how Affiliation (SFTA), defined in a 2015 Linkedin submit how the load of “extreme lending” and “inadequate reserves” led to the financial institution’s final demise. In keeping with Raymond De Roover’s e book “The Rise and Decline of the Medici Financial institution (1397-1494),” revealed in 1963, liquidity was a problem from the financial institution’s inception. De Roover’s e book particulars that the Medicis’ reserves held lower than 10% of deposits as a result of relations’ managerial talents.

The 380-page e book explains how the Medici Financial institution skilled a interval of decline between 1463 and 1490 on account of shady and corrupt banking practices. The fraudulent schemes induced a number of Medici branches to be liquidated and offered off to different banks. De Roover argued that regardless of being a distinguished member of the Home of Medici and a profitable banker, Francesco Sassetti “was unable to keep away from the disastrous liquidation of the Bruges, London, and Milan branches.” De Roover’s e book notes that important lending was a well-liked observe that gathered high-interest charges.

Florins, gold cash minted by the Republic of Florence, had been usually held on the Medici Financial institution stability sheet. Nevertheless, the dearth of reserves was a continuing supply of frustration for each Medici banking companions, and authorities officers and clients. In a 2018 editorial on bigthink.com, creator Mike Colagrossi detailed that “it was on account of developments and monetary options like these that the Medici financial institution turned so highly effective” because the Medicis acquired excessive curiosity on loaned funds. Colagrossi notes that the downfall of the financial institution happened after the demise of Cosimo Medici in 1464, who was the financial institution’s boss on the time.

After the autumn of three main banks in 2023, Jim Bianco, president of Bianco Analysis, a agency that focuses on macro evaluation for institutional traders, defined how fractional reserve banking “was invented by the Medicis in Florence within the late fifteenth century.” In his Twitter post, Bianco additionally mentions the “tuppence” scene within the Nineteen Sixties Disney musical movie “Mary Poppins” and the financial institution run scene from “It’s a Great Life” filmed within the Thirties, stating that “all of those are nonetheless very related depictions of what’s taking place at present.”

Bianco opined:

Nothing that’s taking place is new. Our banking system is a number of hundred years outdated and has continually had these points.

Triple-Entry Bookkeeping — A New System of Accounting

Bianco additionally talked about that double-entry bookkeeping was the “know-how” used to allow the Medici Financial institution’s fractional reserve banking practices. The double-entry scheme entails a ledger that data each debits and credit and continues to be used within the fashionable monetary world at present. On the time, the Franciscan Friar Luca Pacioli wrote a e book about double-entry accounting with assist from the well-known Renaissance artist Leonardo da Vinci. Though Pacioli and da Vinci didn’t declare to invent the brand new system, their analysis led to the broader and extra structured use of double-entry bookkeeping that’s nonetheless used at present.

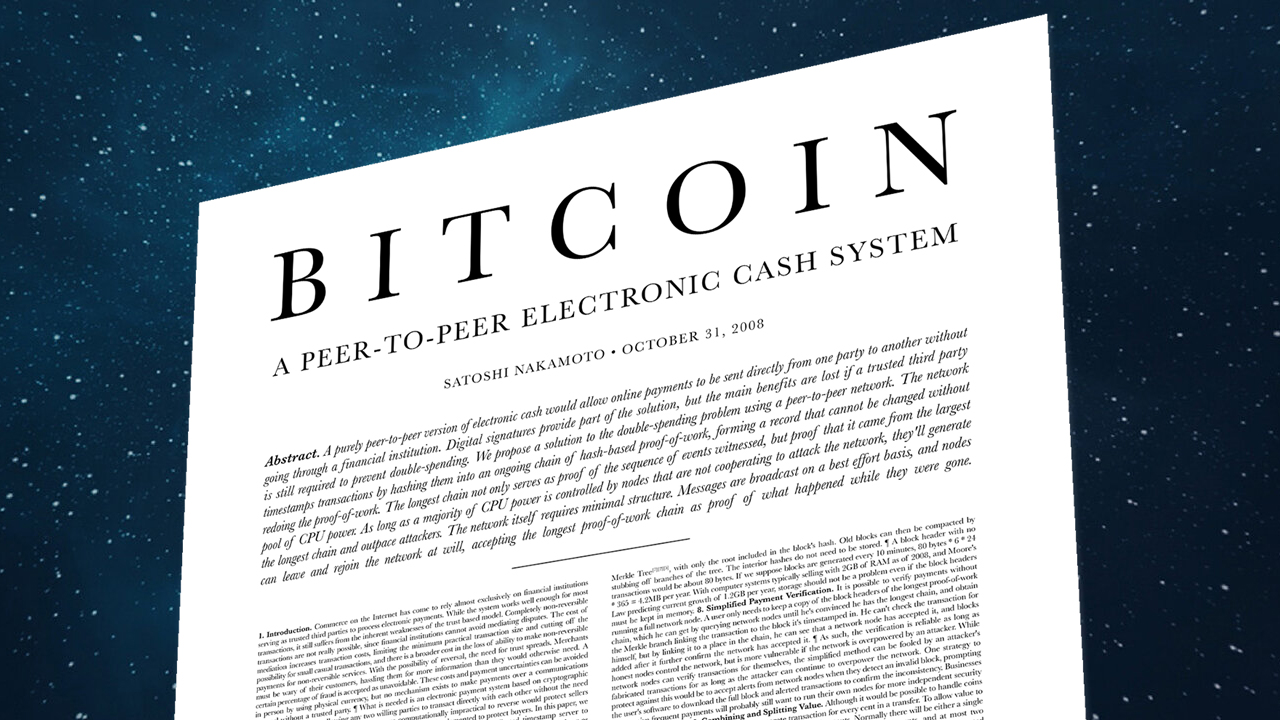

Quickly after the tactic was popularized, Giovanni de Medici applied the idea into his household’s financial institution. It allowed the Home of Medici to function with lower than 10% of deposits and lengthen its lending practices far and broad till liquidity fully dried up. Greater than 600 years later, an nameless individual or group launched a paper that launched the idea of triple-entry bookkeeping. Along with data of each debits and credit, a 3rd part was added, which is a cryptographic receipt verified by a 3rd celebration to validate the ledger’s entries.

Satoshi Nakamoto’s invention has produced a system the place a double-entry bookkeeping system doesn’t must be trusted now that an improved ledger accounting scheme exists. A single-entry or double-entry accounting system may be cast and manipulated, however the cryptographic assurance from a triple-entry bookkeeping system is far more durable so as to add fraudulent information to. Whereas Bianco is right that there’s nothing new with the best way bankers function at present, in comparison with the times of Medici, Nakamoto’s invention has given the world a brand new methodology of accounting that may remodel it an excellent deal, simply because the invention of double-entry bookkeeping has finished.

What classes may be realized from the autumn of the Medici Financial institution? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link